Market Structure Trend Targets

- Indicatori

- Cao Minh Quang

- Versione: 1.1

- Aggiornato: 4 giugno 2025

- Attivazioni: 5

The Market Structure Trend Targets is a powerful trading indicator designed to give traders a clear, structured, and data-driven view of market momentum, breakouts, and key price reaction zones. Built on the principles of smart market structure analysis, it helps identify not only trend direction, but also precise breakout levels, trend exhaustion, and potential reversal zones — all with visual clarity and trader-friendly metrics.

Key Features

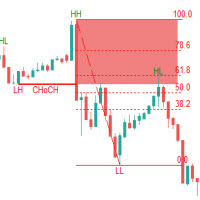

Breakout Points with Numbered Markers

Track significant structural breakouts with sequential numbered markers, helping you visually follow the progression of price action. Whether the market is in an uptrend or downtrend, each breakout point is logged and displayed for easy backtracking and confirmation of structural shifts. The initial breakout (zero break) is marked with the entry price and a arrow icon, while subsequent breakouts within the trend are numbered sequentially (1, 2, 3…) to indicate trend continuation.

Percentage Change

See exactly how much price has moved from each breakout point with percentage change labels. This gives you a real-time sense of market strength, volatility, and potential exhaustion, helping you gauge whether a move still has fuel — or is nearing its limit.

Trailing Stop Loss Levels

This indicator auto-calculates dynamic stop loss levels based on recent structural pivots, breakout confirmation, and volatility. These smart levels adjust as price moves, helping traders trail trends while managing risk with precision. If the price breaches the stop loss level, the indicator will show points indicating a potential end or reversal of the trend.

Reversion Signals

The indicator identifies potential mean reversion points with diamond icons. In an uptrend, if the price falls below the stop loss and then re-enters above it, a diamond is plotted, suggesting a possible mean reversion. Similarly, in a downtrend, if the price moves above the stop loss and then falls back below, it indicates a reversion possibility.

Use Cases:

-

Trend-following strategies based on market structure

-

Confirmation for Smart Money Concepts (SMC) setups

-

Dynamic target and stop placement for swing & intraday traders

-

Visual trade journaling and breakout tracking

User Inputs:

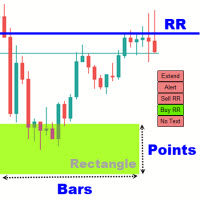

- Length: Defines the number of bars used to identify pivot highs and lows for trend breakouts.

- Display Percentage: Option to toggle between showing sequential breakout numbers or the percentage change from the initial breakout.

- Display Trailing Stop: Show trailing stop on chart

- Colors for Uptrend and Downtrend: Allows customization of color zones for uptrends and downtrends to match individual chart preferences.

- Alert/Notification: Allows send alert or notification to mobile

- Integration EA: Provide EA parameters as global variables

Prefix_ENTRY_PRICE: (double) Entry price

Prefix_ENTRY_TIME: (double) Entry time

Prefix_TRADE_DIRECTION: (1) = BUY; (-1) = SELL

Prefix_TRAILING_SL: (double) Trailing stoploss

The Market Structure Trend Targets transforms price action into actionable, easy-to-read insights — giving traders a tactical edge with clarity, control, and confidence.