Today, I’m going to introduce you to an exciting and powerful trading strategy called the Cypher pattern. Whether you're new to trading or looking to expand your knowledge, this tutorial will provide you with a solid foundation to understand and apply the Cypher strategy effectively.

When I first started looking for a trading strategy, I believed that the more factors my strategy took into account, the less risk I would take and the more profit I would receive. However, now I understand that a profitable strategy doesn't require tons of indicators, price action patterns or major and minor structure confirmation all at the same time. The real secret to having an edge is in having a simple algorithm that you can consistently execute.

My first attempt was the CTS (Combined Technical Score) system. Backtesting this strategy was a complete mess, especially for a beginner like me because there were so many elements to consider. After several months and similar strategies, I realized that this was not for me at all. Next on my radar was the Fibonacci-based patterns, specifically the Cypher pattern.

So, what is the Cypher pattern? It is a straightforward algorithmic approach that requires minimal discretion from the trader. However, this explanation doesn't cover everything.

In this blog post, I will explain what the Cypher pattern is for trading and how to apply it to boost your gains.

Cypher Strategy Rules

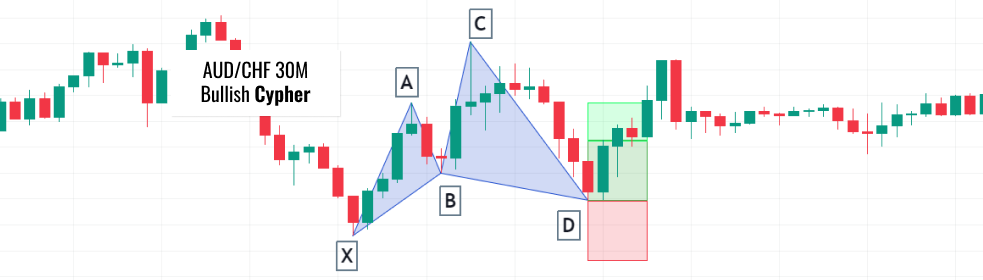

In order to apply the Cypher pattern to your trading, you first need to understand its structure. It is a harmonic pattern that consists of 4 price swings in total: X to A, A to B, B to C and C to D. With the X to A leg and the C to D leg being the most significant. The pattern is considered complete when the price reaches the D point, and this is where you would enter a trade.

To find valid Cypher pattern, you need to follow a few simple steps.

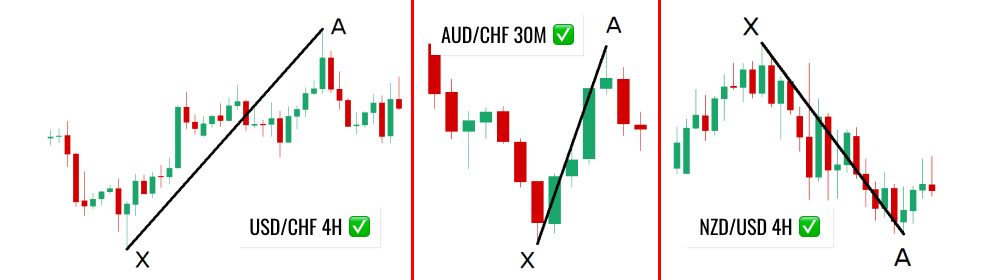

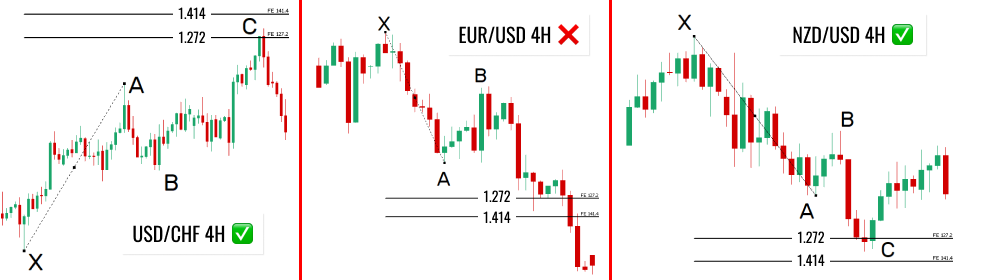

- Identify the X to A leg of the pattern. Which represents the initial move in the price action. This move should be a significant swing in one direction.

When the direction of X to A is up, we are looking for a Bullish Cypher. When the price is going down, we are looking for a Bearish Cypher

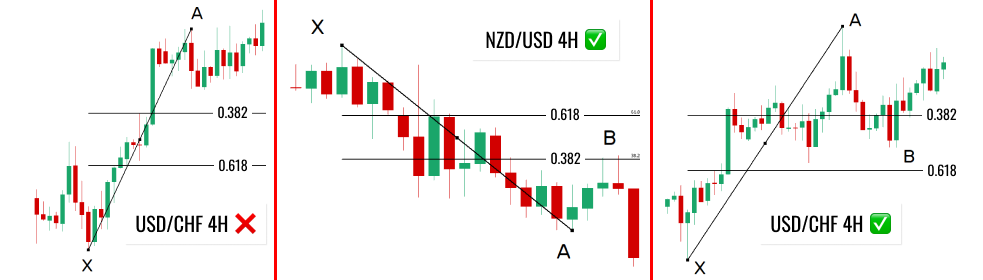

- Draw a Fibonacci retracement from the X to A point

- Find the B point: Look at a X to A retracement between the 0.382 and 0.618 Fibonacci levels, as soon as price will get there - B point of the pattern will be formed. Point B can spike through 0.618 level but it can’t close beyond

- Draw a Fibonacci extension from the X to A point

- Confirm the C point: The C point should form between the 1.272 and 1.414 X to A Fibonacci extension levels. C point can spike through 1.414 X to C extension but close beyond will invalidate whole pattern

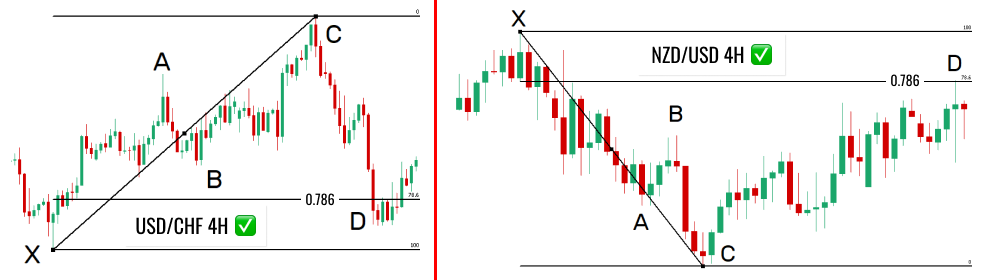

- Draw a Fibonacci retracement from the X to C point

- Wait for the D point completion: The D point must appear exactly at 0.786 X to C Fibonacci retracement. The D point is the price at which you should have your limit orders set - buy for bullish Cypher and sell for bearish Cypher

❗❗ If point B will get beyond D point - Cypher would count as invalid (In bullish case if point B will be lower than point D, in bearish case if point B will get higher than point D)

❗❗ If point B will get beyond D point - Cypher would count as invalid (In bullish case if point B will be lower than point D, in bearish case if point B will get higher than point D)

Conventional targets

Fibonacci retracement from C to D looking for the first target at 0.382 and for the secondary target at 0.618

Remember that you need to adjust your targets as much as D point moves lower in bullish case and higher in bearish case

Stop-Loss

Stop loss goes below X point. Look for optimal method for you strategy like ATR below X or static value (10 pips below X) or 1.13 Fibonacci inversion from A to X.

As soon as target 1 is hit we adjust our stop loss to break even and close 50% of our position.

My observations of Cypher pattern

- This pattern may provide you with inverse risk reward like 0.9:1. But because of big win rate you can trade this pattern regardless of RR ratio

- Like any other trading strategy Cypher pattern will not be profitable on every trading pair and timeframe. You definitely need to backtest strategy before trading it on real account.

- Defining X to A impulse is the only discretional thing in this trading strategy. So it’s really important to perform backtest on big set of data so you can master your skill of identifying the most favorable impulses and improving your overall trading performance.

- If you keep having low win rate try to add some indicator, timing or market conditions based entry rule to filter out losers (e.g. enter trade if RSI is showing oversold or overbought values)

Useful tips

- It seems overwhelming to use 4 pairs of different Fibonacci tool setups. But In Metatrader you can get by with only 1 Fibonacci retracement setup. Here's my settings

Also in table format

Also in table format

Level Description 0.382 38.2 0.618 61.8 0.786 78.6 -0.272 1.272 -0.414 1.414 - MetaTrader platform is popular for wide variety of trading robots (expert advisors) presented in MQL market. Here you can find robot helper that will manage your Cypher pattern trades for you. Select your Cypher in four clicks and bot will do all the work from order placement to dynamic adjustments of take profit level. Also it validates every aspect of the Cypher strategy, ensuring only valid patterns are entered. Here is a link to Trade Cypher robot in MQL5 market