Liquidity Trap Reversals

- Indicatori

- Mohit Dhariwal

- Versione: 1.0

- Attivazioni: 5

The Liquidity Trap reversal indicator hunts the Liquidity sweeps and when there is quick reversal after the stop hunts it catches it nicely and quickly.

A liquidity trap in trading typically refers to a price zone where a large number of orders (especially stop-losses and pending orders) are concentrated.

Liquidity Trap → Stop Hunt → Quick Reversal

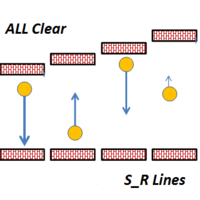

Price consolidates near a key level (e.g., support).

Liquidity builds below this level (stop-losses, breakout orders).

A sudden sharp move (stop hunt) occurs, pushing price beyond the level.

Stops are triggered, and liquidity is absorbed by larger players.

Price reverses quickly, often initiating a new trend or strong move.

The Liquidity Trap reversals exactly catch this move which is used widely by institutions and market makers.

The best trade is to wait for the signal and enter at the second red candle or green after the liquidity line mark up on the chart for big moves.

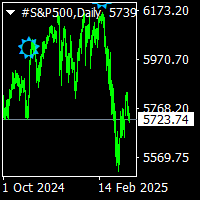

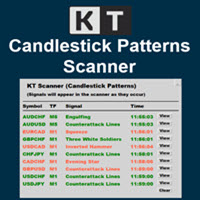

The indicator provides best signals on TF M5, M15 and Higher TFs.

It is non repainting and gives accurate signals after stop is hunted

A full fledge auto Ea on it is also prepared for this which can be taken after the purchase of indicator. It can be used on prop firms too to clear it easily. You can connect me on telegram @anabullbear to get it.

Few copies will be sold at this price after which it will be increased. Grab your copy soon!