You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.15 08:10

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Meeting Minutes and range price movement

2017-08-15 02:30 GMT | [AUD - Monetary Policy Meeting Minutes]

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From rttnews article :

==========

AUD/USD M5: range price movement by RBA Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.16 07:23

AUD/USD Intra-Day Fundamentals: Australian Labour Price Index and range price movement

2017-08-15 02:30 GMT | [AUD - Wage Price Index]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Wage Price Index] = Change in the price businesses and the government pay for labor, excluding bonuses.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Labour Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.17 10:00

AUD/USD Intra-Day Fundamentals: Australian Employment Change and range price movement

2017-08-17 02:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Employment Change] = Change in the number of employed people during the previous month.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.17 10:05

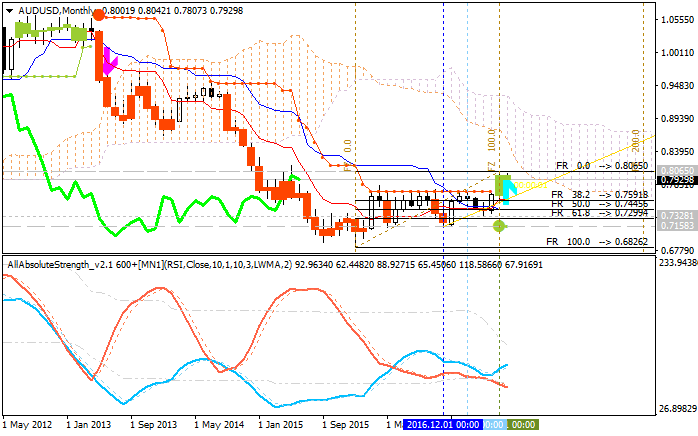

AUD/USD - weekly bullish reversal to be started; 0.8066 is the key (based on the article)

Weekly price is on bear market rally to crossing 200-SMA bullish reversal level to above together with ascending triangle pattern with 0.8066 resistance level for the bullish reversal, otherwise - bearish ranging within the levels near bullish reversal.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.23 07:22

AUD/USD - ranging for direction (based on the article)

Intra-day price on H4 chart is located within 100-SMA/200-SMA levels waiting for the direction of the trend to be started.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.26 08:37

Weekly AUD/USD Outlook: 2017, August 27 - September 03 (based on the article)

The Australian dollar stabilized on high ground, consolidating previous gains. What’s next? Australian capital expenditure and Chinese data stand out in a busier week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.30 09:48

AUD/USD Intra-Day Fundamentals: Australian Building Approvals and range price movement

2017-08-30 02:30 GMT | [AUD - Building Approvals]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Building Approvals news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.03 10:29

Weekly Fundamental Forecast for AUD/USD (based on the article)

AUD/USD - "Investors can also look forward to news of the Australian current account position, job advertisements and service-sector performance, all of which have the potential to move the market. But the overall backdrop for the currency is one of at least relative investor support – even at record lows Aussie yields are attractive – countered by rising RBA watchfulness of the currency level. None of this is likely to change this week so, while AUD/USD may be in for a more volatile ride, the basic backdrop seems set to endure. That’s why I am making a neutral call yet again."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.05 07:37

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and range price movement

2017-09-05 05:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From sbs article :

==========

AUD/USD M5: range price movement by RBA Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.07 07:27

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and range price movement

2017-09-07 02:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Trade Balance news event