This article is for individuals who are currently trading forex as either a side hustle or a main source of income. It is also helpful for those who plan to try their luck with forex trading now or in the future.

In every business on earth, there are hidden tricks learned or uncovered through years of experience by those involved. The forex trading business is no exception. It requires a high level of specialized knowledge that must be acquired over the years, depending on the trader's level of understanding, intelligence, discipline, and determination.

In this article, we will discuss five golden steps to a successful forex trading career. Too much information about a topic can lead to confusion and frustration. This can be especially true of forex trading, where there are many self-proclaimed gurus claiming to have the ultimate solution to success.

As I have discovered in forex trading, it is difficult to know if your trading strategy is healthy if you do not lose two or three times consecutively, yet remain in the market to move forward without eroding your trading account balance. Every big rat calls itself a grasscutter. It is the level ground that will determine who truly is a forex trading guru when the acid test is carried out. A forex trader cannot be deemed a guru based solely on occasional green or positive results with gambling-like risk.

The following are the five golden steps that most people do not know, pay attention to, or ignore, and which have caused many to lose their hard-earned money to the forex market:

1. Trading System

2. Fundamentals

3. Trends

4. Market Entry

5. Trade Management

1. TRADING SYSTEM:

As a successful career-aspiring forex trader, you must have in-depth knowledge about the use of your trading system. What you master is what you become a master over! There are many things to learn in forex trading, such as the forex market itself, how it operates, your trading system, which connects you and your trading strategies to the market for profitable trading experiences, and more.

I say this, and you can quote me anywhere: every trading system is profitable, although the probabilities may be different and subject to each trader's discretion, experiences, and trading styles. The trading system you settle on, in conjunction with these three attributes - discretion, experiences, and trading styles - should give you at least a 50:50 probability and a Risk Reward Ratio of 1:2 (RRR). These two factors alone will make you a successful trader over time, as losses and profits are summed together, plus or minus, and the rest is your profit.

Therefore, my recommendation is to test every trading system you come across and settle on the one(s) that give you the above-mentioned two edges over the market. This advice is for those who have no profitable trading system or are just entering the forex market as a new trader looking for a profitable trading system that will make their trading career a successful one. Initially, this trading system may not work well to produce expected profits, but once you know that this trading system synergizes with your nature or personality type, or trader type, try to stick with it and work consistently to master it until you become its master. This will increase your profit-making probabilities over time.

2. FUNDAMENTALS:

As a forex trading business trainer and trader, I want to advise technical traders who use technical analysis for their trading decisions. Whenever you receive a trade signal from your favorite trading system, always check if the currency pair concerned has been mentioned in the forex news at least for that day.

There are many considerations to keep in mind. If the currency pair is featured in the news during the early hours of the day, then it is fine because most traders would be sleeping, depending on their geographical location. For example, if I am from Nigeria in West Africa, I will be in bed from 0:00 hours till 6-7 am, after then, the European market takes over from the Asian market. Therefore, if the news about that currency pair comes out during the early hours of the day or towards the end of the Asian market season, I do not trade because I am already in bed. I am free to trade such a currency pair during the day - European/US season.

On the other hand, if the news about such a currency pair is released later in the day, from 20:00 pm onwards, then I may consider trading such a currency pair early in the day before the news if I receive a higher probability trade signal from my trading system. If you can't cope, ignore such a currency pair totally to be on the safer side, unless you MUST trade! In plain words, avoid currency pairs that feature in the forex news for the day altogether! If you must trade such pairs, wait for 30 minutes or an hour after the news-release before trading.

3. TRENDS

As a trader, it's important to understand that trends can be your friend until they bend or reverse. However, it's crucial to keep in mind that price reflects everything that happens in the market, and the formation of trends in a particular direction is a result of the accumulation of candles and their price levels. In addition, trends involve various factors such as resistance and support levels, which are affected by the activities of buyers and sellers in all time frames. Analyzing past trends can provide a historical overview of the market and help in determining the present trend direction.

In the forex market, profits are mainly made by identifying the trend direction and trading accordingly. Forex price movements can be classified into three categories: upward, downward, and sideways. Traders can make money during consolidation phases if the channel or range is wide enough to yield a reasonable number of pips. However, most profits are made during upward and downward trends.

To identify the trend direction, traders can use various trend-following indicators such as moving averages or oscillators like RSI or Stochastic. It's also important to determine whether the trend is just starting or getting exhausted, as this will help in avoiding false trade signals. Examining the position of the price between support and resistance levels can also assist in avoiding potential losses due to retracements/pullbacks or total reversal.

It's recommended to examine higher time frames like daily, weekly, and monthly to determine the overall trend direction. The trend starts reversing or bending from smaller time frames, so it's essential to locate the current position of the price in-between support and resistance levels on these higher time frames. If the price is near the resistance level during an upward trend and the trading signal is to buy, it's advisable to wait for a breakout or pullback for a retouch or retest of the resistance level. As for the sell trade also, same is the case in vice versa.

4. MARKET ENTRY:

When it comes to market entry, it's crucial to enter the trade correctly to avoid losses. Examining the market structure on the H1 time frame can help in establishing a well-defined trend direction as correctly established on higher time-frames - Daily, weekly and monthly. Afterward, switching to the 5-minute time frame can assist in finding the right entry point while avoiding pullbacks or retracements. In the case of a breakout, traders can either wait for a retest or enter straight away while placing their stop loss behind the opposite level. The take-profit should be set at a level that provides a good profit margin which can be more than the stop loss. Switching to higher time frames like H1 or H4 can assist in locating the right take-profit point.

This is another important aspects that you need to pay attention to as a forex trader. There are various ways to enter the market, including market orders, limit orders, stop orders, and trailing stop orders. Each of these entry methods has its own advantages and disadvantages.

Market orders are executed at the current market price, while limit orders are executed at a specified price or better. Stop orders are executed when the price reaches a specified level, while trailing stop orders are executed when the price moves in a favorable direction by a specified amount.

As a trader, you need to choose the entry method that works best for your trading style and market conditions. You should also have a clear exit plan in case the trade goes against you. This can include setting a stop loss order or a profit target.

5. TRADE MANAGEMENTS:

Trade management is the process of monitoring and adjusting your trades to maximize profits and minimize losses. To effectively manage your trades, minimizing risk and ensuring profitable trades or at least breaking even is crucial. One recommended method is to implement a stop-loss reduction strategy, as even with multiple confirmations and indicators, a losing trade is inevitable due to the dynamic nature of the forex market. As an individual trader, you are solely responsible for your actions and reactions, and cannot control the actions of other traders who may enter or exit the market at any time.

Other trade management techniques include break-even and trailing stops. With break-even stops, once the price has moved in your favor by a certain number of pips, you can adjust your stop-loss to turn the trade into a risk-free one. As for trailing stops, it is best to leave your stop-loss at break-even if you are a novice trader, as trailing can interfere with price movements and potentially cause losses.

For more experienced traders, trailing stops can be done through support and resistance levels or by counting candles backwards. However, it's important not to force any techniques, as it can lead to missed opportunities or losses.

In addition, you should always be aware of the risks involved in forex trading and manage your positions accordingly. This includes avoiding over-leveraging, diversifying your portfolio, and using proper risk management techniques.

Overall, implementing effective trade management strategies can significantly improve your trading career and increase profitability.

CONCLUSION:

Forex trading can be a profitable and rewarding career if you follow the right steps and approach it with discipline and determination. By following these five golden steps - developing a trading system, paying attention to fundamentals, identifying trends, choosing the right market entry method, and managing your trades effectively - you can increase your chances of success in the forex market.

Remember that forex trading is a marathon, not a sprint. It requires patience, persistence, and a willingness to learn from your mistakes. By staying focused on your goals and consistently applying these five golden steps, you can achieve long-term success in the forex market.

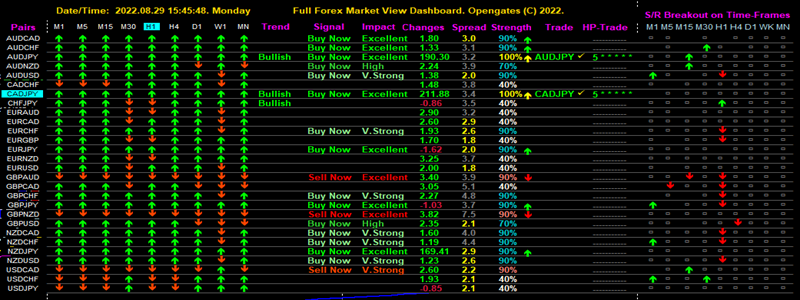

As a trading tool developer, I have have created a custom dashboard indicator (FFXMV Forex Dashboard) that incorporates these trade managements and strategies. To learn more, visit https://www.mql5.com/en/market/product/23156 for further information. Hurry up to access a new year PRICE SLASH PROMO currently going on by contacting me now on the Telegram, search for @Opengates or @Opengates2 and DM me. You can also check my profile on https://www.mql5.com/en/user/opengates2012 as a developer and programmer.

Wishing you a green pips day.

Cheers.

Olufemi O. Adeyemo,

Opengates Success International.

In every business on earth, there are hidden tricks learned or uncovered through years of experience by those involved. The forex trading business is no exception. It requires a high level of specialized knowledge that must be acquired over the years, depending on the trader's level of understanding, intelligence, discipline, and determination.

In this article, we will discuss five golden steps to a successful forex trading career. Too much information about a topic can lead to confusion and frustration. This can be especially true of forex trading, where there are many self-proclaimed gurus claiming to have the ultimate solution to success.

As I have discovered in forex trading, it is difficult to know if your trading strategy is healthy if you do not lose two or three times consecutively, yet remain in the market to move forward without eroding your trading account balance. Every big rat calls itself a grasscutter. It is the level ground that will determine who truly is a forex trading guru when the acid test is carried out. A forex trader cannot be deemed a guru based solely on occasional green or positive results with gambling-like risk.

The following are the five golden steps that most people do not know, pay attention to, or ignore, and which have caused many to lose their hard-earned money to the forex market:

1. Trading System

2. Fundamentals

3. Trends

4. Market Entry

5. Trade Management

1. TRADING SYSTEM:

As a successful career-aspiring forex trader, you must have in-depth knowledge about the use of your trading system. What you master is what you become a master over! There are many things to learn in forex trading, such as the forex market itself, how it operates, your trading system, which connects you and your trading strategies to the market for profitable trading experiences, and more.

I say this, and you can quote me anywhere: every trading system is profitable, although the probabilities may be different and subject to each trader's discretion, experiences, and trading styles. The trading system you settle on, in conjunction with these three attributes - discretion, experiences, and trading styles - should give you at least a 50:50 probability and a Risk Reward Ratio of 1:2 (RRR). These two factors alone will make you a successful trader over time, as losses and profits are summed together, plus or minus, and the rest is your profit.

Therefore, my recommendation is to test every trading system you come across and settle on the one(s) that give you the above-mentioned two edges over the market. This advice is for those who have no profitable trading system or are just entering the forex market as a new trader looking for a profitable trading system that will make their trading career a successful one. Initially, this trading system may not work well to produce expected profits, but once you know that this trading system synergizes with your nature or personality type, or trader type, try to stick with it and work consistently to master it until you become its master. This will increase your profit-making probabilities over time.

2. FUNDAMENTALS:

As a forex trading business trainer and trader, I want to advise technical traders who use technical analysis for their trading decisions. Whenever you receive a trade signal from your favorite trading system, always check if the currency pair concerned has been mentioned in the forex news at least for that day.

There are many considerations to keep in mind. If the currency pair is featured in the news during the early hours of the day, then it is fine because most traders would be sleeping, depending on their geographical location. For example, if I am from Nigeria in West Africa, I will be in bed from 0:00 hours till 6-7 am, after then, the European market takes over from the Asian market. Therefore, if the news about that currency pair comes out during the early hours of the day or towards the end of the Asian market season, I do not trade because I am already in bed. I am free to trade such a currency pair during the day - European/US season.

On the other hand, if the news about such a currency pair is released later in the day, from 20:00 pm onwards, then I may consider trading such a currency pair early in the day before the news if I receive a higher probability trade signal from my trading system. If you can't cope, ignore such a currency pair totally to be on the safer side, unless you MUST trade! In plain words, avoid currency pairs that feature in the forex news for the day altogether! If you must trade such pairs, wait for 30 minutes or an hour after the news-release before trading.

3. TRENDS

As a trader, it's important to understand that trends can be your friend until they bend or reverse. However, it's crucial to keep in mind that price reflects everything that happens in the market, and the formation of trends in a particular direction is a result of the accumulation of candles and their price levels. In addition, trends involve various factors such as resistance and support levels, which are affected by the activities of buyers and sellers in all time frames. Analyzing past trends can provide a historical overview of the market and help in determining the present trend direction.

In the forex market, profits are mainly made by identifying the trend direction and trading accordingly. Forex price movements can be classified into three categories: upward, downward, and sideways. Traders can make money during consolidation phases if the channel or range is wide enough to yield a reasonable number of pips. However, most profits are made during upward and downward trends.

To identify the trend direction, traders can use various trend-following indicators such as moving averages or oscillators like RSI or Stochastic. It's also important to determine whether the trend is just starting or getting exhausted, as this will help in avoiding false trade signals. Examining the position of the price between support and resistance levels can also assist in avoiding potential losses due to retracements/pullbacks or total reversal.

It's recommended to examine higher time frames like daily, weekly, and monthly to determine the overall trend direction. The trend starts reversing or bending from smaller time frames, so it's essential to locate the current position of the price in-between support and resistance levels on these higher time frames. If the price is near the resistance level during an upward trend and the trading signal is to buy, it's advisable to wait for a breakout or pullback for a retouch or retest of the resistance level. As for the sell trade also, same is the case in vice versa.

4. MARKET ENTRY:

When it comes to market entry, it's crucial to enter the trade correctly to avoid losses. Examining the market structure on the H1 time frame can help in establishing a well-defined trend direction as correctly established on higher time-frames - Daily, weekly and monthly. Afterward, switching to the 5-minute time frame can assist in finding the right entry point while avoiding pullbacks or retracements. In the case of a breakout, traders can either wait for a retest or enter straight away while placing their stop loss behind the opposite level. The take-profit should be set at a level that provides a good profit margin which can be more than the stop loss. Switching to higher time frames like H1 or H4 can assist in locating the right take-profit point.

This is another important aspects that you need to pay attention to as a forex trader. There are various ways to enter the market, including market orders, limit orders, stop orders, and trailing stop orders. Each of these entry methods has its own advantages and disadvantages.

Market orders are executed at the current market price, while limit orders are executed at a specified price or better. Stop orders are executed when the price reaches a specified level, while trailing stop orders are executed when the price moves in a favorable direction by a specified amount.

As a trader, you need to choose the entry method that works best for your trading style and market conditions. You should also have a clear exit plan in case the trade goes against you. This can include setting a stop loss order or a profit target.

5. TRADE MANAGEMENTS:

Trade management is the process of monitoring and adjusting your trades to maximize profits and minimize losses. To effectively manage your trades, minimizing risk and ensuring profitable trades or at least breaking even is crucial. One recommended method is to implement a stop-loss reduction strategy, as even with multiple confirmations and indicators, a losing trade is inevitable due to the dynamic nature of the forex market. As an individual trader, you are solely responsible for your actions and reactions, and cannot control the actions of other traders who may enter or exit the market at any time.

Other trade management techniques include break-even and trailing stops. With break-even stops, once the price has moved in your favor by a certain number of pips, you can adjust your stop-loss to turn the trade into a risk-free one. As for trailing stops, it is best to leave your stop-loss at break-even if you are a novice trader, as trailing can interfere with price movements and potentially cause losses.

For more experienced traders, trailing stops can be done through support and resistance levels or by counting candles backwards. However, it's important not to force any techniques, as it can lead to missed opportunities or losses.

In addition, you should always be aware of the risks involved in forex trading and manage your positions accordingly. This includes avoiding over-leveraging, diversifying your portfolio, and using proper risk management techniques.

Overall, implementing effective trade management strategies can significantly improve your trading career and increase profitability.

CONCLUSION:

Forex trading can be a profitable and rewarding career if you follow the right steps and approach it with discipline and determination. By following these five golden steps - developing a trading system, paying attention to fundamentals, identifying trends, choosing the right market entry method, and managing your trades effectively - you can increase your chances of success in the forex market.

Remember that forex trading is a marathon, not a sprint. It requires patience, persistence, and a willingness to learn from your mistakes. By staying focused on your goals and consistently applying these five golden steps, you can achieve long-term success in the forex market.

As a trading tool developer, I have have created a custom dashboard indicator (FFXMV Forex Dashboard) that incorporates these trade managements and strategies. To learn more, visit https://www.mql5.com/en/market/product/23156 for further information. Hurry up to access a new year PRICE SLASH PROMO currently going on by contacting me now on the Telegram, search for @Opengates or @Opengates2 and DM me. You can also check my profile on https://www.mql5.com/en/user/opengates2012 as a developer and programmer.

Wishing you a green pips day.

Cheers.

Olufemi O. Adeyemo,

Opengates Success International.

Files:

ffxmvdsbdTS_MQL5.zip

996 kb