Index 2in1

- Experts

- Extraordinary Productions

- Version: 1.0

- Activations: 20

INDEX 2IN1

1. Description and strategy

The Index2in1 combines two strategies in one ea to enhance the performance and reduce the drawdown. Both strategies only open buy positions.

The first strategy (DLO) refers to a Daily Long Only strategy which means that buy trades are taken daily if it meets the criteria as per the setup in the settings. The strategy is based on the premise that indices tend to go up in the long run. Trades are closed in the evening at the time specified in the settings. The same process is repeated the following day. Closing trades daily benefits from having open trades when large gaps occur, as frequently seen with major indices.

The second strategy is the Turnaround Tuesday (TAT) which is based on the idea that turnarounds usually occur in the beginning of the new week after downturns from the previous week.

For any requests / queries email us at exprtrading@gmail.com

2. Time frame and settings

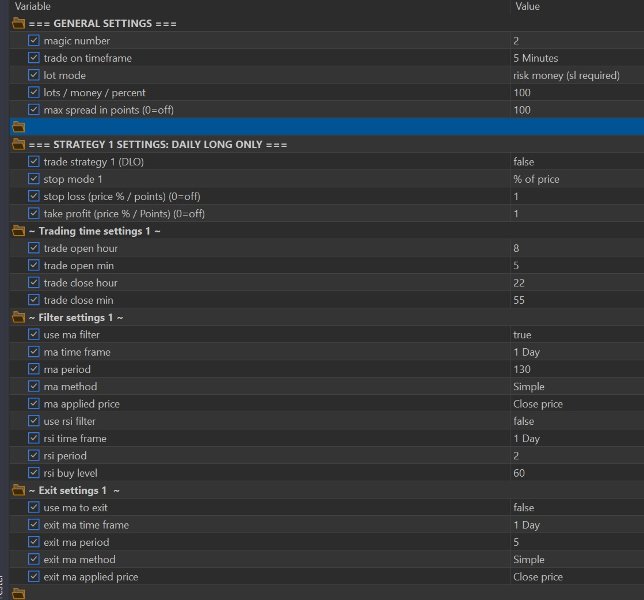

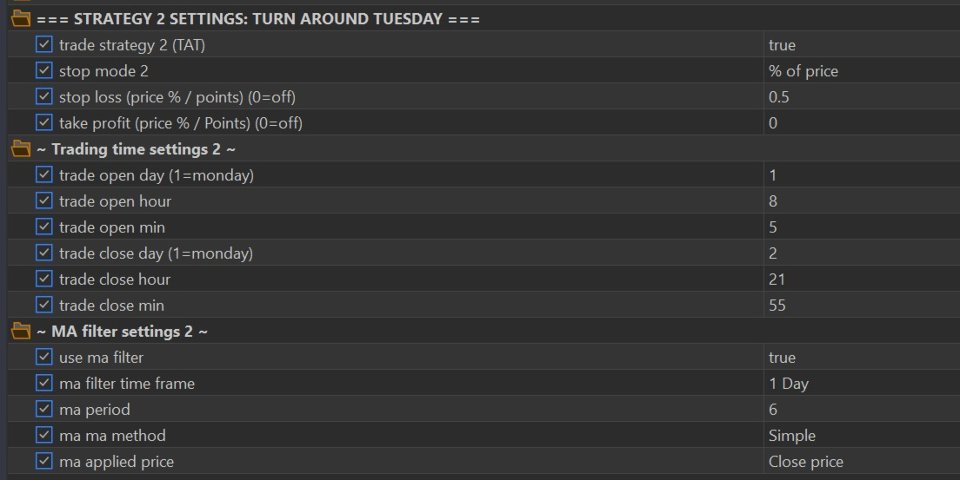

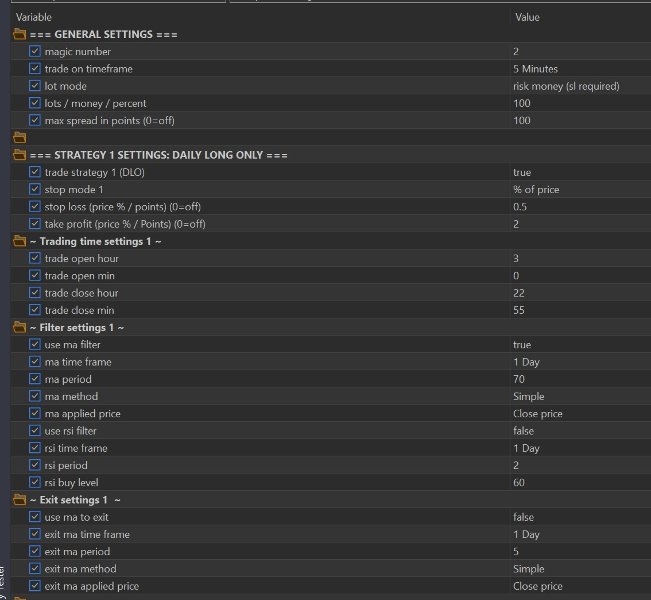

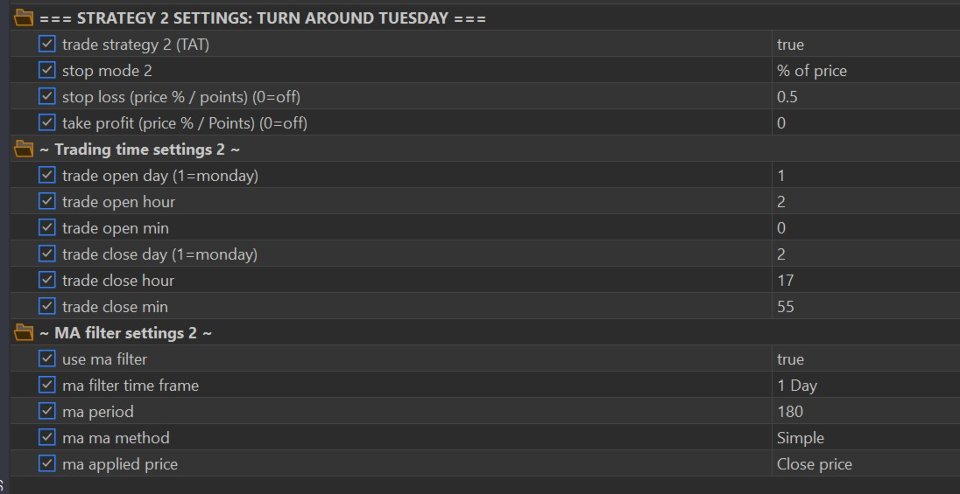

2.1 General

The user can select their own magic number for each chart. It is recommended that the user select a unique magic number for each chart.

The user can select the time frame to take trades on. Note that this input should correspond to the chart’s time frame and the trading time settings.

2.1 Lot Size | Volume

Lot sizes are calculated based on the user’s selection from four different types / modes:

1. Fixed lots (user selects their own lot size which will remain fixed)

2. Lots based on equity (lot size is calculated dynamically based on the equity balance e.g. if the user selects 1 and the equity is 100,000 then the lot size will be 1, if the equity is 10,000 then the lot size will be 0.1, and if the equity is 1,000 then the lot size will be 0.01). The lot size changes dynamically based on the equity at the time of the trade.

3. Lots based on % of account (lot size is calculated dynamically based on the % of the current equity. Users will select this option if they want to risk a % of their account e.g. selecting one 1 will risk 1 % of the account. A stop loss is required for this option). The maximum the user can risk per trade is 10%.

4. Lots based on money (lot size is calculated based on a monetary value selected by the user e.g. risk $100 per trade. A stop loss is required for this option.)

Note that calculated lot sizes will be adjusted to minimum and maximum values allowed if they fall outside of the allowable range.

2.3 Stop & spread levels

There are two stop modes to choose from.

The first is based on a percentage of the current price (% of price), the second is based on points.

The user can also select the maximum spread allowed to trade. If the broker’s spread is higher that selected, no trade will be made.

2.4 Trading times

Trading times

2.5 Filters

Both strategies can use trading filters such as moving averages. If the filter is set to true, The Daily Long Only will only open buy trades if the current price is above the moving average. If the RSI filter is selected, then it will only allow trades if the RSI is below the selected RSI buy level.

For the Turn Around Tuesday strategy, the moving average filter will only allow buy trades to open if the current price is below the moving average.

3. Optimizations

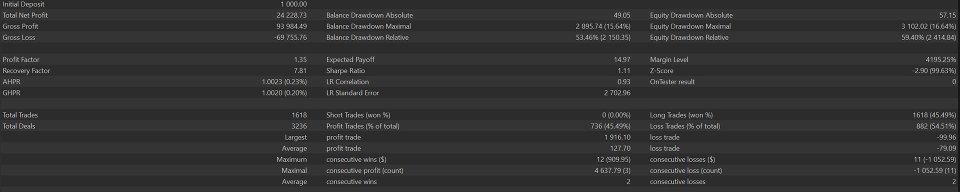

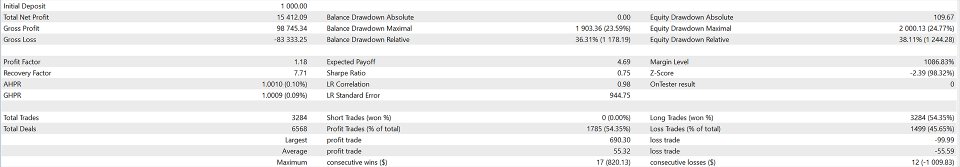

Refer to the screenshots for optimization examples.

Note that they are only examples.

Always do your own back tests and optimizations based on your risk profile before committing to a trading strategy.

4. Disclaimer / Notice

The optimization results shown should only be used as an indication of the profitability potential of the EA. They do not guarantee that similar results will be obtained in future when using this EA.

Please note that using this EA does not guarantee any performance expectations.

Due to the high-risk nature, do not invest capital that you cannot afford to lose.