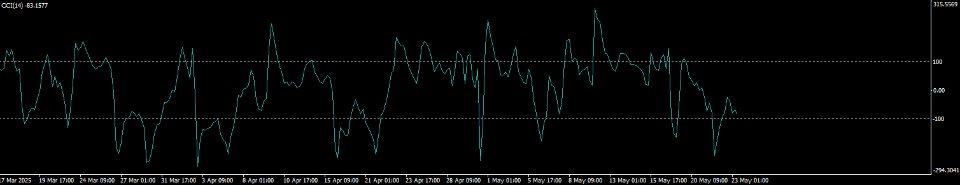

Commodity Channel Index

- Göstergeler

- Rami Fatmi Fernandez

- Sürüm: 1.0

- Etkinleştirmeler: 10

CCI (Commodity Channel Index) Indicator – Technical Accuracy on Your Chart

Description:

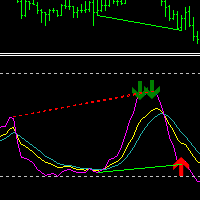

The CCI (Commodity Channel Index) is a professional technical indicator designed to identify overbought and oversold conditions, as well as potential market reversal points. This indicator calculates the deviation of the typical price from its moving average, making it a powerful tool for both scalping and medium- and long-term trading.

Key Features:

Smooth CCI line with standard ±100 levels for clear reading.

Optimized calculation using internal buffers for increased performance.

Customizable calculation period (default: 14).

Compatible with any asset type or timeframe.

Ideal for momentum-based or divergence-based strategies.

Advantages:

Easy visual interpretation.

Clean, efficient, and editable code.

Based on typical price for greater sensitivity.

For professional and educational use.

This indicator is perfect for traders looking to add a robust and reliable tool to their technical arsenal. Ideal for complementing analysis with RSI, MACD, or moving averages.