You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.19 09:01

USD/CNH Intra-Day Fundamentals: China Gross Domestic Product and range price movement

2017-10-19 03:00 GMT | [CNY - GDP]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

USD/CNH M5: range price movement by China Gross Domestic Product news event

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.27 15:52

Intra-Day Fundamentals - GBP/USD, USD/CNH and Brent Crude Oil: U.S. Gross Domestic Product

2017-10-27 13:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

GBP/USD M1: range price movement by U.S. Gross Domestic Product news events

==========

USD/CNH M1: range price movement by U.S. Gross Domestic Product news events

==========

Brent Crude Oil M1: range price movement by U.S. Gross Domestic Product news events

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.28 11:47

Weekly Fundamental Forecast for USD/CNH (based on the article)

USD/CNH - "A key message sent from the 19th Party Congress is that China’s growth target has been revised: the country will no longer set high GDP growth rate as a goal; instead, it will shift to focus on the “quality” of the growth. Five years ago, the 18th Party Congress set a target to double GDP in 2020 of that in 2010. Yet, this is removed in the work report delivered by 19th Party General Secretary and China’s President, Xi Jinping. In a press conference this week, Yang Weimin, a senior official, told that this removal is intentional, as the quality of the economic expansion has not been satisfying. This means over the following period, we may see even lower growth rate – a rate below the current target of 6.5% is possible. Also, the top Party leaders believe that China is still in the transformation phase; the recovery seen recently may not be sustainable until three tasks are finished: switching to a new development path, optimizing the economic structure and generating new growth monuments. These goals will take a “relatively long time” to achieve, according to Yang Weimin. This indicates the economy still faces considerable risks; the recovery process could take years to complete. Amid a slower recovery than its U.S. counterpart, the Chinese Yuan could bear additional bearish pressure against the Dollar in the long run. New party leaders have disclosed major strategies for the economy over a time frame from now to the mid-century. Continuing to implement supply-side reform is the first and one of the most important on the list. This includes cutting excess production, which is a pain in the short-term but could generate gains in the long-term. Next week, China will release both the official and Caixin PMI prints for October: the official PMI is expected to drop to 52.1 from 52.4 in the month prior; the Caixin PMI is expected to hold at 51.0. With the on-going supply-side reform, PMI gauges could continue to whipsaw over the following months."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.09 07:54

USD/CNH Intra-Day Fundamentals: China CPI and range price movement

2017-11-09 01:30 GMT | [CNY - CPI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

From rttnews article :

==========

USD/CNH M15: range price movement by China CPI news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.22 15:10

Intra-Day Fundamentals - USD/JPY, USD/CNH and Gold: U.S. Durable Goods Orders

2017-11-22 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From cnbc article :

==========

USD/JPY M1: range price movement by Durable Goods Orders news events

==========

USD/CNH M1: range price movement by Durable Goods Orders news events

==========

XAU/USD M1: range price movement by Durable Goods Orders news events

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.30 09:43

Intra-Day Fundamentals - GBP/USD, AUD/USD and USD/CAD: China Federation of Logistics and Purchasing Index

2017-11-30 01:00 GMT | [CNY - Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From chinadailyasia article :

==========

USD/CNH M15: range price movement by China Manufacturing PMI news events

==========

AUD/USD M5: range price movement by China Manufacturing PMI news events

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.01 07:15

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and range price movement

2017-12-01 01:45 GMT | [CNY - Caixin Manufacturing PMI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Caixin Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report :

==========

USD/CNH M15: range price movement by Caixin Manufacturing PMI news event

==========

The chart was made on M5 timeframe with standard indicators of Metatrader 4 except the following indicator (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.28 07:07

Intra-Day Fundamentals - AUD/USD, USD/CNH and GOLD: The Conference Board United States Consumer Confidence Index

2017-11-29 13:30 GMT | [USD - Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Consumer Confidence] = Level of a composite index based on surveyed households.

==========

From official report :

==========

AUD/USD M5: range price movement by CB Consumer Confidence news events

==========

USD/CNH M5: range price movement by CB Consumer Confidence news events

==========

XAU/USD M1: range price movement by CB Consumer Confidence news events

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Good day Mr Sergey, I have been trying to understand how to interpret or read the brown triangle on one of the above comment, can you explain to me how to read and interpret the market, thanks

Good day Mr Sergey, I have been trying to understand how to interpret or read the brown triangle on one of the above comment, can you explain to me how to read and interpret the market, thanks

Which brown triangle?

Descending or ascending patterns? If yes so look at the following description:

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2013.09.05 09:53

3 Easy Triangle Patterns Every Forex Trader Should Know - Symmetrical Triangle

The first type of pattern is the symmetrical triangle pattern. It is formed by two intersecting trendlines of similar slope converging at a point called the apex.

In the above example of a symmetrical triangle you can easily see on the AUDUSD 1-Hour chart the intersection of a rising trendline and a downtrend line at the bottom of a larger trend. Sellers are unable to push prices lower and buyers can’t push price to new highs.

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2013.09.05 09:56

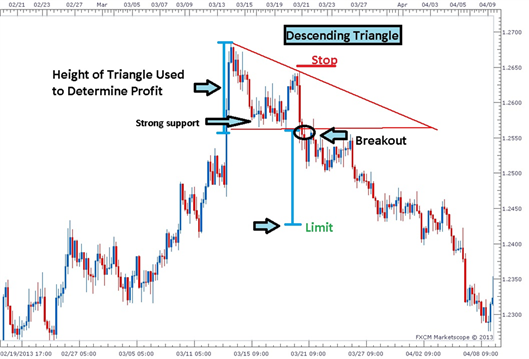

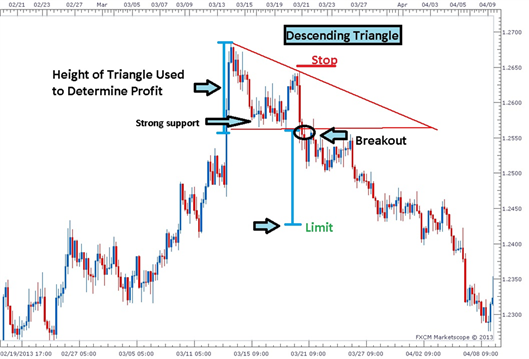

3 Easy Triangle Patterns Every Forex Trader Should Know - Descending Triangle

The last triangle pattern is the descending triangle pattern. The descending triangle is characterized by an area of strong support intersecting a downward sloping trend line. When chartist see this pattern as part of a larger downtrend, they look for a continuation of the downtrend. A close break and close below the area of support would be a confirmation of this pattern signaling traders to enter short with a stop above the top of the pattern.

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2013.09.05 09:56

3 Easy Triangle Patterns Every Forex Trader Should Know - Descending Triangle

The last triangle pattern is the descending triangle pattern. The descending triangle is characterized by an area of strong support intersecting a downward sloping trend line. When chartist see this pattern as part of a larger downtrend, they look for a continuation of the downtrend. A close break and close below the area of support would be a confirmation of this pattern signaling traders to enter short with a stop above the top of the pattern.