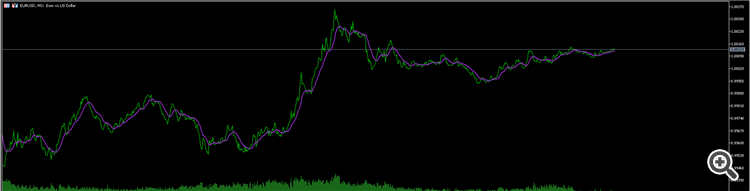

price crossings of the short-period EMA

PS/ it is more accurate to make "pseudo-bars" from crossovers. you will get a chart a la tic-tac-toe.

price crosses the EMA - a new bar starts.

we get strictly alternating black/white bars with prices Open/X/Close. Open,Close=EMA X-deviation.

but there is no need for neural network :-) in the first half of the day it trades in the direction of the highest X, in the second half of the day vice versa :-)

price crosses the EMA - a new bar starts.

we get strictly alternating black/white bars with prices Open/X/Close. Open,Close=EMA X-deviation

but there is no need for neural network :-) in the first half of the day it trades in the direction of the highest X, in the second half of the day vice versa :-)

Curious

You need to feed a stream of tick data. Everything else is its derivatives.

A tick chronology? That's probably not technically possible. In MT minimum OHLC minutes... Or do you mean one specific price - a tick? And then... and it still needs to be trained somehow

About 15 years ago I met an Expert Advisor, which is trained online: at the first launch it opens randomly with a 1:1 tp\sl, and then, if a moose - correction of weights. Since I could not test such an owl at that time, I gave up on it....

- closing prices

...

Closing prices were submitted directly? It's not working well after all.

Better the price difference with the average and or with the middle of the range - to remove the constant component.

Whether bars or ticks is another matter.Did you submit the closing prices? It's not working well after all.

It is better to have the price difference with the average and or with the middle of the range - to remove the constant component.

Whether bars or ticks is another matter.Before this experience, I already had such a conviction, because everywhere I met the instruction that it is necessary to normalise the input data.

And since I am not a certified specialist in this field, I "have fun" by the method of poking.

Surprisingly, the neural network copes with closing prices without normalisation. Here, stupidly, you throw Close[1], and it still manages to draw beautifully upwards on history.

It is better to use the price difference with the average and or with the middle of the range - to remove the constant component.

Accepted, thanks.

Please clarify, what does it mean with the middle of the range? With D1(High minus Low)?

Before this experience, I already had such a conviction, because everywhere I met the instruction that it is necessary to normalise the input data.

And since I am not a certified specialist in this field, I am "having fun" by poking around.

Surprisingly, the neural network copes with closing prices without normalisation. Here, stupidly, you throw Close[1], and it still manages to draw beautifully upwards on the history.

Accepted, thanks.

Could you clarify, please, what does it mean with the middle of the range? With D1(High minus Low)?

If you normalise, then not each pattern separately, but all together, so that the patterns keep the proportion relative to each other.

But it is not necessary, it is automatically adjusted by the weights on the inputs during training.

But it is desirable to remove the constant component. I also noticed that just feeding prices works, but not always well.

The middle of the range - yes, like the middle of the price channel from the maximum value to the minimum.

Allow me my 5 kopecks...

1 - inertia is built into the indicators - lag on start and finish. So only the price can be entered. Normalised to the range.

2 - + delta between low and high candles. Also normalised to the range.

3 - + to detect cyclicality by day - time in hours, weekly - number of the day of the week, monthly - number of the month.

+ a couple more indicators.

If you are interested - I can elaborate.

Also the second part of the ballet - strategy. When training, it is a one-handed game. Because for the purity of analysis lot should be fixed, stops, take-outs - its own nuances. + more conditions. I will expand the idea if you wish. It is irrational to restrain oneself like this in the combat mode. But this is not all. And I will tell you at once - MT resource is not enough to cover a more or less large period with training. When training on the 5th month - the results of the first month degrade by ...%. Thus, some predictability can be detected, but the randomness of the sequences is still more than we were able to fix.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

-closing prices

- difference of closing prices of N candles in a row

- difference of closing prices of N candles in a row from all allied pairs on both the euro and dollar sides, on the eurodollar pair

- ratios of candles' shadows to their bodies of N candles in a row

- ratio of closing price to all OHLC of all N candles in a row

- all of the above with N and N*k gaps between candles

And....I'm out of ideas))))