Technische Indikatoren für den MetaTrader 5 - 43

Wichtigste Erkenntnisse Dieser Timer verzögert nicht wie andere Timer-Indikatoren Zeigt das Zeitende von Candlesticks und Spread an Ausblenden oder Anzeigen des Spreads je nach Benutzerbedarf Funktioniert auf allen Zeitrahmen Textgröße anpassen Textfarbe anpassen Textschriftart anpassen

If you love this indicator, please leave a positive rating and comment, it will be a source of motivation to help me create more products <3

FREE

Der ATR-Indikator (Average True Range) ist ein leistungsstarkes Instrument zur Messung der Marktvolatilität. Dieser Indikator liefert genaue Daten zu den Preisbewegungsspannen und hilft Händlern, Risiken effektiver zu verwalten und fundierte Handelsentscheidungen zu treffen. Er basiert auf dem weit verbreiteten ATR-Indikator und eignet sich sowohl für professionelle Händler als auch für Anfänger zur Analyse der Marktvolatilität. Mit dem ATR-Indikator können Sie die aktuelle Kursbewegungsspanne v

FREE

Ritz Area Konsolidasi - Smart Market Compression & Breakout Visualizer

Der Ritz Area Konsolidasi-Indikator erkennt und visualisiert auf intelligente Weise Marktkonsolidierungszonen - Bereiche, in denen die Kursbewegung innerhalb einer definierten Spanne vor einem potenziellen Ausbruch komprimiert wird. Durch die Kombination von adaptiver ATR-basierter Volatilitätsanalyse mit präziser Bereichslogik hilft er Händlern, wichtige Akkumulations-, Distributions- oder Unentschlossenheitszonen in Echtze

Der Algorithmus basiert auf der Idee des Currency Power Meter-Indikators. In dieser Version ist die Anzahl der angezeigten Werte unbegrenzt, der Code ist kompakter und schneller, Werte des aktuellen Balkens können über Indikatorpuffer abgerufen werden. Was der Indikator zeigt : Ein dünnes Band und die obere Zahl vor der Währung zeigen den relativen Stärkeindex für die letzten N Stunden (N wird in den Parametern in der Variablen 'Stunden' eingestellt), ein breiteres Band zeigt den Tagesindex an

FREE

ZumikoFX Handelsstatistiken - Professionelles Konto Dashboard Übersicht ZumikoFX Trading Stats ist ein umfassendes Echtzeit-Kontoüberwachungs-Dashboard, das für seriöse Trader entwickelt wurde, die einen vollständigen Überblick über ihre Handelsleistung benötigen. Dieser Indikator zeigt alle wichtigen Handelsstatistiken in einem eleganten, leicht zu lesenden Panel in der oberen rechten Ecke Ihres Charts an. Hauptmerkmale Vollständige Kontoüberwachung Kontostand & Eigenkapital - Kontostatus in

FREE

OmniSignal Pivot Session kombiniert zwei leistungsstarke Handelskonzepte - tägliche Pivots und (NY, London und COMEX) Session Opening Levels - in einem einzigen, intelligenten Signalindikator. Er wurde entwickelt, um wichtige Marktniveaus zu identifizieren und klare, nicht übermalende Einstiegssignale zu liefern, die auf einem robusten 3-Kerzen-Bestätigungsmuster basieren. So können Sie Marktgeräusche herausfiltern und mit mehr Vertrauen handeln.

Empfohlene Symbole: XAUUSD, US30, DE40

(könnte

FREE

Server-Zeituhr

Version: 1.2 Der Server Time Clock Indicator ist ein leichtgewichtiges und visuell ansprechendes Tool zur Anzeige des aktuellen Datums und der Uhrzeit des Servers direkt im Chart. Dieser Indikator wird dynamisch jede Sekunde aktualisiert und bietet die folgenden Funktionen: Anpassbares Erscheinungsbild : Passen Sie Schriftfarbe, Hintergrundfarbe und Schriftgröße an das Thema Ihres Diagramms an. Anzeige von Tag und Uhrzeit : Zeigt den aktuellen Tag, das Datum und die Uhrzeit in ei

FREE

Indikator im Histogrammformat, der anhand von Daten zum Finanzvolumen, Tick-Volumen und dem Balkenkörper berechnet wird.

Es ist möglich, sich Momente vorzustellen, in denen es zu einem großen Volumenzugang kam, sowohl finanziell als auch in Ticks, und in denen es dem Markt aufgrund der Größe des Balkenkörpers gelang, sich in eine Richtung (nach oben oder unten) zu entwickeln und voranzutreiben Es gab wirklich einen Sieg für eine Seite der Verhandlungen (Käufer und Verkäufer).

Standardmäßig si

PO3 FIBONACCI GOLDBACH - Der definitive Indikator für die Marktanalyse

Entschlüsseln Sie die Geheimnisse des Marktes mit der perfekten Verbindung von fortschrittlicher Mathematik und intelligentem Handel!

---

EXKLUSIVE EIGENSCHAFTEN:

1. EINZIGARTIGES GOLDBACH LEVELS SYSTEM - Automatische Identifizierung von Orderblöcken (OB), Fair Value Gaps (FVG), Liquiditätslücken (LV) und Mitigation Blocks (MB). - Präzise Berechnung von Rejection Blocks (RB) und Equilibrium Zones (EQ) basierend auf der

Clever Parabolic RSI Ein intelligenter Oszillator, der Parabolic SAR und RSI kombiniert – für präzise Marktsignale Dieser Oszillator vereint die Stärken zweier bewährter technischer Indikatoren – Parabolic SAR und RSI – und bildet daraus ein intelligentes System, das den Marktzustand , die Trendstärke sowie klare Kauf- und Verkaufssignale visuell darstellt. Funktionsweise: Ein grüner quadratischer Punkt signalisiert den Beginn eines Aufwärtstrends Ein roter quadratischer Punkt zeigt

Clean Reversal Signals ist ein sauberes und effizientes visuelles Tool, das darauf abzielt, hervorzuheben, wann der Kurs den oberen oder unteren Extremwert eines Donchian-Kanals (120 Perioden) berührt - Zonen, die oft entscheidend für potenzielle Umkehrungen oder Kursreaktionen sind. Dieser Indikator generiert keine Kauf- oder Verkaufssignale und sollte nicht allein zum Eingehen von Geschäften verwendet werden . Wie der Name schon sagt, handelt es sich um einen Indikator - seine Aufgabe ist es,

FREE

--- StudentK Sync Chart --- 1. Diagramme zur gleichen Zeit verschieben 2. Cross-Check zwischen verschiedenen Symbolen und Timeframes 3. Planen Sie Ihre eigenen Handelsstrategien

=== Einfache (kostenlose) Version ===

1. Erlaubt nur USDJPY

2. Unterstützt M5 und M15

3. * Kontaktieren Sie StudentK, um alle Timeframes freizuschalten.

--- Kontext --- StudentK wird nicht als Meister oder K Sir für wissende Person bezeichnet, die behauptet, immer zu gewinnen. (Aber viele Händler sollten die Tatsache

FREE

ATR ist ein Maß für die Volatilität, das von Markttechniker J. Welles Wilder Jr. in seinem Buch "New Concepts in Technical Trading Systems" eingeführt wurde. Im Allgemeinen sind Händler daran gewöhnt, die ATR in Form eines Sub-Fenster-Indikators zu sehen. Was ich hier vorstelle, ist eine vereinfachte Version der ATR - nur die aktuelle ATR-Zahl -, die sehr nützlich ist, um nur den aktuellen Moment des aktuellen Charts zu überwachen. Wenn Sie mehrere Zeitrahmen im selben Chart überwachen möchten,

FREE

Dieser Indikator basiert auf dem Bollinger Bands Indikator. Er hilft dem Benutzer zu erkennen, ob er kaufen oder verkaufen soll. Er verfügt über einen Alarm, der ertönt, sobald ein neues Signal erscheint. Ihre E-Mail-Adresse und die Einstellungen für den SMTP-Server sollten im Einstellungsfenster der Registerkarte "Mailbox" in Ihrem MetaTrader 5 angegeben werden. Blauer Pfeil nach oben = Kaufen. Roter Pfeil nach unten = Verkaufen. Linie = Trailing Stop. Sie können eines meiner Trailing Stop-Prod

FREE

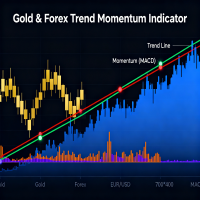

Einer der besten Trendindikatoren, die der Öffentlichkeit zur Verfügung stehen. Der Trend ist Ihr Freund. Funktioniert bei allen Paaren, Indizes, Rohstoffen und Kryptowährungen Korrekte Trendlinien Mehrere Bestätigungslinien Bollinger Bands Trendbestätigung Trendumkehr-Vorhersage Nachlaufende Stop-Loss-Linien Scalping von Mini-Trends Signale Alarme und Benachrichtigungen Äußerst flexibel Einfache Einstellungen Lassen Sie mich im Abschnitt "Bewertungen" wissen, was Sie darüber denken und ob Sie i

FREE

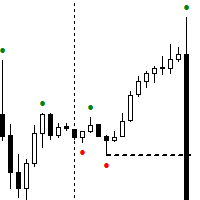

Wir markieren die Fair-Value-Lücke (FVG) und warten darauf, dass der Kurs diese Zone erreicht, aber manchmal kehrt er um, bevor er sie erreicht. Das kann passieren, weil wir die Balanced Price Range (BPR) übersehen haben. Meine Tools verbessern Ihre Analyse, indem sie alles auf dem Chart anzeigen und Ihnen helfen, potenzielle Preisumkehrbereiche zu identifizieren, damit Sie fundierte Entscheidungen darüber treffen können, wann Sie in den Markt einsteigen sollten. MT4 - https://www.mql5.com/en/m

SuperTrend-Indikator - Beschreibung und wichtiger Hinweis Der SuperTrend ist ein zusammengesetzter technischer Indikator, der Ihnen helfen soll, den primären Trend zu identifizieren, seine Stärke zu messen und die Signalqualität zu bewerten. Ein Indikator ist jedoch nur ein Hilfsmittel - er ist nie 100%ig genau und kann ein solides Risikomanagement nicht ersetzen. 1. Kernformel & Komponenten ATR (Average True Range): misst die Preisvolatilität; die Empfindlichkeit kann über Perioden und Multipli

FREE

MovingRegressionBands - Polynomialer Regressionsindikator mit adaptiven Bändern Beschreibung MovingRegressionBands ist ein fortschrittlicher technischer Indikator, der polynomiale Regression mit adaptiven Bändern kombiniert, um Markttrends und Umkehrpunkte zu identifizieren. Der Indikator verwendet ausgefeilte mathematische Berechnungen und bietet durch ein Regressionsmodell höherer Ordnung eine präzisere Sicht auf die Preisbewegungen. Hauptmerkmale Konfigurierbare polynomiale Regressionsordnung

FREE

Der MT5 CCI Dashboard Scanner Der MT5 CCI Dashboard Scanner ist ein Tool, das hilft, die Werte des Commodity Channel Index (CCI) über verschiedene Zeitrahmen und Instrumente zu verfolgen und in Echtzeit Warnungen zu geben, wenn ein neues Signal erkannt wird. Es ist benutzerfreundlich und benötigt wenig Rechenleistung, was eine reibungslose Leistung auf jedem Computer gewährleistet. Hauptmerkmale Automatische Instrumentengruppierung : Der Scanner sammelt alle Instrumente aus Ihrer Marktbeobachtun

FREE

Vegas Tunnel, mit bis zu 20 Ebenen, so dass Sie zu plotten oder nicht jede Ebene mit Farbwechsel, Liniendicke und ON / OFF Visualisierung für die einfache Nutzung 100% kostenlos und Lebensdauer Empfohlene Verwendung für Zeitrahmen: Original --> H1 Fraktale --> M15, M30, H4, D1 und W1 Wenn die schwarzen Punkte oberhalb des Tunnels sind, starten Sie Short-Positionen. Wenn sich die schwarzen Punkte unterhalb des Tunnels befinden, sollten Sie Long-Positionen eingehen. Es ist wichtig, sich daran zu e

FREE

Indikator, der Candlestick-Balken mit einer anderen Sampling-Methode als der festen Zeit anzeigt. Der Indikator wird mit Echtzeitdaten gespeist und kann als Ersatz für das Standarddiagramm verwendet werden. Jeder Balken wird gebildet, wenn eine vordefinierte Anzahl von Ticks empfangen wird, und zeigt im Diagramm den OHLC dieses Clusters von Ticks. Die Eingabevariable ist die Anzahl der Ticks für jeden Balken. Es handelt sich um einen anderen Ansatz des Samplings, bei dem die Anzahl der Balken pr

FREE

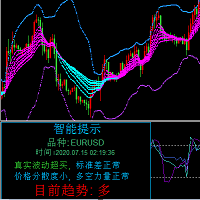

Dies ist eine Kombination von Indikatoren zur Analyse von Trends, Unterstützungswiderständen, Kauf- und Verkaufspunkten. Es verwendet MA, Bollinger Bands, KDJ, CCI, RSI. Die obere und untere Linie des Hauptdiagramms sind die oberen und unteren Bollinger Bänder, mit 20 Zyklen und 2,3 Standardabweichungen können verwendet werden, um Widerstand zu unterstützen. In der Mitte ist die Trendanalyse des durchschnittlichen, Trend-Analyse ist es, die durchschnittliche Multi-Cycle verwenden: Aufwärtstrend,

FREE

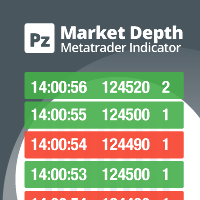

Mögen Sie Scalping? Dieser Indikator zeigt Informationen über die letzten vom Broker erhaltenen Kursnotierungen an. [ Installationsanleitung | Update-Anleitung | Fehlerbehebung | FAQ | Alle Produkte ]

Einfaches Erkennen von Tick-Trends Eine blaue Zeile bedeutet, dass der Kurs gestiegen ist. Eine rote Zeile bedeutet, dass der Preis gesunken ist Anpassbare Farben und Schriftgrößen Anzeige der gewünschten Anzahl von Zeilen Der Indikator wird nicht neu gezeichnet

Parameter Rows: Anzahl der Zeilen m

FREE

Der Keltner-Kanal Pro ist eine moderne und verbesserte Version des klassischen Keltner-Kanals und wurde für Händler entwickelt, die Trends, Umkehrungen und überkaufte/überverkaufte Zonen mit größerer Genauigkeit erkennen möchten. Mit EMA (Exponential Moving Average) und ATR (Average True Range) passt sich dieser Indikator automatisch an die Marktvolatilität an und liefert dynamische Kanäle, die helfen, Störungen herauszufiltern und das Handels-Timing zu verbessern. Hauptmerkmale: Hauptkanal (obe

FREE

MultiPip Range Label v2 - Leichte tägliche/wöchentliche/monatliche Pip-Statistiken

MultiPip_RangeLabel_v2 ist ein ultraleichter Indikator ohne Plot, der ein kompaktes, verschiebbares Textfeld mit objektiven Bereichsstatistiken druckt - perfekt für Orderflow- und Breakout-Händler, die schnellen Kontext ohne Unordnung benötigen.

Keine Hintergründe, keine aufwendigen Zeichnungen - nur gestochen scharfe Beschriftungen, die Sie überall auf dem Chart platzieren können. Die Kopfzeile ist verschiebba

FREE

BeST_Hull MAs Directional Strategy ist ein Metatrader-Indikator, der auf dem entsprechenden Hull Moving Average basiert und sowohl die wahrscheinlichsten Einstiegspunkte als auch die am besten geeigneten Ausstiegspunkte rechtzeitig lokalisiert und entweder als eigenständiges Handelssystem oder als Zusatz zu jedem Handelssystem verwendet werden kann, um die am besten geeigneten Einstiegs- oder Ausstiegspunkte zu finden/bestätigen. Dieser Indikator verwendet nur die Richtungsneigung und die Wende

PACK 2 von Phi Cubic Fractals mit der Option, die Indikatoren in FUTURE, auf der rechten Seite des Charts zu erweitern Dieses Produkt enthält die Indikatoren von PACK 2 (ROC voll / SAINT 8 / SAINT 17 / SAINT 34 / SAINT 72 ) + FUTURE MODE Phi ROC - ein Oszillator-Indikator, ähnlich dem MIMAROC, der in der Lage ist, die Richtung und Stärke des Marktes anzuzeigen und den optimalen Einstiegspunkt zu bestimmen; Phi SAINT - ein oszillatorähnlicher Indikator, ähnlich dem SANTO von Phicube, der die Ric

Kostenloser Indikator zur schnellen Erkennung von Trendlinienausbrüchen und hohen oder niedrigen Preisspannen. Es zeigt Linien basierend auf den Hochs und Tiefs der Preise an und findet und zeigt geneigte Trendlinien an. Sobald der Preis über die Linie hinausgeht und der Kerzenhalter schließt, signalisiert der Indikator dies mit einem Pfeil (Sie können auch eine Warnung aktivieren). Dieser Indikator ist einfach zu bedienen und auch kostenlos. Die Anzahl der Kerzen zur Definition von Trendlinien

FREE

Fractals ST Patterns Strategy ist eine Modifikation des Fractals-Indikators von Bill Williams. Er ermöglicht es, eine beliebige Anzahl von Balken für die Suche nach einem Fraktal einzustellen. Dieser einfache Indikator entspricht den Parametern, die in der ST Patterns Strategy (https://stpatterns.com/) angegeben sind. Structural Target Patterns sind im Wesentlichen der Markt selbst, der konsequent in Komponenten aufgeteilt wird. Um ST-Patterns zu bilden, werden keine Trendlinien, geometrischen P

FREE

Willkommen beim Provlepsis-Indikator.

"Provlepsis" ist ein hochentwickelter Indikator, der für den MQL-Markt entwickelt wurde. Durch die Analyse früherer Balken zur gleichen Tageszeit berechnet er präzise das potenzielle Kursbewegungsintervall und liefert wertvolle Einblicke in zukünftige Preisfluktuationen. Im Gegensatz zum traditionellen ATR-Indikator berücksichtigt "Provlepsis" den Zeitfaktor und ist damit ein leistungsstarkes Werkzeug, das sich an unterschiedliche Marktbedingungen anpasst. W

FREE

Unverzichtbar für Händler: Tools und Indikatoren Waves automatisch berechnen Indikatoren, Kanal Trend Handel Perfekte Trend-Welle automatische Berechnung Kanal Berechnung , MT4 Perfekte Trend-Welle automatische Berechnung Kanalberechnung , MT5 Lokales Trading Kopieren Einfaches und schnelles Kopieren, MT4 Einfaches und schnelles Kopieren, MT5 Lokales Trading-Kopieren für DEMO Einfaches und schnelles Kopieren , MT4 DEMO Einfaches und schnelles Kopieren, MT5 DEMO

Kann der Zyklus für andere Sorte

FREE

Bei diesem Indikator, den ich hier öffentlich vorstelle, handelt es sich um eine Anpassung für MetaTrader 5 (MT5), und ich möchte klarstellen, dass es sich nicht um meine Originalarbeit handelt. Der Originalcode wurde auf der TradingView-Plattform veröffentlicht und kann unter dem folgenden offiziellen Link frei zugänglich gemacht werden:

TradingView - Original-Indikator Der Grund für die Veröffentlichung auf MetaTrader 5 ist, dass ich möchte, dass mehr Menschen freien Zugang zu diesem Indik

FREE

If you love this indicator, please leave a positive rating and comment, it will be a source of motivation to help me create more products <3 Wichtigste Erkenntnisse Erzeugt Kauf- und Verkaufssignale früher als reguläre MA Dieser Indikator kann einen Trend erkennen, wenn er gerade erst beginnt Filter : Ein spezieller Parameter, der nützlich ist, um Spikes herauszufiltern, ohne eine Verzögerung zu verursachen. Um falsche Signale zu vermeiden, ist es am besten, den Dots-Indikator zusammen mit ande

FREE

Der Expert Advisor für diesen Indikator kann hier gefunden werden: https: //www.mql5.com/en/market/product/115567 Der Indikator Contraction/Expansion Breakout Lines with Fair Value Gaps (FVGs) für MetaTrader 5 (MT5) ist ein leistungsstarkes technisches Analysewerkzeug, das Händlern helfen soll, Ausbrüche auf kritischen Kontraktions- und Expansionsniveaus in Finanzmärkten zu identifizieren und zu visualisieren. Durch die Einbeziehung von Fair Value Gaps (FVGs) verbessert dieser Indikator die Fähi

FREE

Binary Connect (THI Reversal) ist ein professioneller Signalindikator , der für binäre Optionen und Scalping entwickelt wurde. Er hilft Händlern bei der Identifizierung von Umkehrpunkten mit hoher Wahrscheinlichkeit, indem er eine Kombination aus RSI und Bollinger Bands verwendet. ️ Bitte beachten Sie: Dieses Produkt ist ein technischer Indikator , der Einstiegspfeile auf dem Chart anzeigt. Es handelt sich NICHT um einen Expert Advisor (EA) und platziert nicht automatisch selbständig Trades.

FREE

Reversal Zones Pro - ein Indikator, der speziell für die genaue Identifizierung von wichtigen Trendumkehrzonen entwickelt wurde. Er berechnet die durchschnittliche wahre Spanne der Preisbewegung von der unteren bis zur oberen Grenze und zeigt potenzielle Umkehrzonen direkt auf dem Chart an, was Händlern hilft, entscheidende Wendepunkte im Markt effizient zu erkennen. Hauptmerkmale: Identifizierung von Umkehrzonen: Der Indikator hebt potenzielle Umkehrzonen direkt auf dem Chart visuell hervor und

Smart Super Trend Indicator (kostenlos) Turn volatility into opportunity — Catch trends early and trade smarter Der Supertrend-Indikator ist eines der zuverlässigsten Instrumente der technischen Analyse, das Händlern hilft, den vorherrschenden Markttrend schnell zu erkennen und potenzielle Einstiegs- und Ausstiegspunkte präzise zu bestimmen. Dieser trendfolgende Indikator, der auf Preisbewegungen und Volatilität basiert, passt sich dynamisch an die Marktbedingungen an und ist damit sowohl für An

FREE

عنوان: محلل الدعم والمقاومة الذكي

وصف مختصر: يقوم بتحديد مستويات الدعم والمقاومة الرئيسية بشكل ديناميكي، مع تسليط الضوء على نقاط المحور الحاسمة وأعلى الارتفاعات وأدنى الانخفاضات لاتخاذ قرارات تداول دقيقة.

الوصف الكامل: أطلق العنان لقوة تحليل السوق الديناميكي مع SmartSRAnalyzerR! يرصد هذا المؤشر المتقدم تلقائيًا قمم وقيعان نقاط المحور، ويحسب أقرب مستويات الدعم والمقاومة، ويعرضها بوضوح على مخططك البياني.

الميزات الرئيسية:

الدعم والمقاومة الديناميكية: تحدد تلقائيًا المستويات الرئيسية استنادًا

FREE

Magischer Trend

Dieser MT5-Indikator ist ein Gleitender Durchschnitt mit 3 Signalfarben. Die 3 Eingabeparameter dieses Indikators geben Ihnen die Möglichkeit, einen gleitenden Durchschnitt Ihrer Wahl einzustellen. Eine Kombination aus 2 verschiedenen exponentiellen gleitenden Durchschnitten, dem Relative-Stärke-Index, dem Commodity-Channel-Index und dem William's Percent Range liefert die Signale.

Weiße Farbe = Null/Nein/Ausstiegssignal Grüne Farbe = Kaufsignal Rote Farbe = Verkaufssignal

Hi

FREE

Die Wahrscheinlichkeit weitergehender Kursbewegungen steigt, wenn der Larry Williams Percentage Range Oszillator "WPR" seine historischen Widerstandsniveaus in Verbindung mit dem Ausbruch der Kurse aus den Widerstandsniveaus durchbricht. Es wird dringend empfohlen, den Ausbruch des Preises mit dem Ausbruch des Oszillators zu bestätigen, da sie vergleichbare Auswirkungen haben wie das Durchbrechen von Unterstützungs- und Widerstandsniveaus durch den Preis; eine ähnliche Sichtweise gilt für Short-

FREE

MTF Candle Panel zeigt echte Multi-Timeframe-Candlesticks in einem kompakten Seitenpanel auf Ihrem Chart an, so dass Sie die Kursentwicklung in höheren und niedrigeren Timeframes sofort sehen können , ohne den Chart wechseln zu müssen . Jeder Zeitrahmen wird in einer eigenen Zeile mit korrekt skalierten Kerzen angezeigt, so dass Sie auf einen Blick eine genaue Vorstellung von Struktur, Richtung und Momentum erhalten. MT4-Version - https://www.mql5.com/en/market/product/163704/ Anmeldung zum Erle

SMC VALID EA (MT5) Version: 1.10

Autor: Marrion Brave Wabomba

Kategorie: Smart Money Concepts (SMC) und ICT-Konzepte ICT Smart Money Daily Zones (SMC Pro) ICT Smart Money Daily Zones (SMC Pro) - ICT Daily Buy & Sell Zones Pro ist ein professioneller Smart Money Concepts (SMC) / ICT-Handelsindikator für MetaTrader 5, der entwickelt wurde, um institutionelle Tagesniveaus klar abzubilden und Händler mit Entscheidungszonen mit hoher Wahrscheinlichkeit zu führen. Dieser Indikator analysiert autom

Volume Thermal Vision Basic ist die vereinfachte Version des renommierten Indicators Volume Thermal Vision, entwickelt für Trader, die die Volumenintensität praktisch und effizient analysieren möchten. Mit 6 Stufen lebendiger Farben können Sie zwischen den Modi StealthMode, NightVision und FrostVision wählen, um Volumendaten klar und strategisch darzustellen. Perfekt für Einsteiger oder als Ergänzung Ihrer Analyse – dieser Indikator ist leicht, intuitiv und ideal, um Ihre Handelsentscheidungen z

FREE

Wie oft haben Sie schon nach einem PIVOT gesucht, der jeden Tag zu einer bestimmten Kerze funktioniert?

Viele Händler schätzen gerne die Richtung des Tagestrends zu einem bestimmten Zeitpunkt am Tag ein, z. B. 30 Minuten nach Markteröffnung oder um 12 Uhr mittags und so weiter.

Mit diesem Indikator können Sie einen bestimmten Zeitpunkt (Stunde und Minute) festlegen und einen Pivot von diesem Zeitpunkt bis zum nächsten Tag zur gleichen Zeit einzeichnen. Er zeigt fünf Linien an, die auf dieser

FREE

Indikator, der Candlestick-Balken mit einer anderen Sampling-Methode als Time Fix anzeigt. Der Indikator wird mit Echtzeitdaten versorgt und kann als Ersatz für die Standardgrafik verwendet werden. Jeder Balken wird gebildet, wenn ein vordefiniertes Volumen von Vermögenswerten gehandelt wurde und zeigt in der Grafik den OHLC dieser Clusterung. Die Anzahl der Balken ist proportional zur Anzahl der Verhandlungen anstelle einer Stichprobe in einer festen Zeitspanne. Wenn der Broker das tatsächliche

FREE

WaSwap MT5 Indicator zeigt den aktuellen Swap Long und den aktuellen Swap Short mit Farbe an.

* Stellen Sie den Swap Threshold und die Farbe ein, um zu erkennen, wann der aktuelle Swap unter oder über dem Spread Threshold liegt.

* Legen Sie die X- und Y-Achse fest und wählen Sie die Ecke und den Anker, um das Swap-Label auf dem Chart zu positionieren.

* Schreiben Sie die Schriftart und die Schriftgröße für mehr Komfort.

* Aktivieren Sie einen Alarm, wenn der aktuelle Swap Long oder der aktu

FREE

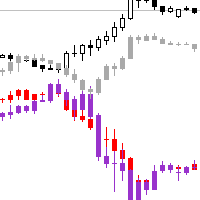

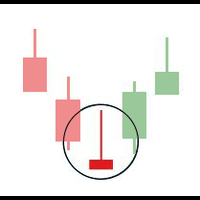

Der Basing Candles Indikator ist ein automatischer Indikator, der Basing Candles auf dem Chart erkennt und markiert. Eine Basing Candle ist eine Kerze, deren Körperlänge weniger als 50% ihrer Hoch-Tief-Spanne beträgt. Eine Basing Candle oder Basing Candlestick ist ein Handelsindikator, bei dem die Länge des Kerzenkörpers weniger als die Hälfte der Spanne zwischen Höchst- und Tiefstkursen beträgt. Das sind weniger als 50 % des Bereichs.

Der Indikator hebt die Basing Candles mit Hilfe von Custom

FREE

Dieser Indikator zeigt den aktuellen Spread im Hauptfenster des Charts an. Sie können die Schriftparameter, die Position des Indikators und die Normalisierung des Spread-Wertes ändern. Der Spread wird nach jedem Tick neu gezeichnet, so dass immer der aktuellste und aktivste Spread-Wert angezeigt wird. Dies kann für Broker mit variablen Spreads oder mit Spreads, die häufig ausgeweitet werden, nützlich sein. Sie können auch die Anzeige eines Spread-Labels in der Nähe der aktuellen Bid-Linie aktivi

FREE

Indikator für MT5, der den Spread, BUY SWAP (BS) und SELL SWAP (SS) in einem Unterfenster anzeigt.

Die Größe und Farbe der Schriftart der Anzeige kann eingestellt werden, und die Spread-Anzeige kann zwischen PIPS und POINTS umgeschaltet werden, so dass Sie sie je nach den Farbeinstellungen des Charts verwenden können. Die Anzeige ist auf die Größe des Unterfensters zentriert.

(Bitte kooperieren Sie!) Dies ist ein kostenloser Service. Sie können ihn gerne nutzen. Wenn Sie möchten, können Sie au

FREE

Ursprünglich wurde dieser Indikator entwickelt, um Punkte oder Kerzen zu verfolgen, bei denen eine Trendstärke vorliegt. Wie bei großen Entdeckungen habe ich einen Indikator entwickelt, der hauptsächlich Umkehrkerzen, Spannungspunkte, hohe Liquidität und Widerstand anzeigt. Der Indikator vereinfacht das Diagramm, indem er alle Punkte anzeigt, an denen wir möglicherweise lta's, ltb's, gleitende Durchschnitte, Bänder, hohe ifr haben könnten. Der Indikator steuert das Risiko nicht, er zeigt nur die

FREE

Der Indikator zeichnet drei gleitende Durchschnitte. Zwei kurze Durchschnitte kreuzen einen langen.

Gleichzeitig ändert der lange MA seine Farbe: Wenn beide kurzen MAs über dem langen liegen - erste Farbe; Wenn beide kurzen MAs unter dem langen liegen - zweite Farbe; Wenn die beiden Short-MAs auf entgegengesetzten Seiten des Long-MAs liegen - dritte Farbe. Alle drei MAs basieren auf Schlusskursen mit einer Glättungsmethode von "einfach".

cross MA cross 3 MA cross three Moving Average across Mo

FREE

Stoppen Sie Margin Calls. Beginnen Sie den Handel mit einer klaren SOP. Erhalten Sie immer wieder Margin Calls?

Haben Sie immer noch keinen Indikator oder keine Technik gefunden, die eine konstante tägliche Performance liefert?

Sind Sie es leid, Geld einzuzahlen und zu hoffen, dass Sie es endlich abheben können? Machen Sie sich keine Sorgen - ich bin ein echter Vollzeit-Trader . Dies ist derselbe Entry-Box-Indikator , den ich persönlich verwende, zusammen mit einer Schritt-für-Schritt-SOP , dam

Stoppen Sie Margin Calls. Beginnen Sie den Handel mit einer klaren SOP. Erhalten Sie immer wieder Margin Calls?

Haben Sie immer noch keinen Indikator oder keine Technik gefunden, die eine konstante tägliche Performance liefert?

Sind Sie es leid, Geld einzuzahlen und zu hoffen, dass Sie es endlich abheben können? Machen Sie sich keine Sorgen - ich bin ein echter Vollzeit-Trader . Dies ist derselbe Entry-Box-Indikator , den ich persönlich verwende, zusammen mit einer Schritt-für-Schritt-SOP , dam

MTF Levels And Moving Averages ist ein professioneller Indikator, der die wichtigsten Unterstützungs- und Widerstandsniveaus über mehrere Zeitrahmen hinweg identifizieren kann. Das Tool hilft Händlern bei der Suche nach präzisen Einstiegs- und Ausstiegspunkten, indem es die Marktstruktur und Preisaktionsmuster analysiert. Hauptmerkmale Der Indikator bietet eine Multi-Timeframe-Analyse, die H1-, H4-, D1- und W1-Perioden gleichzeitig abdeckt. Er identifiziert Angebots- und Nachfragezonen, in denen

Doji Engulfing Paths ermöglicht es, Signale und Daten über Doji und Engulfing-Muster auf Charts zu erhalten. Es macht es möglich, Gelegenheiten von Trends zu bekommen, und die Richtungsbewegungen zu folgen, um einige Gewinne auf den Forex- und Aktienmärkten zu bekommen. Es ist von Vorteil, alle sich bietenden Gelegenheiten mit Umkehrsignalen und direkten Signalen zu nutzen, um auf dem Forex-Markt Gewinne zu erzielen. In der Demoversion sind nur die Signale ab der 20. Kerze oder dem 20.

Merkmale

FREE

TrendMaster Dashboard: Ihr umfassendes Trendanalyse-Tool Das TrendMaster Dashboard ist ein fortschrittlicher Expert Advisor (EA) für MetaTrader 5 (MT5), der Ihre Handelserfahrung vereinfachen und verbessern soll. Dieses leistungsstarke Tool konsolidiert mehrere technische Indikatoren und Preisaktionsanalysen in einem einzigen, benutzerfreundlichen Dashboard und bietet klare Kauf-, Verkaufs- und Umkehrsignale durch ein gewichtetes Scoring-System. Ganz gleich, ob Sie neu im Handel sind oder ein e

Die Farben werden je nach Handelsvolumen und Marktrichtung generiert.

Die Analyse wird nach der Richtung des Preises und des gehandelten Volumens durchgeführt, wenn der gehandelte Wert die Berechnungsbasis übersteigt übersteigt, wechselt das System die Farbe zu grün und informiert Sie darüber, dass die Preisrichtung stark zum Kauf geeignet ist, liegt der gehandelte Wert unter als die Berechnungsbasis, wechselt das System zu rot und zeigt damit an, dass der Preis zum Verkauf tendiert.

FREE

Der Indikator "Vertikale Linien zur Sitzungszeit" zeigt auf dem Diagramm vertikale Linien an, die den Beginn und das Ende der wichtigsten globalen Handelssitzungen markieren: Sydney, Tokio, London und New York . Er soll Händlern dabei helfen, aktive Marktzeiten, Überschneidungen und potenziell umsatzstarke Zeiträume direkt auf dem Kursdiagramm zu erkennen. Dieses Tool ist besonders nützlich für Intraday-Händler, die sich bei der Planung von Ein- und Ausstiegen auf das Timing der Marktsitzungen v

FREE

Bedienfeld Positionen

Dies ist ein Panel zum Zählen der aktuellen Icon-Bestände. Bequem Händler jederzeit die Position und Gewinn und Verlust Situation zu sehen. Perfekt für Händler, die mehrere Aufträge gleichzeitig halten möchten. Hauptfunktionen : Positionsstatistik Gesamtgewinn Berechnung des Durchschnittspreises TP-Preis-Berechnung ST-Kursberechnung Wert der Positionen

FREE

Indikator-Forecaster. Sehr nützlich als Assistent, dient als Schlüsselpunkt für die Vorhersage der zukünftigen Kursbewegung. Die Vorhersage wird mit der Methode der Suche nach dem ähnlichsten Teil in der Geschichte (Muster) gemacht. Der Indikator wird als eine Linie gezeichnet, die das Ergebnis der Veränderung des Schlusskurses der Balken anzeigt. Die Tiefe der Historie, die Anzahl der Balken in der Prognose, die Größe des Musters und die Qualität der Suche können über die Einstellungen des Indi

FREE

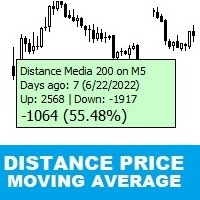

Gleitender Durchschnitt des Entfernungspreises

Dies ist ein Indikator, der in Echtzeit den Abstand vom Preis zum gleitenden Durchschnitt berechnet.

Damit können Sie die maximale Abweichung des Preises vom gleitenden Durchschnitt in einem bestimmten, von Ihnen gewählten Zeitraum überwachen, beispielsweise die Distanz gemäß der maximalen Abweichung der letzten 30 Tage überwachen.

Es ist möglich, den Zeitraum und die Art des gleitenden Durchschnitts zu wählen.

Um es noch besser zu machen, hab

FREE

Der "Trend Fishing Indicator" ist ein leistungsfähiger benutzerdefinierter Indikator, der Händlern helfen soll, potenzielle Trendumkehrpunkte zu erkennen und von der Marktdynamik zu profitieren. Dieser Indikator verwendet mehrere gleitende Durchschnitte mit unterschiedlichen Zeiträumen, um kurzfristige und langfristige Markttrends zu bewerten. Durch den Vergleich der kurzfristigen gleitenden Durchschnitte mit den langfristigen generiert er klare Kauf- und Verkaufssignale, die Händlern helfen kön

FREE

Das Bull DCA DowJones Signal - Premium Trend & Swing Indikator (WinWiFi Robot Series) Überblick: Erschließen Sie das volle Potenzial des Indexhandels mit der neuesten Innovation aus der WinWiFi Robot Series . Das "Bull DCA DowJones Signal" ist ein präzisionsgefertigter Indikator, der entwickelt wurde, um die globalen Indizes, Energie- und Devisenmärkte zu erobern. Optimiert für den H4-Zeitrahmen , filtert dieses Tool das Marktrauschen heraus und liefert klare, umsetzbare Signale für Trendfolge,

FREE

Es besteht die Wahrscheinlichkeit, dass höhere Kurse verzeichnet werden, wenn der MACD aus dem historischen Widerstandsniveau des Oszillators ausbricht. Es wird dringend empfohlen, Kursausbrüche mit Oszillatorausbrüchen zu bestätigen, da sie vergleichbare Auswirkungen haben wie das Durchbrechen von Unterstützungs- und Widerstandsniveaus durch den Kurs; sicherlich werden Short-Trades die gleiche Wahrnehmung haben. Der Vorteil ist, dass der Oszillatorausbruch oft dem Preisausbruch vorausgeht und s

FREE

** Alle Symbole x Alle Zeitrahmen scannen nur durch Drücken der Scanner-Taste ** *** Kontaktieren Sie mich , damit ich Ihnen eine Anleitung schicken und Sie in die "ABCD-Scanner-Gruppe" aufnehmen kann, um Erfahrungen mit anderen Benutzern auszutauschen oder zu sehen. Einführung Dieser Indikator scannt AB=CD Retracement-Muster in allen Charts. Das ABCD ist ist die Grundlage für alle harmonischen Muster und hoch repetitiv mit einer hohen Erfolgsrate . Der ABCD-Scanner-Indikator ist ein ABCD-Umkehr

Übersicht QuantumEdge Oscillator ist ein professioneller Handelsindikator, der fortschrittliche Momentum-Analyse mit hochentwickelten Algorithmen zur Trenderkennung kombiniert. Diese 30-tägige Testversion bietet vollen Zugriff auf alle Funktionen und ermöglicht es Ihnen, seine Fähigkeiten unter Live-Marktbedingungen gründlich zu testen, bevor Sie eine Kaufentscheidung treffen. Hauptmerkmale Zwei-Signal-System : Kombiniert den gleitenden RSI-Durchschnitt mit geglätteten ATR-basierten Volatilitäts

FREE

Sehen Sie sich mein deutsches Pro Signal an - https://www.mql5.com/en/signals/2354346

Quantum Core - Phase Shift ist eine neuronale Synchronisationsmaschine, die für die Phasendiagnose zwischen den Märkten entwickelt wurde.

Mit Hilfe von Algorithmen zur zeitlichen Verschiebung und Flussharmonik entschlüsselt er das verborgene oszillatorische Verhalten von Marktenergiefeldern. Der NeuroLink Trace gibt den Kernstabilitätsvektor wieder, während der Quantum Phase Core die Phasendivergenz durch ei

FREE

Sehen Sie sich mein deutsches Pro Signal an - https://www.mql5.com/en/signals/2354346

Astral Universe (MT5)

Dieser Indikator aus dem Astral Mechanics Lab - Ptr777 - visualisiert die kosmische Interaktion zwischen zwei fundamentalen Marktenergien: Momentum und Resonanzstärke . Er interpretiert ihre astrale Ausrichtung und zeigt drei harmonische Zustände - Aufstieg , Abstieg und Gleichgewicht - in einem strahlenden Histogrammfeld an. Jeder Balken verkörpert den aktuellen Energiefluss des Mar

FREE

Sehen Sie sich mein German Pro Signal an - https://www.mql5.com/en/signals/2354346

Der Cosmic Nebula Oscillator ist ein Momentum- und Trendstärke-Oszillator, der entwickelt wurde, um den Marktdruck durch farbkodierte Histogrammzustände zu visualisieren. Er wandelt die Richtungsenergie in vier intuitive kosmische Phasen um, die um die Nulllinie (Ereignishorizont) herum gezeichnet werden, so dass sowohl die Richtung als auch die Qualität des Momentums auf einen Blick zu erkennen sind. Der Indika

FREE

Freund des Trends: Ihr Trend-Tracker Meistern Sie den Markt mit Friend of the Trend , dem Indikator, der die Trendanalyse vereinfacht und Ihnen hilft, die besten Momente zum Kaufen, Verkaufen oder Abwarten zu erkennen. Mit seinem intuitiven und visuell ansprechenden Design analysiert Friend of the Trend die Kursbewegungen und liefert Signale über ein farbiges Histogramm: Grüne Balken : signalisieren einen Aufwärtstrend und weisen auf Kaufgelegenheiten hin. Rote Balken : Warnen vor einem Abwärtst

FREE

Der MetaTrader Market ist eine einzigartige Plattform für den Verkauf von Robotern und technischen Indikatoren.

Das Merkblatt für Nutzer der MQL5.community informiert Sie über weitere Möglichkeiten: nur bei uns können Trader Handelssignale kopieren, Programme bei Freiberuflern bestellen, Zahlungen über das Handelssystem automatisch tätigen sowie das MQL5 Cloud Network nutzen.

Sie verpassen Handelsmöglichkeiten:

- Freie Handelsapplikationen

- Über 8.000 Signale zum Kopieren

- Wirtschaftsnachrichten für die Lage an den Finanzmärkte

Registrierung

Einloggen

Wenn Sie kein Benutzerkonto haben, registrieren Sie sich

Erlauben Sie die Verwendung von Cookies, um sich auf der Website MQL5.com anzumelden.

Bitte aktivieren Sie die notwendige Einstellung in Ihrem Browser, da Sie sich sonst nicht einloggen können.