VR System MT 5

- インディケータ

- Vladimir Pastushak

- バージョン: 23.110

- アップデート済み: 13 11月 2023

- アクティベーション: 20

VR システム は単なる指標ではなく、金融市場で取引するためのバランスの取れた取引システム全体です。このシステムは、古典的な取引ルールと、移動平均とドンチャン チャネルの指標の組み合わせに基づいて構築されています。 VR システム は、市場に参入するためのルール、市場でポジションを保持するためのルール、およびポジションを決済するためのルールを考慮します。シンプルな取引ルール、最小限のリスク、明確な指示により、VR システムは金融市場のトレーダーにとって魅力的な取引戦略となっています。

設定、設定ファイル、デモ版、説明書、問題解決方法は、以下から入手できます。 [ブログ]

レビューを読んだり書いたりすることができます。 [リンク]

のバージョン [MetaTrader 4]

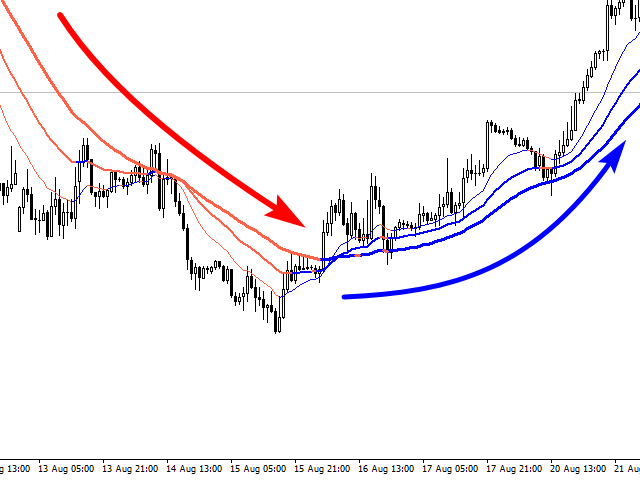

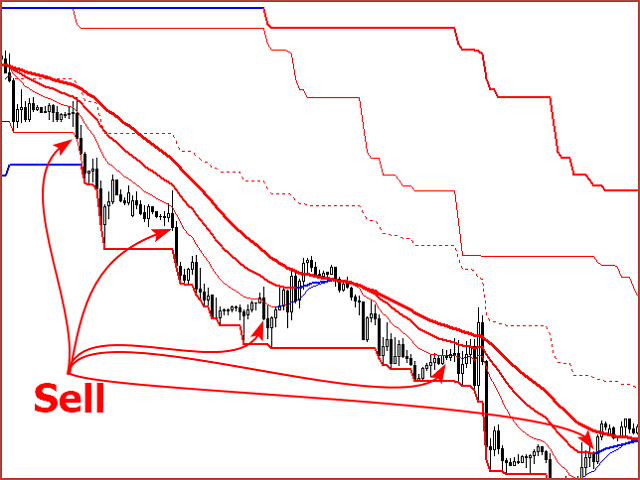

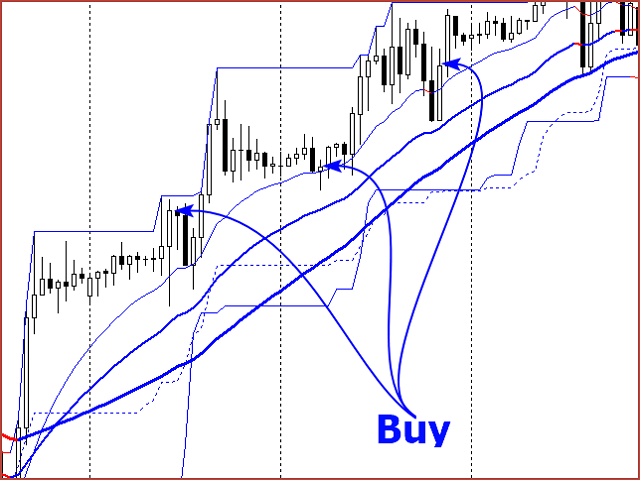

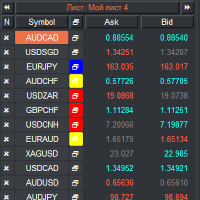

取引システムは、移動平均とドンチャン チャネルの 2 つの組み合わせ指標で構成されます。

Donchian channel – 金融商品の現在の状態を判断するために設計されたこのインジケーターは、トレンドまたはフラットを判断するための古典的なルールに従って構築されています。新しい極大値が以前のものより高い、新しい極小値が以前のものより高い、金融商品は「上昇傾向」であるとみなされる 新しい極大値が以前のものより低い、新しい極小値が前のものよりも低い場合、その金融商品は「下降トレンド」であると考えられます。 上記のルールのいずれも適用できない場合、その金融商品には不確実性または横ばいがあると考えられます。

Moving Average – 移動平均は、市場へのエントリーポイントを決定するために設計されています。このインジケーターには、異なる期間の 3 つの移動平均があります。遅い移動平均 - 市場に参入する方向を示します。移動平均 – 金融商品の現在の傾向を確認します。高速移動平均 – 現在閉じているバーと一緒にエントリーポイントを表示します。

金融商品の購入:

購入するには、次のインジケーターの状態を考慮する必要があります。 1 時間、4 時間、および 1 日の期間では、上記のドンチャン チャネル ルールに従って上昇傾向があります。 - 3 つの移動平均の色が変わり、増加傾向を示しています。期間の最後のローソク足は上昇して終了しましたが、最後のローソク足の安値は高速移動平均を下回っています。金融商品を売るには、リバースシグナルが考慮されます。

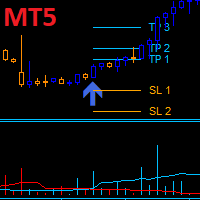

ポジションの保有:

オープンポジションの場合、ストップロス、テイクプロフィット、トレーリングストップが使用されます。テイクプロフィットはドンチャンチャネルのトップラインの下に配置されます。ストップロスはドンチャンチャネルの最終ラインの下に配置されます。トレーリングストップはチャネルの 3 分の 1 のサイズに配置する必要があります。

ポジションを決済する:

トレーリングストップでは、ポジション量が最低ロットより大きい場合、ポジションの一部を決済し、残りを損失なく移管することが可能です。取引戦略の逆のシグナルに基づいています。

一般的な推奨事項。

- 4 時間、1 日の古い期間から金融商品の分析を開始します。

- 常にストップロスとテイクプロフィットを設定し、あらゆる方法でポジションを保護します。重要なのは、入金額の1〜2%を超える損失を受け取らないことです。

- 利益を増やし、ポジションを部分的に決済し、損失を出さないように残高を移管し、長期間放置してください。

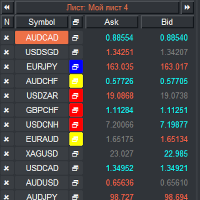

- 複数の金融商品を扱うことで、より多くの取引シグナルを受け取ることができます。

- 取引戦略の基本ルールに厳密に従ってください。

システム設定

- < --- I --- > - ドンチャンチャネル周期設定

- Period Donchian - 若い頃のドンチャンチャンネル

- Period Big Donchian - 古い時代のドンチャン水路

- < --- II --- > - 移動平均1の設定

- Period Moving Average 1 - 期間移動平均 1

- Method Moving Average 1 - 移動平均法 1

- Price Moving Average 1 - 価格移動平均 1

- < --- III --- > - 移動平均2の設定

- Period Moving Average 2 - 期間移動平均 2

- Method Moving Average 2 - 移動平均2法

- Price Moving Average 2 - 価格移動平均2

- < --- IV --- > - 移動平均3の設定

- Period Moving Average 3 - 期間移動平均 3

- Method Moving Average 3 - 移動平均3法

- Price Moving Average 3 - 価格移動平均 3

- < --- V --- > - メッセージ設定

- Push - スマホの通知

- Alert - 端末内の通知

- Mail - 電子メール通知

- < --- VI --- > - その他の設定

- Show Bars (-1 all) - 表示される計算の数 (すべて -1)

Владимир! Спасибо, Вам за подробное, детальное, легкое видео! За индикатор вообще большое спасибо! Отличное дополнение и не только! Здоровья Вам и новых достижений!