-

https://www.mql5.com/en/market/product/103005

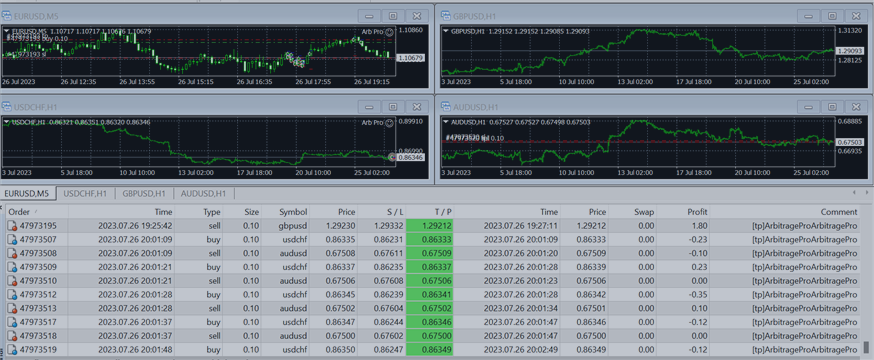

- The script monitors six currency pairs: CurrencyPair1 , CurrencyPair2 , CurrencyPair3 , CurrencyPair4 , CurrencyPair5 , and CurrencyPair6 .

IMPORTANT: THIS WILL NOT MAKE MANY TRADES IN FLAT MARKETS WHEN SPREADS ARE ALL TIGHT, THIS EA NEEDS VOLATILITY

-

Arbitrage Opportunity Detection:

- The script calculates the price differences between bid and ask prices for three pairs at a time (e.g., between CurrencyPair1 and CurrencyPair2 , CurrencyPair3 and CurrencyPair4 , CurrencyPair5 and CurrencyPair6 ).

- If the absolute value of any of these price differences exceeds the specified ArbitrageThreshold , the script identifies an arbitrage opportunity.

-

Order Placement:

- When an arbitrage opportunity is detected, the script places market orders to capitalize on the price imbalances.

- For each set of pairs, it places a "Buy" order on the currency with a lower price and a "Sell" order on the currency with a higher price.

- For example, if the script detects an opportunity between CurrencyPair1 and CurrencyPair2 , it might place a "Buy" order on CurrencyPair1 and a "Sell" order on CurrencyPair2 .

-

Position Management:

- The script checks if the maximum number of positions for each currency pair ( MaxPositions ) has been reached before opening new positions.

-

Volume Check:

- The script includes a check to ensure that the order volume ( LotSize ) is within the allowed limits for each symbol.

-

Stop Loss and Take Profit:

- The script sets stop loss ( StopLossPips ) and take profit ( TakeProfitPips ) levels for each order.

Things to consider.

-

Correlation:

- Pairs with higher correlations might exhibit more synchronized movements, making it easier to predict and take advantage of arbitrage opportunities. Conversely, pairs with lower correlations may have more independent price movements.

-

Market Conditions:

- Consider pairs that are influenced by different market conditions. For example, a combination of major and minor currency pairs or pairs from different regions may respond differently to economic events or geopolitical factors.

-

Liquidity:

- Ensure that the selected pairs have sufficient liquidity to support the execution of orders without significant slippage. More liquid pairs tend to have tighter spreads.

-

Volatility:

- Volatility is a key factor in arbitrage opportunities. Pairs with higher volatility may experience larger price discrepancies, potentially leading to more profitable trades. However, higher volatility also comes with increased risk.

-

Transaction Costs:

- Be mindful of transaction costs, including spreads and trading commissions. These costs can vary between brokers and can impact the overall profitability of the arbitrage strategy.