Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.01 09:56

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The week ahead will offer plenty of opportunities to confirm if this is truly so. On the data front, ISM manufacturing- and service-sector activity surveys and the March jobs report are in focus. The Fed will also publish minutes from the last FOMC sit-down. A meeting between Donald Trump and his Chinese counterpart Xi Jinping may complicate matters however. The US President said the meeting will be “very difficult”, alluding to what he has described as China pursuing “unfair” international trade advantage. Worries about escalating tensions between the world’s top-two economics may weigh on market-wide risk appetite if the tone of the meeting appears to be adversarial. In this scenario, Fed rate hike bets may sink alongside stock markets, which may hurt the US unit in the near term."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.06 17:05

Intra-Day Fundamentals - EUR/USD, Dollar Index and Bitcoin/USD: U.S. Jobless Claims

2017-04-06 13:30 GMT | [USD - Unemployment Claims]

- past data is 259K

- forecast data is 251K

- actual data is 234K according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - Unemployment Claims] = The number of individuals who filed for unemployment insurance for the first time during the past week.

==========

From rttnews article:

- "With the monthly jobs report looming, the Labor Department released a report on Thursday showing a much bigger than expected drop in first-time claims for U.S. unemployment benefits in the week ended April 1st."

- "The report said initial jobless claims fell to 234,000, a decrease of 25,000 from the previous week's revised level of 259,000."

==========

EUR/USD M5: 10 pips range price movement by U.S. Jobless Claims news events

==========

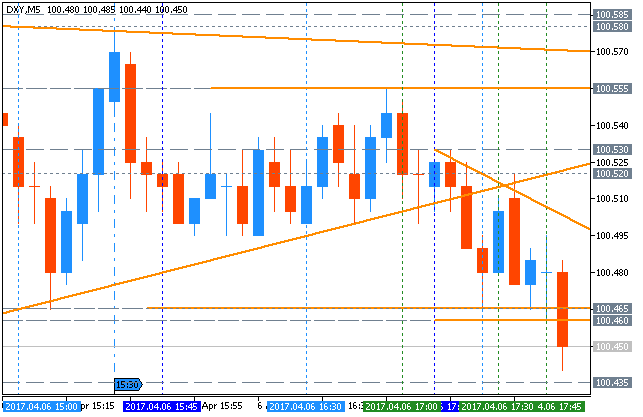

Dollar Index M5: range price movement by U.S. Jobless Claims news events

==========

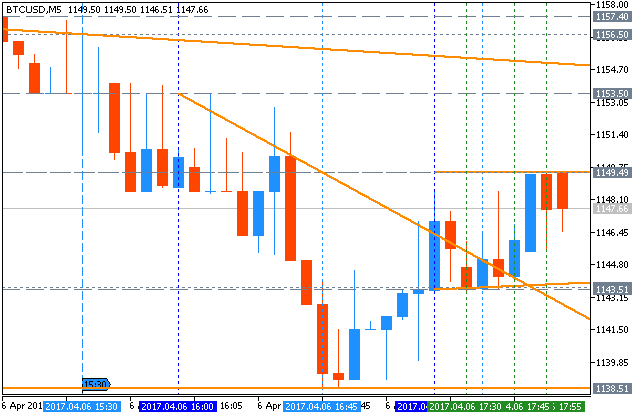

BTC/USD M5: ange price movement by U.S. Jobless Claims news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.08 12:41

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "Next week, a speech from Fed Chair Janet Yellen is likely to reiterate an intent to press on with stimulus withdrawal and CPI data is expected to show a pickup in core inflation. That may keep the greenback marching higher as traders weigh the US policy path against standstill elsewhere in the G10."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.15 10:41

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The markets need only to weigh these considerations for them to begin shaping US Dollar price action. In this scenario, the rebuilding of Fed rate hike expectations may see the benchmark currency return to the offensive. A reasonably solid Beige Book – the central bank’s assessment of regional economic conditions that informs its policy decisions – may help matters."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.19 08:54

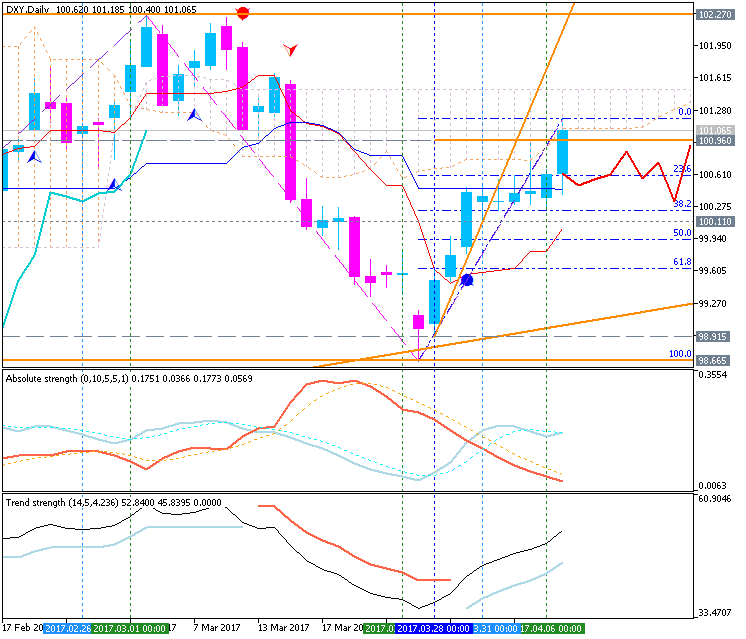

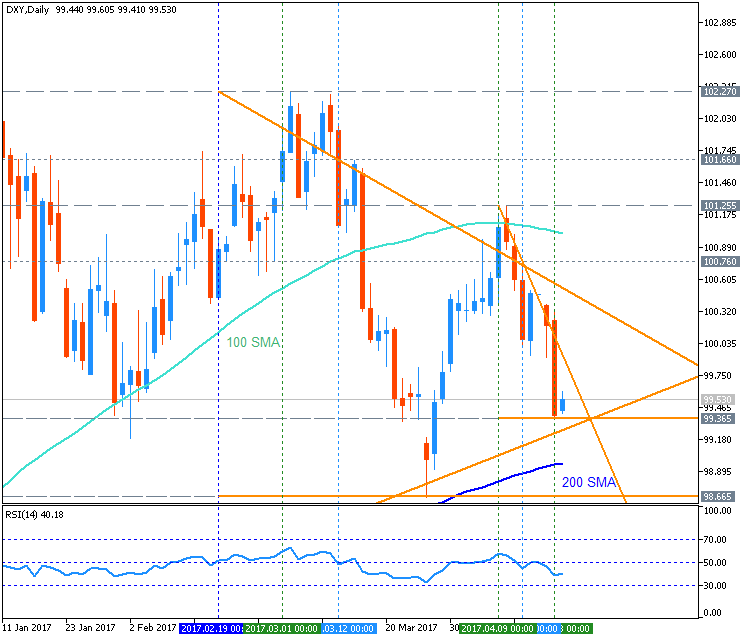

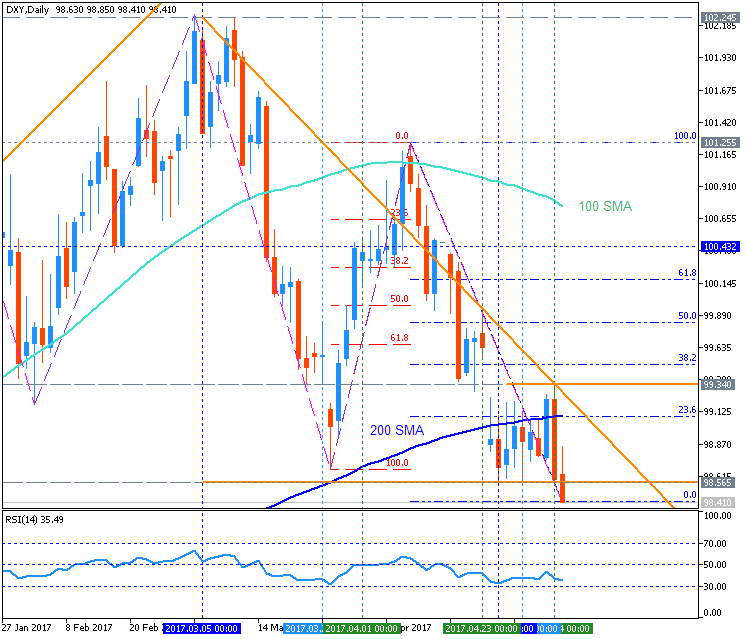

Dollar Index - bullish ranging near 200-day SMA waiting for direction (based on the article)

Daily price is located above 200-day SMA in the bullish area of the chart and below 100-day SMA with the secondary ranging market condition.

- If the price breaks 200 SMA to below together with 98.66 support level so the bearish reversal will be started.

- If the price breaks 100 SMA together with 101.25 resistance to above so the primary bullish trend will be resumed.

- if not so the price will be in bullish ranging waiting for direction

"DXY held trendline support at the March low and just found resistance from the median line of the 2016 channel. I don’t have a strong opinion on direction right now but the barriers are the January-March line and 2016 trendline. A move on either side of these lines (daily close) ideally ushers in the next directional move."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.22 10:49

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The US Dollar fell for a second consecutive week as the Fed rate hike outlook continued to deteriorate. Geopolitical jitters are almost certainly a big part of that story, even if the narrative has somewhat shifted from US tensions with Russia and North Korea to EU politics. Homegrown factors have also emerged however amid growing worries about slowing economic growth. An ominous picture is painted by the closely watched GDPNow model from the Atlanta Fed. It updates quarterly GDP growth projections with each incoming bit of relevant economic data. That forecast now predicts that output will add just 0.5 percent in the three months to March. That is far weaker than the 1-2 percent range expected by the markets."

Forum on trading, automated trading systems and testing trading strategies

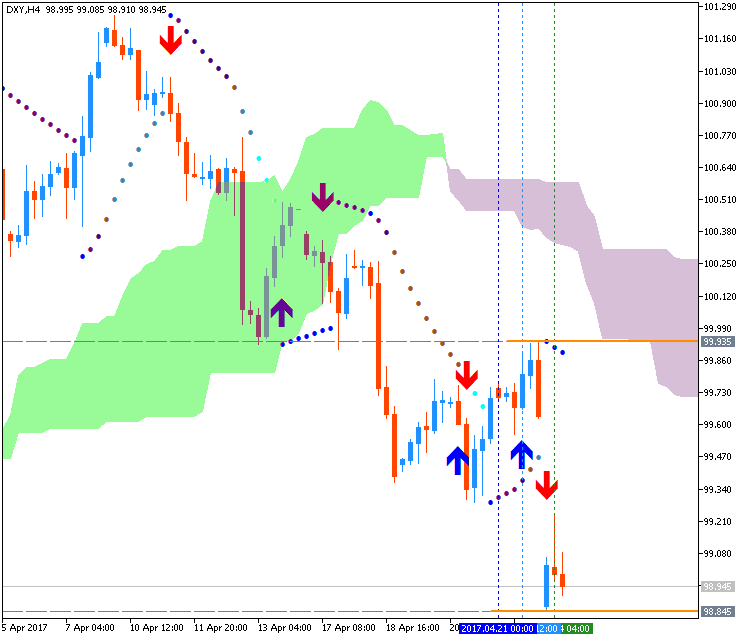

Sergey Golubev, 2017.04.24 08:21

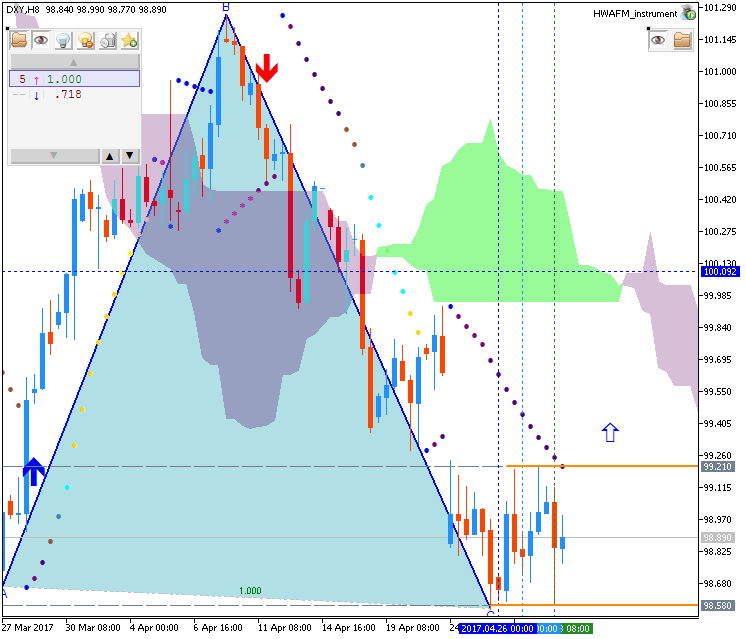

French Election for Dollar Index: intra-day bearish breakdown; 98.84 support level is the key (based on the article)

Daily H4 intra-day price was bounced from 99,93 resistance level to below for the bearish breakdown: the price is testing 98.84 support level to below for the bearish breakdowntobe continuing.

- "Relief rally? European stocks, French bonds and the euro should all be fairly perked up come this Monday morning in London, Paris and Frankfurt after the initial votes in the first round of France’s general election pointed to no major upset and the very “strong likelihood” of a pro-EU, pro-euro president."

- "According to Neil Wilson, a senior markets analyst at brokers ETX Capital in The City of London, the “market nightmare scenario has been averted” with Emmanuel Macron, a former investment banker who is running under the En Marche! banner, set to face off against Marine Le Pen, president of the National Front (FN), in the second round on May 7, 2017."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.28 13:08

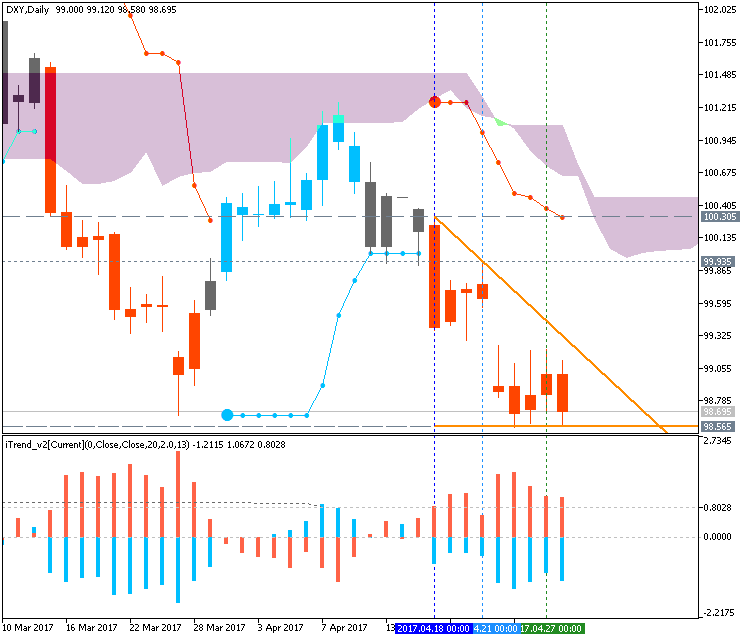

Dollar Index - testing support at 98.56 for the bearish to be resumed (adapted from the article)

Daily price is below Ichimoku cloud for the testing 98.56 support level together with descending triangle pattern to below for the bearish trend to be resumed.

"The barriers are the January-March line and 2016 trendline. A move on either side of these lines (daily close) ideally ushers in the next directional move.” The drop below the line indicates a potentially major trend change. If DXY bounces, then pay attention to the underside of the line (99.50s) for resistance."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.29 17:19

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The Fed’s own Beige Book survey of regional economic conditions remained optimistic even as data flow increasingly underperformed relative to consensus forecasts. If this foreshadows a sanguine attitude in the FOMC policy statement, the greenback is likely to advance. Further, the market-moving potential of soft data outcomes will be diminished. That may dull the pain of disappointment if April’s payrolls figures also fall short of expectations. However, the same outcome will probably sink the currency if the Fed sounds concerned and looking for reasons to backpedal."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.05.06 13:18

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The economic calendar is loaded with high-profile event risk. The PPI and CPI measures of inflation, retail sales statistics, and the May edition of the University of Michigan consumer confidence survey are all set to cross the wires. The Fed-speak docket is also busy, with eight policymakers scheduled to give ten separate speeches over five days (some will speak twice). This flood of fundamental news-flow might normally be expected to stoke substantial volatility. Timid price action following the payrolls print hints that may not be the case this time around. The Fed dismissed the first-quarter slowdown in US growth as “transitory”, so the bar for disappointment big enough to alter policy bets is extraordinarily high. Alternatively, upbeat results would just confirm what traders already know."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

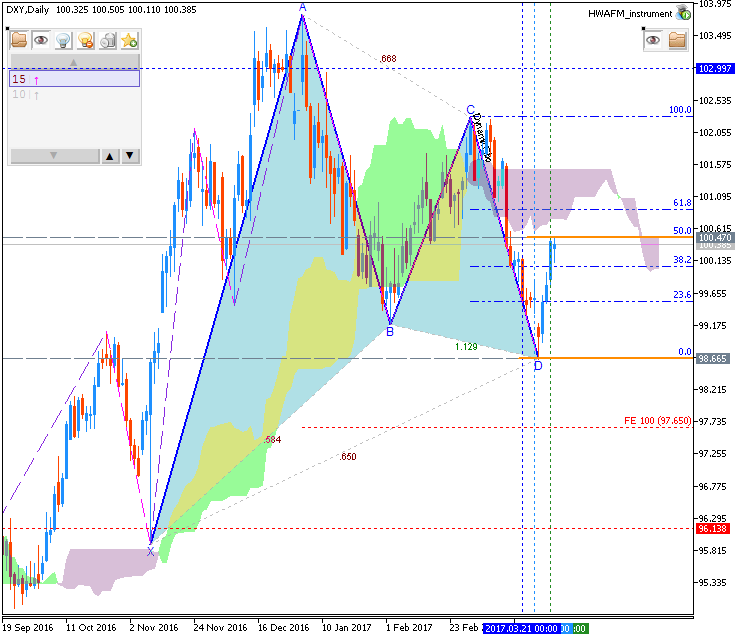

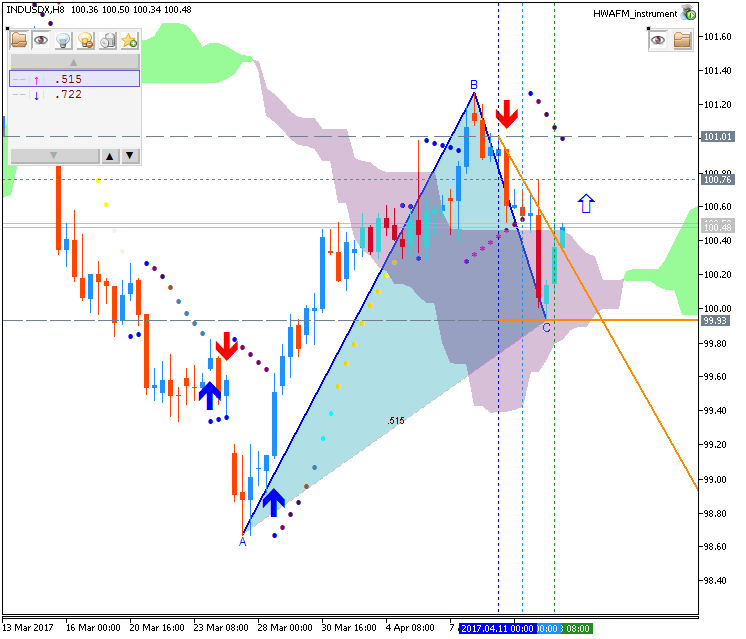

Dollar Index April-June 2017 Forecast: ranging correction

W1 price is located above Ichimoku cloud in the primary area of the chart. The price is on secondary correction which was started in the beginning of this year by bouncing from 103.80/102.27 resistance levels to below. For now, the price is testing 98.65 support level to below for the correction to be continuing.

Chinkou Span line is above the price indicating the ranging bullish trend, Trend Strength indicator is estimating the correction to be continuing, and Absolute Strength indicator is evaluating the trend as a ranging as well. Non-lagging Tenkan-sen/Kijun-sen signal is for ranging market condition for now and for very near future for example.Trend:

W1 - ranging bullish