Market Condition Evaluation based on standard indicators in Metatrader 5 - page 199

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.15 09:01

Intra-Day Fundamentals - EUR/USD, USD/CAD and AUD/USD : German Gross Domestic Product

2016-11-15 07:00 GMT | [EUR - GDP]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

"German economic growth is losing some momentum. In the third quarter of 2016, the gross domestic product (GDP) rose 0.2% on the second quarter of 2016 after adjustment for price, seasonal and calendar variations; this is reported by the Federal Statistical Office (Destatis). In the first half of the year, the GDP had increased somewhat more, by 0.4% in the second quarter and 0.7% in the first quarter."

==========

EUR/USD M5: 30 pips range price movement by German Gross Domestic Product news events

==========

USD/CAD M5: 25 pips range price movement by German Gross Domestic Product news events

==========

AUD/USD M5: 28 pips range price movement by German Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.15 15:01

Intra-Day Fundamentals - EUR/USD, USD/CAD and GOLD (XAU/USD): Advance Retail Sales2016-11-15 13:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From Market Watch article: U.S. retail sales post biggest back-to-back sales since 2014

"Retail sales jumped 0.8% last month after a revised 1% gain in September, the government said Tuesday. Economists surveyed by MarketWatch had forecast a seasonally adjusted 0.7% advance."

==========

EUR/USD M5: 30 pips range price movement by U.S. Retail Sales news events

==========

USD/CAD M5: 29 pips range price movement by U.S. Retail Sales news events

==========

GOLD (XAU/USD) M5: range price movement by U.S. Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.16 06:58

AUD/USD Intra-Day Fundamentals: Australia Labour Price Index and 27 pips range price movement

2016-11-16 00:30 GMT | [AUD - Wage Price Index]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Wage Price Index] = Change in the price businesses and the government pay for labor, excluding bonuses.

==========

From official report:

==========

AUD/USD M5: 27 pips range price movement by Australia Labour Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.16 07:51

Trading News Events: U.K. Claimant Count Change (adapted from dailyfx)

Bearish GBP Trade: Job & Wage Growth Falls Short of Market Forecasts

- "Need red, five-minute candle following the report to favor a short GBP/USD trade."

- "If market reaction favors a long sterling trade, buy GBP/USD with two separate position."

- "Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit, set reasonable limit."

Bullish GBP Trade: U.K. Employment Report Beats ExpectationsDaily price is on bullish trending along Senkou Span line which is the border between the primary bearish and the primary bullish area on the chart. The price is on ranging within 1.2673 'bullish continuation' resistance level and 1.2352 'bearish reversal' support level waiting for the direction of the primary trend to be started.

GBP/USD M5: 19 pips range price movement by U.K. Jobless Claims news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.16 14:59

Intra-Day Fundamentals - EUR/USD, USD/CNH and NZD/USD: Producer Price Index (PPI)2016-11-16 13:30 GMT | [USD - PPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report:

"The Producer Price Index for final demand was unchanged in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.3 percent in September and were unchanged in August. On an unadjusted basis, the final demand index increased 0.8 percent for the 12 months ended in October, the largest 12-month rise since advancing 0.9 percent in December 2014."

==========

EUR/USD M5: 14 pips range price movement by Producer Price Index news events

==========

USD/CNH M5: 46 pips price movement by Producer Price Index news events

==========

NZD/USD M5: 17 pips range price movement by Producer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.17 09:40

AUD/USD Intra-Day Fundamentals: Australian Employment Change and 34 pips range price movement

2016-11-17 00:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

From official report:

==========

AUD/USD M5: 34 pips range price movement by Australian Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.17 12:55

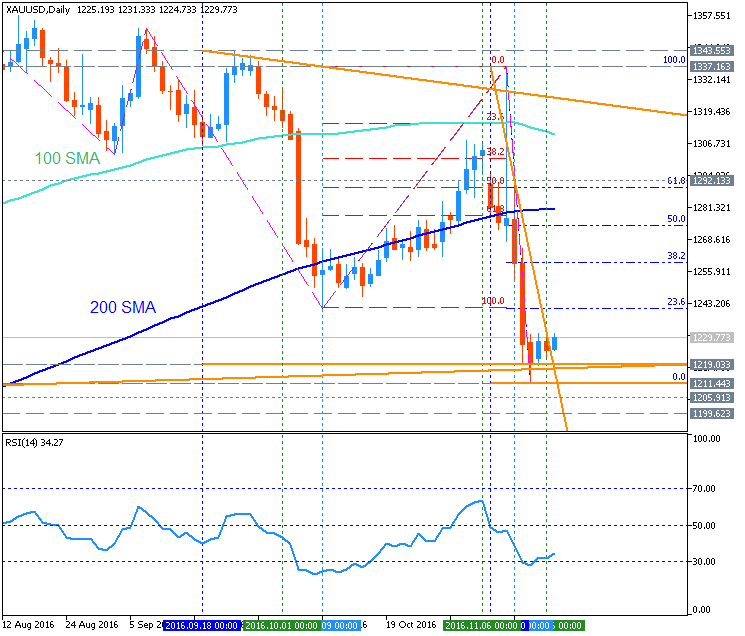

GOLD (XAU/USD) Daily Bearish Breakdown With 1.1219 Support To Continue (adapted from the article)

Daily price broke 100-day SMA/200-day SMA reversal levers to be reversed to the primary bearish area of the chart. For now, the price is on testing 1,1219 support level to below for the bearish breakdown to be continuing with 1,211 and 1,200 nearest daily bearish target to re-enter.

Most likely scenarios for the daily price movement are the following: the price will be continuing with the bearish breakdown by 1,200 psy level to be broken, or the ranging bearish condition will be started for the price to be waiting for the direction of the trend based on the future fundamental factors for example.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.17 14:57

Intra-Day Fundamentals - EUR/USD, S&P 500 and Dax Index: U.S. Consumer Price Index and Residential Building Permits2016-11-17 13:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

2016-11-17 13:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From official reports:

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.6 percent before seasonal adjustment."

==========

EUR/USD M5: 38 pips range price movement by CPI and Building Permits news events

==========

S&P 500 M5: range price movement by CPI and Building Permits news events

==========

Dax Index M5: range price movement by CPI and Building Permits news events

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q4'16 - levels for Hang Seng Index (HSI)

Sergey Golubev, 2016.11.18 10:00

Hang Seng Index: End Of Week Technicals - ranging with narrow levels waiting for direction

This trading week is ended with some results concerning Hang Seng Index: the daily price was bounced from 21,903 support level to above for the ranging condition to be started within the primary bearish trend.

---------D1 price is located below Ichimoku cloud for the ranging within the following key s/r levels:

H4 price is on located on the bearish area of the chart for the ranging within the narrow s/r levels waiting for direction:

If H4 price breaks 22,487 resistance level to above on close bar so the local uptrend as the bear market rally will be started.

If H4 price breaks 23,008 resistance level to above on close bar so we may see the reversal of the price movement from the bearish to the primary bullish market condition.

If H4 price breaks 22,115 support on close bar so the primary bearish trend will be resumed with 21,903 bearish target to re-enter.

If not so the price will be on bearish ranging within the levels.

SUMMARY: bearish

TREND: rangingForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.11.18 10:48

Trading News Events: Canada Consumer Price Index (adapted from dailyfx)

Bullish CAD Trade: Canada CPI Picks Up for Second Consecutive Month

- "Need to see red, five-minute candle following the release to consider a short trade on USD/CAD."

- "If market reaction favors a long loonie trade, sell USD/CAD with two separate position."

- "Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward."

- "Move stop to entry on remaining position once initial target is hit; set reasonable limit."

Bearish CAD Trade: Inflation Report Falls Short of Market ExpectationsDaily price is on bullish ranging condition for 1.3551 resistance level to be broken on close daily bar for the daily bullish trend to be resumed. Alternative, if the price breaks 1.3399 support level to below on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

-------