Neural Network

Neural Network: discussion/development threads

- Better NN EA development thread with indicators, pdf files and so on.

- Better NN EA final thread

- Neural Networks thread (good public discussion)

- How to build a NN-EA in MT4: usefull thread for developers.

- Radial Basis Network (RBN) - As Fit Filter For Price: the thread

Neural Network: Indicators and systems development

- Self-trained MA cross!: development thread for new generation of the indicators

- Levenberg-Marquardt algorithm: development thread

Neural Network: EAs

- CyberiaTrader EA: discussion thread and EAs' thread.

- Self learning expert thread with EAs' files here.

- Artificial Intelligence EAs threads: How to "teach" and to use the AI ("neuron") EA thread and Artificial Intelligence thread

- Forex_NN_Expert EA and indicator thread.

- SpiNNaker - A Neural Network EA thread.

Neural Network: The Books

- What to read and where to learn about Machine Learning (10 free books) - the post.

The article

- Deep neural network with Stacked RBM. Self-training, self-control - MT4

- Connecting NeuroSolutions Neuronets - MT5

- Using Neural Networks In MetaTrader - MT4

- Price Forecasting Using Neural Networks - MT4

- Recipes for Neuronets - MT4

- Third Generation Neural Networks: Deep Networks - MT5

- Neural Networks Cheap and Cheerful - Link NeuroPro with MetaTrader 5 - MT5

- Creating Neural Network EAs Using MQL5 Wizard and Hlaiman EA Generator - MT5

- Neural network: Self-optimizing Expert Advisor - MT5

- Neural Networks: From Theory to Practice - MT5

- Using MetaTrader 5 Indicators with ENCOG Machine Learning Framework for Timeseries Prediction - MT5

- Using Self-Organizing Feature Maps (Kohonen Maps) in MetaTrader 5 - MT5

- Deep Neural Networks (Part I). Preparing Data - MT5

-

Deep Neural Networks (Part II). Working out and selecting predictors - MT5

CodeBase

- Next price predictor using Neural Network - indicator for MetaTrader 4

- ALGLIB - Numerical Analysis Library - library for MetaTrader 4

- MTS Neural network plus MACD - expert for MetaTrader 4

- ArtificialIntelligence_Right - expert for MetaTrader 4

- NeuroNirvamanEA - expert for MetaTrader 4

- Create your own neural network predictor easily (example: MA and RSI Predictors) - indicator for MetaTrader 4

- Automated Trading System "Сombo" - expert for MetaTrader 4

- MTC Neural network plus MACD - expert for MetaTrader 5

- Bollinger Band Width calculation with Neural Network using - expert for MetaTrader 5

- PNN Neural Network Class - library for MetaTrader 5

- GRNN Neural Network Class - library for MetaTrader 5

- RBF Neural Network Class - library for MetaTrader 5

- MLP Neural Network Class - library for MetaTrader 5

- Artificial Intelligence - expert for MetaTrader 5

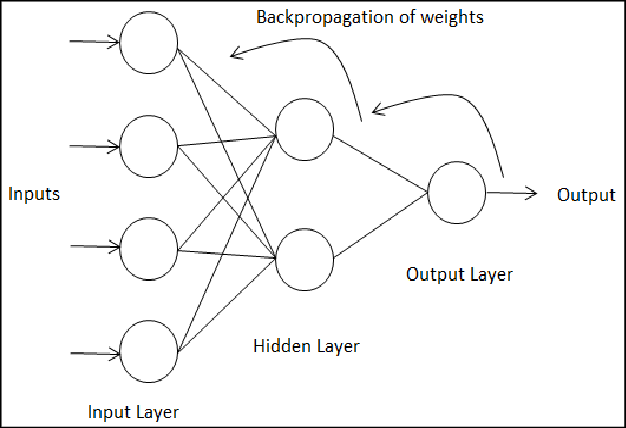

And here my question. How does the backpropagation function works? As far as I have read, its a function that corrects the weights based on the costs of the function (sigmoid function I think).

The main idea is: when the result is negative, use backpropagation for adjusting the weights and when the result is positive use the same idea to give a reward to the NN.

Any ideas? Thoughts?

Sounds to me your aim is to self-optimize.

My advice is experiment with the NN first. You can train the network with the optimizer. The good thing with NN's is that is very efficient in coming up with good answers, this is also the pitfall. Unless you know what you are doing, NN are very prone to curve fitting (over fitting). Most if not all examples posted by Sergey fit the category garbage in garbage out. You need to ask the right question in order to get the right answer.

Experiment first, then complicate things with self optimizing because it is a whole subject of its own. For example you need large enough sample sizes. Self optimizing on a trade by trade bases is too slow, you would need some type of virtual trading environment to speed up the self optimizing process. Take into consideration the amounts of weights times the weight bandwidth the combinations add up real fast and thus can become rather resource intensive.

Hello eveyone!

I was wondering on how a NN works in forex and how to "train" it depending on the peformance.

The idea is this: based on 3 indicators, I create a NN that consist on 4 neurons(N).

N1 recieves data from indicator 1 and 2.

N2 recieves data from indicator 1 and 3.

N3 recieves data from indicator 2 and 3

N4 recieves data from indicator 1, 2 and 3.

Then, the result of each neuron gets multiplied by other weights and then goes to the output.

All weights are started as random numbers when the EA starts.

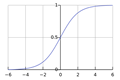

The next step, is to apply a sigmoid function to the values and, if the value is greater than a bias, activate a buy or sell operation, depending on the current state.

If the operation results in a loss, it is obviously desired to apply a correction to the weights, since we can't modify the inputs.

And here my question. How does the backpropagation function works? As far as I have read, its a function that corrects the weights based on the costs of the function (sigmoid function I think).

The main idea is: when the result is negative, use backpropagation for adjusting the weights and when the result is positive use the same idea to give a reward to the NN.

Any ideas? Thoughts?

I'm posting how I created the neuron and the sigmoid function I'm using. Is this something that has the potential of giving good results?

Backprop works the opposite direction. From a known output (constant) & its indicators values (constant) at instant T you deduce weights that suits the ouput (variable).

It seems easy said so but it's f*king complicated to code entirely considering all layers, I strongly suggest you to use the new python integration for it :

- iamtrask.github.io

I would never use indicator data for NN.

Just the raw price data only.

I would never use indicator data for NN.

Just the raw price data only.

Sounds to me your aim is to self-optimize.

My advice is experiment with the NN first. You can train the network with the optimizer. The good thing with NN's is that is very efficient in coming up with good answers, this is also the pitfall. Unless you know what you are doing, NN are very prone to curve fitting (over fitting). Most if not all examples posted by Sergey fit the category garbage in garbage out. You need to ask the right question in order to get the right answer.

Experiment first, then complicate things with self optimizing because it is a whole subject of its own. For example you need large enough sample sizes. Self optimizing on a trade by trade bases is too slow, you would need some type of virtual trading environment to speed up the self optimizing process. Take into consideration the amounts of weights times the weight bandwidth the combinations add up real fast and thus can become rather resource intensive.

Indeed, I want to avoid curve fitting. I don't know if self optimizing is what it should be doing, maybe more like learning by auto adjusting the weights.

Most of them are based on indicator connected with NN, this is futile because instead of optimizing parameters you would be optimizing the network either backwards or forwards, does not matter. No difference there. Besides Indicators are a bad idea because all of them are not profitable to begin with from a long term statistical perspective. I too would never use an indicator for NN input.

Raw prices is better but prices only from asset you are trading does not make any sense either. Better try to design a structure to incorporate more factors which impact price. Such as OIL for trading CAD or AUD, correlation between assets, or a triangle of assets Such as EURUSD/GBPUSD/EURGBP. Problem with that is that in can become complicated very fast, and the risk of over fitting is still there if you do not know what you are doing.

Toy with some of the EA's posted by Sergey (examine code carefully, many make logic mistakes, especially code posted in codebase) see if you can improve them, or make very simple test to see how things work like trying to forecast next day direction based on D1 OHLC data. It is not easy to make it perform better then a coin flip but you will learn a lot.

Most of them are based on indicator connected with NN, this is futile because instead of optimizing parameters, you would be optimizing the network either backwards of forwards, does not matter, no difference there. Besides Indicators are a bad idea because all of them are not profitable to begin with from a long term statistical perspective. I too would never use an indicator for NN input.

Raw prices is better but prices only from asset you are trading does not make any sense either. Better try to design a structure to incorporate more factors which impact price. Such as OIL for trading CAD or AUD, correlation between assets, or a triangle of assets Such as EURUSD/GBPUSD/EURGBP. Problem with that is that in can become complicated very fast, and the risk of over fitting is still there if you do not know what you are doing.

Toy with some of the EA's posted by Sergey (examine code carefully, many make logic mistakes, especially code posted in codebase) see if you can improve them, or make very simple test to see how things work like trying to forecast next day direction based on OHLC data. It is not easy to make it perform better then a coin flip but you will learn a lot.

Hi,

It's the obvious choice.

You want it to train properly without the use of ANY indicators.

It's the obvious choice.

You want it to train properly without the use of ANY indicators.

I don't get it...I mean, for example, moving averages are based on prices (close price, open price, high,low,typical,etc). ATR is based on price also, many indicators are price based, so why an indicator like this would be a bad choice?

And, for example, if only raw prices, you would take prices of the last candles? The highs,lows,closes? Or tick prices that are coming right now? And how would you use the backpropagation function in this case?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hello eveyone!

I was wondering on how a NN works in forex and how to "train" it depending on the peformance.

The idea is this: based on 3 indicators, I create a NN that consist on 4 neurons(N).

N1 recieves data from indicator 1 and 2.

N2 recieves data from indicator 1 and 3.

N3 recieves data from indicator 2 and 3

N4 recieves data from indicator 1, 2 and 3.

Then, the result of each neuron gets multiplied by other weights and then goes to the output.

All weights are started as random numbers when the EA starts.

The next step, is to apply a sigmoid function to the values and, if the value is greater than a bias, activate a buy or sell operation, depending on the current state.

If the operation results in a loss, it is obviously desired to apply a correction to the weights, since we can't modify the inputs.

And here my question. How does the backpropagation function works? As far as I have read, its a function that corrects the weights based on the costs of the function (sigmoid function I think).

The main idea is: when the result is negative, use backpropagation for adjusting the weights and when the result is positive use the same idea to give a reward to the NN.

Any ideas? Thoughts?

I'm posting how I created the neuron and the sigmoid function I'm using. Is this something that has the potential of giving good results?