NeoBank

- Experts

- Angel Torres

- Versione: 1.0

- Attivazioni: 5

NeoBank is a hedge + grid/martingale EA with independent BUY and SELL cycles. It starts a new cycle when there are no positions on that side, and if price moves against the cycle it adds entries in stages using a stepped distance in points (base distance multiplied per stage) and a progressive lot sizing model (initial lot multiplied per stage).

Exits are not based on per-order TP/SL. The EA calculates the weighted average open price of the basket (per side) and closes all positions on that side when price reaches a dynamic ATR-based target:

Basket TP = AvgPrice ± (ATR * Mult) and optionally Basket SL = AvgPrice ∓ (ATR * Mult) if enabled.

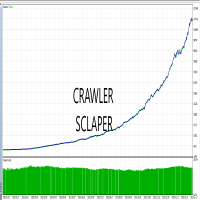

Example performance result (EURUSD, Exness-style environment)

On an Exness-style setup with no daily swap and no commissions (depending on account type and broker conditions), using data from 2020 (more than 5 years), this example shows:

Initial deposit: $2,000

Net profit: $27,691.26 (final balance approx. $29,691.26)

Profit factor: 1.97

Recovery factor: 13.64

Trades: 11,945

Win rate: 87.98%

Max balance drawdown: 20.00% (about $501)

Max equity drawdown: 88.13% (about $2,029.72), typical for strategies with large floating exposure (grid/martingale)

Average returns (using net profit as reference)

Using net profit of $27,691.26 and assuming 5 years (simple average):

Average per year: $5,538.25/year (about 276.9% of initial capital per year, linear average)

Average per month: $461.52/month (about 23.08% per month, linear average)

Average per day: $15.17/day (about 0.76% per day, linear average)

If you look at it as compounded growth (5-year CAGR), the equivalent is approximately 71.5% per year, about 4.6% per month, and about 0.148% per day (compounded).

Scaling and diversification

Even though it can start with less, a practical approach is to build liquidity up to $2,000–$3,000 to keep a reserve and better withstand floating drawdowns. Then it can be replicated across multiple currency pairs (not only EURUSD), adjusting parameters to each symbol’s volatility and spread.