🚨⚡ Wolf Pack Fury EA – Advanced Entry Filtering + Equity Protection 🚨⚡

🚨⚡ Wolf Pack Fury EA 🚨⚡

🧠 Strategy Engine: Volatility-Aware Entry Sequencing

At the core of Wolf Pack Fury EA lies a volatility-aware logic engine that adjusts its behavior based on the candle’s size and market activity. Trade entries are not opened blindly; instead, they’re spaced dynamically using a combination of:

– Moving (minimum distance between entries)

– NextTrades (maximum trade count)

– EquityRisk (exposure control)

This layered control structure ensures that entries are paused during news candles or unstable conditions, reducing unnecessary exposure.

Product Page: https://www.mql5.com/en/market/product/141380

📊 Adaptive Profit Management

Unlike EAs that use static Take Profits, this EA utilizes adaptive exits. While each position holds a default 200-pip TP, the EA actively monitors floating profit and decides whether:

– To lock in larger gains early

– Or cut minor losses on smaller trades if it improves overall net return

This mechanism optimizes capital retention without needing user intervention.

⚖️ Lot Scaling via Progressive Entry (Multi Parameter)

The “Multi” system governs how position sizes increase when the price moves against the trade. It’s a controlled progression, not a martingale.

Each trade cycle is evaluated as a unit, where:

– Larger entries may be closed earlier

– Smaller ones may be kept or closed at minor losses

– Net result is prioritized over individual trades

This behavior amplifies the recovery potential after short-term drawdowns while remaining within equity limits.

🔒 Drawdown Protection Through Equity-Based Safeguards

The EA includes two critical protective mechanisms:

– EquityStop: Immediately closes all trades when a defined equity floor is breached

– EquityRisk: Caps the risk per cycle (default 5%) based on balance

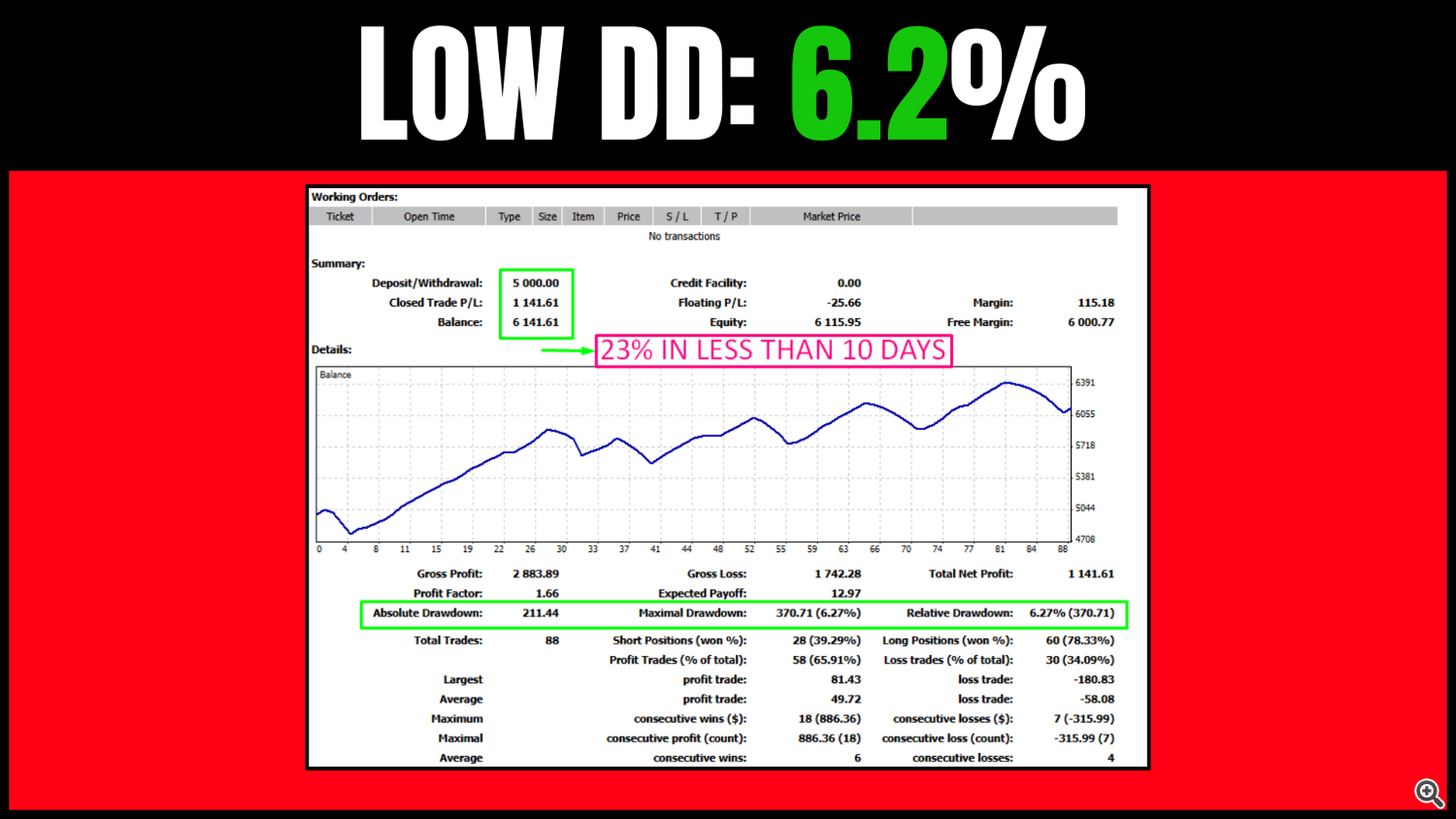

These tools prevent cumulative loss escalation, keeping drawdowns controlled (as shown in the performance image: ~6.2%).

⌛ Time-Filtered Entry Logic

Trading is only allowed during custom time windows. For example:

– OpenHour / CloseHour limit trading to optimal volatility hours

– FridayHour restricts exposure before the weekend gap

This prevents overnight risk and illiquid hour execution.

🔄 Daily Target & Trade Control Options

If the daily target feature is activated:

– Trading pauses once the daily profit is hit

– Prevents overtrading or risk accumulation

– Resumes automatically the next day

This option is ideal for traders seeking daily consistency over raw pip count.

🔍 Underlying Code Structure (Simplified View)

Behind the scenes, the EA relies on custom-built logic like:

if((Ask - entryPrice) > Moving * Point && OrdersTotal() < NextTrades) { double newLot = NormalizeDouble(baseLot * MathPow(Multi, OrderCount), 2); OrderSend(Symbol(), OP_BUY, newLot, Ask, slippage, 0, 0, "Wolf Entry", magic, 0, clrBlue); }

This fragment demonstrates how entry spacing, lot size scaling (Multi) and risk (NextTrades) are calculated live. Instead of stacking trades blindly, a complex condition tree filters each opportunity based on current spread, equity limits, and trend health.

✅ Wolf Pack Fury EA

Wolf Pack Fury EA was not designed as a high-frequency system, but as a precise, condition-based engine that mimics how a disciplined discretionary trader might approach the chart—with structure, risk controls, and adaptive exits.

📬 Have questions? Reach me directly — I’ll gladly assist!

🚀Stay Updated 🚀

Join the official channel to stay informed about future releases and updates: https://www.mql5.com/en/channels/signalsandindicators