About:

ATR Orders Manager EA on MT5: https://www.mql5.com/en/market/product/152116

This tool helps you to place trades in MT5 with ease and it's using a simple but intuitive graphical interface.

You can place risk-controlled market orders or pending orders (Buy Stop/Sell Stop) with dynamic stop losses based on Average True Range (ATR).

Maybe you ask yourself why to use stop losses based on ATR and not a fixed percentage or a fixed number of pips.

Most traders are taught to “risk 1% of your account per trade” — and that’s excellent advice. But the big question is: 1% on how many pips?

If you use a fixed pip distance (e.g., always a 50-pip stop) or a fixed percentage of price, you run into problems:

- On a quiet pair like EURCHF, 50 pips might be huge — you tie up capital for ages waiting for a tiny move.

- On gold or GBPJPY during news, 50 pips is nothing — you get stopped out by normal market noise, even when your trade idea was good.

The result? Inconsistent risk, random win rates, and a lot of frustration.

ATR (Average True Range) fixes this beautifully. It simply measures how much the market actually moves on average over the last few periods. When volatility is high, ATR grows and your stop automatically widens a little (giving the trade room to breathe). When volatility is low, ATR shrinks and your stop tightens (so you’re not over-exposed).

You still risk exactly the same 1% of your account (or whatever you choose) — but now the stop distance adapts to the market you’re trading. The same 1% buys you the same statistical “comfort zone” whether you’re on forex, gold, crypto, or indices.

This volatility-adjusted approach is exactly what trading psychology and position-sizing legend Van K. Tharp recommended for decades.

In his classic book Trade Your Way to Financial Freedom and in his workshops, Van Tharp showed through thousands of simulations that the very best systems risk a fixed percentage of equity, but base the stop (and therefore the position size) on current market volatility — not on arbitrary pips or percentages of price.

He called fixed-pip or non-adjusted stops one of the biggest hidden mistakes amateur traders make, because they treat every market and every day as identical when they clearly aren’t.

By combining Van Tharp’s fixed-percentage risk rule with ATR-based stop placement, the ATR Orders Manager gives you professional-grade position sizing in one click. Your risk stays consistent, your stops respect the market’s natural behavior, and you finally get the kind of smooth, predictable equity curve that Tharp’s research proved is possible.

In short: same disciplined 1% risk, but smarter — because the market tells the tool how far the stop should really be.

Full MT5 Compatibility: Works on any symbol/timeframe. Lightweight, efficient, and fully customizable via inputs.

Improvements added:

- Trail stop based on average true range

- The EA uses the trading platform's official, certified calculation engine (OrderCalcProfit()). This ensures the risk and lot size are always calculated accurately using the broker's own data, so you get consistent results whether you're on FTMO, IC Markets, or any other broker.

- accurate ATR calculations using only closed candles.

Hit "PLACE ORDER" for instant submission.

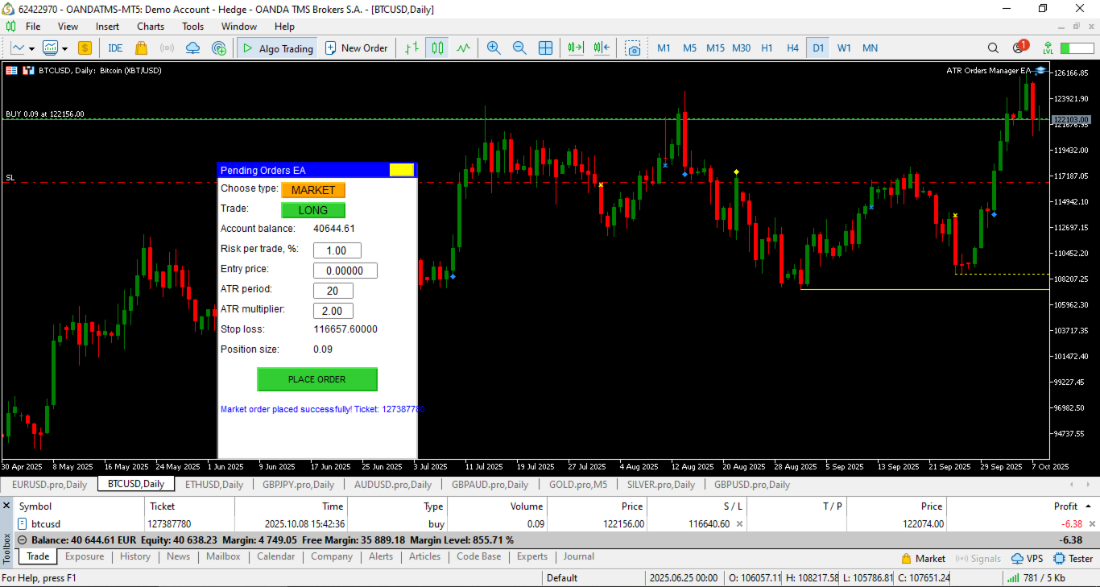

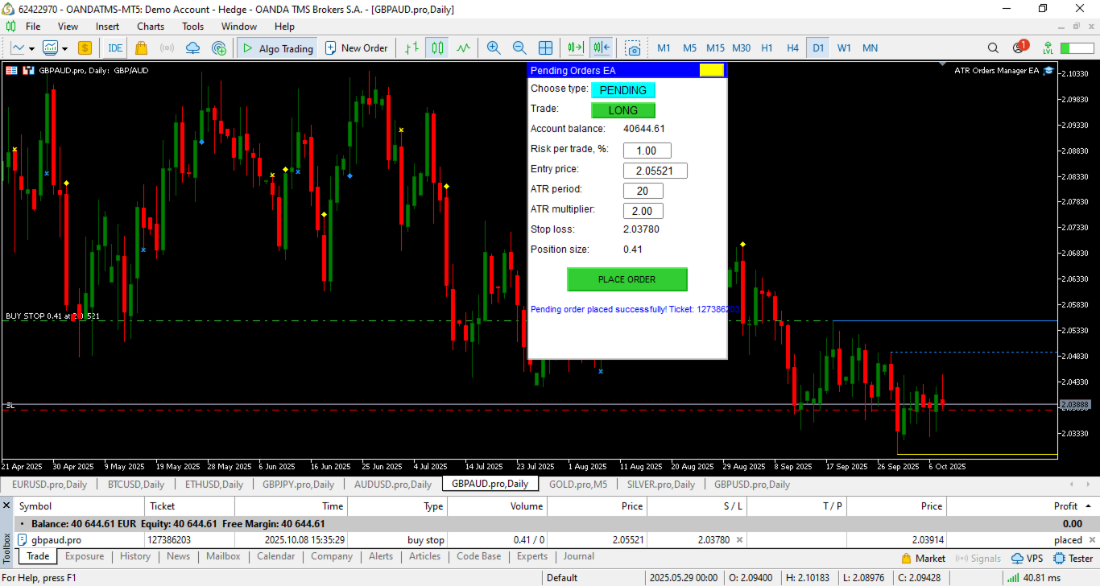

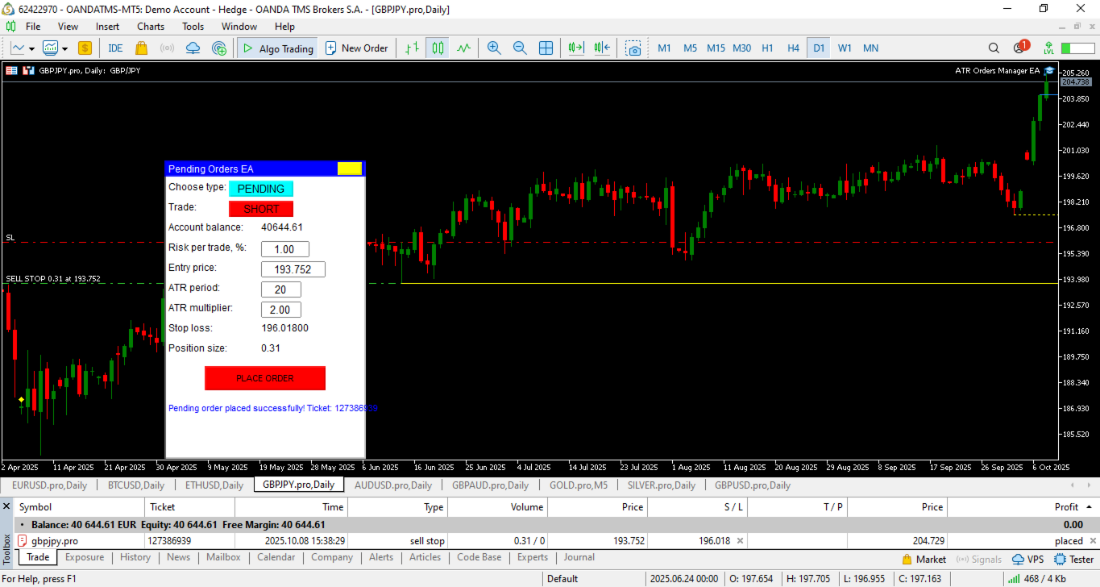

Notice that when you want to place a long trade the color of the buttons is green and when you want to place a short it becomes red.

Now let's look at few examples of placing trades using this EA.

Example 1 - a long market order. When you place a market order you don't have to enter the price!

Example 2 - a long pending order

Example 3 - a short pending order

Professional risk management that used to take spreadsheets, calculators, and years of discipline is now just one drag of a panel away.