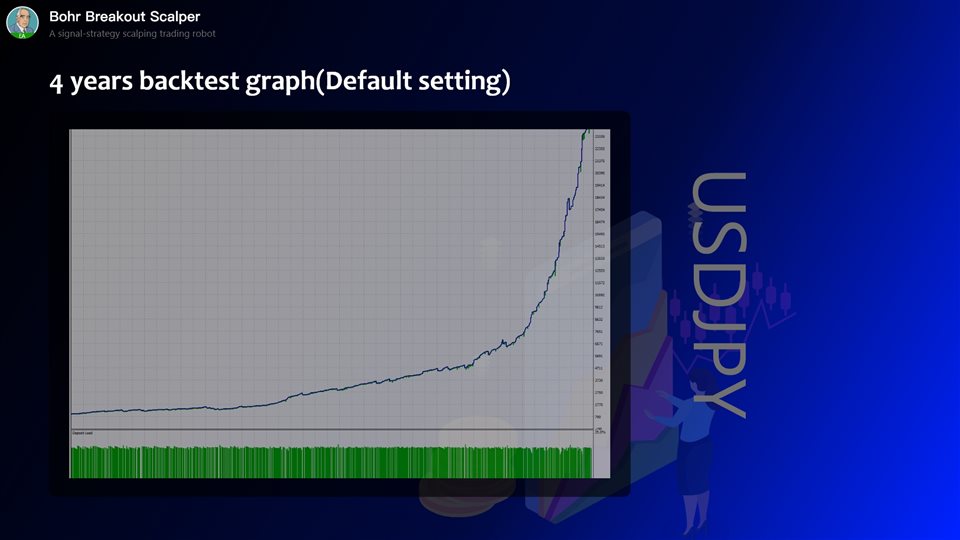

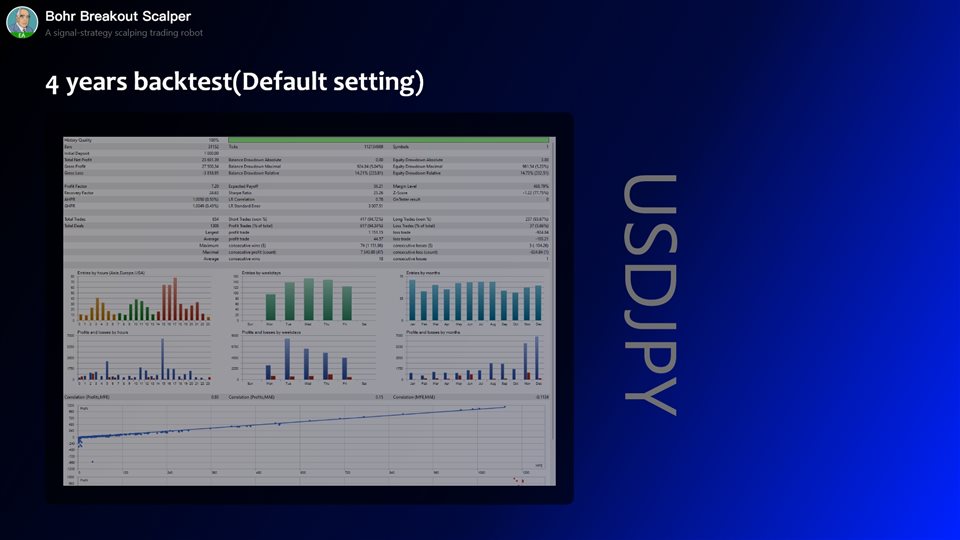

Bohr breakout scalper

Designed for traders seeking a dynamic approach to navigating price fluctuations, Bohr Breakout Scalper integrates multiple market-proven wave trading methodologies into a cohesive, adaptive system. It operates as a strategy integrator rather than a simple order executor, leveraging precision algorithms to identify favorable trading points amid market volatility—without relying on rigid, one-size-fits-all rules.

Signal:

- MT5:https://www.mql5.com/en/signals/2333073 (The same strategy is applied to XAUUSD. Strongly select the XAUUSD adapted version:https://www.mql5.com/en/market/product/161554)

Core Functionality

- Multi-Wave Strategy Integration: Combines validated wave trading logics that work in synergy, like interlocking gears, to navigate changing market conditions. The system avoids over-reliance on single signals, balancing responsiveness with prudence.

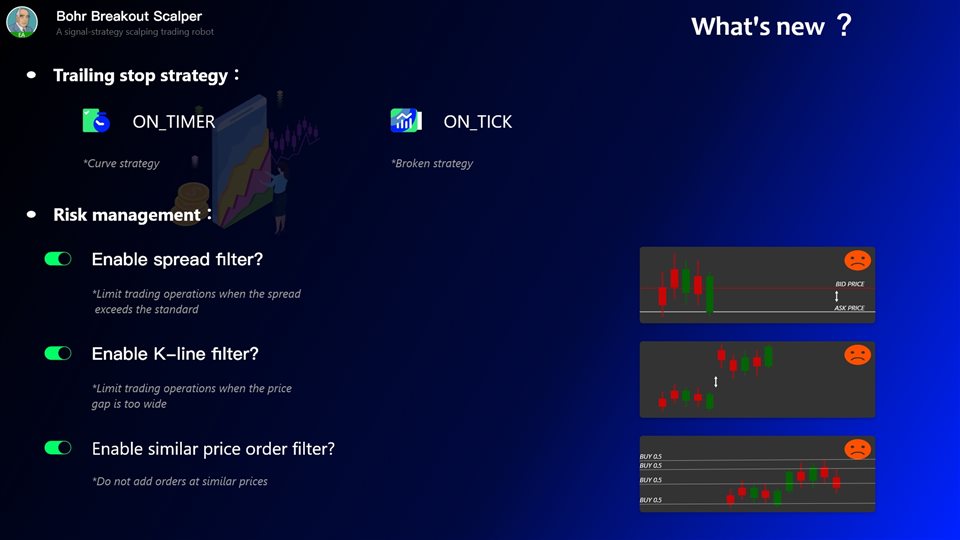

- Risk Filtering System: Acts as a targeted risk management tool, identifying and filtering high-risk signals to mitigate potential losses. It processes order flow data to distinguish between genuine opportunities and market noise.

- High-Speed Execution Engine: Core algorithms operate in milliseconds to generate market-adapted strategies and execute trades within a single cycle. This design minimizes delays that could impact trade entry and exit points.

- Trend-Adaptive Framework: Integrates trend-following mechanisms to adjust to steady price climbs, sharp declines, or sudden reversals. The system modifies its approach dynamically instead of adhering to fixed plans.

Technical Foundation

- Expectation Calculation: Uses existing variable estimates to map potential price trajectories.

- Maximization Calculation: Refines these estimates to identify corresponding price levels for strategy execution.

Usage Notes

- Compatible with MetaTrader 4 and MetaTrader 5 client terminals, in line with MQL5/MQL4 language specifications.

- No DLL calls or external dependencies—operates as a standalone compiled EX5/EX4 file.

- The number of allowed activations is set to 10 per buyer, covering multiple device and operating system configurations.

- Free updates are provided to all buyers, with manual installation required for version upgrades.

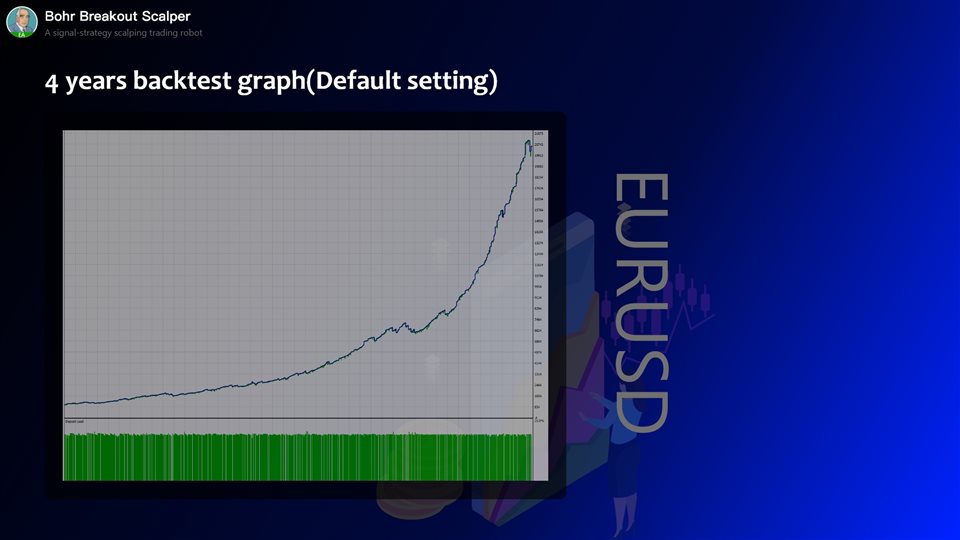

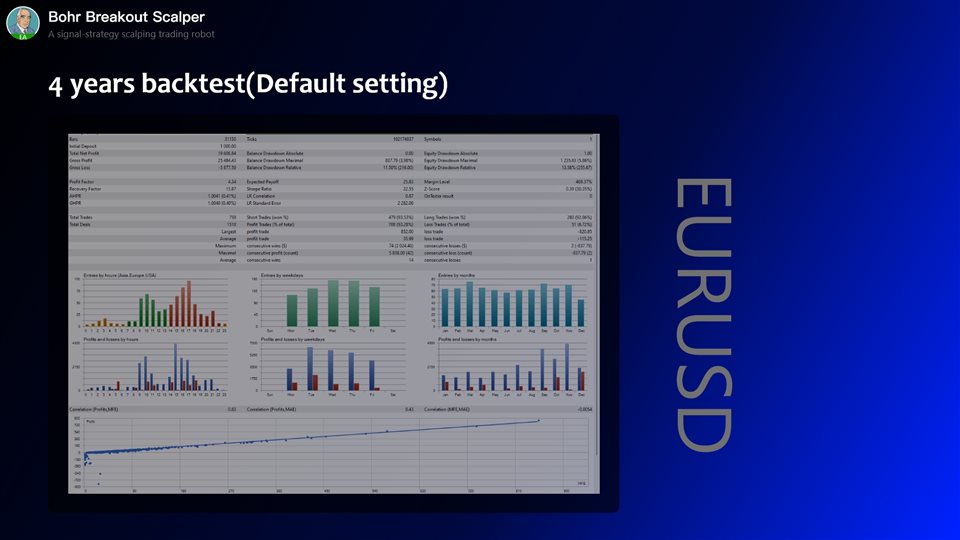

- For optimal performance, test the tool in the MetaTrader Strategy Tester using historical data relevant to your trading instruments and timeframes.

Important Disclosures

- This tool is a trading (auxiliary) tool, not a guarantee of trading results. Past performance in backtesting or demo environments does not indicate future profitability.

- All trading involves inherent risks. Users should apply appropriate risk management practices, including position sizing and stop-loss orders.

- The tool undergoes formal functionality testing as required by the MQL5 Market, but no system can eliminate the risk of losses in financial markets.

Requirements

| Trading pairs | EURUSD,USDJPY |

| Timeframe | H1 |

| Minimum deposit | $100~$500 |

| Leverage | 1:100 ~ 1:500 |

| Brokers | Hedging ECN account. Low spreads and zero stops level |

| 4.3 | 200~400 |

| 4.4 | 300~500 |

What's new channel:

https://www.mql5.com/en/channels/03CA9E800E21D901

Positive feedback