Maximizing Profits with Algorithmic Trading Strategies in Forex

Introduction

Algorithmic trading strategies have become increasingly popular in the forex market. These strategies use computer algorithms to automatically execute trades based on predefined rules and parameters. The goal of algorithmic trading is to maximize profits by taking advantage of market inefficiencies and fluctuations. In this article, we will explore the basics of forex trading, the role of algorithmic trading in forex, the benefits of algorithmic trading strategies, different types of strategies, how to develop effective strategies, the importance of backtesting and optimization, risk management, and choosing the right broker for algorithmic trading.

Maximizing profits is a key objective for any forex trader. The forex market is highly volatile and can be influenced by a wide range of factors such as economic indicators, geopolitical events, and market sentiment. By using algorithmic trading strategies, traders can automate their trading process and take advantage of market opportunities in real-time. This can help them make more informed decisions and execute trades more efficiently, ultimately leading to higher profits.

Understanding the Basics of Forex Trading

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global marketplace. The forex market is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. It operates 24 hours a day, five days a week, allowing traders to participate in the market at any time.

Forex trading involves several components, including currency pairs, bid and ask prices, spreads, and leverage. Currency pairs represent the exchange rate between two currencies. For example, the EUR/USD pair represents the exchange rate between the Euro and the US Dollar. The bid price is the price at which traders can sell a currency pair, while the ask price is the price at which traders can buy a currency pair. The difference between the bid and ask prices is known as the spread.

Several key factors can affect forex trading, including economic indicators, central bank policies, geopolitical events, and market sentiment. Economic indicators, such as GDP growth, inflation rates, and employment data, can provide insights into the health of a country's economy and influence the value of its currency. Central bank policies, such as interest rate decisions and monetary policy statements, can also have a significant impact on currency values. Geopolitical events, such as elections, wars, and natural disasters, can create volatility in the forex market. Finally, market sentiment, which refers to the overall attitude of traders towards a particular currency or the market as a whole, can also influence forex trading.

The Role of Algorithmic Trading in Forex

Algorithmic trading, also known as automated trading or black-box trading, involves using computer algorithms to automatically execute trades based on predefined rules and parameters. These algorithms can analyze market data, identify trading opportunities, and execute trades in real-time. Algorithmic trading has become increasingly popular in the forex market due to its ability to improve trading efficiency and reduce emotional bias.

One of the main benefits of algorithmic trading is its ability to execute trades at high speeds. Algorithms can analyze market data and execute trades within milliseconds, allowing traders to take advantage of small price movements and market inefficiencies. This can result in higher profits and reduced slippage.

Algorithmic trading can also help reduce emotional bias in decision-making. Emotions such as fear and greed can cloud judgment and lead to poor trading decisions. By using algorithms to execute trades, traders can remove emotions from the equation and make more rational decisions based on predefined rules and parameters.

Furthermore, algorithmic trading allows traders to analyze large amounts of data and identify patterns that may not be visible to the naked eye. Algorithms can process vast amounts of historical and real-time data to identify trends, support and resistance levels, and other technical indicators. This can help traders make more informed decisions and improve their overall trading performance.

Benefits of Algorithmic Trading Strategies in Forex

There are several benefits of using algorithmic trading strategies in forex. One of the main benefits is increased efficiency and speed in trading. Algorithms can analyze market data and execute trades within milliseconds, allowing traders to take advantage of small price movements and market inefficiencies. This can result in higher profits and reduced slippage.

Another benefit of algorithmic trading is the reduced emotional bias in decision-making. Emotions such as fear and greed can cloud judgment and lead to poor trading decisions. By using algorithms to execute trades, traders can remove emotions from the equation and make more rational decisions based on predefined rules and parameters.

Additionally, algorithmic trading allows traders to analyze large amounts of data and identify patterns that may not be visible to the naked eye. Algorithms can process vast amounts of historical and real-time data to identify trends, support and resistance levels, and other technical indicators. This can help traders make more informed decisions and improve their overall trading performance.

Types of Algorithmic Trading Strategies in Forex

There are several types of algorithmic trading strategies that can be used in forex trading. These strategies can be broadly categorized into trend-following strategies, mean reversion strategies, news-based strategies, and high-frequency trading strategies.

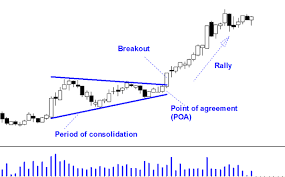

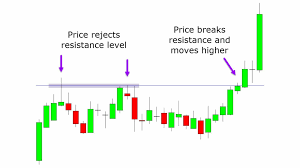

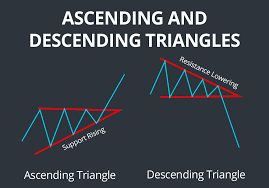

Trend-following strategies aim to identify and take advantage of trends in the forex market. These strategies use technical indicators such as moving averages, trendlines, and momentum oscillators to identify the direction of the trend and enter trades in the same direction. Trend-following strategies can be effective in trending markets but may result in losses during periods of consolidation or range-bound markets.

Mean reversion strategies aim to take advantage of price deviations from their long-term average. These strategies assume that prices will eventually revert to their mean or average value. Mean reversion strategies use technical indicators such as Bollinger Bands, RSI, and stochastic oscillators to identify overbought or oversold conditions and enter trades in the opposite direction. Mean reversion strategies can be effective in range-bound markets but may result in losses during trending markets.

News-based strategies aim to take advantage of market reactions to economic news releases and other significant events. These strategies use algorithms to analyze news headlines, economic indicators, and other relevant data to predict the impact on currency values and enter trades accordingly. News-based strategies can be highly profitable but require fast execution and access to real-time news feeds.

High-frequency trading strategies aim to take advantage of small price movements and market inefficiencies. These strategies use algorithms to analyze market data and execute trades within milliseconds. High-frequency trading strategies require advanced technology, low-latency trading infrastructure, and access to real-time market data.

How to Develop Effective Algorithmic Trading Strategies in Forex

Developing effective algorithmic trading strategies in forex requires careful planning and analysis. Here are some steps to follow when developing a strategy:

1. Identify trading goals and objectives: Before developing a strategy, it is important to identify your trading goals and objectives. Are you looking to make short-term profits or long-term investments? Are you interested in day trading or swing trading? Understanding your goals and objectives will help you choose the right indicators and parameters for your strategy.

2. Choose the right indicators and parameters: Once you have identified your goals and objectives, you need to choose the right indicators and parameters for your strategy. Technical indicators such as moving averages, trendlines, and oscillators can help you identify trends, support and resistance levels, and other important price levels. It is important to choose indicators that are relevant to your trading goals and objectives.

3. Test and refine the strategy: After choosing the indicators and parameters, you need to test the strategy using historical data. This process is known as backtesting. Backtesting allows you to evaluate the performance of your strategy under different market conditions and make any necessary adjustments. It is important to backtest your strategy over a significant period of time to ensure its effectiveness.

The Importance of Backtesting and Optimization in Algorithmic Trading

Backtesting is a crucial step in the development of algorithmic trading strategies. It involves testing a strategy using historical data to evaluate its performance and make any necessary adjustments. Backtesting allows traders to assess the profitability and risk of a strategy before deploying it in live trading.

During the backtesting process, traders can analyze the performance of their strategy under different market conditions and make any necessary adjustments. This can help them identify potential weaknesses or flaws in the strategy and refine it to improve its performance.

Optimization is another important step in the development of algorithmic trading strategies. It involves adjusting the parameters of a strategy to maximize its profitability or minimize its risk. Optimization can be done using various techniques, such as genetic algorithms, brute force optimization, or machine learning algorithms.

It is important to note that backtesting and optimization are not foolproof methods for guaranteeing the success of a trading strategy. Market conditions can change, and past performance is not always indicative of future results. However, backtesting and optimization can provide valuable insights into the performance and risk of a strategy and help traders make more informed decisions.

Risk Management in Algorithmic Trading Strategies in Forex

Risk management is a crucial aspect of algorithmic trading strategies in forex. The forex market is highly volatile and can be influenced by a wide range of factors, including economic indicators, central bank policies, geopolitical events, and market sentiment. It is important for traders to manage their risk effectively to protect their capital and maximize their profits.

One of the key principles of risk management is diversification. Diversification involves spreading your investments across different currency pairs, asset classes, and trading strategies. By diversifying your portfolio, you can reduce the impact of any single trade or event on your overall performance.

Another important aspect of risk management is position sizing. Position sizing refers to the amount of capital allocated to each trade. It is important to determine the appropriate position size based on your risk tolerance, trading goals, and the volatility of the currency pair. Using proper position sizing can help you limit your losses and protect your capital.

Stop-loss orders are another important tool for managing risk in algorithmic trading strategies. A stop-loss order is an order placed with a broker to sell a security when it reaches a certain price. By setting a stop-loss order, you can limit your losses and protect your capital in case the trade goes against you.

Choosing the Right Broker for Algorithmic Trading in Forex

Choosing the right broker is crucial for successful algorithmic trading in forex. Here are some factors to consider when choosing a broker for algorithmic trading:

1. Regulation: It is important to choose a broker that is regulated by a reputable financial authority. Regulation provides protection for traders and ensures that the broker operates in a fair and transparent manner.

2. Trading platform: The trading platform is the software that traders use to execute trades and manage their accounts. It is important to choose a broker that offers a reliable and user-friendly trading platform with advanced charting tools, technical indicators, and other features.

3. Execution speed: Algorithmic trading requires fast execution and low-latency trading infrastructure. It is important to choose a broker that offers fast execution speeds and low-latency connectivity to the market.

4. Market access: Different brokers offer different levels of market access. It is important to choose a broker that provides access to the currency pairs and markets that you are interested in trading.

5. Cost: Trading costs can have a significant impact on your profitability. It is important to consider factors such as spreads, commissions, and overnight financing charges when choosing a broker.

Some of the top brokers for algorithmic trading in forex include Interactive Brokers, OANDA, FXCM, and IG.

Conclusion: Maximizing Profits with Algorithmic Trading Strategies in Forex

In conclusion, algorithmic trading strategies can play a crucial role in maximizing profits in forex trading. These strategies use computer algorithms to automatically execute trades based on predefined rules and parameters. By using algorithmic trading strategies, traders can increase efficiency and speed in trading, reduce emotional bias in decision-making, and analyze large amounts of data. There are several types of algorithmic trading strategies, including trend-following strategies, mean reversion strategies, news-based strategies, and high-frequency trading strategies. Developing effective strategies requires careful planning, testing, and optimization. Risk management is also crucial for successful algorithmic trading. Finally, choosing the right broker is important for algorithmic trading in forex.

Some Of the Signal , are custom indicators , that can assis in the systematic trading and a basis to develop Algo systems .

https://www.mql5.com/en/market/product/47776

Multi Time Frame Multi Currency Signals Dashboard

https://www.mql5.com/en/market/product/47755

https://www.mql5.com/en/market/product/47989

https://www.mql5.com/en/market/product/50592

Trendlines Chart Patterns Indicator

https://www.mql5.com/en/market/product/47773

https://www.mql5.com/en/market/product/47796

REVERSAL AREA INDICATOR

https://www.mql5.com/en/market/product/59520?source=Site+Profile+Seller

Top Bottom Scalper

https://www.mql5.com/en/market/product/59528?source=Site+Profile+Seller

Dual Trend Scalper

https://www.mql5.com/en/market/product/59529?source=Site+Profile+Seller