Dunia Maya, South East and NET Z, THE LONG TERM INVESTMENT EXPERT ADVISOR

"If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you." -Zig Ziglar (US Author 1926-2012)

| Important Note: Before using SEA/NETZ/DUNIAMAYA, please read this manual guide carefully. My concern is, not many of SEA/NET/DUNIAMAYA users want to read the EA Manual Guide, this makes their trading results less than optimal because they don't understand all the uses of the features offered, as a result they are unable to understand the strengths and weaknesses of an EA and cannot master it properly. so that they cannot act calmly, appropriately, and confidently when critical conditions occur. | Hope you all got abundant profit. |

|---|

Dunia Maya, South East and Net Z EA have the same concept, which is to use a simple strategy combined with a simple formula.

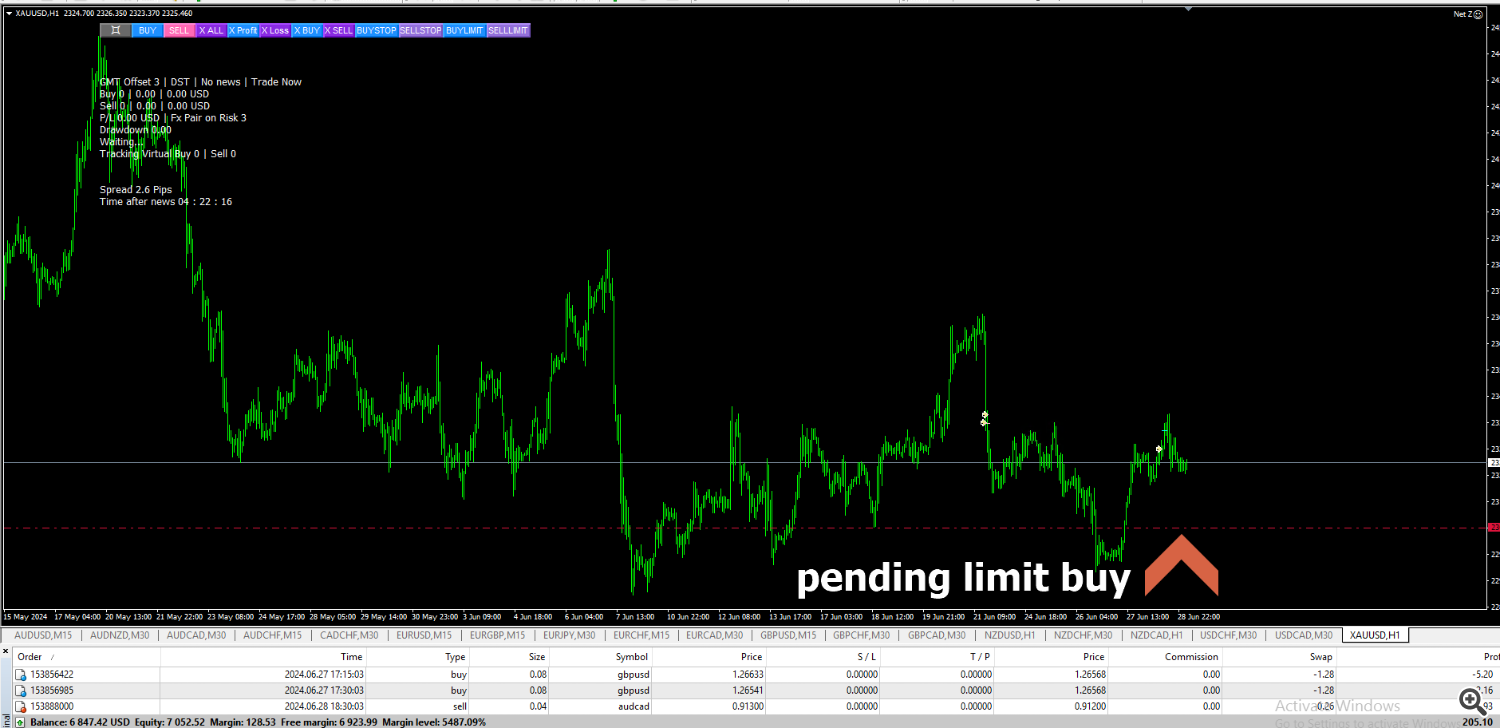

I made NET, MAYA and SEA with the concept of buy at low and sell at high. This is my manual trading system which I converted to full automatic.

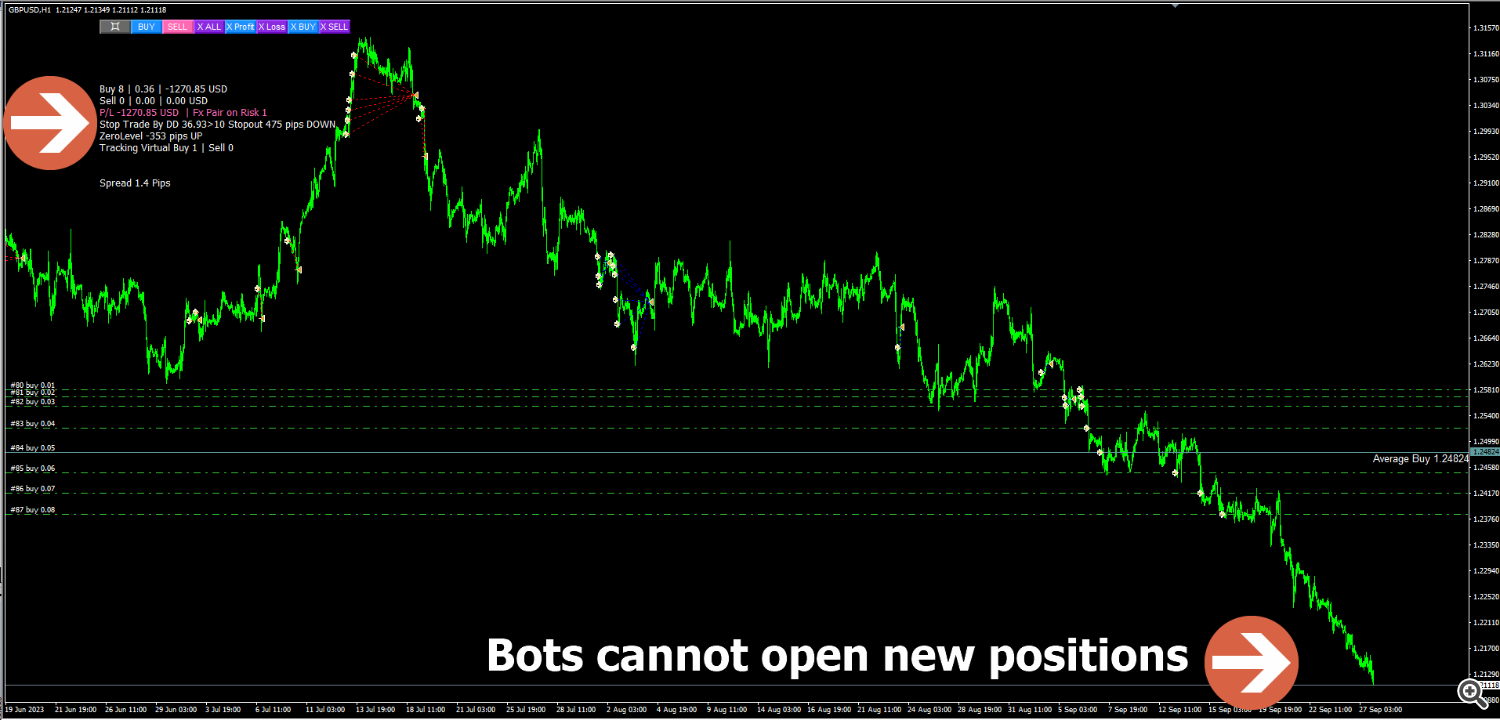

In the manual trade system, I am used to placing pending stop buys at low and pending stop sells at high (see picture). But I realize that humans have limitations, so I tried to create an Expert Advisor that can work in fullly automatic with the concept I want and I usually do in manual trades.

Why did I make 3 EAs with the same concept?

Yes..you know, I really like this concept and I happen to find many variants of entry points in the process so I can create 3 eas at once. Besides that I am not a big fan of lot compounding, so I want to use these 3 eas to open new positions with the same pair without increasing the lot. And the third reason is that it is really hard to throw away of an entry method strategy that is proven to be good with a very small difference in results.

The criteria for an expert advisor to be considered good are:

1. Small deposit, EA does not require a large deposit, so it can limit risk and the worst condition is to lose small amounts of money. Whether you use a Grid EA or a Non-Grid EA, you still have to limit the amount of your deposit, because even with a non-grid EA that uses StopLoss, you can still lose your money if you hit stoploss multiple times.

2. Big Profit, can generate big profits with a small deposit.

3. Low Drawdown, Drawdown shows the accuracy of the Expert advisor in opening a positions. With high accuracy, it will not require a large deposit.

Net Z, SEA and Dunia Maya do not require big lots to generate big profits, by using small lots and accuracy in position entry, the drawdown will also be smaller.

Entry point accuracy can be obtained by using the strategy of buy at low and sell at high. Looking for and waiting for the formation of extreme highs for sell and extreme lows for buy requires patience, because this can take a day or two, or even a week or two, depending on the current trend movement.

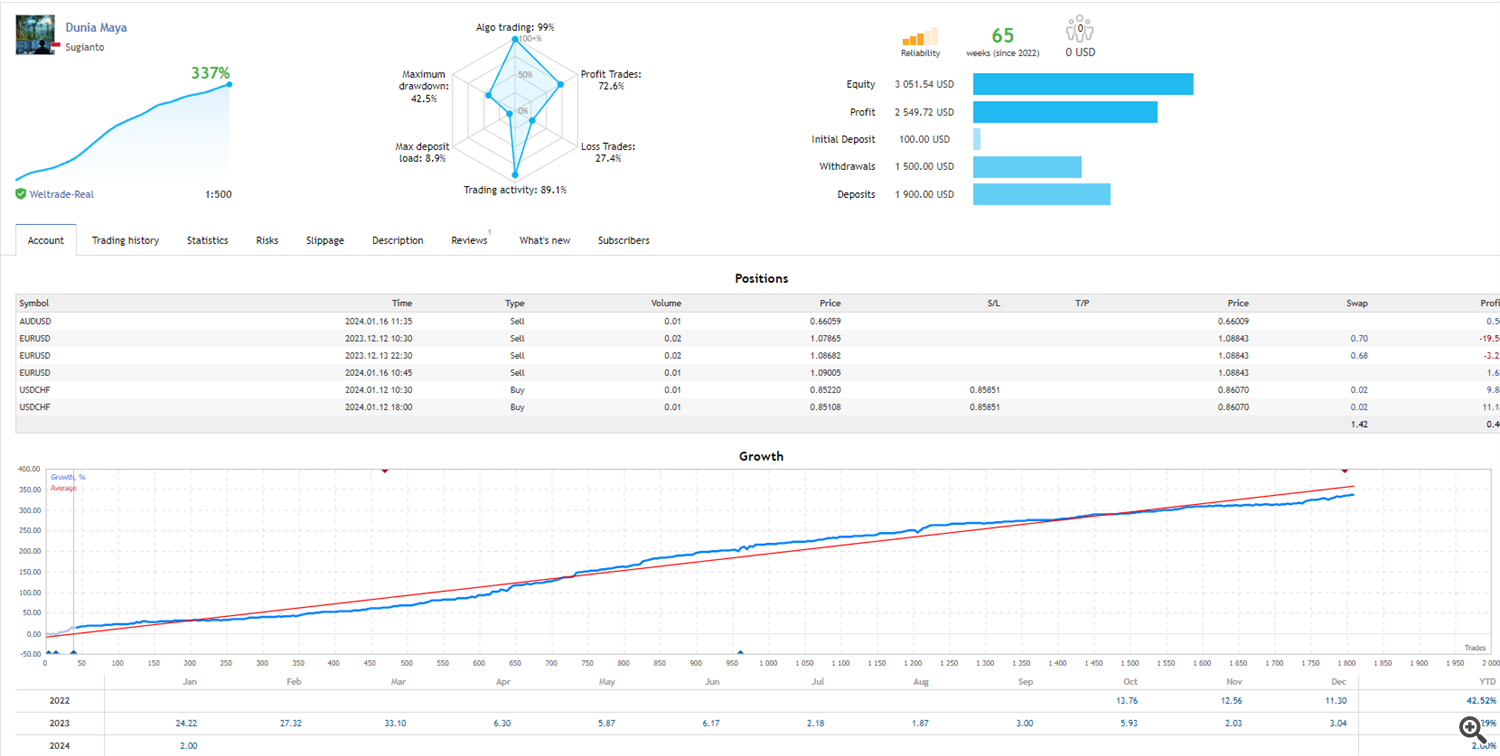

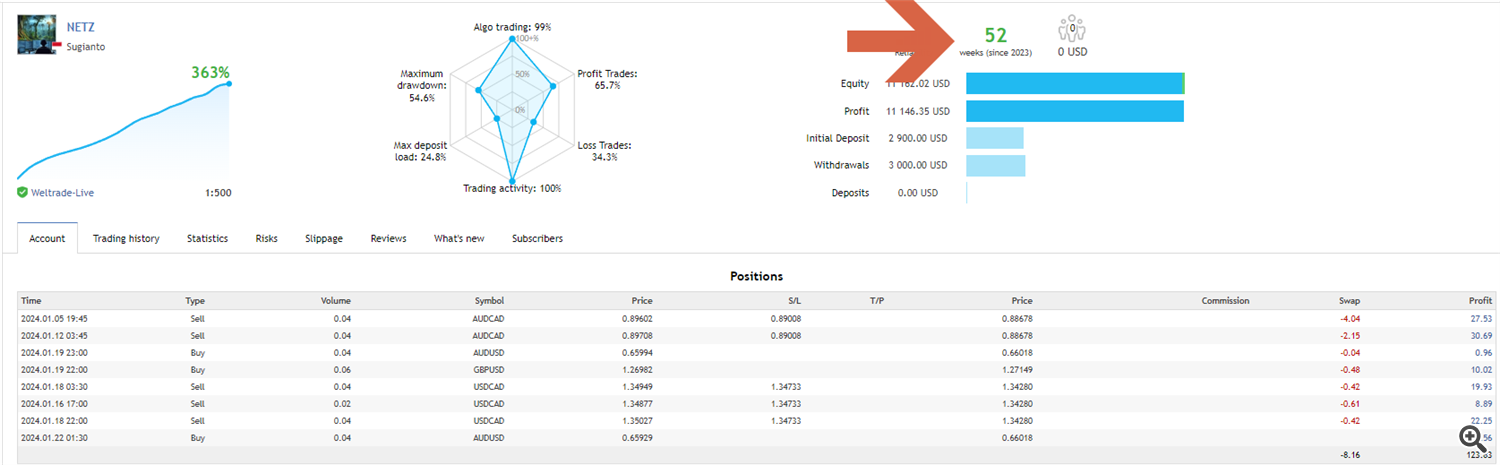

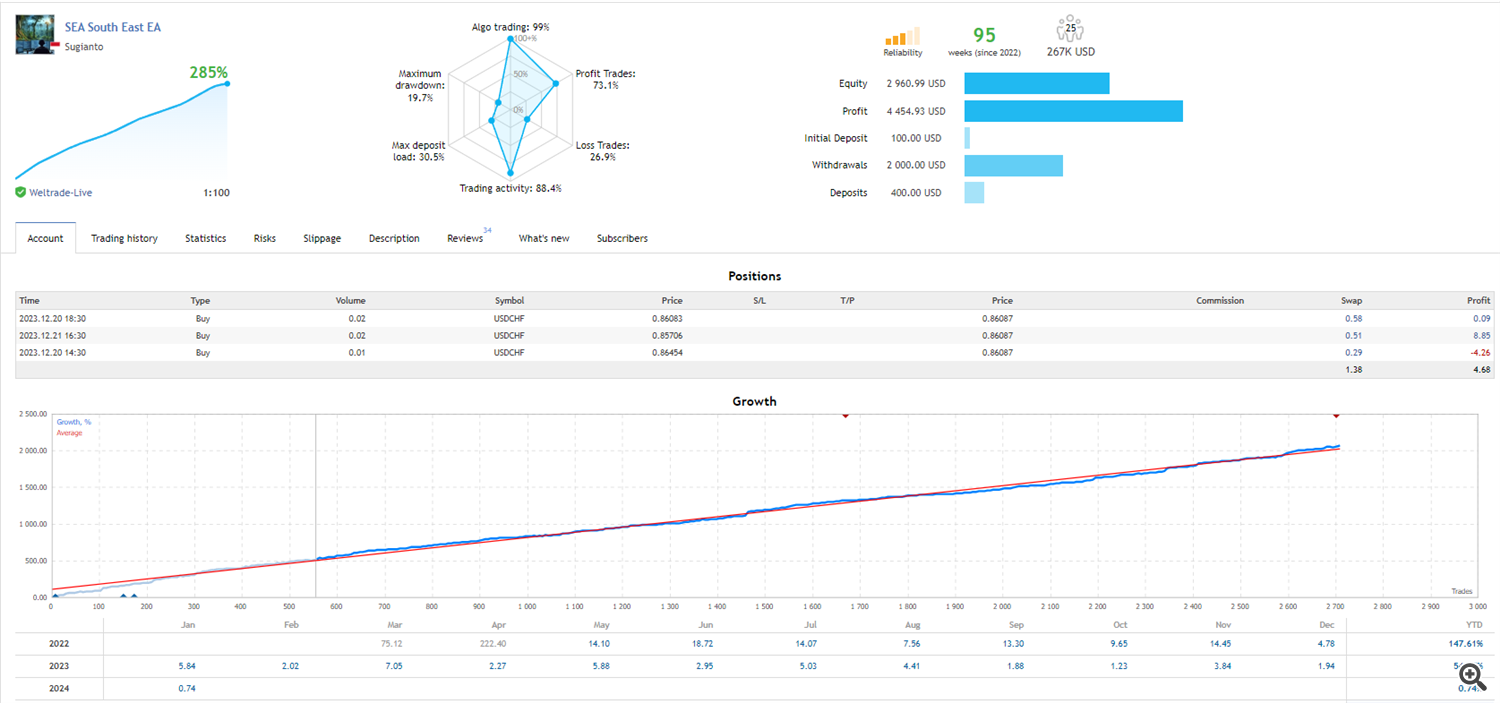

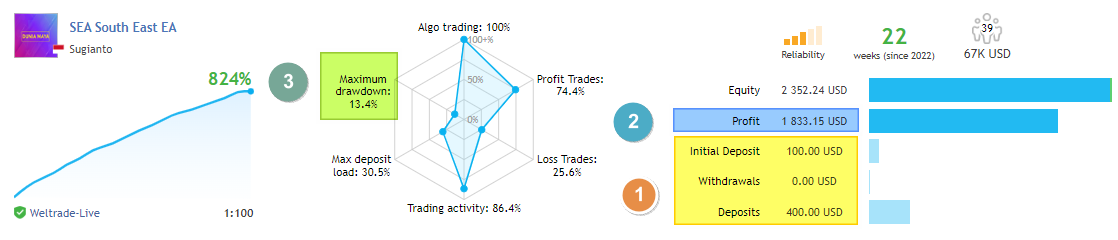

Long term investment

Net Z, Dunia Maya and South East are very suitable for long term investment with stable income. The start balance is not too big so your risk is also limited as low as possible. Easy to manage and trade 24 hours 5 days a week.Our trio EA, NETZ, Dunia Maya and South East have been going through live trade real accounts for more than 1 year with very stable performance, and South East signal is always in the top ranking of Popular Among Subscribers. This kind of track record shows the quality of a product that has been proven over the long term.

Dunia Maya, Net Z and South East apply 5 virtual techniques:

2. Virtual Pending Order: This virtual technique is to place a pending order so that the position entry is not too late or too early. The virtual technique will guarantee that your pending orders are not easily shifted by the broker (for any reason).

3. Virtual Grid: Virtual technique in determining the next open position if the previous open position experienced a loss.

4. Virtual Stoploss and Virtual Takeprofit: stoploss and takeprofit on the MT4 client and will not appear on the broker's server so that they are not easily detected by brokers.

5. Virtual close partial, EA will calculate profit and loss open positions and close partial the far loss position to reduce the used margin.

By using virtual code techniques to minimize brokers detecting your trading method you will avoid unwanted events.

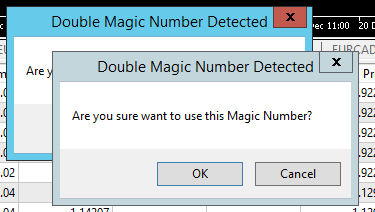

Double Magic Number Check

EA is equipped algorithm to check double magic numbers and will give a warning if a double magic number is detected in the same pair. This feature is especially useful if you are going to open the same pair using different eas. Example AUDUSD (DUNIA MAYA), AUDUSD (NETZ), AUDUSD(SEA)

Note: When restart the MT5/4 terminal or change timeframe or change input parameter ea and there is an existing position open, a Double Magic Number alert will appear, user just need to click the ok icon if they are sure it is a false alert and there is no double magic number in the same pair.

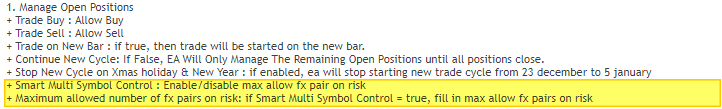

Smart Multi Symbol Control (SMSC)

How to use Smart Multi Symbol Control:

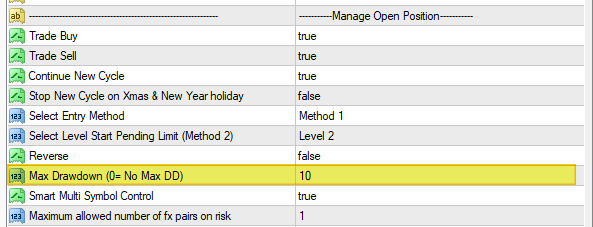

1. Enable Smart Multi Symbol Control=true.

2. Fill in "Maximum allowed number of fx pairs on risk" with the total number of symbols that you allow the bot to open

Example of how Smart Multi Symbol Control works:

1. If the fx pair is still floating minus, then the fx pair will be calculated, and EA will handle the 1 fx pair until profit.

2.if the fx pair is trailing profit, then SMSC will not calculate the fx pair, so EA can open the second FX pair.

So with this SMSC feature, if the user activates the Max Allow Number of pairs on risk=1, the ea will only handle 1 fx pair that is floating minus at a time.

example on real trade ;

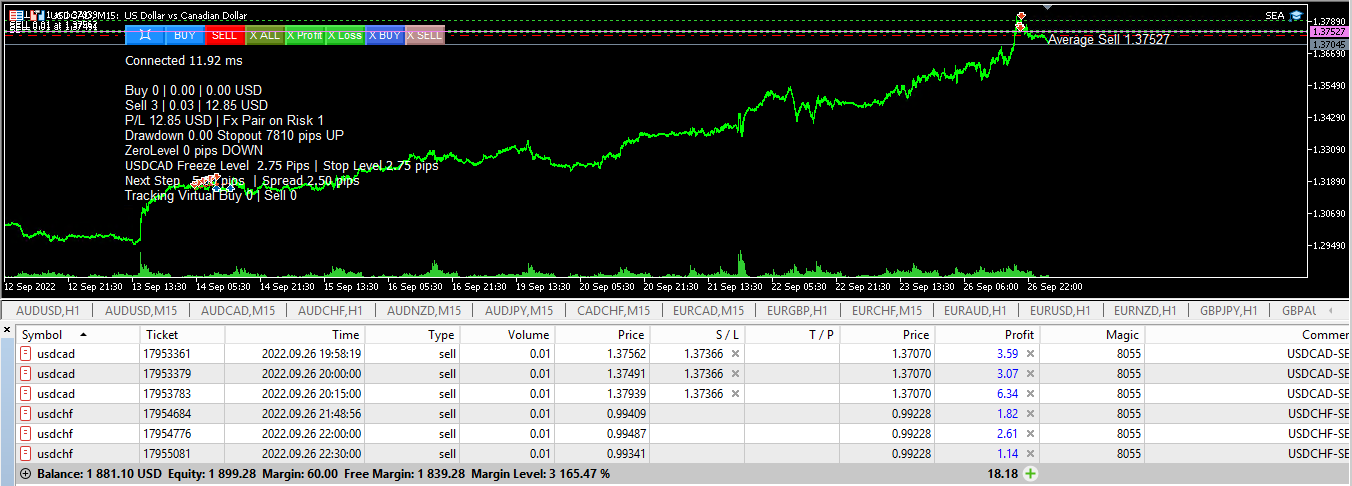

1. Open Symbol 2 : USDCAD and USDCHF

SMSC only calculates USDCHF which, even though it has been floating profit, has not yet been trailing profit, while USDCAD which is currently trailing profit is no longer counted by SMSC.

2. Now usdcad and usdchf are trailing profit and smsc doesn't count the two fx pairs, this provides an opportunity to open a 3rd fx pair

With SMSC feature, you will not lose the opportunity to trade as many fx pairs as possible, as long as the previous fx pairs are already trailing profit.

Max DD (DrawDown) limitation, this feature will stop opening new positions if the Max DD limit is reached

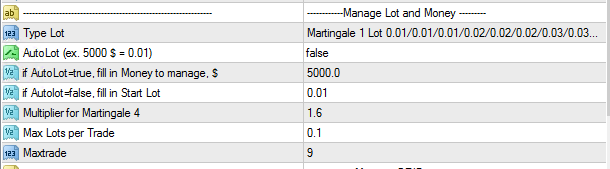

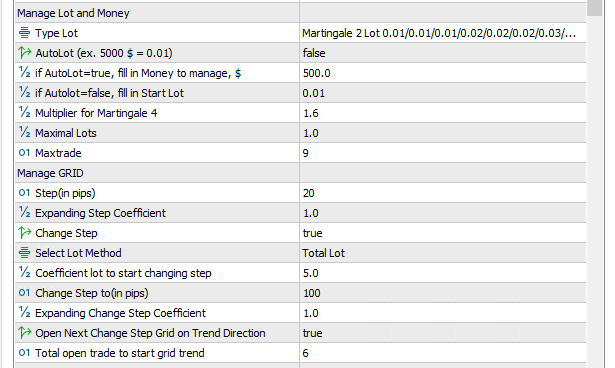

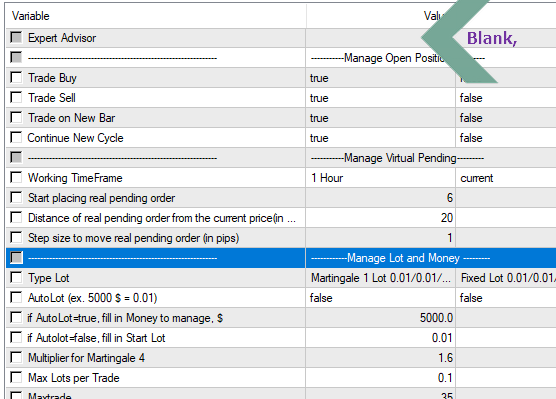

1. Type of lot: select the type of lot, there are 5 types of lots to choose from:

1.1 Fixed Lot 0.01/0.01/0.01/0.01/0.01/.............

1.2 Martingale 1 Lot 0.01/0.01/0.01/0.02/0.02/0.02/0.03/0.03/0.03/0.04/0.04/0.04/............

1.3 Martingale 2 Lot 0.01/0.01/0.01/0.01/0.01/0.02/0.02/0.02/0.02/0.02/0.03/0.03/...........

1.4 Martingale 3 Lot 0.01/0.02/0.03/0.04/0.05/.............

1.5 Martingale 4 Lot 0.01/0.02/0.04/0.08/0.16/.............

2. AutoLot (ex. 5000$ = 0.01); enable/disable autolot. example 5000$=0.01 means that the lot will increase by 0.01 every time the balance increases by 5000$.

3. if AutoLot=true, fill in Money to manage, $ : If you activate auto lot, enter the amount of money to be managed.

4. if Autolot=false, fill in Start Lot, if not enable autolot, fill in startlot.

5. Multiplier for Martingale 4, lot coefficient multiplier for martingale 4

6. Max Lots per Trade, maximum lots allowed for each single trade.

7. Maxtrade, the maximum number of open positions allowed.

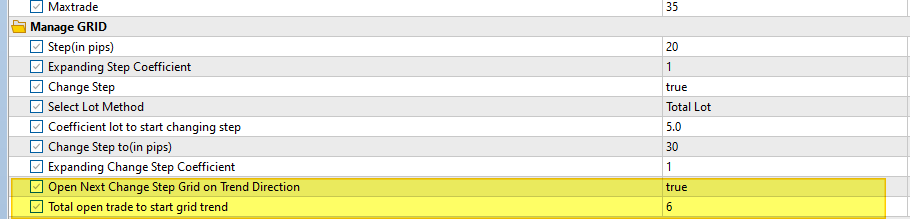

Manage Grid

-

Step (in pips):

- Description: This parameter defines the fixed distance, measured in pips, between successive open positions in the grid. It sets the initial gap between each trade, ensuring a consistent spacing based on your trading strategy.

-

Expanding Step Coefficient:

- Description: This is a multiplier applied to the step distance for subsequent positions. The higher the coefficient, the more the step distance will increase for each new position in the grid. This helps in reducing the frequency of trades as market conditions change, potentially lowering risk in volatile markets.

-

Change Step (Enable/Disable):

- Description: This toggle allows you to enable or disable the dynamic adjustment of the step distance. When enabled, the step distance can change according to the specified conditions, making the grid more adaptable to market trends.

-

Select Lot Method:

- Options:

- Last Lot: Uses the last trade’s lot size to calculate when to change the step distance.

- Total Lot: Uses the total cumulative lot size of all open trades to determine when to adjust the step.

- Note:

- Last Lot is typically used with Martingale strategies.

- Total Lot is better suited for Fixed Lot strategies.

- Options:

-

Lot Coefficient to Start Changing Step:

- Description: This parameter sets a multiplier to determine when the step distance should begin to change. It calculates the threshold lot size that triggers the adjustment.

- Example Calculation:

- Coefficient Lot to Start Changing Step: 5

- Starting Lot: 0.01

- Calculation: 5 × 0.01 = 0.05 5 \times 0.01 = 0.05 5×0.01=0.05

- Application:

- If Lot Method = Last Lot and using a Martingale strategy, the grid step will change after reaching the 13th order with a lot size of 0.05.

- If Lot Method = Total Lot and using a Fixed Lot strategy, the grid step will adjust after the total lot size reaches 0.05, typically on the 6th order.

-

Change Step to (in pips):

- Description: This parameter allows you to specify the new step distance in pips once the conditions for changing the step are met. It gives you control over how far the next position should be from the previous one, adapting to market conditions.

-

Expanding Step Coefficient:

- Description: This multiplier determines how much the step distance increases after the change step is triggered. A larger coefficient means a wider gap for the next open position, providing more room for the market to move before placing additional trades.

8. Open Next Change Step Grid on Trend Direction

- Description: This feature enables the Expert Advisor (EA) to automatically adjust the grid step size based on the current market trend. When activated, the EA will increase or decrease the distance between grid levels depending on the direction of the trend. This allows the EA to better adapt to market conditions, potentially optimizing trade entries and reducing the risk of adverse price movements.

9. Total Open Trades to Start Grid Trend

- Description: This feature automatically activates the "Open Next Change Step Grid on Trend Direction" when a specified number of trades are open. For example, if you set this value to 5, the EA will start adjusting the grid step size according to the trend direction only after 5 trades have been opened. This allows for more dynamic grid trading, as the grid adapts only when market exposure reaches a certain level, balancing risk management with trend-following opportunities.

Dynamic grid trading mean, the step will change if 2 conditions are met:

1. a minimum Change Step has been reached

2. There is a signal (trend) to open a position, that's why it is called GRID TREND.

- Example : If 'Select Lot Method' = Total Lot, Coefficient lot to start changing step = 5.0, which means after 4 trades, total lot = 0.05 which is the sum of (0.01,0.01,0.01,0.02). So after a total of 4 trades, the grid step will be 100 pips.

- If total open trades= 6, the next grid step shall be larger than 100 pips. If a total of 9 open trades, no more orders will be opened by SEA.

In Summary:

| Total trades | Step |

|---|---|

| 1-4 | 20 |

| 5-6 | 100 |

| 7-9 | >100 |

Trailing

The concept of SEA is to get a trend reversal so we can buy at low and sell high, with the hope of getting the best price and making a big profit.

This is why the trailing start is set at 25 pips from average price and the trailing size is set at 5 pips.

Most customers will complain because negative closes often occur, because the ideal trend reversal conditions are not achieved and the price experiences a correction resulting in a negative close. If that happens, my suggestion is trailing size = 1 pips so that the stop loss is close to the average price.

But, I don't really have a problem if a negative close occurs, this shows that the trend reversal is still not strong enough and can only be called a price correction

Backtest Cannot be used to assess the performance of NETZ/MAYA/SEA

- Duniamaya, NETZ and SEA do not use indicators and only use data collected from Virtual Trade. Virtual trades become active and start collecting data when Duniamaya/NETZ/SEA is attached to the chart.

- Limiting the max FX pair on risk will also make trade differences between accounts. Because if the symbol has reached the max fx pair on risk, then the pair that should get the trade is cancelled/deleted

- That's why backtests cannot be relied on to assess the performance of MAYA/NET and SEA because in real live trade, virtual trade , max fx pair on risk, and news filters really influence the results.

Not One Chart Set Up EA

SEA, NET Z and Dunia Maya are not EA one chart set up. This is because each fx pair has different settings and different trading timeframes.

Manageable drawdowns:

+ Stop out monitor is available for free for SEA, NET Z and Maya users. Please Contact me to get this indicator.

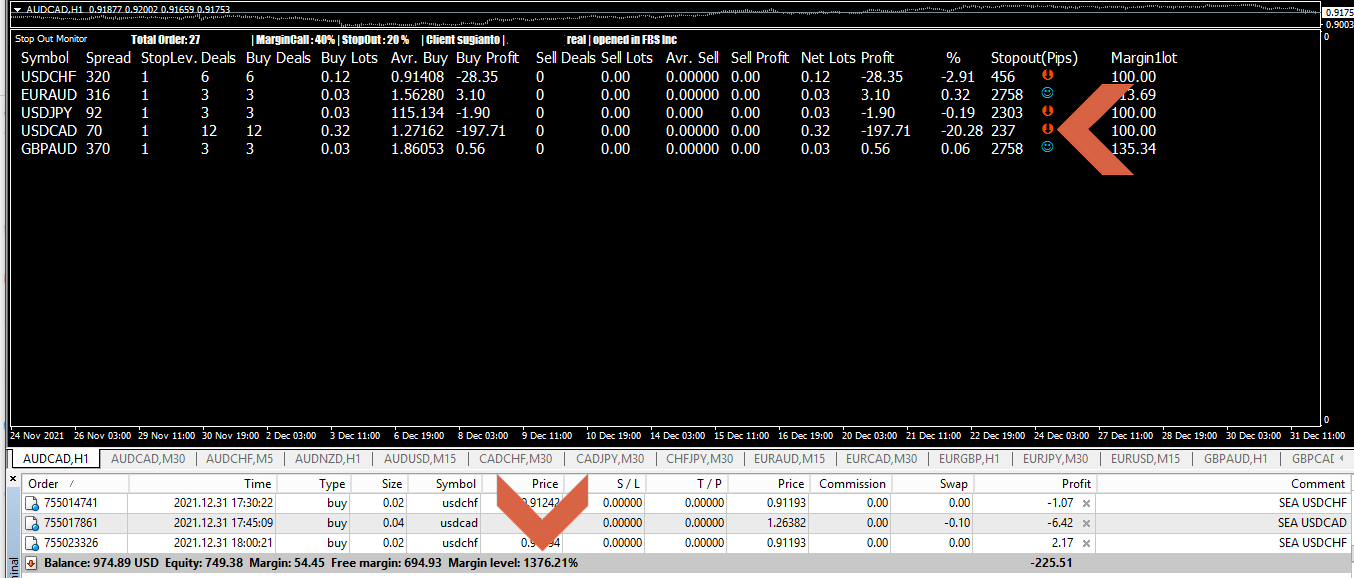

Stopout Monitor

Dunia Maya, Net Z and South East do not use stop loss in their strategy. However, the EA must be assisted with tools for monitoring stop outs.

Stopout Monitor will calculate how many more pips each pair will have a stopout. User only have to monitor and can take action by adding funds if the condition is close to critical, for example 100 pips again your account will experience a stop out.

Example of a stop out vs margin level comparison.

In the picture it can be seen that USCAD will have a stop out of 237 pips again, while the total margin level is still 1376% with a free margin of 694 $.When you see the margin level and free margin in total, you will remain calm. But if you look at the details of the stop out by pips I'm sure you won't be able to calm down anymore, because USDCAD in 1 month timeframe can go up and down more than 300 pips.

With this data you can make calculations and predictions, can USDCAD go down to 237 pips again or will it experience a upturn? If the prediction data and subsequent developments show that the USDCAD continues to downtrend, you must of course prepare additional funds to be added to your account to avoid a margin call.

With this stop out data, you can add funds precisely and not roughly based on the percentage margin level.

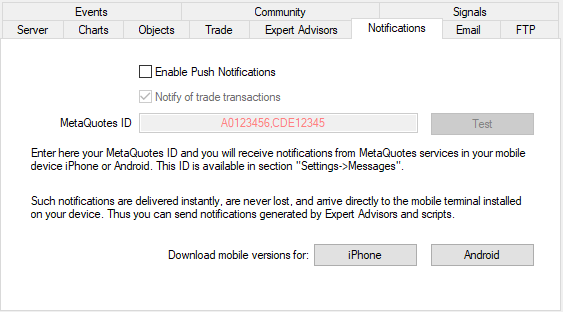

Metaquotes id

It is highly recommended to use a stop out monitor by activating an alert at least 300 pips.

Especially for colleagues who are not always in front of the vps, activate alerts to metaquotes id.

Every time we install the MT5/MT4 app on Android, usually a metaquotes id is available at setting menu, make sure to fill in the metaquotes id to tools/option/notification

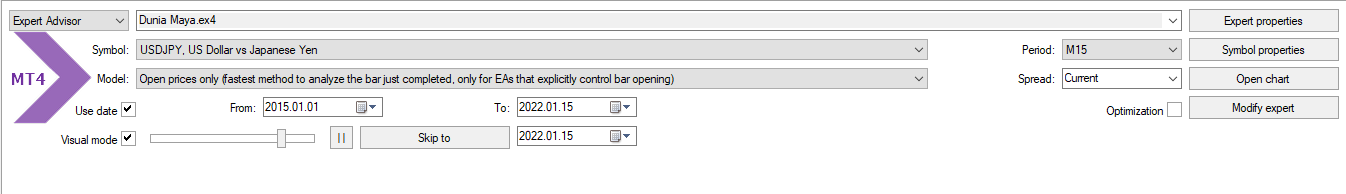

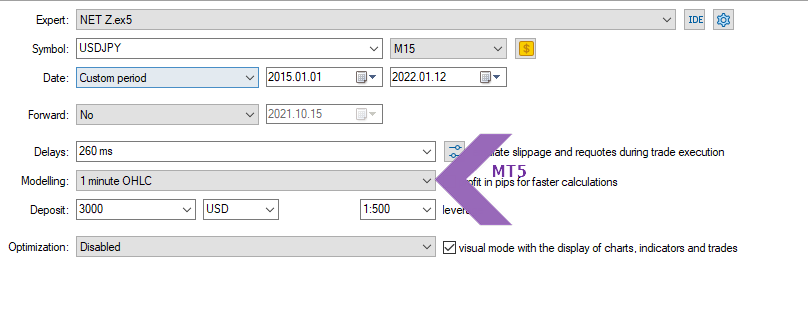

Backtest, Setfile and Adjustments

I have provided a setfile for each currency, but for MT4 version user may have to make some adjustments because the characteristics of forex brokers are always different from one another.

This difference is mainly in the determination of spreads, stop levels, freezelevels, and speed of order execution.

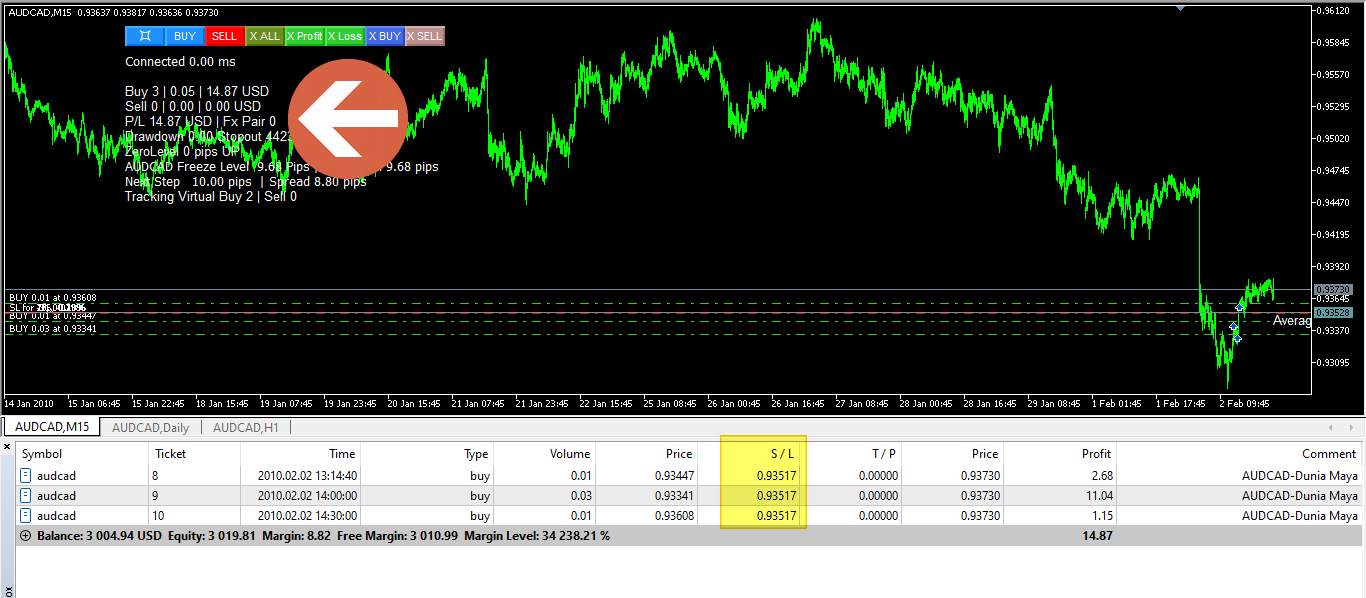

User can make adjustments by doing a backtest at least 7 years back (2015-2022), and even better if it can be 12 years back (2010-2022).

In addition to adjustments to the ea input parameters, user can also make timeframe adjustments. User can make adjustments to the following 3 timeframes: M15, M30, and H1. If the setfile fails to backtest on the H1 timeframe, user can try the backtest on the M30 and M15 timeframes, look for the backtest results with the smallest drawdown and the largest profit, with the best winning trades.

For the MT4 version, Backtest can be done by modeling Open Prices only, or control point or every tick because the results will not be much different. This can happen because the MT4 version uses open prices to open and close positions.

Meanwhile for the MT5 version you can use 1 minute OHLC modeling because the ea is equipped with an algorithm to take a position with a 1 minute OHLC modeling price structure.

South East EAs MT4 version can't be backtested, this is because MT4 is not powerful enough to run the embedded algorithm, user can backtest the MT5 version. Net Z MT4 entry method 6 requires history data to be able to backtest, how to download history data will be explained below.

How to download history data

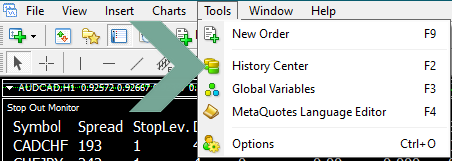

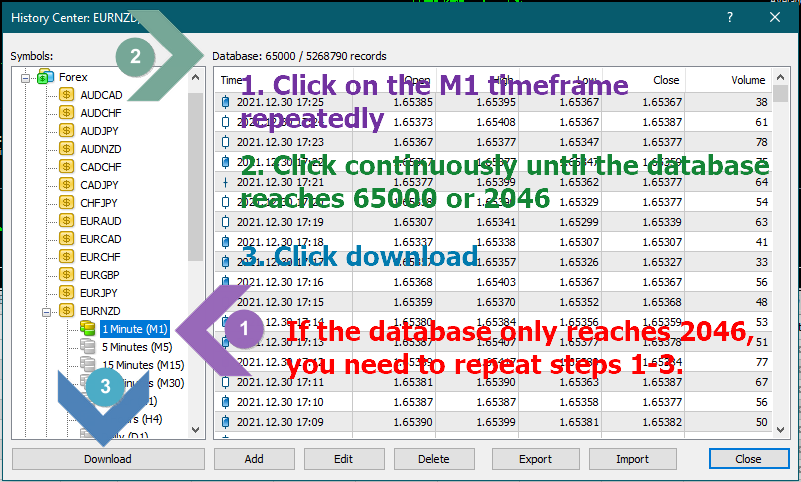

In doing backtest, user need to download history data.Download the data by going to Tools\History Center and following these steps:

1. Click on the M1 Timeframe repeatedly

2. Click continuously until the database reaches 65000 or 2046

3. Click Download

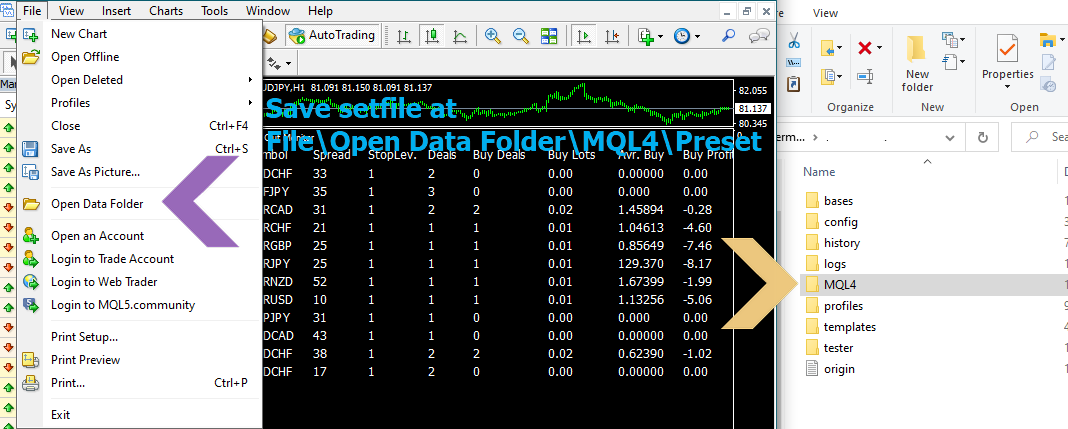

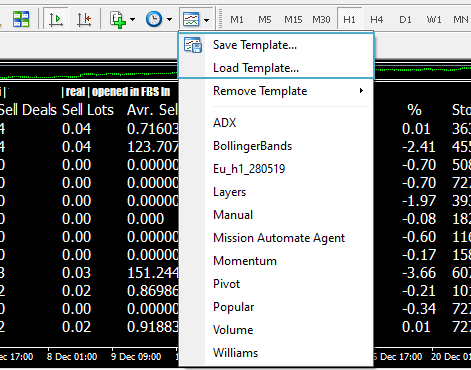

Save the setfile in the presets folder to make it easier to upload it.

Click the file tab, select Open Data Folder, click the MQL4 folder, click the presets folder and paste the setfile into this folder.

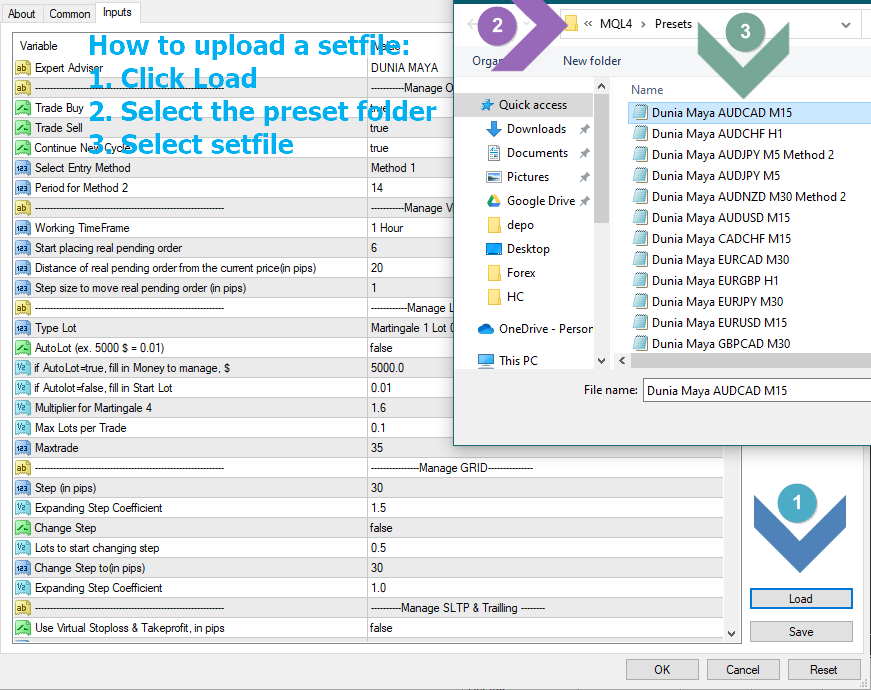

How to upload a setfile

Click Load, select preset folder, select setfile

Demo Account and Real Account

For beginners in forex, I highly recommend to try on a demo account for at least 3 months so that you can understand well how ea works, and how to set ea parameters, and can simulate how to handle difficult situations by adding funds.I highly recommend using the ic market demo account because it is easy to create a demo account and add funds.

Once you understand how it works, you can switch to a real account.

On a real account, you can open charts in stages.

Example :

Stage 1: open 5 charts, after 1 month, you can enter stage 2Stage 2: open 5 charts, after 1 month, you can enter stage 3

Stage 3: open 5 charts, after 1 month, you can enter stage 4

Stage 4: open 5 charts, and so on

By opening the chart gradually, the drawdown will be easier to control.

Which must be considered:

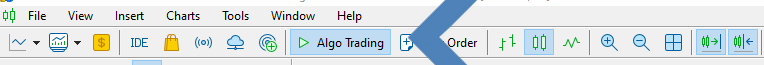

+ Before attaching the ea to the chart, make sure to enable auto trade on the MT5/4.

Auto Trade MT5

Auto Trade MT4

![]()

+ When restarting the MT4/5 , re-check each chart to make sure all expert advisors are loaded perfectly, if not you have to re-attach the ea to the chart.

+ For MT4 version, if during restart, you find a blank expert advisor, please reload the setfile. Normally there is text with the words Net Z, Dunia Maya or SEA

+ Double check the loaded timeframe and setfile, must match the symbol and timeframe chart. Don't get the wrong setfile load.

+ Use the save and load template features to make it easier to reload ea and setfiles.

+ Minimize restarting the MT5/4. User may have to turn off the vps auto update to minimize restarting the MT5/4.

+ Have to frequently check and recheck the expert tab and journal tab on the MT5/4 to check for errors.

+ Setfile will continue to experience updates and changes, make sure you can connect with us to receive ea and setfile updates information. You may have to leave a comment in the comment section of ea so that you can be added to the group to facilitate communication.

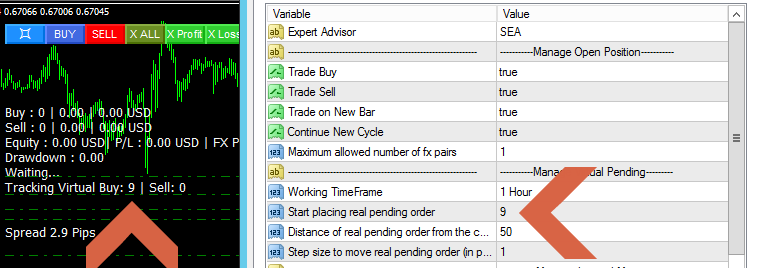

How to check whether the ea has been set up properly

SEA takes time in building the data to determine the entry point.This certainly raises doubts whether it has been attached properly and correctly because SEA does not immediately open a position.

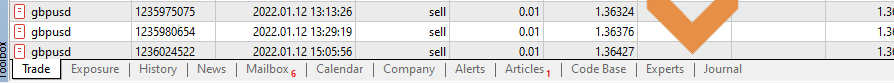

SEA will start placing pending orders if Tracking Virtual Buy/Sell=Start placing real pending orders.

User can see Tracking Virtual Buy/Sell on the panel, and Start Placing real pending on the EA parameter input.

2. Start placing real pending orders=9

SEA will start placing real pending orders when Virtual trade buy=start placing real pending orders

![]()

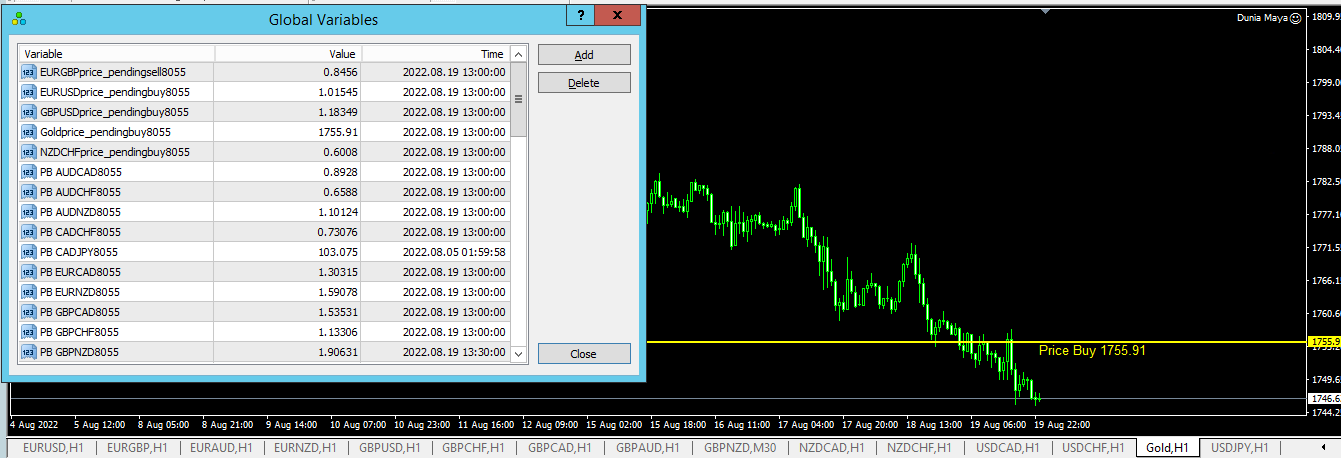

In addition, user can check global variables by pressing F3 and pay attention to the pending order section, meaning that there is already an FX pair that has placed a pending order.

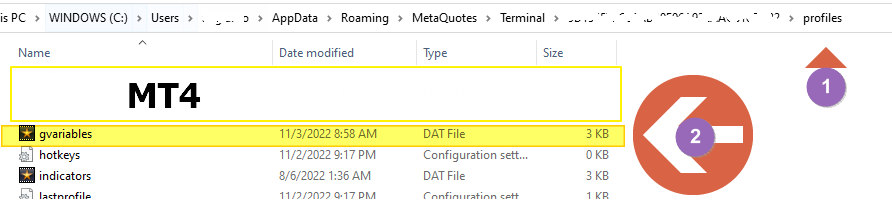

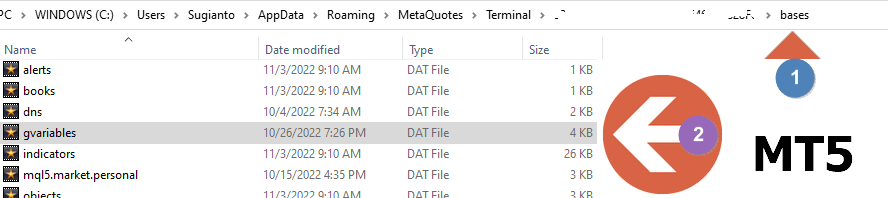

How to move Global Variables between MT4/MT5

When moving MT5/MT4 to a new vps, users can copy global variables from old MT5/4 to new MT5/4 in the following way:

1. Old MT4: Copy the Global variable data in profiles folder

Old MT5: Copy the Global variable data in bases folder

2. move it to:

New MT4: Profiles folder

New MT5: bases folder

3. Restart the MT5/MT4

Manual Trade

The button is provided to make it easier if user want to close a position and buy/sell is for manual trades. EA will delete all data collected in global variables when there are open positions, including open positions that are manually opened via the buy/sell button.

Wrong perspective on backtest results

Backtest aims to determine whether the embedded algorithm is in accordance with the wishes.

Of course, the better the backtest result, the closer to the author's design.

However, many people misunderstand that:

1. A good backtest is a guarantee of good trading results.

2. Good backtest results will not cause margin calls.

Remember, the forex market will always change, while the backtest is based on historical data (fixed).

Below I will propose a strategy to deal with dynamic forex market conditions.

Trade One Fx Pair On Risk at a time

The advantages of this strategy are:

1. Start balance required is minimal.

2. The drawdown is controlled because it only handles one fx pair. at a time

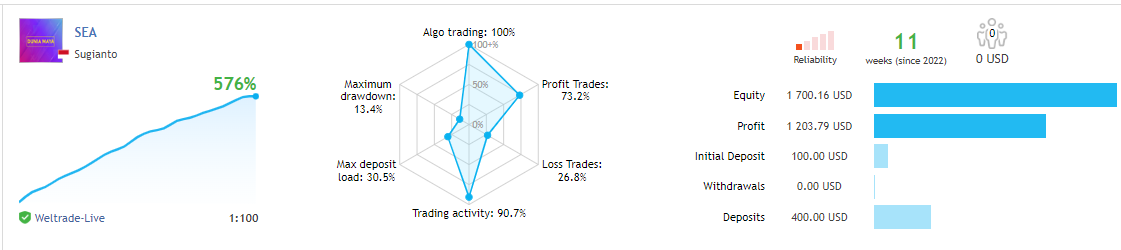

The following is an example of the results of this strategy:

Self Adapt

My Strategy in Using EA NET Z, Dunia Maya and South East EA

It would be very good if we have a good trading strategy and money management strategy too.

Although SEA, NET and MAYA setfiles have been through backtest 2010-2022 and 2015-2022 to ensure all setfiles used have been tested in the long term.

But backtest results or history results cannot reflect future results, because no one knows for sure the future forex price movements.

And I've set up a feature to anticipate that:

1. SEA, NET and MAYA uses mild martingale lots, so it doesn't spend so much free margin and drawdown is easier to control.

2. SEA, NET and MAYA only opens trade when there is a new bar, so if there is a spike, then the next step open position will widen automatically and this will really help reduce the used margin and drawdown with such flexible steps.

3. I use a stop out monitor to monitor the health of my account, and if necessary I can do a cut loss or use a stop loss.

But it would be better if you can withdraw regularly and have a good money management strategy.

I myself have the following plans for SEA, NET and MAYA money management;

1. I will use the smallest possible start balance, in this case I will use 100$. If it's not enough I will add funds gradually, as you can see in the SEA MT4 and MT5 signals.

2. I will only trade one fx pair at a time to make sure the amount of start balance I use is not too large.

3. I plan 2 things when my profit has reached 5k

a. I will increase the lot size to 0.02 to increase the profit.

b. Or I can withdraw periodically and just make sure my balance remains 5k.

For the first account, I highly recommend withdrawing regularly if your profit has reached 5k and just making sure the balance remains 5k.

After that you can set up a second account using plan 1, which is to increase the lot size to 0.02 when the profit has reached 5k.

MT5 Version :

South East EA : here

Net Z EA : here

Stop Out Monitor MT5: for SEA, NET Z and Maya users. Please Contact me to get this indicator.

MT4 Version :

Dunia Maya EA : hereSouth East EA : here

Net Z EA: here

Stop Out Monitor MT4: for SEA, NET Z and Maya users. Please Contact me to get this indicator.

PS:

+ It took me 1 year to create this blog with the aim of making it easier for SEA, NET Z and Maya users to understand the bot's features. Thank you and I really appreciate those of you who are willing to read to the end. If you have any input, please contact me.