You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2022.01.26 20:25

Intra-Day Fundamentals - AUD/USD, NZD/USD and Hang Seng Index : Federal Funds Rate and FOMC Statement

2022-01-26 19:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous value) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From official report :

==========

AUD/USD: range price movement by Federal Funds Rate news events

==========

NZD/USD: range price movement by Federal Funds Rate news events

==========

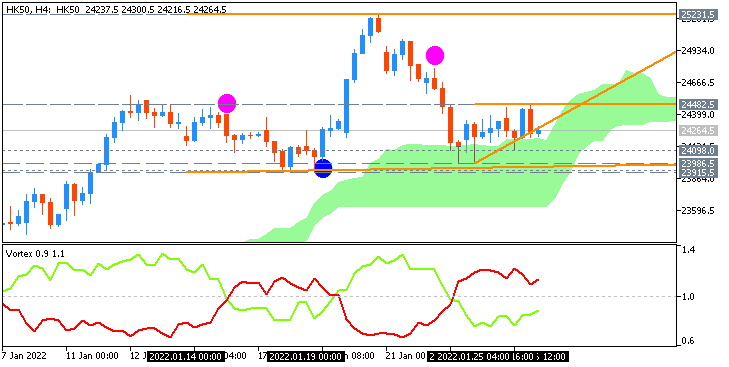

Hang Seng Index (HK50) : range price movement by Federal Funds Rate news events

==========

Charts were made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2022.01.26 20:25

Intra-Day Fundamentals - AUD/USD, NZD/USD and Hang Seng Index : Federal Funds Rate and FOMC Statement

2022-01-26 19:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous value) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

...==========

Hang Seng Index (HK50) : range price movement by Federal Funds Rate news events

...Next day chart (just to compare about were the price was going to) -

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2022.05.11 15:34

Intra-Day Fundamentals - USD/JPY, AUD/USD and Hang Seng Index (HK50): United States Core Consumer Price Index (CPI)

2022-05-11 12:30 GMT | [USD - Core CPI]

if actual > forecast (or previous value) = good for currency (for USD in our case)

[USD - Core CPI] = Change in the price of goods and services purchased by consumers, excluding food and energy.

==========

From official report :

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis after rising 1.2 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.3 percent before seasonal adjustment. The index for all items less food and energy rose 0.6 percent in April following a 0.3-percent advance in March".

==========

USD/JPY: range price movement by United States Core Consumer Price Index news event

==========

AUD/USD: range price movement by United States Core Consumer Price Index news event==========

Hang Seng Index (HK50): range price movement by United States Core Consumer Price Index news event

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2022.10.08 11:18

Intra-Day Fundamentals - USD/JPY, USD/CNH and Hang Seng Index (HK50) : United States Nonfarm Payrolls

2022-10-07 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous value) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From forbes article :

==========

USD/JPY : range price movement by Nonfarm Payrolls news events

==========

USD/CNH : range price movement by Nonfarm Payrolls news events==========

Hang Seng Index (HK50) : range price movement by Nonfarm Payrolls news events==========

Charts were made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2023.04.13 15:10

Intra-Day Fundamentals - Dollar Index, GOLD (XAU/USD) and Hang Seng Index: United States Producer Price Index (PPI)

2023-04-13 12:30 GMT | [USD - PPI]

if actual > forecast (or previous good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From rttnews article :

"Reflecting a steep drop in energy prices, the Labor Department released a report on Thursday showing an unexpected decrease in U.S. producer prices in the month of March. The Labor Department said its producer price index for final demand fell by 0.5 percent in March following a revised unchanged reading in February."

==========

Dollar Index: range price movement by United States Producer Price Index (PPI)==========

GOLD (XAU/USD): range price movement by United States Producer Price Index (PPI)==========

Hang Seng Index: range price movement by United States Producer Price Index (PPI)

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2023.08.04 17:15

Intra-Day Fundamentals - USD/CNH, GOLD (XAU/USD) and Hang Seng Index (HKI50) : United States Nonfarm Payrolls

2023-08-04 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous value) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From rttnews article :

==========

USD/CNH : range price movement by Nonfarm Payrolls news events

==========

GOLD (XAU/USD) : range price movement by Nonfarm Payrolls news events

==========

Hang Seng Index (HKI50) : range price movement by Nonfarm Payrolls news events==========

Charts were made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

==========

Same systems for MT4/MT5:

The beginning

After

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2023.09.19 17:35

Intra-Day Fundamentals - NZD/USD, GBP/USD and Hang Seng Index : United States Building Permits

2023-09-19 12:30 GMT | [USD - Building Permits]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Building Permits] = Annualized number of new residential building permits issued during the previous month.

==========

From rttnews article :

==========

NZD/USD: range price movement by U.S. Building Permits news events

==========

GBP/USD: range price movement by U.S. Building Permits news events

============

Hang Seng Index : range price movement by U.S. Building Permits news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2024.06.07 14:58

Intra-Day Fundamentals - NZD/USD, Dollar Index (DXY) and Hang Seng Index (HK50): United States Nonfarm Payrolls

2024-06-07 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous value) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

NZD/USD: range price movement by Nonfarm Payrolls news events

==========

Dollar Index (DXY): range price movement by Nonfarm Payrolls news events==========

Hang Seng Index (HK50): range price movement by Nonfarm Payrolls news events==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5: