Смотри обучающее видео по маркету на YouTube

Как купить торгового робота или индикатор

Запусти робота на

виртуальном хостинге

виртуальном хостинге

Протестируй индикатор/робота перед покупкой

Хочешь зарабатывать в Маркете?

Как подать продукт, чтобы его покупали

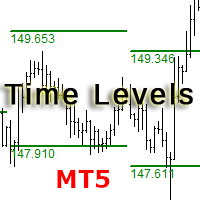

Технические индикаторы для MetaTrader 5 - 43

BinaWin NoTouch - это индикатор, который посылает сигнал тревоги, когда сделка находится в правильной позиции, чтобы дождаться пробоя бокового рынка.

Он специально разработан для торговли по стратегии «без касания» платформы Binary.Com с синтетическими индексами N.10, N.25, N.50, N.75 и N.100.

Аналогичным образом, торговля может быть осуществлена с помощью обычной стратегии CALL и PUT любой платформы бинарных опционов.

Требования к использованию индикатора:

1. Иметь учетную запись на Bina

FREE

For those who needs a levels of a first day of a month fully coded with Grok AI Standard settings: * line width * historic Lvl's * Line colors/type *************************************************************************************** Inspired by trader, to use these levels, but i wanted to mark these levels fast and not waste my time on drawing them.

FREE

Overview QuantumEdge Oscillator is a professional-grade trading indicator that combines advanced momentum analysis with sophisticated trend detection algorithms. This 30-day trial version provides full access to all features, allowing you to thoroughly test its capabilities in live market conditions before making a purchase decision. Key Features Dual-Signal System : Combines RSI moving average with smoothed ATR-based volatility bands Multi-Timeframe Analysis : Built-in support for higher timefr

FREE

Индикатор TickCounter осуществляет подсчет тиков вверх и вниз на каждом новом баре. Подсчет начинается с момента установки индикатора на график. Столбики гистограммы отображают: Желтые столбики - общее количество тиков; Синие столбики - тики ВВЕРХ; Красные столбики - тики ВНИЗ. Если синий столбик не виден, значит тиков вниз больше и красный столбик отображается поверх синего (красный слой выше синего). MT4 version: https://www.mql5.com/en/market/product/82548 Каждая переинициализация ин

APT – Advance Pivot Trader Indicator for MetaTrader 5 APT – Advance Pivot Trader is a technical indicator developed for MetaTrader 5.

The indicator is based entirely on mathematical and algorithmic calculations and is designed to analyze market structure using pivot-based logic. The indicator does not use grid techniques, martingale strategies, or position sizing methods. It provides analytical information to support structured and disciplined trading decisions. Timeframe and Risk Guidance The

FREE

Timer PRO

Candle timer with real-time gain/loss display.

FUNCTIONS:

- Exact countdown to candle close

- Floating profit/loss display updated every second

- Green for gains, red for losses

- Automatic sum of all positions for the symbol

- Works on all timeframes (M1 to MN)

- Customizable position and colors

IDEAL FOR:

- Scalping and day trading

- Trading with precise timing

- Visual position management

- Instant profit and loss monitoring

INSTALLATION:

Download → Drag to the chart → Done

Com

FREE

RSI Divergence Lite (Free) - MT5 Indicator ------------------------------------------------- This is the Lite (free) version of RSI Divergence.

- Detects basic Bullish and Bearish divergence between price and RSI - Works only on M15 timeframe - No divergence lines, no alerts - Fixed internal settings (RSI 14, pivot sensitivity, thresholds) - For educational and testing purposes

For the full PRO version (multi-timeframe, alerts, divergence lines, advanced UI), please upgrade to RSI Divergence

FREE

Hi Traders, RSI and Stochastic are among the most popular indicators used to measure momentum and help identify overbought and oversold conditions. This indicator displays two optional RSI and Stochastic values on your chart, helping you save chart space and keep things clean and organized. You can set your desired upper and lower thresholds for RSI and Stochastic to monitor conditions. If the RSI (or Stochastic) value is between the upper and lower thresholds, the text color will remain your de

FREE

SuperTrend Pro – Advanced Trend Detection Indicator (MT5) SuperTrend Pro is a modern, optimized trend-following indicator for MetaTrader 5 , designed to deliver clear trend direction, precise market structure, and a premium visual trading experience . It is based on an enhanced ATR-powered SuperTrend algorithm , combined with smart visuals, chart styling, and a real-time information panel. -Key Features - Advanced SuperTrend Logic Uses ATR (Average True Range) with adjustable Period and Multipli

FREE

Short Market Description (recommended) Market Periods Synchronizer highlights higher-timeframe (HTF) sessions directly on your current chart, so you can trade the lower timeframe with full higher-timeframe context. Draws vertical lines for each HTF bar (e.g., H1 on an M5 chart) Optional body fill (green for bullish, red for bearish) for each HTF candle Optional Open/Close markers with labels to spot key reference levels fast Optional minor-timeframe dividers (e.g., M30 & M15) only inside each

FREE

Here is the full technical and strategic description for the Gann Square of 9 indicator. Full Name Gann Square of 9 - Intraday Levels (v2.0) Overview This is a mathematical Support & Resistance indicator based on W.D. Gann's "Square of 9" theory. Unlike moving averages which lag behind price, this indicator is predictive . It calculates static price levels at the very beginning of the trading day (based on the Daily Open) and projects them forward. These levels act as a "road map" for the day,

FREE

Neural Levels Indicator – Precise AI-Based Market Levels Unlock next-level trading precision with the Neural Levels Indicator, a powerful market analysis tool built on advanced price-action principles and inspired by cutting-edge neural networks. Instantly identify three key neural trading levels directly on your chart:

Neural Level 1 Purpose: Crucial equilibrium level, ideal for identifying market balance points and potential turning zones.

Neural Level 2 (Optimal Entry) Purpose: Indicates p

FREE

RSI talking, use all your senses while trading!

The idea When trading your eyes might be very stressed. Therefore I programmed the RSItalking. Trade what you see and what you hear !

Function This indicator says "rsioverbought" when rsi is over a threshold value (default 75%) and "rsioversold" if it is under a lower threshold (default 25%). When you keep a long position be adviced to realize profit when the indicator tells you "rsioverbought" and vice versa. You will find an explanation of the

FREE

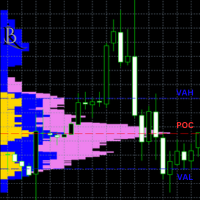

Объем и MarketProfile Pro Описание: Индикатор MarketProfile предоставляет точный и детализированный анализ торгового объема по различным уровням цен. Он рассчитывает и отображает профиль объема для каждого торгового дня, помогая вам понять структуру рынка и распределение объема для принятия обоснованных торговых решений. Основные характеристики: Ежедневный анализ объема: Индикатор рассчитывает и отображает профиль объема для каждого торгового дня, позволяя вам легко определить распределение объ

Initial Balance Session The Initial Balance Indicator is a professional-grade tool for MetaTrader 5 traders, designed to enhance your trading by visualizing key price levels during the Asia, London, and US market sessions. This indicator plots the Initial Balance (IB) range—the high, low, and midpoint prices—formed during the first hour of each session, with a customizable box to highlight the range and optional extension levels for advanced analysis. Optimized for smooth, flicker-free perform

Free for now, price is going to be 30 USD at Jan 1. 2025.

Features: Pin Bar Detection : The indicator is designed to identify bullish and bearish pin bars based on specific criteria, including the relative size of the candle’s body and shadow, as well as the position of the candle's body in relation to the 38.2% Fibonacci level. Customizable Labels : Custom text is displayed above each identified bullish or bearish pin bar, such as "[38.2]" for bullish and "[-38.2]" for bearish, helping traders

FREE

MM Ultimate Pro Analyzer v10.0 - USER GUIDEBASIC USAGEStep 1: Add to Chart Open any chart in MetaTrader 5 Go to Navigator → Indicators Find MM Ultimate Pro Analyzer Drag it onto your chart A settings window will appear Step 2: Configure for Your Timeframe Choose settings based on what you trade: Timeframe NumberOfCandles VolumeAveragePeriod M1-M5 (Scalping) 10-20 50 M15-M30 (Day Trading) 5-10 30 H1-H4 (Swing Trading) 3-7 20 D1+ (Position Trading) 3-5 14 Step 3: Understand the Button Bar At the t

Это версия MT5. Это алгоритм для раннего обнаружения изменений тренда. Вы должны попробовать несколько значений для параметра мультипликатора (1 < <10 рекомендуется). На первый взгляд вы можете увидеть эффективные записи. Это, по сути, один из строк, что Гелег Faktor первоначально было. Но он был удален, потому что он больше не нужен. Других строк было достаточно для эффективности G.Faktor, но я все еще хотел поделиться этим. Всегда тест, прежде чем использовать его на живой счет, так что вы пол

FREE

ATR Monitor ATR is a measure of volatility introduced by market technician J. Welles Wilder Jr. in his book, "New Concepts in Technical Trading Systems". In general, traders are accustomed to seeing the ATR in the form of a sub-window indicator. What I am presenting here is a simplified version of ATR - just the current ATR number - very useful for monitoring just the very moment of the current chart. And, by default, this indicator will not show up on screen, you can just use the buffers thems

FREE

This simple indicator paints with a darker color on the volume bar when the quantity traded is above the average of select number of periods of the volume itself, highlighting the moments when there was a large volume of deals above the average. It is also possible to use a configuration of four colors where the color tone shows a candle volume strength. The indicator defaults to the simple average of 20 periods, but it is possible to change to other types of averages and periods. If you like t

FREE

A very useful Price Action point is the previous day Closing VWAP. We call it Big Players Last Fight . This indicator will draw a line showing on your chart what was the last VWAP price of the previous trading session. Simple and effective. As an additional bonus, this indicator saves the VWAP value on the Public Terminal Variables, so you EA could read easily its value! Just for the "Prefix + Symbol name" on the variables list and you will see!

SETTINGS How many past days back do you want to s

FREE

Volume Profile Trading System is NOT just another volume indicator. It's a complete trading ecosystem that combines professional volume profile visualization with an intelligent automated trading strategy. While other indicators show you WHERE volume is concentrated, Volume Profile Trading System shows you WHERE , WHEN , and HOW to trade it! displaying real volume distribution by price instead of time. It helps traders identify fair value zones, institutional activity, and high

Dynamic Swing Anchored VWAP — это точный инструмент цена–объём, который остаётся актуальным в условиях живого рынка. Вместо статичного VWAP, который с течением сессии уходит всё дальше от цены, этот индикатор привязывает VWAP к новым локальным максимумам и минимумам и адаптирует его чувствительность при изменении волатильности. Результат — это справедливая ценовая траектория, которая следует за ценой более точно, облегчая определение и торговлю на откатах, ретестах и возврате к среднему значению

TransitGhost Signal indicator, this is one of my best forex trading strategy. The strategy is based on the simple moving average cross, 5 SMA AND 200 SMA of which take a longer time to cross. Whenever the is a cross between the 5 SMA and 200 SMA a signal will be given, when the 5 SMA cross the 200 SMA to the upside ,a buying arrow will appear on chart, and push notification(alert) "Buy now, use proper risk management" will be sent on both the MT5 PC and mobile app, and when the 5 SMA cross the 2

FREE

ToolBot Probabilistic Analysis - FREE An effective indicator for your negotiations

The toolbot indicator brings the calculation of candles and a probabilistic analysis so that you have more security on your own.

Also test our FREE tops and bottoms indicator: : https://www.mql5.com/pt/market/product/52385#description Also test our FREE (RSI, ATR, ADX, OBV) indicator: https://www.mql5.com/pt/market/product/53448#description

Try our EA ToolBot for free: https://www.mql5.com/market/prod

FREE

StrikeZone Macd Atr is an advanced volatility-adaptive oscillator that scales the traditional MACD using ATR.

This approach solves the common problem of conventional MACD: it does not react properly to changing volatility.

With ATR scaling, momentum becomes clearer, smoother, and more meaningful across all market conditions. Key Features 1. ATR-Scaled MACD Oscillator The indicator adjusts (MACD – Signal) by ATR ratio, allowing: Reduced noise during high-volatility periods Enhanced sensitivity du

FREE

The TRIXe Indicator is the combination of the TRIX indicator (Triple Exponential Moving Average) with the addition of an EMA (Exponential Moving Average) signal. It provides signs of trend continuity and the start of a new trend.

The entry and exit points of operations occur when the indicator curves cross.

It performs better when combined with other indicators.

FREE

The seven currencies mentioned are: GBP (British Pound): This is the currency of the United Kingdom. AUD (Australian Dollar): This is the currency of Australia. NZD (New Zealand Dollar): This is the currency of New Zealand. USD (United States Dollar): This is the currency of the United States. CAD (Canadian Dollar): This is the currency of Canada. CHF (Swiss Franc): This is the currency of Switzerland. JPY (Japanese Yen): This is the currency of Japan. Currency strength indexes provide a way to

FREE

Индикатор Fractals ST Patterns Strategy является модификацией индикатора Fractals Билла Вильямса и позволяет задавать любое количество баров для нахождения фрактала. Этот простой индикатор соответствует параметрам ST Patterns Strategy ( https://stpatterns.com/ ) . Structural Target Patterns по своей сути и есть сам рынок, последовательно разделенный на составляющие. Для формирования ST Patterns не нужны линии тренда, геометрические пропорции самой модели, объем торгов или открытый рыночный интер

FREE

Supertrend Analysis Dashboard (Multi-Timeframe Edition) Advanced Real-Time Trend, Volatility & Risk Analysis Tool for Smart Traders Short Description

A professional multi-timeframe Supertrend indicator with a real-time analytical dashboard, risk alerts, pullback zones, and higher-timeframe confirmation system — all visualized directly on the chart.

Full Description

Supertrend Analysis Dashboard is a next-generation indicator that combines Supertrend logic, multi-timeframe confirmation, and r

FREE

XAUUSD Heat Map Scalping Indicator Perfect for 1M, 3M, 5M, 15M Scalping on Gold (XAUUSD) Take your scalping to the next level with this exclusive Heat Map indicator , designed and optimized specifically for XAUUSD . This tool is a powerful visual assistant that helps you instantly identify market strength, pressure zones, and potential entry points in real time. Key Features: Optimized for Fast Scalping : Works best on 1-minute, 3-minute, 5-minute, and 15-minute timeframes Specializ

Индикатор создан чтобы отобразить на графике данные ценовые уровни: Максимум и минимум прошлого дня. Максимум и минимум прошлой недели. Максимум и минимум прошлого месяца. В настройках индикатора, для каждого типа уровней, можно менять стиль линий, цвет линий, включить и отключить нужные уровни.

Настройки ----Day------------------------------------------------- DayLevels - включение / отключение уровней прошлого дня. WidthDayLines - толщина линий дневных уровней. ColorDayLines - цвет лин

FREE

Transaction Data Analysis Assistant: This is a statistical analysis tool for transaction data, and there are many data charts for analysis and reference. language: Support language selection switch (currently supports Chinese and English active recognition without manual selection) The main window shows: Balance display Total profit and loss display Now the position profit and loss amount is displayed Now the position profit and loss ratio is displayed The total order volume, total lot size, and

FREE

Initialize RSI with period 2 above the closing price. Initialize EMA with period 20 above the closing price. Buy condition: RSI < 15 (oversold). Closing price of 4 consecutive candles > EMA (uptrend). Place BUY signal at the bottom of the candle. Sell condition: RSI > 85 (oversold). Closing price of 4 consecutive candles < EMA (downtrend). Place SELL signal at the top of the candle

FREE

UzFx-Local Currency Converter-MT5 — это мощный и простой в использовании индикатор, разработанный для трейдеров, которые хотят отслеживать свои плавающие и ежедневные прибыли и убытки (P&L) как в долларах США, так и в своей местной валюте. Этот инструмент обеспечивает конвертацию в режиме реального времени с использованием заданного пользователем обменного курса, помогая трейдерам более эффективно визуализировать свои торговые результаты.

Ключевые особенности

Отображает текущую прибыль и убыт

FREE

Introduction Poppsir is a trend-range indicator for metatrader 5 (for now), which distinguishes sideways phases from trend phases.

With this tool it is possible to design a trend following-, meanreversion-, as well as a breakout strategy.

This indicator does not repaint!

The signal of the Poppsir indicator is quite easy to determine. As soon as the RSI and Popsir change their respective color to gray, a breakout takes place or in other words, the sideways phase has ended.

Interpretation

FREE

Forex 17 – Bollinger Bands Pure Sound Alert No Plots подает звуковые сигналы, когда цена пересекает верхнюю или нижнюю полосу Bollinger Bands. Разные звуки используются для восходящих и нисходящих пробоев, помогая выявлять потенциально перекупленные или перепроданные состояния. Версия без графического отображения не рисует визуальные элементы на графике. Настраиваемые параметры включают период, отклонение и интервалы между сигналами. Чисто звуковой подход подходит для сохранения чистоты графиков

FREE

Product Description: Swing Points & Liquidity (MT5) What it does:

This indicator automatically identifies significant "Swing Highs" and "Swing Lows" (Fractals) on your chart. It assumes that these points represent Liquidity (where Stop Losses and Buy/Sell stops are resting) or Supply and Demand Zones . When a Swing High is formed, it projects a Red Box/Line to the right (Supply/Resistance). When a Swing Low is formed, it projects a Green Box/Line to the right (Demand/Support). As

Highly configurable Rate of Change (ROC) indicator. Features: Highly customizable alert functions (at levels, crosses, direction changes via email, push, sound, popup) Multi timeframe ability Color customization (at levels, crosses, direction changes) Linear interpolation and histogram mode options Works on strategy tester in multi timeframe mode (at weekend without ticks also) Adjustable Levels Parameters:

ROC Timeframe: You can set the current or a higher timeframes for ROC. ROC Bar Shift:

FREE

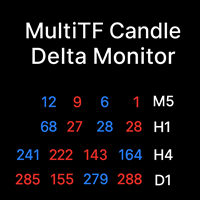

MultiTF Candle Delta Monitor — Multi-Timeframe Difference Panel (Visualizing candle changes as numeric values)

Overview: Monitor candle differences across multiple timeframes in a compact numeric panel. Each row represents a timeframe, and each cell shows the recent close-to-close difference (pips/ticks). Blue = upward, Red = downward, Gray = no change. Since it uses label rendering only, it is lightweight and does not interfere with the chart.

Key Features: - Multi-timeframe support (M1, M5,

FREE

Cybertrade Double Bollinger Bands - MT5 The Bollinger Bands indicator shows the levels of different highs and lows that a security price has reached in a given duration and also their relative strength, where the highs are close to the upper line and the lows are close to the lower line. Our differential is to present this indicator in a double form, with the availability of its values to simplify automation.

It works on periods longer than the period visible on the chart. All values are

FREE

AliSession Highlight is an indicator that highlights a specific period of time according to your preferences. It can help you gain a clear vision of price movements into a specific session, the range of a session, and also to easily identify the high and low of the session. You can use it on any currency pairs, indices, and any timeframes. Settings: Start Hour: Set the hour to initiate the session highlight. Start Min: Set the minute for the start of the session highlight. End Hour: Specify the

FREE

Esse indicador é a combinação do RSI (IFR) com Média Móvel Simples aplicada o RSI em um único indicador para facilitar a criação de alguma estratégia. Fiz esse indicador para que um único indicador contenha os buffer necessários para implementar alguma EA.

Descrição dos Buffers para o EA,

Buffer 0 -> Valor do RSI Buffer 1 -> Valor da média móvel aplicada ao RSI

FREE

Индикатор Volatility Exhaustion Описание для пользователей Volatility Exhaustion - это уникальный индикатор, использующий особую технологию анализа волатильности. Он определяет критические моменты на рынке, когда текущая активность достигает экстремальных уровней относительно исторических данных. Ключевые особенности: Простота интерпретации: Индикатор использует бинарную систему сигналов Универсальность: Работает на любых таймфреймах и инструментах Эффективность: Особенно полезен на флэтовых и т

FREE

You may find this indicator helpfull if you are following a session based strategy. The bars are colored according to the sessions. Everything is customisable.

Settings: + Asia Session: zime, color, high, low + London Session: zime, color, high, low + US Session: zime, color, high, low

Please feel free to comment if you wish a feature and/or give a review. Thanks.

FREE

RSI Scanner, Multiple Symbols and Timeframes, Graphical User Interface An indicator that scans multiple symbols added from the market watch and timeframes and displays result in a graphical panel. Features: Multi symbol Multi timeframe Alerts and Notifications Live Monitoring Sorting modes One click to change symbol and timeframe Inputs for RSI and scanner settings

FREE

CANDLESTICK_MT5

Очень интересный индикатор свечных паттернов, конвертированный из бесплатной версии индикатора CANDLESTICK для терминала MetaTrader4 в версию для терминала MetaTrader5. Помимо свечных паттернов, он рисует линии поддержки и сопротивления, которые отлично отрабатываются ценой на графике. Может работать на любом таймфрейме. Имеет простые настройки. При конвертировании были максимально сохранены логика работы и дизайн оригинального индикатора CANDLESTICK для терминала МТ4.

FREE

PRO VERSION https://www.mql5.com/en/market/product/144989?source=Site https://www.mql5.com/en/users/gedeegi/seller GEN Support & Resistance (EGGII77) is an MT5 indicator that automatically detects and draws Support & Resistance levels based on pivot highs and lows. The indicator features two sets of S&R (main structure and quick levels), a customizable maximum number of lines, adjustable colors, and a clean chart display for clearer price action analysis.

FREE

Gann Bar Counting - Identifies the Candle Sequence Description:

The "Gann Bar Counting" indicator is designed to identify bullish and bearish candle sequences according to the Gann counting methodology. This approach helps detect continuation or reversal patterns, providing a clear view of the market structure. Indicator Conditions: Bullish Sequence: A green dot is placed above the candle if: The current high is greater than the high of the previous candle. The current low is greater than the l

FREE

The new version of MirrorSoftware 2021 has been completely rewriten and optimized.

This version requires to be loaded only on a single chart because it can detect all actions on every symbol and not only the actions of symbol where it is loaded.

Even the graphics and the configuration mode have been completely redesigned. The MirrorSoftware is composed of two components (all components are required to work): MirrorController (free indicator): This component must be loaded into the MASTER

FREE

Higher Timeframe Chart Overlay will display higher timeframe candles, including the number of candles high/low you specify.

You no longer need to switch timeframes to check the candles. Everything can be shown in one chart. Get Full Version - https://www.mql5.com/en/market/product/115682 Please feel free Contact me if you have any questions regarding this tool.

FREE

Индикатор сканирует до 15 торговых инструментов и до 21 таймфрейма на наличие высоковероятностных моделей паттерна Двойная вершина/дно с ложными прорывами . Что определяет этот индикатор: Этот индикатор находит особую форму таких паттернов, так называемые двойных вершин и нижних частей, так называемый Двойная вершина/дно с ложными прорывами . Паттерн "Двойная вершина с ложными прорывами" формируется, когда максимальная цена правого плеча выше левого плеча. Паттерн "Двойное дно с ложными прорывам

FREE

VR ATR Pro — технический индикатор, предназначенный для определения целевых уровней на основе статистического анализа предыдущих торговых периодов. В его основе лежит математический расчёт среднего ценового движения за выбранный период времени. Принцип работы индикатора, основанный на статистике В основе работы индикатора лежит наблюдение за ежедневным поведением цены: каждый торговый период характеризуется определённой амплитудой движения — цена проходит некоторое расстояние в пунктах как вверх

Time to Trade Trading timing indicator is based on market volatility through 2 ATR indicators to determine the timing of a transaction. The indicator determines the times when the market has strong volatility in trend. When histogram is greater than 0 (blue) is a strong market, when histogram is less than 0 (yellow) is a weak market. Should only trade within histograms greater than 0. Based on the histogram chart, the first histogram value is greater than 0 and the second histogram appears, this

FREE

This MT5 alert is designed to identify potential buying opportunities based on several technical indicators and price action patterns. Here's how it works: Buy Conditions 1. RSI Condition: The Relative Strength Index (RSI) for the current period is below a specified low threshold (RsiLow). This indicates oversold conditions.

2. Candlestick Pattern: It checks for a specific candlestick pattern across three consecutive candles: - The current candle (1) closes higher than it opens (bulli

FREE

If you have difficulty determining the trend as well as entry points, stop loss points, and take profit points, "Ladder Heaven" will help you with that. The "Ladder Heaven" algorithm is operated on price depending on the parameters you input and will provide you with signals, trends, entry points, stop loss points, take profit points, support and resistance in the trend That direction.

Helps you easily identify trends, stop losses and take profits in your strategy! MT4 Version: Click here Fea

FREE

About. This indicator is the combination of 3 Exponential Moving averages, 3,13 and 144. it features Taking trades in the direction of trend, and also helps the trade to spot early trend change through Small moving averages crossing Big Moving averages Product features 1. Have built in Notification system to be set as the user desires (Alerts, Popup notification and Push Notification to Mobile devices) so with notification on, you do not need to be at home, or glued to the computer, only set and

FREE

Moving Average Color

Moving Average (MA) - трендовый индикатор, представляющий собой изогнутую линию, рассчитываемую на основе изменения цены. Соответственно, скользящая средняя является помощником трейдера, подтверждающим тренд. На графике это выглядит как изгибающаяся линия, повторяющая движение цены, но более плавно. Moving Average Color – стандартный индикатор скользящей средней, цвет которого меняется при изменении направления тренда. Также добавлена возможность устанавливать дополнительные

FREE

PipTick Correlation отображает текущую корреляцию между выбранными инструментами. Настройки по умолчанию установлены на 28 валютных пар, золото и серебро, но индикатор может сравнивать любые другие символы.

Интерпретация индикатора Положительная корреляция (выше 80 %) Отрицательная корреляция (ниже -80 %) Слабая корреляция/корреляция отсутствует (между -80 и 80 %)

Основные характеристики Индикатор показывает текущую корреляцию между выбранными символами. Простое сравнение одного символа с друг

A lot of professional traders use high quality divergence signals as a part of their strategy to enter a position. Spotting correct divergences quickly can often be hard, especially if your eye isn’t trained for it yet. For this reason we’ve created a series of easy to use professional oscillator divergence indicators that are very customisable so you get only the signals you want to trade. We have this divergence indicator for RSI, MACD, Stochastics, CCI and OBV. RSI: https://www.mql5.com/en/

BB and EMA 50 This indicator merges BollingerBands and EMA50 to clarify trend strength, momentum shifts, volatility expansion, and directional bias, offering structured insights for breakout detection, pullback validation, and dynamic trend continuation across varied market conditions while improving precision in identifying reliable trade setups. It also includes an interactive hide-and-show line control using integrated buttons for flexible visual analysis.

FREE

The Trend Duration Forecast MT5 indicator is designed to estimate the probable lifespan of a bullish or bearish trend. Using a Hull Moving Average (HMA) to detect directional shifts, it tracks the duration of each historical trend and calculates an average to forecast how long the current trend is statistically likely to continue. This allows traders to visualize both real-time trend strength and potential exhaustion zones with exceptional clarity. KEY FEATURES Dynamic Trend Detection: Utiliz

One of the most powerful and important ICT concepts is the Power of 3. It explains the IPDA (Interbank Price Delivery Algorithm) phases. PO3 simply means there are 3 things that the market maker's algorithm do with price:

Accumulation, Manipulation and Distribution

ICT tells us how its important to identify the weekly candle expansion and then try to enter above or below the daily open, in the direction of the weekly expansion.

This handy indicator here helps you keep track of the weekly and

The Extreme Spike PRT Indicator is an effective tool for identifying sharp market fluctuations . It performs its calculations using the ATR (Average True Range) indicator and displays candles with extreme volatility in two categories: primary spikes and secondary spikes , within the Metatrader platform oscillator window. This tool assists traders in detecting intense price movements and conducting more precise analyses based on these fluctuations. Time Frame 15-minute - 1-ho

VWAP Indicator, the short form of Volume Weighted Average Price, is similar to a moving average but takes into consideration the tick volume of the candles. The indicator calculates the moving average multiplying the price of each candle for the tick volume in the candle. Said calculation weighs with more significance price where more transactions were made.

Features: Visual styling customizable Period customizable Ease of use

FREE

You need to revise your product description to comply with advertising policies that prohibit guaranteeing or hinting at profits. The current description uses phrases that could be interpreted as promises of financial gain, which violates these rules. Wave Trend Oscillator Indicator for MetaTrader 5 Discover the Wave Trend Oscillator Indicator , a sophisticated technical analysis tool for MetaTrader 5. This indicator is designed to help traders better understand market dynamics by visualizing w

The Double Stochastic RSI Indicator is a momentum indicator which is based on the Stochastic Oscillator and the Relative Strength Index (RSI). It is used help traders identify overbought and oversold markets as well as its potential reversal signals. This indicator is an oscillator type of technical indicator which plots a line that oscillates within the range of zero to 100. It also has markers at levels 20 and 80 represented by a dashed line. The area below 20 represents the oversold area, wh

The DFG Chart Indicator displays the historical DFG levels used in the DFG dashboard. These levels are generated dynamically using moving averages and Fibonacci ratios. The Fibonacci Bands automatically adjust to reflect changes in the price range and trend direction. The indicator also features buttons for selecting chart symbol and timeframe, along with a wide range of customization options. Key Features Dynamic DFG Levels

Automatically calculated using moving averages and Fibonacci ratios. H

FREE

The Metatrader 5 has a hidden jewel called Chart Object, mostly unknown to the common users and hidden in a sub-menu within the platform. Called Mini Chart, this object is a miniature instance of a big/normal chart that could be added/attached to any normal chart, this way the Mini Chart will be bound to the main Chart in a very minimalist way saving a precious amount of real state on your screen. If you don't know the Mini Chart, give it a try - see the video and screenshots below. This is a gr

RSI Screener for MT5 is a simple dashboard-type indicator that displays the RSI (Relative Strength Index) oscillator values on different instruments and time frames chosen by the user. In addition, it can be configured by the trader to show signals when the RSI is in overbought/oversold condition, when it crosses these levels or when it crosses the 50 level, which is important in some strategies. It is simple and easy to configure. On its own, it should not be used as a trading system since RSI

MetaTrader Маркет - уникальная площадка по продаже роботов и технических индикаторов, не имеющая аналогов.

Памятка пользователя MQL5.community расскажет вам и о других возможностях, доступных трейдерам только у нас: копирование торговых сигналов, заказ программ для фрилансеров, автоматические расчеты через платежную систему, аренда вычислительных мощностей в MQL5 Cloud Network.

Вы упускаете торговые возможности:

- Бесплатные приложения для трейдинга

- 8 000+ сигналов для копирования

- Экономические новости для анализа финансовых рынков

Регистрация

Вход

Если у вас нет учетной записи, зарегистрируйтесь

Для авторизации и пользования сайтом MQL5.com необходимо разрешить использование файлов Сookie.

Пожалуйста, включите в вашем браузере данную настройку, иначе вы не сможете авторизоваться.