Gold Scalping vs. Swing Trading _Which Strategy Performed Best in 2025?

Gold Scalping vs. Swing Trading:

Which Strategy Performed Best in 2025?

The year 2025 has been a turbulent yet highly profitable period for gold traders. With XAUUSD volatility at elevated levels due to global macroeconomic uncertainty, traders have increasingly debated one critical question: Is scalping or swing trading more effective when it comes to gold trading strategies in 2025?

In this article, we will compare gold scalping vs. swing trading, analyze their performance during 2025, and highlight the pros and cons of each method. By the end, you’ll have a clearer understanding of which approach is better suited to your trading style.

What Is Gold Scalping?

Gold scalping refers to a short-term trading approach where traders target small price movements in XAUUSD over very short timeframes, such as M1, M5, or M15 charts. Scalpers typically rely on:

-

Tight spreads (low-cost brokers are critical).

-

Fast execution and sometimes Expert Advisors (EAs).

-

High liquidity periods (usually overlapping London and New York sessions).

In 2025, gold’s average daily range often exceeded $40–$50, making scalping highly attractive for traders who can quickly capitalize on intraday volatility.

What Is Swing Trading Gold?

Swing trading gold takes a medium-term approach, holding trades for several days or even weeks. Swing traders use H1, H4, and Daily timeframes to capture larger price moves. Key characteristics include:

-

Technical setups such as breakouts, Fibonacci retracements, and moving average crossovers.

-

Patience and larger stop-losses.

-

Reliance on fundamental drivers such as Fed interest rate decisions, inflation reports, and geopolitical risk.

In 2025, when central banks continued adjusting policy rates and inflation remained sticky, swing trading gold offered opportunities to ride longer-term trends.

Performance Comparison in 2025

Scalping Gold in 2025 – High Volatility, High Potential

During 2025, gold’s price action created frequent scalping setups due to sharp intraday moves triggered by:

-

US inflation releases

-

Central bank announcements

-

Geopolitical tensions affecting safe-haven demand

Scalpers who mastered risk management in gold scalping and used strict stop-losses were able to consistently extract 5–15 pips per trade, accumulating profits over multiple sessions.

Best time to scalp gold XAUUSD remained during the London–New York overlap, when spreads tightened, and liquidity was at its peak.

Swing Trading Gold in 2025 – Riding the Macro Trends

For swing traders, 2025 was defined by macro-driven moves in gold. The commodity frequently broke out of consolidation ranges, creating opportunities to ride $100+ moves over several weeks.

For example:

-

January–March 2025: Gold surged as markets priced in slower Fed tightening.

-

June–August 2025: A sharp correction occurred as the US dollar strengthened.

-

October–December 2025: Renewed demand for safe-havens pushed gold back toward yearly highs.

Swing traders who caught these macro-driven moves benefited significantly, though they needed larger capital buffers to withstand drawdowns.

Pros and Cons of Gold Scalping vs Swing Trading:

Advantages of Scalping Gold

-

Quick profits with multiple opportunities per session.

-

Reduced exposure to overnight risk.

-

Ideal for traders with smaller accounts.

Disadvantages of Scalping Gold

-

Requires intense focus and fast execution.

-

Higher transaction costs due to frequent trades.

-

Vulnerable to false breakouts during low liquidity.

Advantages of Swing Trading Gold

-

Captures large market moves with fewer trades.

-

Better alignment with macro fundamentals.

-

Less stressful compared to rapid scalping.

Disadvantages of Swing Trading Gold

-

Requires patience and discipline.

-

Exposure to overnight risks (gaps, news events).

-

Larger stop-losses demand stronger risk management.

Which Performed Best in 2025?

The answer depends on the trader’s profile:

-

Scalping gold in 2025 outperformed for traders who thrive in high-frequency environments, can quickly adapt to market volatility, and use robust scalping strategies. Many intraday scalpers reported higher win rates due to consistent volatility in XAUUSD.

- Swing trading gold in 2025 delivered the biggest returns for traders who caught the multi-week trends and had enough margin to withstand retracements. Those who traded based on macroeconomic catalysts often made significant gains from extended moves.

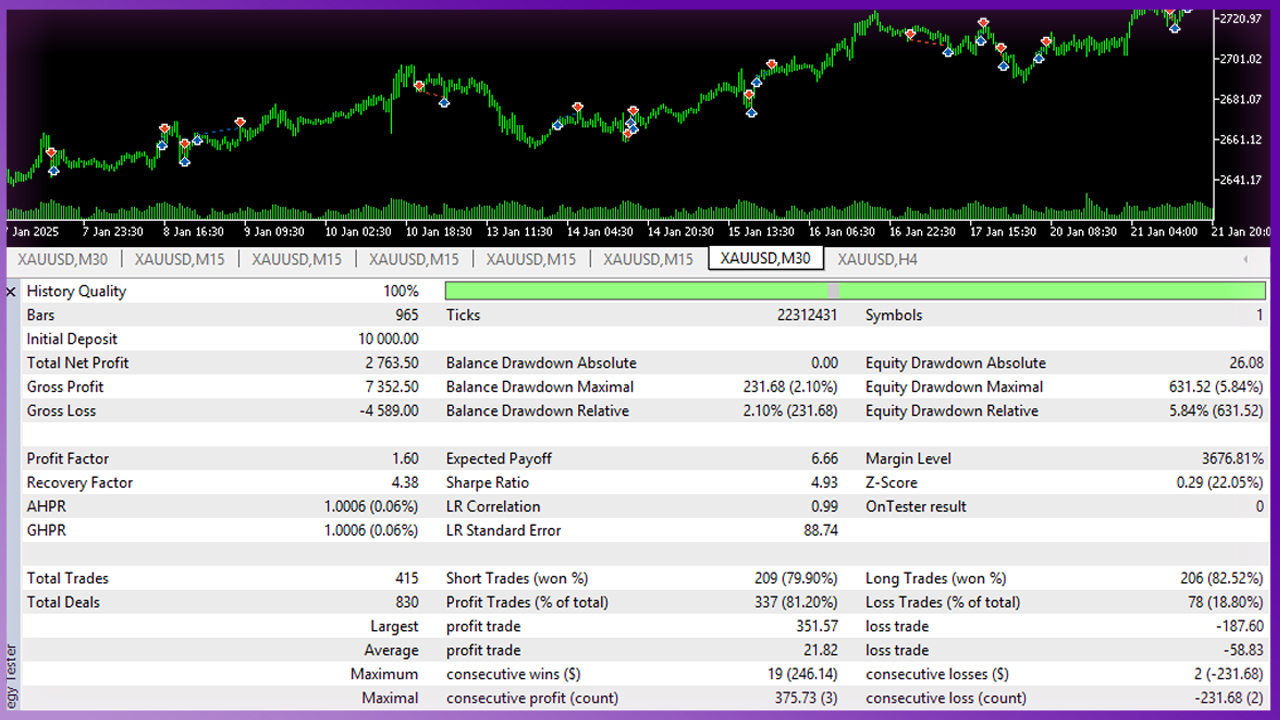

Scalping vs Swing Trading Backtest Results

Several backtests conducted on gold trading strategies in 2025 revealed:

-

Scalping strategies yielded steady but smaller cumulative gains, averaging 8–12% monthly with high trade frequency.

-

Swing trading strategies delivered larger but less consistent profits, with potential monthly gains above 20%, but higher drawdowns.

This shows that scalping offered stability and consistency, while swing trading rewarded patience and strong nerves with bigger payoffs.

Final Verdict – Which Strategy Should You Choose?

So, which is better: scalping or swing trading gold in 2025?

-

If you prefer fast-paced trading, enjoy multiple setups daily, and can dedicate full attention to charts, then gold scalping strategies are a great fit.

-

If you lean toward a macro-driven approach, prefer fewer trades, and have the patience to ride larger trends, then swing trading gold may outperform for you.

Ultimately, many successful traders in 2025 combined both approaches: scalping during high volatility sessions while holding swing trades aligned with macro fundamentals. This hybrid method maximized opportunities across different market conditions.

Conclusion

In 2025, both gold scalping and swing trading XAUUSD proved profitable when executed with discipline, risk management, and the right strategy. Scalping offered consistency and frequent opportunities, while swing trading provided larger profits from macro trends.

The real winner depends not on the strategy itself, but on the trader’s timeframe preference, risk tolerance, and psychological strengths.

For traders looking ahead to 2026, combining the best gold scalping strategies with swing trading setups may provide the most balanced and profitable approach to XAUUSD trading strategies.

If you have anysuggestions or face any issues, feel free to chat with us.

The Trade Wizard Team wishes you success and prosperity with peace of mind.

The Trade Wizard Team wishes you success and prosperity with peace of mind.