Simple M15 Strategy Automated Using The Market Reversal Alerts Indicator

The S&P500 (SPX) is one of the most heavily traded indicies in the world. It tracks the top 500 companies in the US and as such is engineered to rise as these companies grow year on year.

Most strategies that are profitable revolve around taking long positions only on this index as it rises constantly and it does not make sense to take short positions on something that just typically goes up.

The S&P500 Index Daily Trend

Tick Data Testing Over 12 Months With 99.90% Accuracy

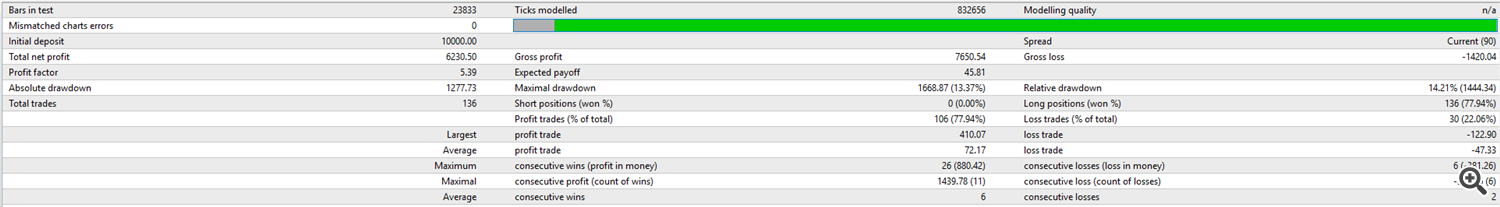

The market reversal alerts EA has been backtested over a period of 12 months on the M15 and M5 timeframes using a trend pullback strategy and has produced consistent low drawdown results. Tested over 30th August 2020 - 30th August 2021.

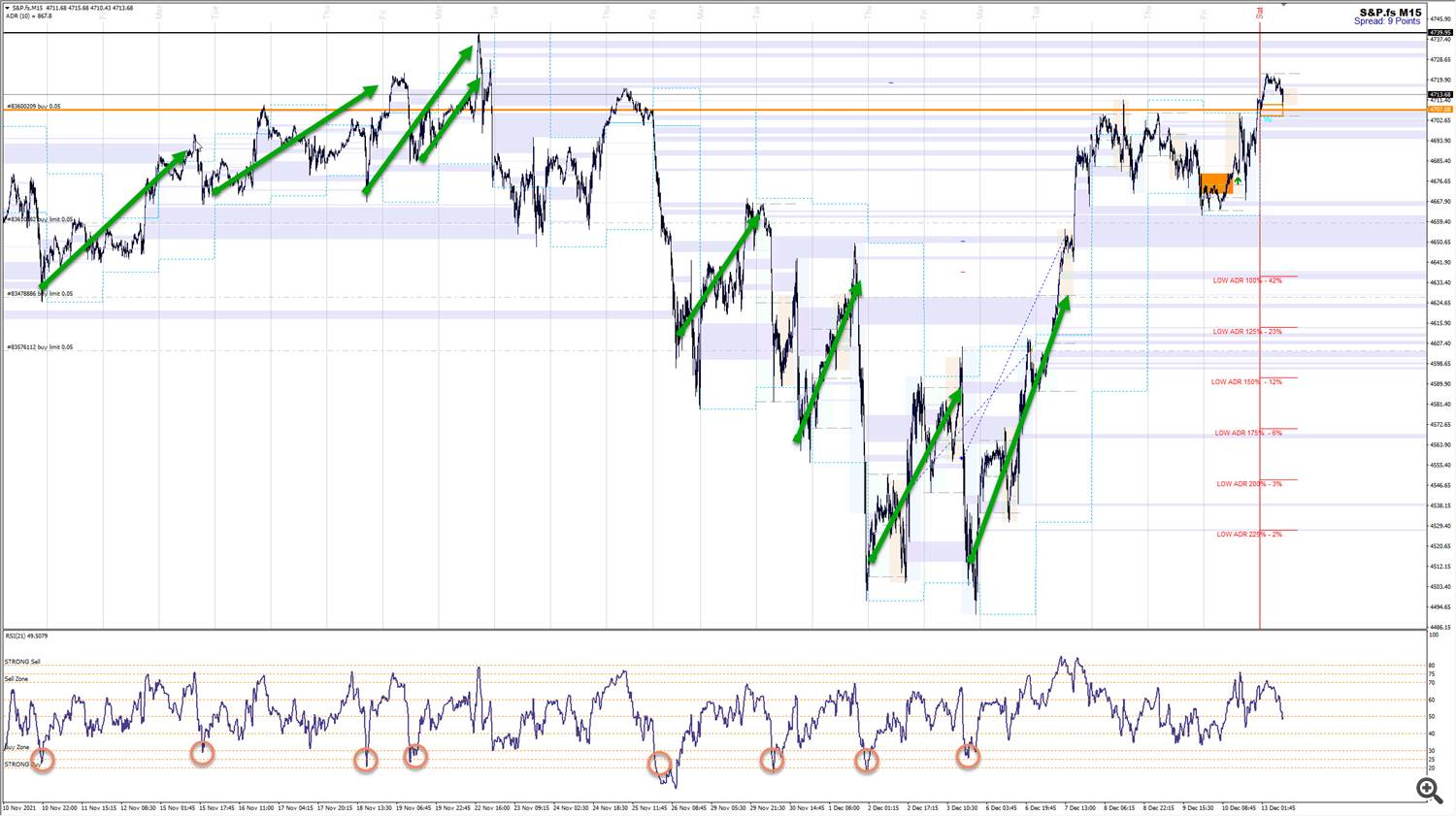

M15 Entry Positions Using The Market Reversal Alerts EA

The M15 strategy with the market reversal alerts EA simply takes long positions when the RSI 21 period is extended below 30 on the 15 minute time frame and it looks to target 1/2 ADR move to the upside which typically happens on a daily basis. Occasioanlly the move will be stong and if that happens the EA gets into additional positions spaced a minimum of 1/4 ADR apart and waits for the market correction of 1/2 ADR to happen.

Drawdown Control Option In The EA To Manage Drawdown

In extreme cases if the correction does not happen and the S&P moves 2 X ADR away from the entry position the EA will automatically start to close out the position in small chunks to minimise drawdown, taking small losses.

******UPDATE 13TH DECEMBER 20201******

Have added set files for aggressive version of the strategy which gets into trades at the 40 RSI level and also targets 1 X ADR instead of 0.5% ADR. The results are 3X the profit but also 3X the drawdown.

Adjust as necessary but again this set file is using 0.2% risk per position on a £10k account and achieving 60% growth per year with a 13% drawdown.

Room For Improvement

With further testing there are a number of improvements that could be made to the strategy.

These results (20+% net gain in in 12 months) outperforms the normal 8% gain on the S&P500 considerably but there is still room for improvement. The drawdown is tiny using just 0.2% risk per entry with the set file attached to this post. If you increased your risk your drawdown would also increase but the rewards would obviously be considerably higher also.

Additional entries could also be found using moving average filters and lower extensions on the RSI (35 or 40 for example) but this would also lead potentially to more short term drawdown, however more entries would mean much higher profits too so the settings used would be down to the individuals risk and drawdown tollerances.

Get The Market Reversal Alerts EA For MT4 and MT5:

Product page for MT4 - https://www.mql5.com/en/market/product/65383

Product page for MT5 – https://www.mql5.com/en/market/product/74958

Set files for MT4 & MT5 are attached to this blog post.

Tested over 30th August 2020 - 30th August 2021