Roman Klymenko / Profile

- Information

|

7+ years

experience

|

6

products

|

20

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

Markets dropped down by more that 30% within one month. It seems to be the best time for testing grid- and martingale-based Expert Advisors. This article is an unplanned continuation of the series "Creating a Cross-Platform Grid EA". The current market provides an opportunity to arrange a stress rest for the grid EA. So, let's use this opportunity and test our Expert Advisor.

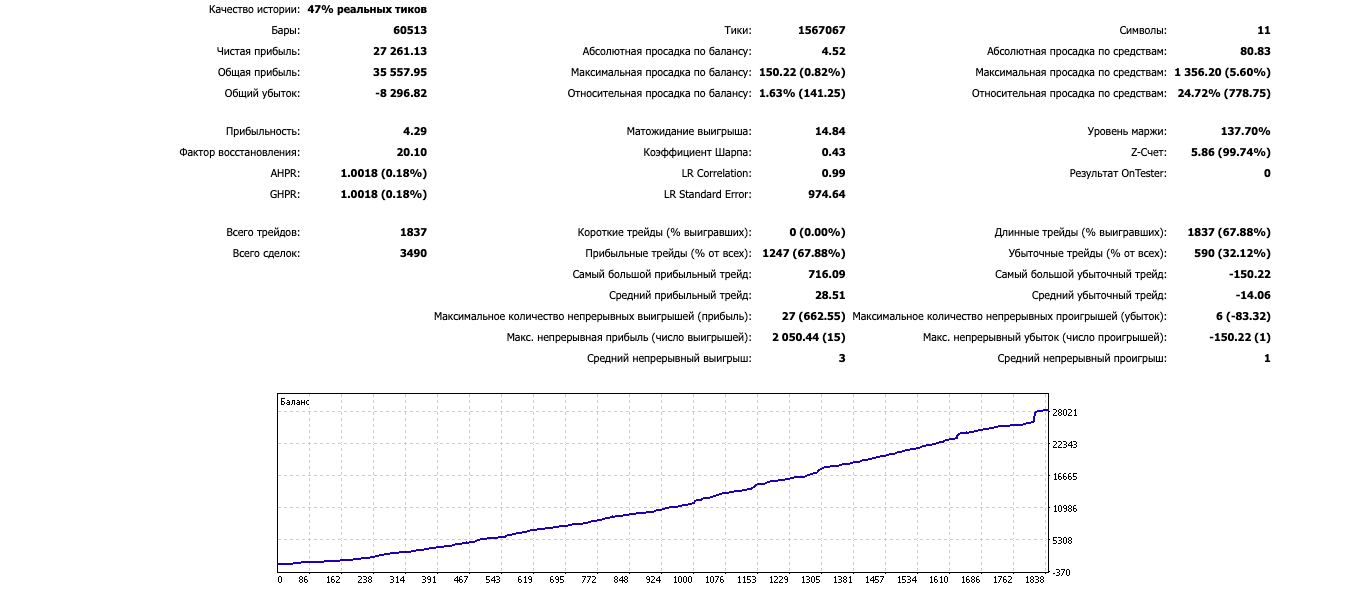

Скриншот последнего тестирования на периоде с 2016 по 2019 год прикрепил. 2 700% прибыли за 3 последних года на фондовом рынке при постепенном увеличении торгового лота. Максимальная просадка не больше 20% по отношению к текущему балансу.

По приведенной ссылке больше скриншотов и описание самой торговой системы.

In previous articles within this series, we tried various methods for creating a more or less profitable grid Expert Advisor. Now we will try to increase the EA profitability through diversification. Our ultimate goal is to reach 100% profit per year with the maximum balance drawdown no more than 20%.

In this article, we will make an attempt to develop the best possible grid-based EA. As usual, this will be a cross-platform EA capable of working both with MetaTrader 4 and MetaTrader 5. The first EA was good enough, except that it could not make a profit over a long period of time. The second EA could work at intervals of more than several years. Unfortunately, it was unable to yield more than 50% of profit per year with a maximum drawdown of less than 50%.

In this article, we will create an Expert Advisor for automated entry lot calculation based on risk values. Also the Expert Advisor will be able to automatically place Take Profit with the select ratio to Stop Loss. That is, it can calculate Take Profit based on any selected ratio, such as 3 to 1, 4 to 1 or any other selected value.

In this article, we will develop a grider EA for trading in a trend direction within a range. Thus, the EA is to be suited mostly for Forex and commodity markets. According to the tests, our grider showed profit since 2018. Unfortunately, this is not true for the period of 2014-2018.

In this article, we will continue expanding the functionality of the utility. This time, we will add the ability to display data that simplifies our trading. In particular, we are going to add High and Low prices of the previous day, round levels, High and Low prices of the year, session start time, etc.

In this article, we will learn how to create Expert Advisors (EAs) working both in MetaTrader 4 and MetaTrader 5. To do this, we are going to develop an EA constructing order grids. Griders are EAs that place several limit orders above the current price and the same number of limit orders below it simultaneously.

In this article, we continue expanding the features of the utility for collecting and navigating through symbols. This time, we will create new tabs displaying only the symbols that satisfy some of the necessary parameters and find out how to easily add custom tabs with the necessary sorting rules.

In this article we will consider in detail the martingale system. We will review whether this system can be applied in trading and how to use it in order to minimize risks. The main disadvantage of this simple system is the probability of losing the entire deposit. This fact must be taken into account, if you decide to trade using the martingale technique.

In this article, we are going to expand the capabilities of the previously created utility by adding tabs for selecting the symbols we need. We will also learn how to save graphical objects we have created on the specific symbol chart, so that we do not have to constantly create them again. Besides, we will find out how to work only with symbols that have been preliminarily selected using a specific website.

Experienced traders are well aware of the fact that most time-consuming things in trading are not opening and tracking positions but selecting symbols and looking for entry points. In this article, we will develop an EA simplifying the search for entry points on trading instruments provided by your broker.

This is the last article within the series devoted to the Reversing trading strategy. Here we will try to solve the problem, which caused the testing results instability in previous articles. We will also develop and test our own algorithm for manual trading in any market using the reversing strategy.

Утилита помогает открыть сделку со стоп-лоссом не больше той суммы, которую вы указали, или же вообще отказаться от сделки. То есть, она определяет количество лотов, на которые нужно совершить сделку, чтобы стоп-лосс был максимально приближен, но не больше суммы, которую вы указали. Например, она будет незаменима при торговле по стратегии Герчика. То есть, при торговле от рисков, когда у вас фиксированный риск и фиксированный тейк-профит по отношению к стоп-лоссу. Например, если вы всегда

Утилита помогает открыть сделку со стоп-лоссом не больше той суммы, которую вы указали, или же вообще отказаться от сделки. То есть, она определяет количество лотов, на которые нужно совершить сделку, чтобы стоп-лосс был максимально приближен, но не больше суммы, которую вы указали. Например, она будет незаменима при торговле по стратегии Герчика. То есть, при торговле от рисков, когда у вас фиксированный риск и фиксированный тейк-профит по отношению к стоп-лоссу. Например, если вы всегда

In this article, we continue to dwell on reversing techniques. We will try to reduce the maximum balance drawdown till an acceptable level for the instruments considered earlier. We will see if the measures will reduce the profit. We will also check how the reversing method performs on other markets, including stock, commodity, index, ETF and agricultural markets. Attention, the article contains a lot of images!

In this article, we will study the reverse martingale technique and will try to understand whether it is worth using, as well as whether it can help improve your trading strategy. We will create an Expert Advisor to operate on historic data and to check what indicators are best suitable for the reversing technique. We will also check whether it can be used without any indicator as an independent trading system. In addition, we will check if reversing can turn a loss-making trading system into a profitable one.

This utility displays the information required for making trades on each opened chart. For example: spread value, swap value; triple swap day; session closing time; ATR of the symbol by Gerchik; total profit/loss for the current symbol; the number of trades made earlier; the percentage change in the quotes of 6 selected instruments; and much more. The spread value is always shown. The rest of the information is displayed depending on the settings: Show total orders at the moment (long, short)

This utility displays the information required for making trades on each opened chart. For example: spread value, swap value; triple swap day; session closing time; ATR of the symbol by Gerchik; total profit/loss for the current symbol; the number of trades made earlier; the percentage change in the quotes of 6 selected instruments; and much more. The spread value is always shown. The rest of the information is displayed depending on the settings: Show total orders at the moment (long, short)

The utility helps open a deal with a stop loss that does not exceed the specified amount, or to refrain from it altogether. That is, it determines the number of lots to open the deal so that the stop loss is as close as possible to the specified amount in USD without exceeding it. For example, it will be indispensable when trading according to the Gerchik strategy. That is, when trading based on risks, with a fixed risk and a fixed take profit relative to stop loss. For example, if you always