MACD with FVG Signal

- Indicatori

- Cao Minh Quang

- Versione: 1.5

- Aggiornato: 27 agosto 2025

- Attivazioni: 5

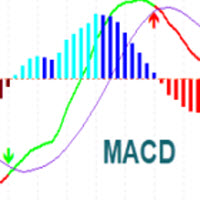

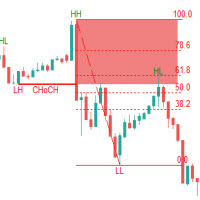

The MACD-FVG Signal System is a hybrid trading indicator that combines the power of momentum analysis through the MACD (Moving Average Convergence Divergence) with the precision of Fair Value Gap (FVG) detection to generate high-probability buy and sell signals.

This indicator enhances traditional MACD signals by validating momentum shifts with market inefficiencies, offering traders a more refined entry strategy.

Key Features:

-

MACD with Histogram Display

Clearly visualizes the MACD line, Signal line, and the Histogram, allowing quick identification of trend momentum and reversals. -

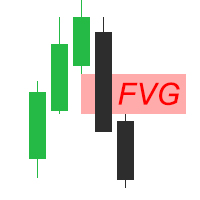

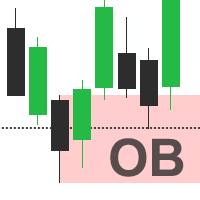

Integrated FVG (Fair Value Gap) Detection

Detects FVG in the same direction nearest to point A MACD crossover (bullish or bearish) occurs -

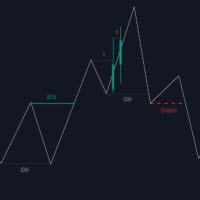

Buy/Sell Signal Generation

A signal is triggered only when both:-

A MACD crossover (bullish or bearish) occurs

-

Prices form a Fair Value Gap zone

This dual confirmation reduces false signals and improves timing accuracy.

-

-

Trend Confirmation Mode

Optional setting to filter signals in the direction of the dominant trend using MACD histogram slope or zero-line bias. -

Buy/Sell Signal Buffer

-

Signal BUY/SELL: 1=BUY/-1=SELL

-

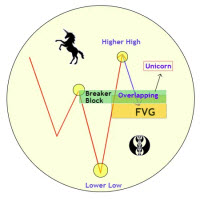

Entry Price/Stoploss/Takeprofit

-

-

Customizable Parameters

-

MACD Fast EMA, Slow EMA, and Signal EMA periods

-

FVG detection sensitivity (gap size threshold by ATR)

-

Take profit and stop loss points are calculated according to the pivot point of the higher candle

-

Alert options

-

Use Case:

-

Buy Signal:

Triggered when MACD line crosses above Signal line while price form a bullish FVG zone (gap left behind after strong bullish movement). Buy at the closing candle forming FVG Bullish. -

Sell Signal:

Triggered when MACD line crosses below Signal line while price form a bearish FVG zone (gap left behind after sharp bearish move). Sell at the closing candle forming FVG Bearish.

This indicator is ideal for trend-following and reversal traders seeking stronger confirmation before entering a trade. It works best on higher timeframes (H1 and above), but can be adjusted for intraday scalping as well.