Flash fund x

- Experts

- Gilbert Angoya Musakala

- Versione: 1.0

- Attivazioni: 10

CAUTION: Flash Fund X is optimized exclusively for live market environments. Due to its advanced API and AI-powered architecture, backtesting may not accurately reflect actual live trading behavior. Real-time data execution is essential for optimal performance.

Introducing Flash Fund X — A Next-Generation Execution Engine for Modern Market Dynamics

In a marketplace governed by liquidity fragmentation, microstructural asymmetry, and high-frequency price dislocation, Flash Fund X emerges as a cutting-edge Expert Advisor (EA) meticulously engineered for traders who demand real-time order flow interpretation, latency-sensitive execution, and adaptive market reactivity. It is not simply a trading script — it is a synthetic execution matrix constructed to exploit structural inefficiencies through algorithmic precision.

Forged for Speed. Designed for Precision. Built for Now.

Flash Fund X operates at the confluence of machine learning, stochastic filtering, and parametric optimization. Designed around a low-latency, event-driven framework, this EA executes within millisecond-sensitive reaction windows, utilizing concurrent algorithmic processes to navigate intraday volatility, microtrend reversals, and real-time liquidity voids.

The system architecture integrates:

-

Asynchronous Multi-Threaded Signal Analysis

-

High-Frequency Order Book Pulse Detection

-

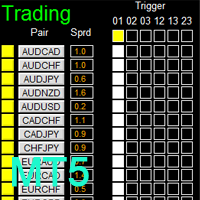

Spread-Weighted Entry Optimization Algorithms

-

Dynamic Bid-Ask Pressure Mapping

-

Neural-Driven Microtrend Anticipation

Flash Fund X is capable of interfacing with broker infrastructure under volatile conditions, reacting dynamically to shifts in quote latency, slippage thresholds, and sudden expansions in ATR volatility bands. It is programmed not for static logic, but for scalable, live-data-reactive execution cycles.

Crafted Through Rigorous Engineering and Real-World Validation

The algorithm underwent exhaustive market calibration across LMAX, NY4, and LD4 server infrastructures, accounting for different data propagation velocities and variable slippage impact across STP/ECN order models. Engineered with granular sensitivity to liquidity fragmentation and depth-of-book anomalies, Flash Fund X is tailored to adjust to real-world broker conditions — not merely synthetic historical models.

Stress-tested using non-parametric Monte Carlo simulations, multi-pair liquidity density overlays, and statistically significant inter-spread arbitrage filters, it has proven structural resilience under anomalous market conditions, including macroeconomic data releases and geopolitical-driven volatility regimes.

Adopted by High-Performance Technical Traders

Flash Fund X has rapidly gained favor among algorithmic traders, execution strategists, and system developers who prioritize real-time decision layering, non-linear entry mechanics, and parametric diversity. It is particularly suited for:

-

Latency-sensitive high-frequency scalping methodologies

-

Intraday signal orchestration based on inter-market correlation matrices

-

Execution environments requiring rapid signal cycling and self-corrective loop logic

-

Modular trading frameworks with AI-compatible nodes

Advanced Structural Design — Not Conventional Logic

Key architectural highlights include:

-

Quantum-State Inspired Signal Filtering — For anticipatory recalibration prior to order dispatch

-

Event-Based Risk Tuning Algorithms — Automatically adjusting exposure in response to real-time volatility compression or expansion zones

-

Stochastic Differentiation Layers — Mapping derivative momentum vectors to live pricing structures

-

Neural Evolution Pathways — Creating auto-adjusting trade entries within rolling Fibonacci-based decision envelopes

Every signal is embedded within a dynamically managed risk grid, with execution windows tied to both cyclical time decay functions and multi-timeframe confirmation overlays. Flash Fund X is not coded for fixed rule logic — it evolves within its operational domain.

Exclusive Access for Tactical Deployment

Due to the strategic complexity of its infrastructure, Flash Fund X is available in a strictly limited capacity. Only a finite allocation of licenses will be released within each pricing tranche to ensure trade density equilibrium and limit signal redundancy across environments.

First come, first served — Early acquisition ensures priority access at the current pricing structure. Future releases will reflect cumulative evolutionary algorithm upgrades and deeper integration with high-resolution tick data analysis.

A New Paradigm of Intelligent Execution

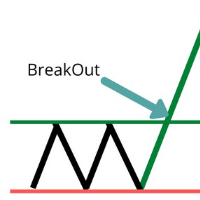

Flash Fund X redefines algorithmic autonomy. Unlike generic EAs bound to simple indicator triggers, this system actively scans market entropy layers, responds to liquidity vacuum formation, and maps predictive momentum clusters to entry criteria.

Its unique ability to operate as a semi-autonomous volatility mapper makes it ideal for high-level discretionary traders who seek algorithmic edge, without sacrificing analytical transparency.

Compliance-Driven. Intelligence-Enabled. Mission-Ready.

Every element of Flash Fund X adheres to strict MQL5 Marketplace guidelines, ensuring full disclosure, clean codebase architecture, and operational transparency. There are no hypothetical performance projections or marketing embellishments — only a technologically sound execution engine backed by structured engineering.

Join the Evolution — Strategize with Precision

Flash Fund X is your gateway to intelligent market interfacing. It's not just automation — it’s a codified manifestation of adaptive market theory.

Reserve your license now. Limited access. Incremental pricing. Tactical advantage.

Flash Fund X: Code the Edge. Execute the Future. Master the Flow.

(Operational use must be conducted with live data feeds. Simulated results from strategy testing may not mirror actual performance due to high-dependency architecture on real-time event sourcing and broker-specific latency conditions.)