What to feed to the input of the neural network? Your ideas... - page 72

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

No matter what you feed to the neural network input, you will always get the Grail until the data is fed. Ж)

...

I combined both ideas, and the result is the following: instead of MLP- Neuron-Filter(Neuron Butko - as Maxim called it), and it already performs the task of filtering pre-prepared inputs.

That is, the inputs (conditions for entry) are selected manually, and the filter will perform any of the following tasks, even in the aggregate:

1) Allow/deny to trade

2) Select the direction of the trade: BUY or SELL

3) Shift the opening of a position into the future (wait for the opening), if the opening condition allows a signal that operates in time (for example, the position above/below the indicator lines, etc.), and already starts signalling the opening.

Since the code architecture contains coefficients (weights), which are not multiplied and do not perform any mathematical operations at all, their very presence is suitable for calling the optimisation sets by the word "model".

An example of the approach below:

As always: not all conditions for entry are good, you should also choose/find/create/creative/collect them and experiment with them.

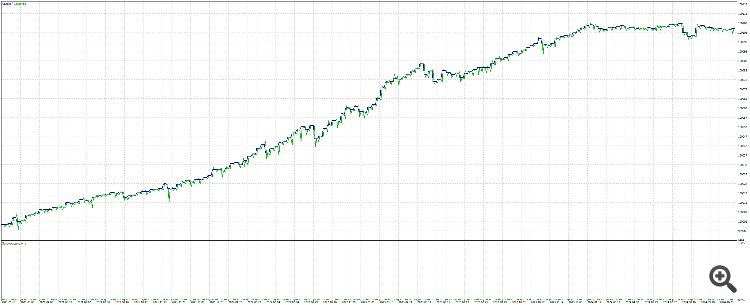

The point of the example is the following: the formal approach (only fulfilment of the entry condition, without filtering) even if the parameters of pre-calculation tools are optimised (periods of indicators, etc.) - in the current example gives a plum on the forward. In most cases.

Re-optimisation on history, and plum (or flat) - on the forward.

And so on all sets - one after another you click - they all flail or plummet, or slightly (accidentally) earn.

But if you add a neural filter, you can find such models in the optimisation results somewhere at the top of the list.

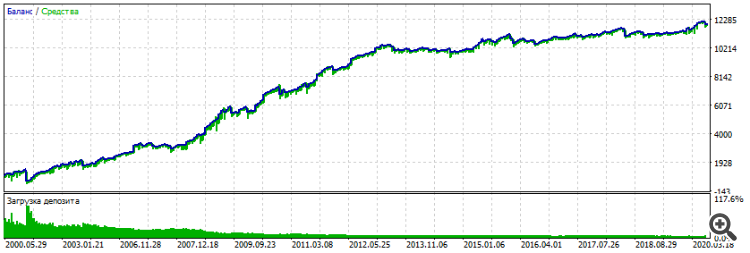

Optimisation EURUSD H1 2000-2021

Forward 2021-2025

Considering that once before I posted similar forwards, there was a terminal from metaquotes, without spreads and stuff. Here I have an Aisimarkets account, in it 99% of all tests from the previous terminal failed.

Few trades, now we need to work on it.

But as a replacement for MLP, I think the method is good.

But as a replacement for MLP, I think the method is good.

You don't use MLP at all now? Not quite clear, are the optimisation criteria in-house, or custom?

You don't use MLP at all now? Not quite clear, are the optimisation criteria in-house, or custom?

somewhere on the forum put an advisor on Mashka, which made the chat GPT

the most interesting thing is that the code analyses the МАшка both in the direction of increasing the number of bars and decreasing it.

of course, I did not try to apply this in practice due to repeated fiascoes when using indicators, but I think there is something in it.

---

TC asked a question on the topic of trading on MN1

I think that the idea of such trading due to the decent lag of indicators will eventually come down to analysing the economic situation rather than the chart.

And the grannies in the neighbouring shop said that eggs have gone up in price because of the Martian invasion. MA is also basically a poor digital filter, only with the same coefficients. That's why the performance is so poor.

...

But if you add a neural filter...

...

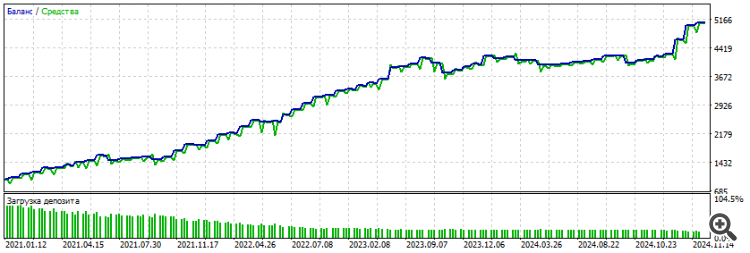

Forward 2021-2025

Not enough trades, now that's something to work on.

... ...

Managed to increase the number of trades a bit, but the quality of balance growth suffered a bit

Tried the following filter:

If High1 >= High2 , then IN[0] = numeric value N1

If High1 < High2, then IN[0] = numeric value N2

If Low1 >= Low2, then IN[1] = numeric value N3

If Low1 < Low2 , then IN[1] = numeric value N4

And so any construct can be built.

N(i) and- optimise in the tester optimiser.

Then we sum them all up. Without any activations and offsets, they are not needed here, everything will be done by the genetic algorithm of the optimiser.

Add the obtained sum to some "manual" condition like "If the fly crossed the fly, and the sum of signals > 0" then BUY.

If you just add the sum of signals to buy or sell without manual intervention - nothing good will come out at all. But as a filter - interesting.

What is also interesting, since the candle has directions, it makes sense to add "mobility" to prices, because they have their own OHLC chronology depending on the colour. .

Thus, I added additional conditions to the input data: If the candle is up, then: " If High1 >= High2 , then IN[0] = numeric value N1.... then LOW". And if the candle is down, then vice versa - the first coefficient will describe another (mirror) rule: " If Low1 >= Low2 , then IN[0] = numerical value N1"

And here, purely subjectively - the result above (set) I got exactly after adding this mobility. Apparently, there is something "intellectual", or in another way - meaningful in it.

The output is the most accurate AI

Even my TC's bucktests are cooler than your AI-trained history.

Don't even get your hopes up - there is no one cooler than Rena on this forum. )))

Ivan Butko #:

Managed to increase the number of trades a bit, but the quality of balance growth suffered a bit

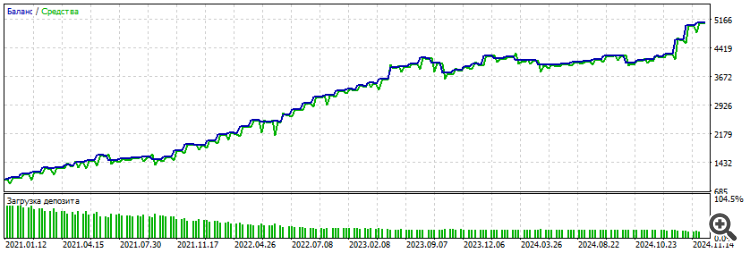

Playing with parameters using creative methods (mixing formulas by poking and prodding) can sometimes improve results, again - conditionally.

In the example below we managed to increase the number of forward trades again, the chart started to look better, but at the end it started to fade. + victim was the backtest outside the optimisation period (from 2000 to 2012), it failed.

Forward 2021-2025 in EUR.

I still have a feeling that the market is described by some kind of formula, looped (some chart parameters have to be linked to each other somehow) and such an owl will work almost everywhere. Thoughts aloud

Playing with parameters using creative methods (mixing formulas by poking and prodding) can sometimes improve results, again - conditionally.

In the example below we managed to increase the number of forward trades again, the chart started to look better, but at the end it started to fade. + The backtest outside the optimisation period (from 2000 to 2012) became a victim, it failed.

Forward 2021-2025 for EUR

I still have a feeling that the market is described by some kind of looped formula (some chart parameters should be connected with each other somehow) and such an owl will work almost everywhere. Thoughts aloud