In this video, we will look at different tools that traders will use to help decide when to enter a trade - we are assuming that the trader has used his edge to

form an opinion or bias to what price will do next, and now he is ready

to enter the trade.

Entering the trade

After finding an edge to trade, a trader needs a set of tools or instructions guiding them on how to enter the trade. Let's say a trader is trading an overall up-trend. In other words, the overall trend of price is going up over time. However, price does not go straight up. At times, price will reverse and drop down a bit before reversing back to continue the up-trend. A trader attempting to trade the trend may enter on the pull back. In other words, they enter when price drops down hoping to catch the reversal back up.

To decide when to enter, a trader may use support and resistance. So as price reverses back down, they wait for price to hit a level of support and then enter.

Or the trader may use technical indicators. Perhaps the trade enters when a shorter term moving average crosses over a longer term moving average.

Perhaps the trader looks for divergence such as RSI divergence. As price drops, they enter when they see RSI diverge from the downtrend and turn back up with the expectation that price will soon reverse and rise back up as well.

Perhaps they will use fibonacci retracements or pivot points to judge how far price will drop before reversing back up.

Perhaps the trader will use volume. As price drops back down, they will wait if volume is increasing, which implies that price is picking up momentum, and then enter when volume declines which implies that the downward movement is running out of steam.

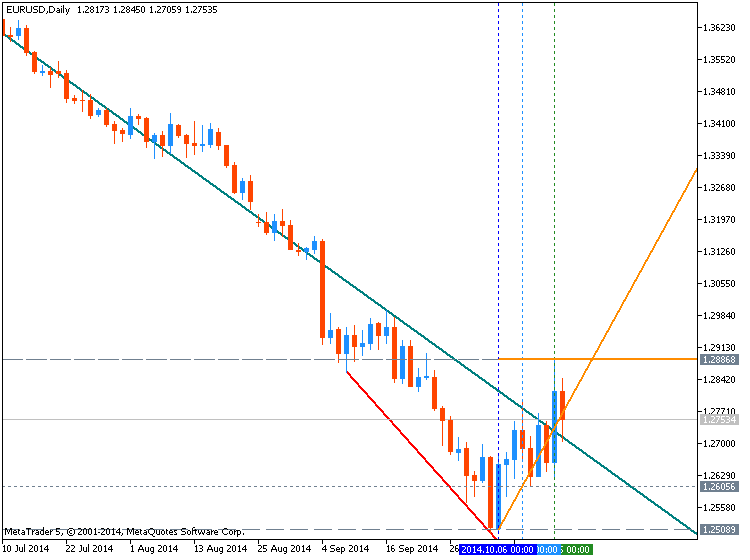

Let's continue with our range trading plan from the last video. To re-cap- after making a large move up or down, price tends to go into a horizontal range for a bit while it 'figures out' if it is going to continue in the same direction, or reverse back the other way. So our edge is that we look for price to make a big move and then go into a horizontal range. We are looking to enter as price approaches the wall of the range and ride price to the other side of the range.

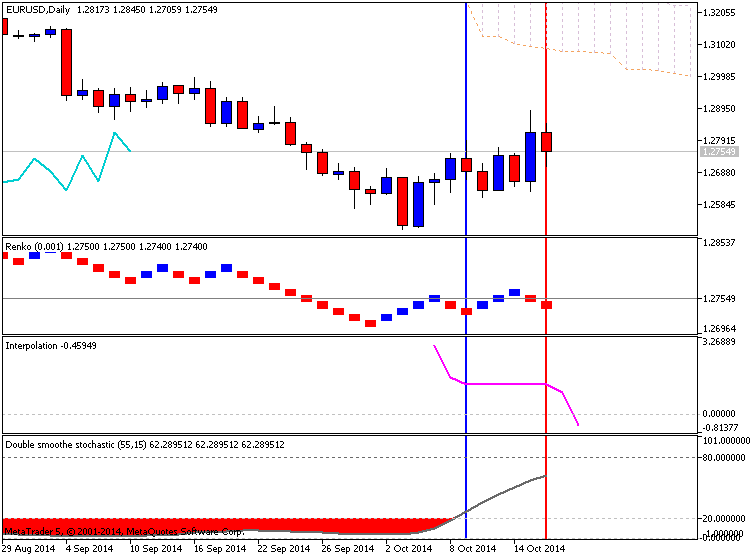

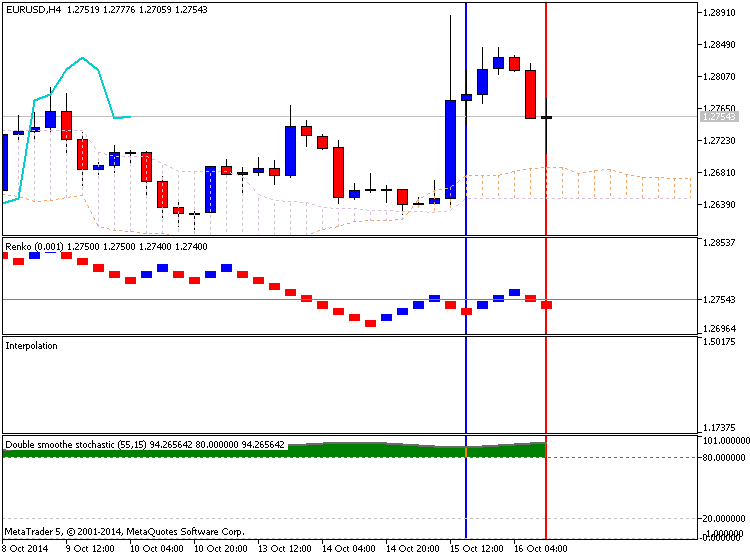

Ranges are not always so clearly defined by support and resistance lines. For instance, sometimes price reverses close to the wall of the range without actually touching the wall. Therefore, the best place to enter the trade is also not always so clearly defined, and we can use some tools to help guide us on when to enter. Some common tools a trader may use to help enter range trades are oscillators. A trader may enter when price touches the wall of a bollinger band versus the wall of the range, or when Stochastics shows over bought or over sold, or when RSI reverses.

So that was two examples of common ways traders will enter a trade. There are more tools and ways to enter than can possibly be described in one video. However, how one enters is just one part of a complete trading plan that includes trade management and money management, both of which are more important than the edge or how one enters into the trade.

Entering the trade

After finding an edge to trade, a trader needs a set of tools or instructions guiding them on how to enter the trade. Let's say a trader is trading an overall up-trend. In other words, the overall trend of price is going up over time. However, price does not go straight up. At times, price will reverse and drop down a bit before reversing back to continue the up-trend. A trader attempting to trade the trend may enter on the pull back. In other words, they enter when price drops down hoping to catch the reversal back up.

To decide when to enter, a trader may use support and resistance. So as price reverses back down, they wait for price to hit a level of support and then enter.

Or the trader may use technical indicators. Perhaps the trade enters when a shorter term moving average crosses over a longer term moving average.

Perhaps the trader looks for divergence such as RSI divergence. As price drops, they enter when they see RSI diverge from the downtrend and turn back up with the expectation that price will soon reverse and rise back up as well.

Perhaps they will use fibonacci retracements or pivot points to judge how far price will drop before reversing back up.

Perhaps the trader will use volume. As price drops back down, they will wait if volume is increasing, which implies that price is picking up momentum, and then enter when volume declines which implies that the downward movement is running out of steam.

Let's continue with our range trading plan from the last video. To re-cap- after making a large move up or down, price tends to go into a horizontal range for a bit while it 'figures out' if it is going to continue in the same direction, or reverse back the other way. So our edge is that we look for price to make a big move and then go into a horizontal range. We are looking to enter as price approaches the wall of the range and ride price to the other side of the range.

Ranges are not always so clearly defined by support and resistance lines. For instance, sometimes price reverses close to the wall of the range without actually touching the wall. Therefore, the best place to enter the trade is also not always so clearly defined, and we can use some tools to help guide us on when to enter. Some common tools a trader may use to help enter range trades are oscillators. A trader may enter when price touches the wall of a bollinger band versus the wall of the range, or when Stochastics shows over bought or over sold, or when RSI reverses.

So that was two examples of common ways traders will enter a trade. There are more tools and ways to enter than can possibly be described in one video. However, how one enters is just one part of a complete trading plan that includes trade management and money management, both of which are more important than the edge or how one enters into the trade.