You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Intra-Day Fundamentals - EUR/USD, USD/CAD and GBP/USD : Non-Farm Payrolls

2016-11-04 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

"Total nonfarm payroll employment rose by 161,000 in October, and the unemployment rate was little changed at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in health care, professional and business services, and financial activities."

==========

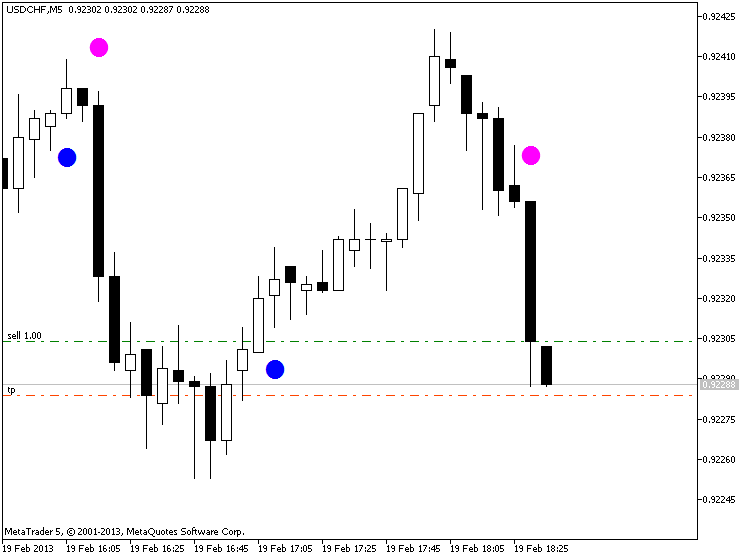

EUR/USD M5: 20 pips range price movement by Non-Farm Payrolls news events

==========

USD/CAD M5: 65 pips range price movement by Non-Farm Payrolls news events

==========

GBP/USD M5: 25 pips range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

EURUSD correlation GDP Growth Rate and US presidential election

Achmad Armawijaya, 2016.11.05 06:42

EURUSD saw monthly data, we see there is a pattern of bearish butterflies

referring to the United States GDP Growth Rate and GDP Growth Rate EUR, we can see the development of the economy of the USA, and a weakening economy EUR

we see it as a trend following

however, the price trend should reach a point C on butterfiles bearish pattern, traders are still waiting for the American presidential elections that will take place on 8 November 2016, we can predict it will reach the level Fibonaci haga between 1.0500 (0.00) and 1.07800 (23.6) this month after it bounces to 1.2450 in the upcoming months to reach the point D (but it may not be that high because there are level resist) maybe as far as possible 1.22600 , it is in confirmation with pennant pattern (green line) and the price must penetrate button level and top level trend line (red and blue lines).

That's why my predictions for the week ahead, the price will stay down and.....

Donald Trump will become President of the United Sates. :D

EUR/USD Turns Lower on Lackluster NFP Data (based on the article)

"The EUR/USD continues to trade lower despite the release of lackluster NFP figures. NFP release was expected at +175k, and was released at +161k an actual. The big surprise on the day was a revision of September’s employment figures to 191k. This revision was up from the reported 156K, causing US Dollar based pairs to rally."

"Technically, the EUR/USD may be seen below being rejected from a 50% Fibonacci retracement value at 1.1108. This line has been acting as resistance now for three consecutive sessions, and is measured by taking the distance between the August 18th high at 1.1366 and the current October low of 1.0850. If prices continue to trade below this value, traders may see this rejection as the resumption of an ongoing 4th quarter downtrend. However if prices can break above this point, it may solidify a broader EUR/USD retracement."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Weekly Outlook: 2016, November 06 - November 13 (based on the article)

US Presidential Election, Crude Oil Inventories, Unemployment Claims, Prelim UoM Consumer Sentiment, Rate decision in New Zealand. These are the main highlights of this week.

Weekly EUR/USD Outlook: 2016, November 06 - November 13 (based on the article)

EUR/USD managed to recover as November began. Updated EU forecasts and some German data stand out, as Americans go to the polls. Volatility is going to be high. Here is an outlook for the highlights of this week.

Week Ahead On Wall Street: Markets Brace For Election Results (based on Forbes article)

Monday

"British lawmakers will debate the implications of Brexit, after the High Court said that Parliament must give its approval before the country can move forward with its split from the European Union."

Tuesday

"It’s election day. Billionaire Elon Musk has begun campaigning for the merger of SolarCity and Tesla and last week promised that the tie-up would yield big financial benefits for Tesla investors."

Wednesday

"Goldman Sachs is expected to announce which of its top employees have achieved partner status. It does this every two years and in 2014 named 78 people to the position. The partnership ranks are tough to break into and represent fewer than 2% of the firm’s workers."

Thursday

"Starbucks CEO Howard Schultz, activist investor Bill Ackman, Goldman Sachs CEO Llyod Blankfein and others will speak at The New York Times’ Dealbook conference."

Friday

"Bond markets are closed for Veteran’s Day. The stock market will keep its normal hours."

Dollar Index - "Two, four, eight weeks after the US election passes; we will likely see the impact of the event fade into a more subtle promotion of the prevailing trend. There is certainly capacity for the change in leadership to contribute to the bigger picture bearings on speculative positioning; but sentiment’s drive will likely draw from more elemental sources. That means other drivers will likely return to the forefront for global markets and even the Dollar itself. The probability of a December 14th FOMC hike is a factor that is likely to regain its sway over the market after this event passes. According to Fed Funds futures the chances of a hike before year end stand at 78 percent through Friday which is a significant gain over the previous few weeks. Yet the Dollar slid. That is evidence not of a broken fundamental driver, but the market prioritizing. When the risk factor passes, that theme will return. After the Fed’s statement and the strong wage growth in NFPs this past week, a rate hike looks like a high probability. So long as risk doesn’t subvert those chances, a refocus could support the Greenback."

EUR/USD - "Considering this point of view, then, should Clinton be elected, the FOMC would likely be able to retain its current set of growth and inflation forecasts and continue with its current plan for normalizing rates (i.e., hike rates in December). However, given the significant shift in fiscal policy and its resulting impact on the US economy should Trump be elected (for better or for worse), the FOMC would have to alter its forecasts. Such an event would cater to a hold in December. Amid an otherwise bland economic docket this coming week, the US Presidential election is the paramount influence on EUR/USD by a wide margin – let’s not pretend otherwise. If Clinton wins, EUR/USD should quickly shake off the recent built-up political risk premium, allowing EUR/USD to return to its recent lows in the low $1.0800s. On the other side, because of the likely hold in Fed policy in December, EUR/USD’s initial reaction to a Trump victory would likely be a move towards the August highs around $1.1360."

USD/JPY - "Given the changes in the backdrop for the BoJ, we’re going to leave our forecast at neutral for the week ahead on the Yen until more information presents itself. Data out of Japan will be extremely light for next week, so expect the Yen to trade with general macro headwinds that will likely emanate from U.S. Presidential elections."