You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Weekly EUR/USD Outlook: 2017, February 19 - February 26 (based on the article)

EUR/USD was looking for a new direction as politics continued moving markets. The upcoming week features PMIs and some business surveys.

NZD/USD Intra-Day Fundamentals: New Zealand Producer Price Index and 38 pips range price movement

2017-02-19 21:45 GMT | [NZD - PPI Input]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - PPI Input] = Change in the price of goods and raw materials purchased by manufacturers.

==========

From official report:

==========

NZD/USD M5: 38 pips range price movement by New Zealand Producer Price Index news event

Daily price is located below 100 SMA/200 SMA in the bearish area of the chart for the ranging between Fibo support level at 1.0521 and Fibo resistance level at 1.0828.

If the price breaks 1.0521 support so the primary bearish trend will be resumed, if the price breaks 1.0828 resistance so the secondary rally will be started, otherwise - ranging.

USD/CAD Intra-Day Fundamentals: Canada's Wholesale Trade and range price movement

2017-02-20 13:30 GMT | [CAD - Wholesale Sales]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Wholesale Sales] = Change in the total value of sales at the wholesale level.

==========

From official report:

==========

USD/CAD M5: range price movement by Canada's Wholesale Trade news event

AUD/USD Intra-Day Fundamentals: RBA Monetary Policy Meeting Minutes and 21 pips range price movement

2017-02-21 00:30 GMT | [AUD - Monetary Policy Meeting Minutes]

[AUD - Monetary Policy Meeting Minutes] = Detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

From macrobusiness article:

==========

AUD/USD M5: 21 pips range price movement by RBA Monetary Policy Meeting Minutes news event

Nvidia - one of the strongest performing stocks in 2016 (based on the article)

Shares price is located in the bullish area of the daily chart above Ichimoku cloud: the price is continuing with the secondary correction by breaking descending triangle pattern together with 105.65 support level to below for the correction to be continuing. If shares break 99.00 support level so the bearish reversal may be started, if not so the price will be on bullish ranging wityyhin Ichimoku cloud.

"NVIDIA Corp. after Thursday's close Feb 09, 2017's close. This leading stock was one of the strongest performing stocks in 2016. Nvidia hit a record high of $120.92/share in 2017 and is currently trading near $107/share. The stock is prone to big moves after reporting earnings and fell about $10 in the days after reporting earnings. Currently, it is testing its 50 day moving average lines which is a common area of support. The bulls want to see that level hold and for the stock to bounce higher from here."

------------------

"Jen-Hsun Huang, president and chief executive officer of Nvidia Corp., holds the Nvidia Spot as he speaks during a keynote presentation at the 2017 Consumer Electronics Show (CES) in Las Vegas, Nevada, U.S., on Wednesday, Jan. 4, 2017. Nvidia, the biggest maker of graphics chips, announced a new version of its Shield set-top box and the debut of an online service designed to bring millions of new consumers to high-end computer games."

HSBC: breakdown to bearish reversal Senkou Span level (based on the article)

Daily share price broke support levels to below: the price is testing 41.50/41.15 levels which are located near Senkou Span line to be reversed to the primary bearish market condition.

S&P 500 Technical Outlook: More of the Same for Now (based on the article)

Daily price is on bullish market condition to be above Ichimoku cloud: price broke 2351 resistance level to above for the bullish trend to be continuing.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

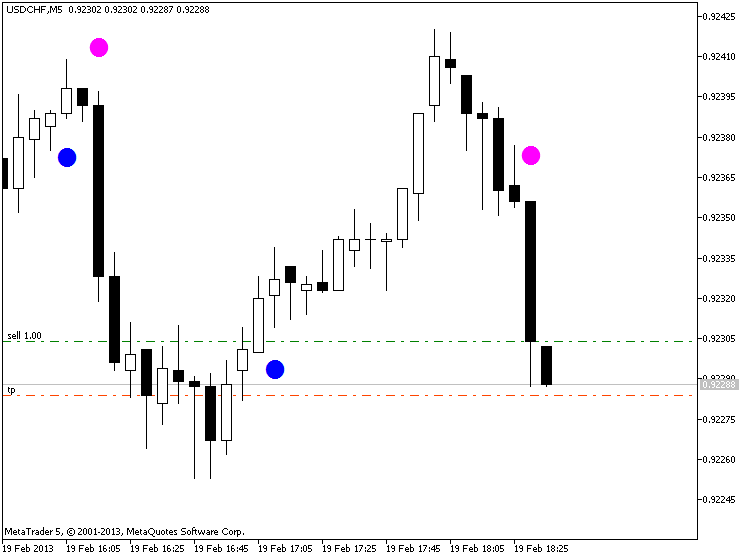

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Crude Oil Price Forecast: ranging within narrow 57.42/53.56 levels (based on the article)

Daily price is located on the bullish area of the chart to be above 100-day SMA/200-day SMA reversal: the price is on ranging within narrow 57.42/53.56 support/resistance levels for the 57.42 level to be testing to above for the bullish trend to be continuing.