You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.19 16:16

Weekly Outlook: 2017, August 20 - August 27 (based on the article)

The US dollar was looking for a new direction and it had a mixed week. The last full week of August features US housing data, durable goods orders and perhaps most importantly, the Jackson Hole Symposium. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.20 10:31

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The best-case scenario for the greenback would see Yellen setting the stage to begin so-called “quantitative tightening” (QT) next month. That would leave room for another rate hike just before year-end if all goes well and the “idiosyncratic” forces holding down inflation evaporate, as the Fed seems to believe they will. Vague rhetoric on QT prospects and ebbing confidence in reflation are likely to hurt the US currency."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.24 17:22

Intra-Day Fundamentals - NZD/USD, Dollar Index and GOLD (XAU/USD): U.S. Jobless Claims

2017-08-24 13:30 GMT | [USD - Unemployment Claims]

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From rttnews article :

==========

NZD/USD M5: range price movement by U.S. Jobless Claims news events

==========

XAU/USD M5: range price movement by U.S. Jobless Claims news events

==========

Dollar Index M5: range price movement by U.S. Jobless Claims news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.25 19:47

Intra-Day Fundamentals - EUR/USD and Dollar Index: Fed Chair Yellen Speech

2017-08-25 15:00 GMT | [USD - Fed Chair Yellen Speech]

[USD - Fed Chair Yellen Speech] = Speech about financial stability at the Federal Reserve Bank of Kansas City Economic Symposium, in Jackson Hole.

==========

From marketwatch article :

==========

EUR/USD M5: range price movement by Fed Chair Yellen Speech news events

==========

Dollar Index M5: range price movement by Fed Chair Yellen Speech news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.26 06:54

Weekly Outlook: 2017, August 27 - September 03 (based on the article)

The US dollar was on the back foot across the board in the last full week of August. An update on US GDP, consumer confidence, and the all-important Non-Farm Payrolls stand out.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.30 17:43

Intra-Day Fundamentals - NZD/USD and Dollar Index: U.S. Gross Domestic Product

2017-08-30 13:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the value of all goods and services produced by the economy.

==========

From official report :

==========

NZD/USD M5: range price movement by U.S. Gross Domestic Product news events

==========

Dollar Index M5: range price movement by U.S. Gross Domestic Product news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.02 09:06

Weekly Outlook: 2017, September 03 - September 10 (based on the article)

The US dollar was under pressure but managed to stage a comeback. The upcoming week features rate decisions in Australia, Canada, and the euro-zone, as well as other events. Here are the highlights for the upcoming week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.03 10:23

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The US Dollar continues to impress with its resilience last week. In the past three weeks, the greenback managed to navigate past political turmoil as well as Fed Chair Janet Yellen’s inconclusive performance at the Jackson Hole symposium, emerging relatively unscathed. It has now managed to shrug off August’s broadly disappointing employment report as well. The numbers showed that last month’s payrolls growth fell short of expectations and July’s increase was revised downward. Meanwhile, the unemployment rate unexpectedly ticked up and wage inflation held steady, falling short of consensus forecasts calling for an increase. On balance, this might’ve been expected to sink the benchmark currency, yet an initial plunge was promptly erased to put it flat by week-end."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.09 15:53

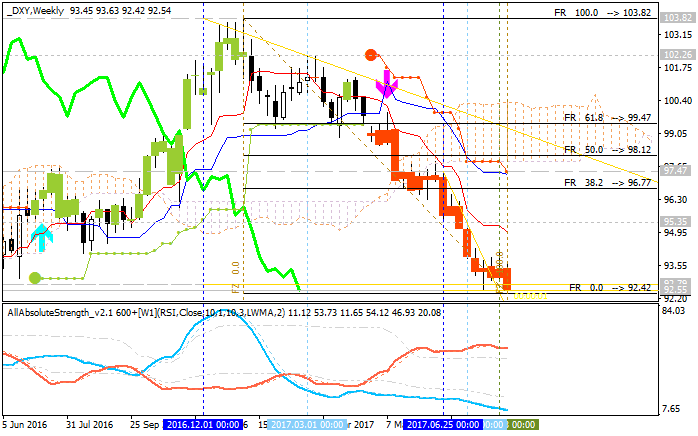

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The forecast will be set to neutral on the U.S. Dollar for the week ahead. While the downtrend is attractive, the Dollar is incredibly oversold and with a key Fed meeting on the docket for the week after next, profit taking from bears ahead of FOMC could potentially offset additional bearish drivers that might show up. If Thursday’s inflation comes-in at 1.6% or less, expect more selling in the Greenback."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.16 10:22

Intra-day Gold bearish reversal with Dollar Index to be testing 91.50 support for the bearish reversal (based on the article)

Price for H4 timeframe was bounced from 1,334 resistance to below to be reversed to the primary bearish market condition with 1,315 support level to be crossing for the bearish trend to be contionuing. By the way, the Dollar Index price is goping to be reersed on intra-day basis as well with 91.50 key support level.

-----

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download).

Same system for MT4: