Join our fan page

- Views:

- 3573

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

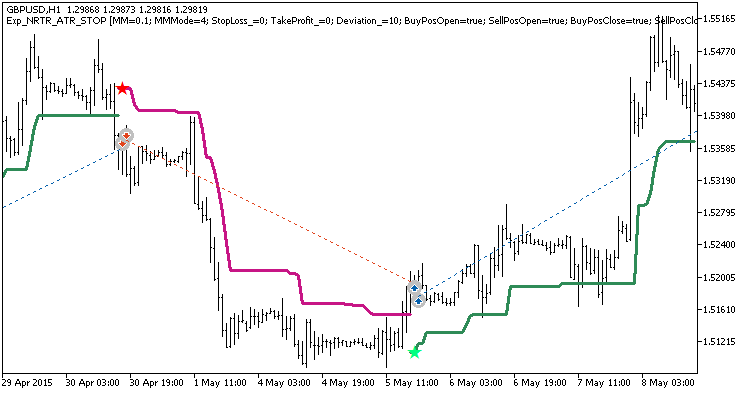

The trading system is based on the NRTR_ATR_STOP indicator signals. A signal is formed at the close of a bar, if a large colored star has appeared.

The Expert Advisor uses the compiled indicator file NRTR_ATR_STOP.ex5 for operation. Save it to <terminal_data_folder>\MQL5\Indicators.

Note that the TradeAlgorithms.mqh library file allows using Expert Advisors with brokers who offer nonzero spread and the option of setting Stop Loss and Take Profit during position opening. You can download more variants of the library at the following link: Trade Algorithms.

Default input parameters of the Expert Advisor were used during the tests shown below. Stop Loss and Take Profit were not used during testing.

Fig. 1. Examples of deals on the chart

Testing results for 2015 at GBPUSD H1:

Fig. 2. Testing results chart

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/18448

exp_Amstell-SL

exp_Amstell-SL

The EA buys if the open price of the last position is higher than the current price.

Crossing of two iMA

Crossing of two iMA

Crossover of two iMAs (Moving Averages), one more iMA (Moving Average) is used as the filter. Lot: manual or risk percent of balance. Stop, Market or Limit orders. The EA also sets Stop Loss, Take Profit, Trailing Stop.

Vertical line

Vertical line

The indicator draws a vertical line (OBJ_VLINE) and then moves it to the specified time (hours and minutes).

i4_GoldenLionTrend_v3

i4_GoldenLionTrend_v3

A trend strength indicator using two Bollinger channels.