Wolf Pack Fury EA

Introduction

Wolf Pack Fury EA is designed for traders who value consistency and prudent capital management. It does not promise overnight miracles; instead, it aims to provide steady monthly returns while preserving complete control over your account balance. The EA operates 24/5, using volatility-based algorithms to adapt to varying market environments.

🚀Stay Updated 🚀

Join the official channel to stay informed about future releases and updates: https://www.mql5.com/en/channels/signalsandindicators

Pricing

- Price increases by $100 each time 10 units are sold

- Purchase price: $1,899

Core Features

- Optimized exclusively for the EURUSD pair on the H1 chart, enabling precise market entries without overtrading

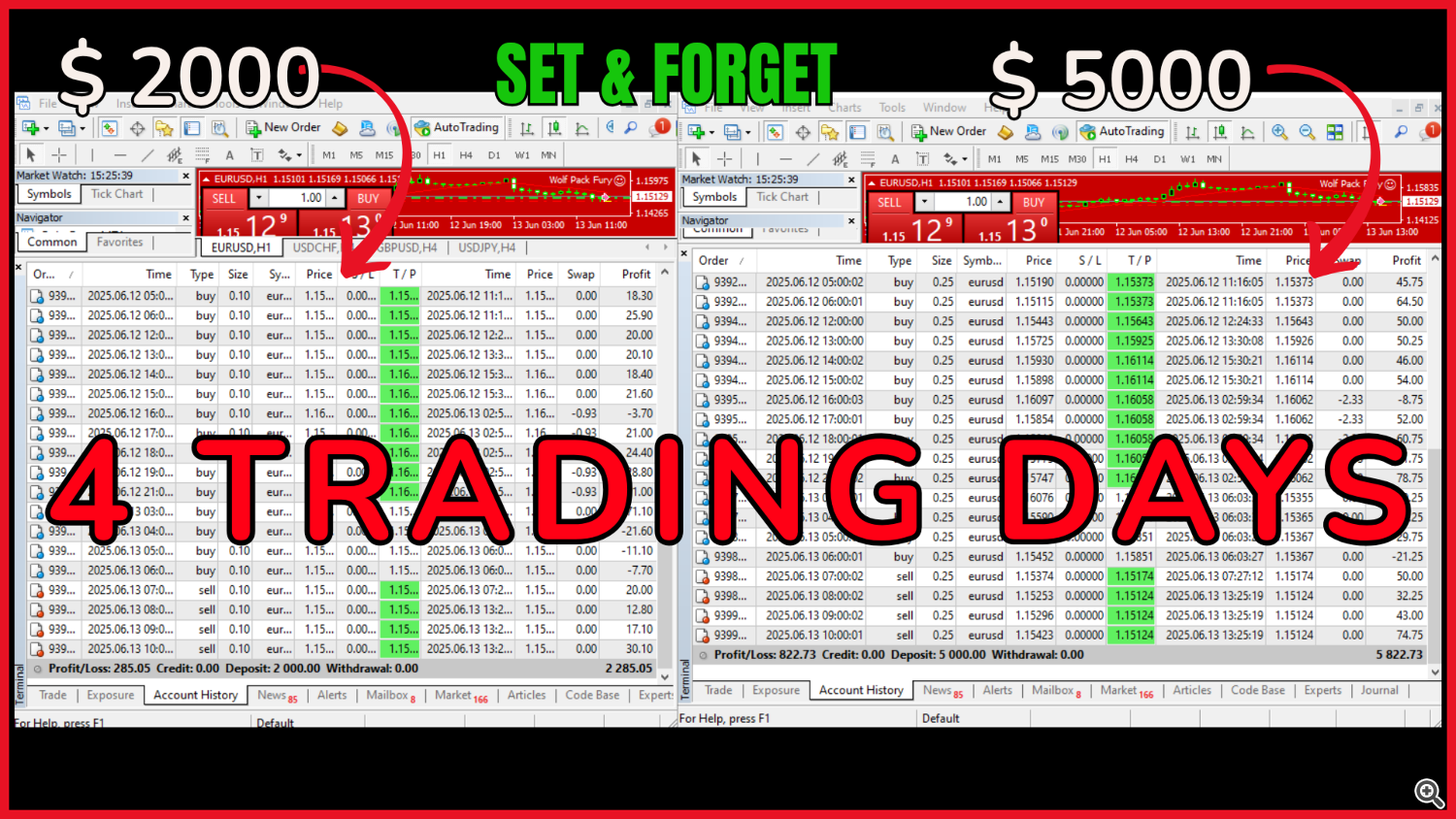

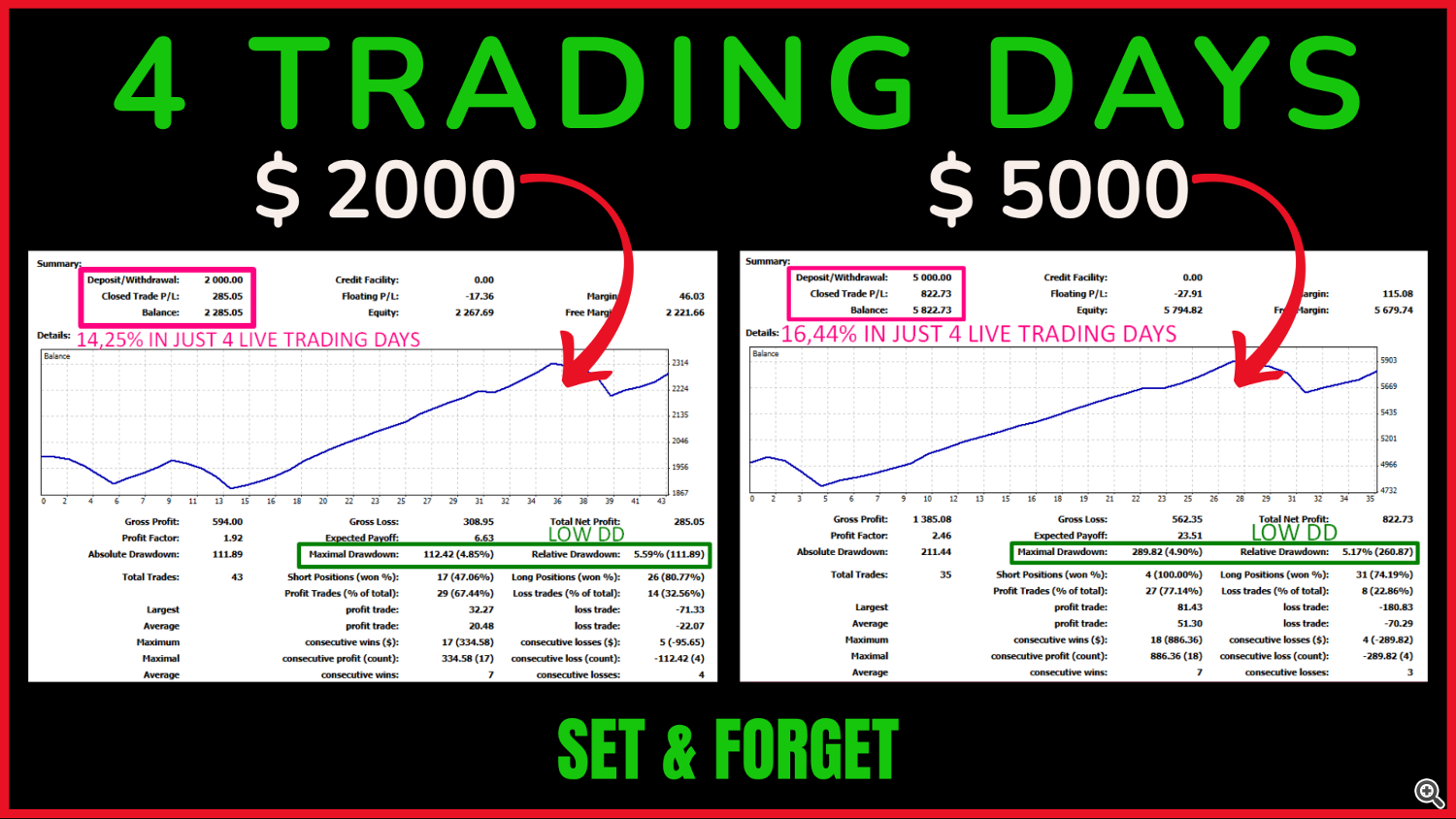

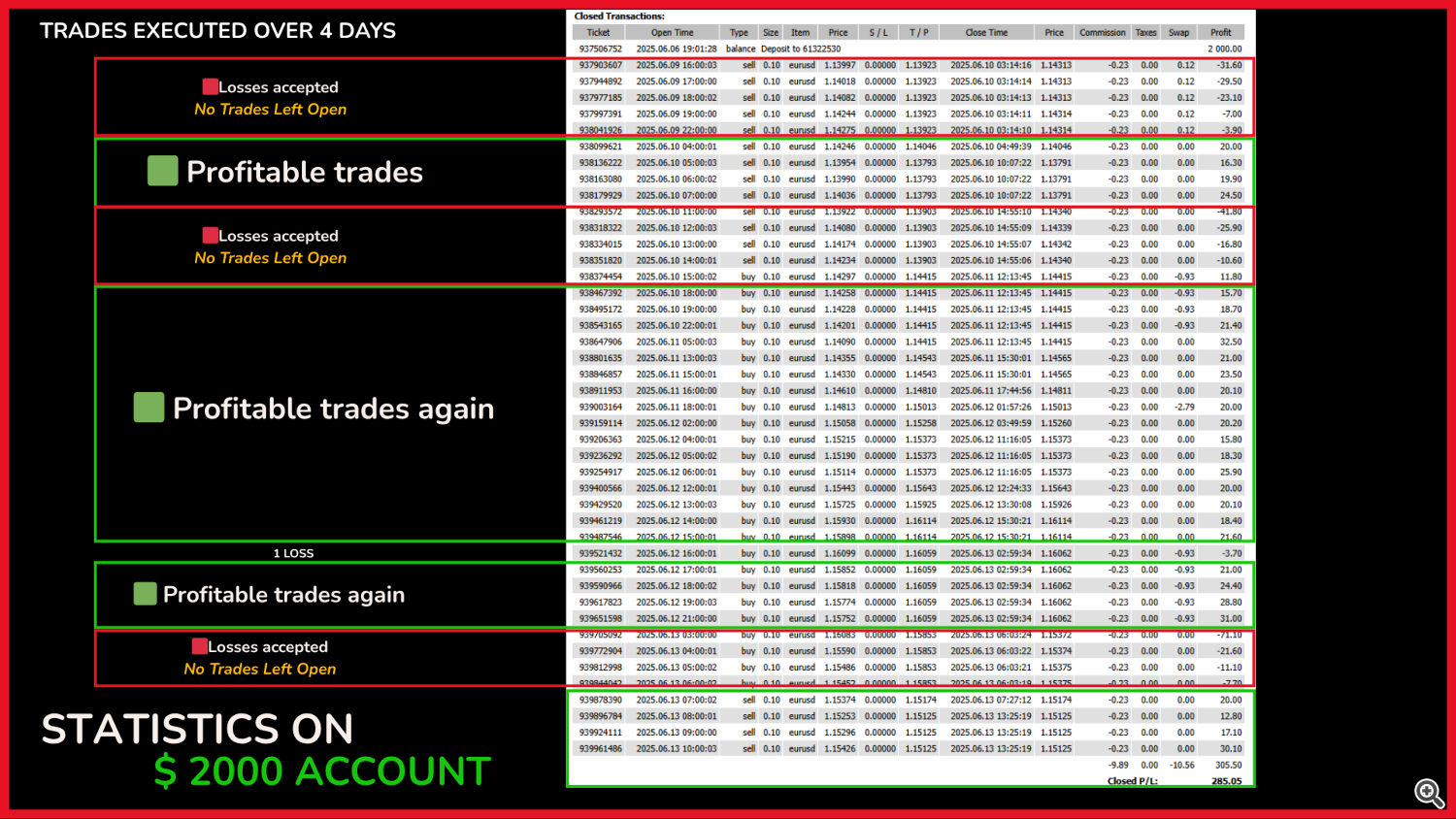

- Crafted for small accounts (from $200 to $5,000) yet capable of scaling to larger balances

- Robust risk controls limit the total exposure per trade cycle, maintaining low drawdowns and account stability

- Intelligent entry spacing that can pause new orders during high-volatility candles (such as news releases) to safeguard both trade logic and capital

Recommend Lot Size Configuration

- Fixed lot-size model based on your account balance

- Only parameter to set manually:

0.01 lots per $200 of balance

Practical examples:

- $200 → 0.01 lots

- $400 → 0.02 lots

- $600 → 0.03 lots

- $800 → 0.04 lots

- $1,000 → 0.05 lots

- $2,000 → 0.10 lots

- $3,000 → 0.15 lots

- $4,000 → 0.20 lots

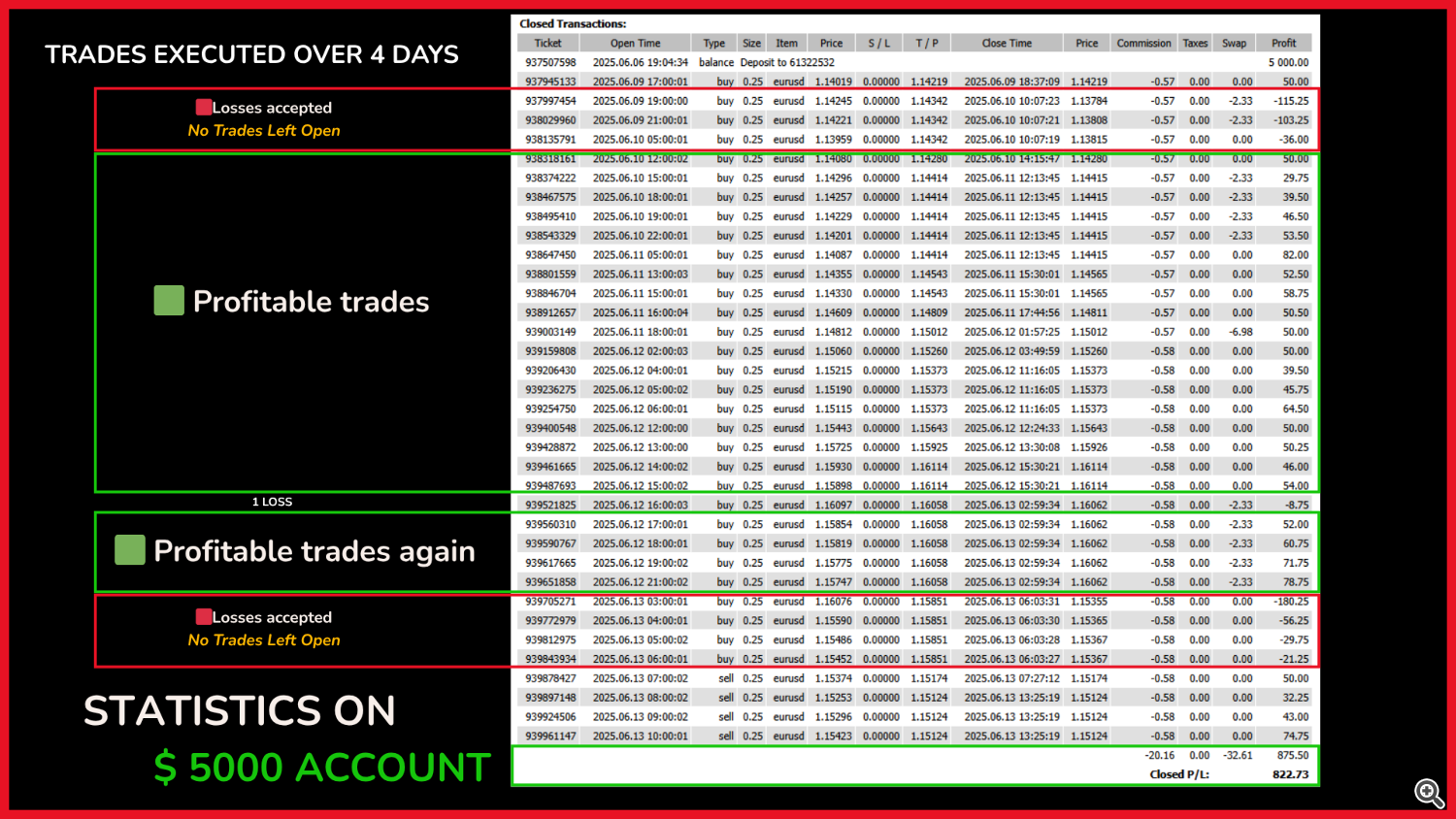

- $5,000 → 0.25 lots

Take Profit (TP)

- Default TP of 200 pips, selected for H1 because it:

- Secures a substantial number of pips

- Is realistic for H1 without being excessive

- Allows efficient exits without breaching risk parameters

- Each position carries its own TP, but the EA employs an adaptive exit mechanism that continuously assesses whether to hold or adjust targets based on current market context:

- Example: When multiple positions are open with varying lot sizes, the system may:

- Lock in gains first on larger lots

- Close smaller lots with a minor loss if it benefits the overall account

- Example: When multiple positions are open with varying lot sizes, the system may:

- This mechanism integrates with the Multi parameter (staged lot progression system)

- Modifying the TP is not advised, as its default setting is calibrated to maintain a balanced risk/reward ratio

Multi Parameter (Progressive Entry Multiplier)

- Employs a layered approach—when price moves against the initial trade, it adds new positions at successive levels to average the entry price

- Multi determines how much the lot size increases with each additional position:

- Enables the EA to close the combined positions effectively once price reverses, even if some did not hit full TP

- Continuously evaluates whether to keep or adapt individual TPs, potentially:

- Closing larger positions in profit

- Exiting smaller positions at a small loss if it’s advantageous for the account

- This is part of an adaptive volatility-based logic, not a fixed rule set

- Important: Multi works together with NextTrades, Moving, and EquityRisk; changing it may disrupt the staggered entry logic and compromise system stability

NextTrades (Max Number of Trades per Cycle)

- Specifies the maximum number of positions the EA can open in one entry sequence

- Default is 10, providing flexibility for different market conditions:

- In practice, EquityRisk control often limits this to 4 or 5 positions before reaching the risk threshold

- Only in rare circumstances—such as using 0.01 lots with a $20,000 balance—might it open all 10 positions

- Following the recommended lot sizing ensures the number of active trades remains within safe limits

Moving (Distance Between Entry Levels)

- Defines the minimum gap between staggered positions when price moves unfavorably

- While this gap is fixed, the EA’s volatility-based logic can temporarily halt or delay the next position if conditions aren’t suitable:

- In visual mode, you’ll notice that during high-volume candles (e.g., news spikes), the EA may refrain from opening the next trade even when the gap is met

- Rather than acting mechanically, it waits for an optimal moment to protect your capital

- Works hand in hand with Multi, NextTrades, and EquityRisk, forming the core of the EA’s intelligence

- Not recommended to alter, as it could upset the progressive entry logic and lead to instability

EquityStop and EquityRisk (Capital Protection)

- EquityStop is enabled (TRUE) by default and automatically closes all open trades if a critical equity level is breached, preserving account safety—do not disable this feature

- EquityRisk sets the maximum allowed risk per trade cycle as a percentage of your account balance (default 5%), calculated based on the EA’s win rate, recommended lot size, and Multi behavior

- Embracing controlled losses is part of sound risk management; these safeguards ensure Wolf Pack Fury EA:

- Keeps drawdown low

- Delivers steady monthly performance

- Preserves capital during prolonged adverse or high-volatility periods

Open Hour / Close Hour (Daily Trading Window)

- Specifies the broker-time window during which the EA may open new trades:

- OpenHour marks the start of permitted trading

- CloseHour marks the end

- Allows you to avoid specific market hours or restrict trading to preferred sessions, ensuring precise control over EA activity

Trade on Friday / Friday Hour (Friday Trading Control)

- TradeOnFriday lets you enable or disable Friday trading (TRUE by default), allowing normal operation until the specified hour

- FridayHour sets the final hour for Friday trades; for instance, setting FridayHour = 12 means the EA stops opening new orders at noon on Fridays (broker time), even though it trades normally Monday–Thursday until CloseHour

- Provides granular control over weekend exposure without altering core logic

Use Daily Target / Daily Target (Daily Profit Goal)

- UseDailyTarget lets you activate a daily profit limit (FALSE by default)

- If turned on (TRUE), the EA stops opening new positions once the target is reached

- DailyTarget is denominated in your account currency (USD, EUR, etc.); reaching this figure pauses trading until the next day

Important

Wolf Pack Fury EA must run on a dedicated account because its risk controls depend on the entire account balance. Letting another EA operate on the same account can disrupt risk coherence and trade logic. Always use a dedicated account with 100% of the capital managed by Wolf Pack Fury EA.

FAQ – Frequently Asked Questions

Can I use Wolf Pack Fury EA on any pair or timeframe?

It is optimized for H1, chosen for its reliability and balanced risk/control profile. It may function on other pairs or timeframes, but manual testing and adjustment would be required. Recommended use: H1 as provided.

What kind of account should I use?

A low-spread, low-slippage account—ideally ECN. The type of account is more crucial than the broker itself.

Can I use it on a standard account with low spread?

Yes, but exercise caution—standard accounts often incur hidden slippage (up to 10 pips). With 2–3 pips of spread added, performance may suffer. Test on a demo first if uncertain.

Any recommended broker?

No specific brokers are endorsed—seek an ECN account. Start with a demo to evaluate performance, then switch if needed.

Does it work on small accounts?

Yes—it is engineered for balances ranging from $200 to $5,000, provided you use the recommended lot size.

Can I run it on the same account as other EAs?

No—it must run alone. Shared account usage can disrupt risk logic and overall stability.

Does it trade every day?

Yes—trading is nearly continuous, only pausing if the market is exceptionally flat.

Do I need a VPS?

Yes—like any EA, it must remain online 100% of the time. Using a home PC risks downtime; a VPS provides uninterrupted operation and peace of mind.

Which VPS should I use?

The broker’s own VPS is ideal—ask them directly, as it typically offers ultra-low latency (2–10 ms). Generic VPS solutions may exhibit around 120 ms latency, while home remote desktops can exceed 220 ms. Higher latency means slower EA reactions.

Can I contact you if I have questions or need help?

Absolutely—if you need assistance with installation, VPS setup, or are unsure where to start, send me a message. No question is too basic; we all start somewhere.