Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.01 09:59

Weekly Fundamental Forecast for USD/JPY (based on the article)

USD/JPY - "Next week brings a slate of medium-importance announcements out of Japan: Manufacturing PMI’s are set to be released on Sunday, Services PMI’s are released on Wednesday, and Consumer Confidence on Thursday. Each of these can add drive to JPY given the implication around stronger data bringing stronger inflation which will, eventually, begin to move the BoJ away from dovish accommodation. But more likely as primary drivers next week will be the larger global macro trends that have developed as questions around the ‘Trump Trade’ continue to circulate."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.05 06:10

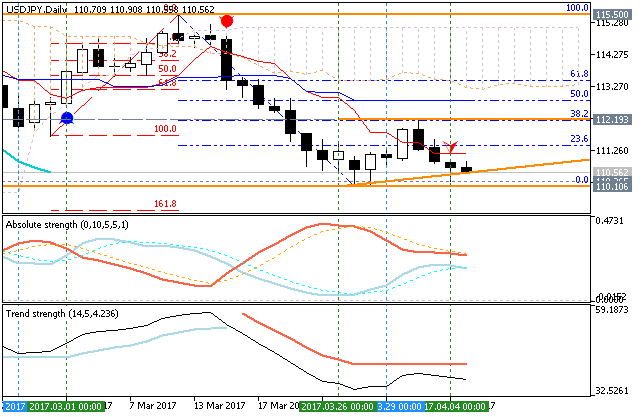

USD/JPY - bearish ranging within narrow s/r levels (based on the article)

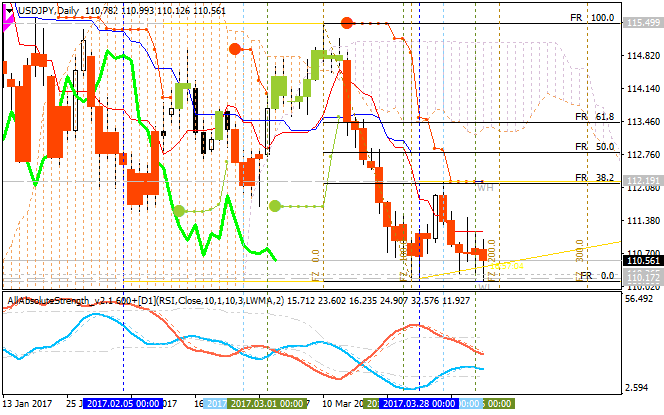

Daily price is located below Ichimoku cloud in the bearish area of the chart: the price is on ranging within 112.19/110.10 narrow support/resistance levels waiting for the direction of the strong trend to be started.

"The former level is being tested now and January lows near 112.60 still present a hurdle.” USD/JPY ended up rolling over between 111.60 and 112.60 (high was 112.20). The rally failing in the middle of congestion doesn’t bode well for near term upside but price is still hanging on to a parallel. Failure to gain traction now (above this parallel) opens up 108.55."

Forum on trading, automated trading systems and testing trading strategies

Japanese Yen, Gold Prices Rise as US Strikes Syria

noorad sharafi, 2017.04.07 05:00

Japanese Yen

Hi noorad sharafi,

About the name of your thread/post above - we do not know yet. It was not reported that this situation was strongly affected on the market ... because exactly same situations were many times between those two countries during the past months so nothing new here.

As to the daily movement so there is no any significant movement for now: the price is still on ranging within 112.19/110.17 support/resistance levels waiting for the strong trend for the secondary rally to be started or for the primary bearish trend to be resumed.

Forum on trading, automated trading systems and testing trading strategies

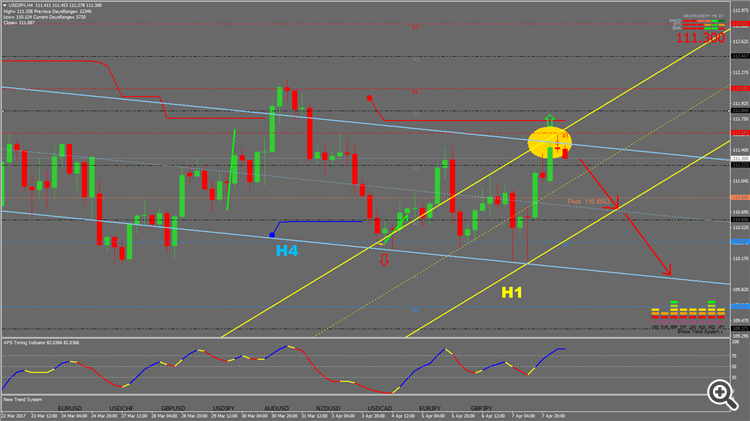

usd/jpy channel analysis

fxtelegram_, 2017.04.10 09:07

The first target under 111.60 may be 110.60 and the next target 110

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.14 15:50

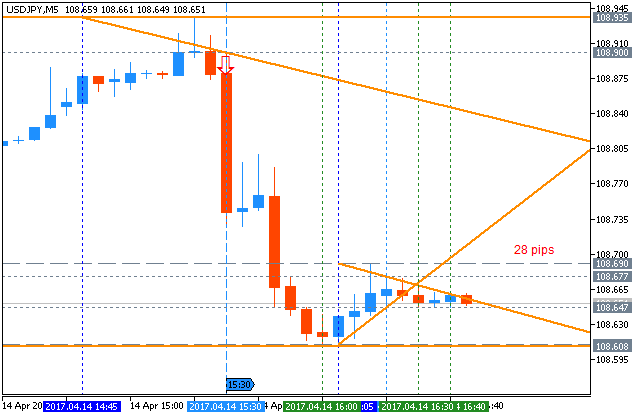

Intra-Day Fundamentals - EUR/USD and USD/JPY: U.S. Consumer Price Index

2017-04-14 13:30 GMT | [USD - CPI]

- past data is 0.1%

- forecast data is 0.0%

- actual data is -0.3% according to the latest press release

if actual < forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.3 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.4 percent before seasonal adjustment."

==========

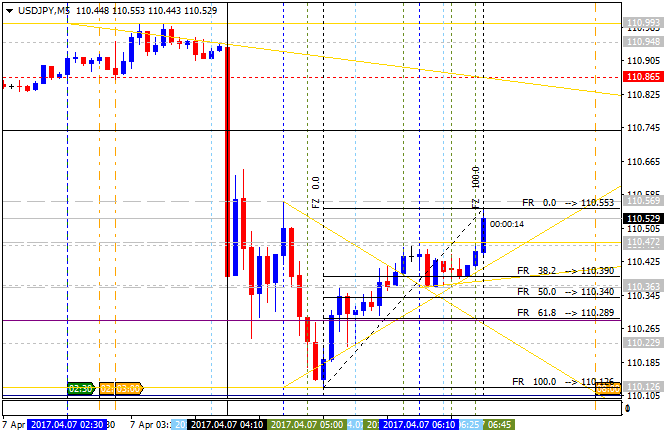

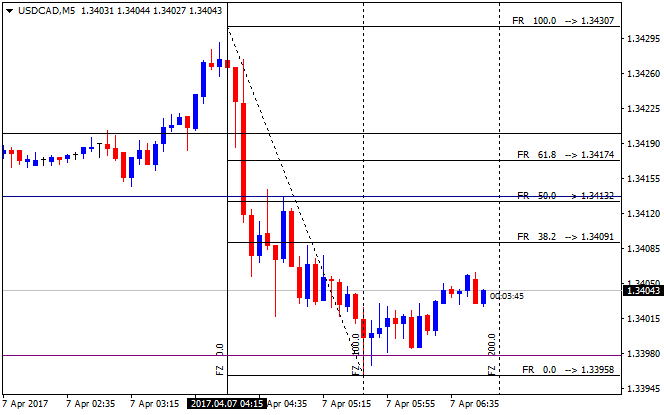

EUR/USD M5: 18 pips range price movement by U.S. Consumer Price Index news events

==========

USD/JPY M5: 28 pips range price movement by U.S. Consumer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.04.15 10:43

Weekly Fundamental Forecast for USD/JPY (based on the article)

USD/JPY - "BoJ Governor Kuroda warned the central bank will remove the non-standard measures once it reaches the 2% target for inflation, and went onto say that a further deprecation in the Yen would make it easier to achieve the goal as the economy stands at full-employment. Even though the BoJ keeps the door open to further embark on its easing-cycle, the comments suggest the BoJ is in no rush to implement more unprecedented measures, and the central bank may toughen the verbal intervention on the local currency as officials strive to achieve the inflation-target over the policy horizon."

Forum on trading, automated trading systems and testing trading strategies

USDJPY FORECASDT

upul siriwardhana, 2017.04.21 16:54

There is a flag pattern appear on USDJPY 30 m chart.up sloping two parallel trend lines that act as support & resistance for the price until the price breaks out. downward trend is upcoming on next hours.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

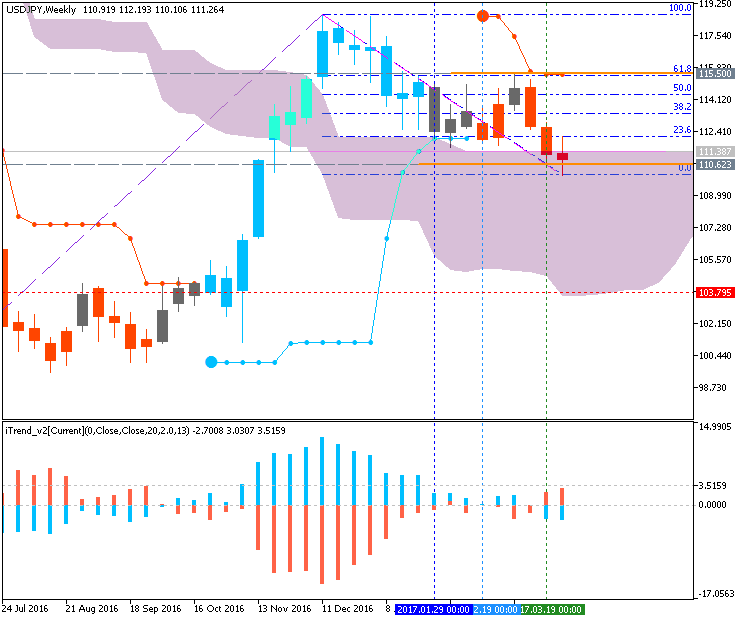

USD/JPY April-June 2017 Forecast: correction to the ranging; 103.79 support is the key level for the possible bearish reversal

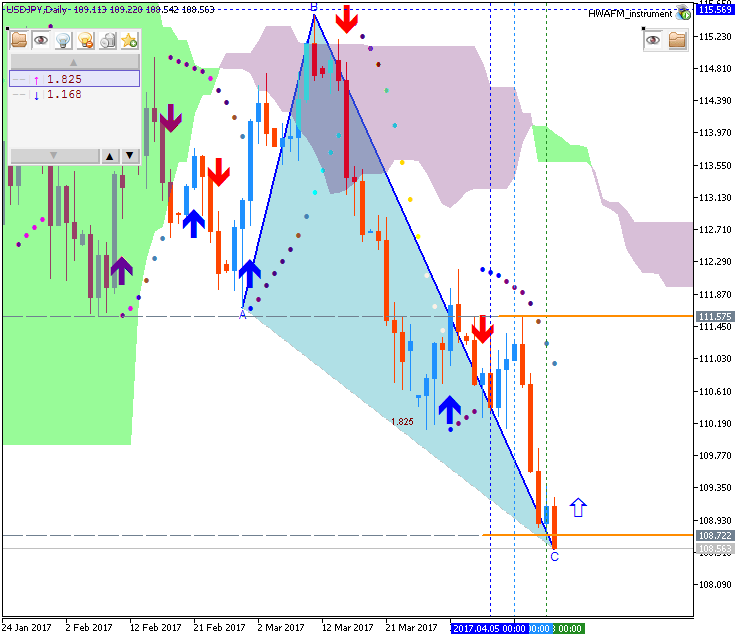

W1 price is on secondary correction within the primary bullish market condition: the price is breaking the upper border of Ichimoku cloud to below to be reversed to the ranging market condition waiting for the direction of the bullish trend to be resumed or the bearish reversal to be started.

Chinkou Span line is above the price indicating the ranging by direction, Trend Strength indicator is estimating the trend as a correction, and Absolute Strength indicator is evaluating the trend as a ranging as well. Non-lagging Tenkan-sen/Kijun-sen signal is for ranging bullish market condition for now and for near future for example.Trend:

W1 - ranging correction