Overview

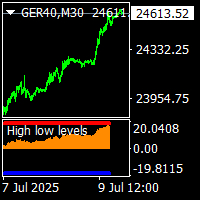

Break Out Zones is a comprehensive market structure analysis indicator for MT4 that identifies and displays key price levels, order blocks, and structural breakouts in real-time. The indicator helps traders understand market flow by automatically detecting swing points, internal structure changes, and significant zones where price action may react.

Key Features

1. Market Structure Detection

- Automatic identification of swing highs and lows with configurable length parameter.

- Internal structure analysis for refined entry opportunities.

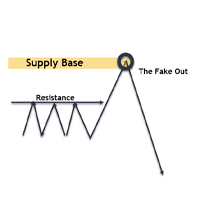

- Real-time detection of Break of Structure (BOS) and Change of Character (CHoCH) patterns.

- Customizable labeling system showing Higher Highs (HH), Lower Highs (LH), Higher Lows (HL), and Lower Lows (LL).

2. Order Block Identification

- Swing-based order blocks for major institutional zones.

- Internal order blocks for precision entries.

- Automatic filtering using ATR or Cumulative Mean Range.

- Visual display of bullish and bearish order blocks.

- Configurable number of zones to display on chart.

3. Zone Breakout Alerts

- Marking breakouts above or below identified zones.

- Configurable styles, sizes, and colors.

- Multi-channel alert system including platform alerts, push notifications, and email.

- Real-time monitoring of price interaction with order blocks.

- Two style modes (Colored or Monochrome).

- Historical or Present mode for chart analysis.

- Adjustable label sizes for structure points.

- Customizable colors for bullish and bearish signals.

- Optional confluence filtering for higher probability setups.

- Control over which structure types are displayed.

Configuration Parameters

The indicator offers extensive customization through input parameters:

1. Structure Settings

Swing Length - Determines the lookback period for swing point detection.

Max Swing History - Limits how many historical swing points are displayed.

Structure Filters - Choose to display all structures, only BOS, or only CHoCH patterns.

Label Size - Three size options (Tiny, Small, Normal) for readability.

2. Order Block Settings

Separate controls for internal and swing order blocks.

Adjustable quantity of zones displayed.

Filter method selection (ATR or Cumulative Mean Range).

Independent color schemes for bullish and bearish zones.

3. Alert Settings

Enable or disable breakout alerts.

Customizable arrow codes and colors.

How It Works

The indicator analyzes price action across multiple timeframes to identify significant structural levels. It uses a pivot-based algorithm to detect swing points, then monitors price behavior around these levels to determine when structure breaks occur. Order blocks are identified based on the last opposing candle before a structural break, filtered by volatility measurements to ensure relevance.

When price breaks through identified zones, the indicator generates visual signals and optional alerts, helping traders recognize potential trend changes or continuation patterns as they develop.

Usage Recommendations

This indicator is designed as a complementary tool for technical analysis. It works best when combined with proper risk management and additional confirmation methods. The indicator does not provide trade signals on its own but rather highlights areas of interest where price structure is changing.

Traders should backtest the indicator on their preferred instruments and timeframes to understand how structural levels behave in different market conditions. The configurable parameters allow adaptation to various trading styles, from scalping to position trading.

Display Performance

The indicator is optimized to handle historical data efficiently while providing real-time updates. The Present mode focuses on recent price action for cleaner charts, while Historical mode provides complete structural context. Object management is automated to prevent chart clutter while maintaining essential information visibility.

Note - Past performance of market structure patterns is not indicative of future results. This tool is intended for analysis purposes and should be used as part of a complete trading strategy with appropriate risk management.