S&P500: In general, the long-term bullish trend remains in force

Trades in world stock markets today mostly go with growth after signs of stabilization of yields of US government bonds have appeared. On Monday, the yield on 10-year US Treasury bonds reached 2.998%, closely approaching the psychological level of 3%. The world stock markets were yesterday, probably on the verge of a new collapse. Investors fear that if the yield of 10-year government bonds exceeds 3% this week, then a new wave of sales may begin on the US stock market, which will provoke a fall on other world stock exchanges.

StoxxEurope600 in the morning trading rose by 0.3%, following the markets of Japan and Hong Kong, where there was a sharp increase.

A number of companies in Asia and Europe, included in the indices, reported profits in the first quarter. Basically, these are technology companies. But there are a number of companies in the oil and gas sector, whose profits have grown against the backdrop of the continuing rise in oil prices.

The barrel of Brent oil rose 0.4% to 74.98 dollars after reaching a maximum since November 2014, and oil and gas companies also entered the number of leaders in Europe.

Today, the yield on 10-year US Treasury bonds fell to 2.959% from the level of 2.998%, recorded on Monday.

It is likely that US stock markets will start trading in the US with an increase. At least, futures for the major US stock indexes are rising since the opening of the trading day on Tuesday. Futures indicates that the S&P500 will start the US trading session with an increase of 0.5%.

Nevertheless, geopolitical tensions, although asleep, may again intensify. The situation on the US Treasury bonds market has stabilized slightly, however, the yield of 10-year bonds is close to multi-month highs, closely approaching 3%.

The darkest scenario has not yet been realized, which allowed the risky assets to recover slightly.

However, sales may once again intensify as soon as the geopolitical situation deteriorates again, and the reports of US companies may not be so positive.

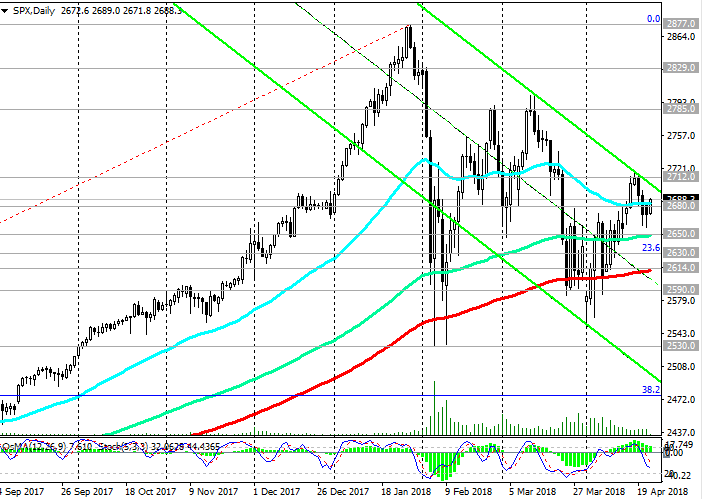

Investors are not yet ready for active purchases of high-yield, but also risky, assets of the stock markets. Although, in general, the long-term bullish trend, while the S&P500 is trading above the support level of 2614.0 (200-period moving average on the daily chart), remains in force.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 2680.0, 2650.0, 2630.0,

2614.0, 2590.0, 2530.0, 2480.0

Resistance levels: 2700.0, 2712.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

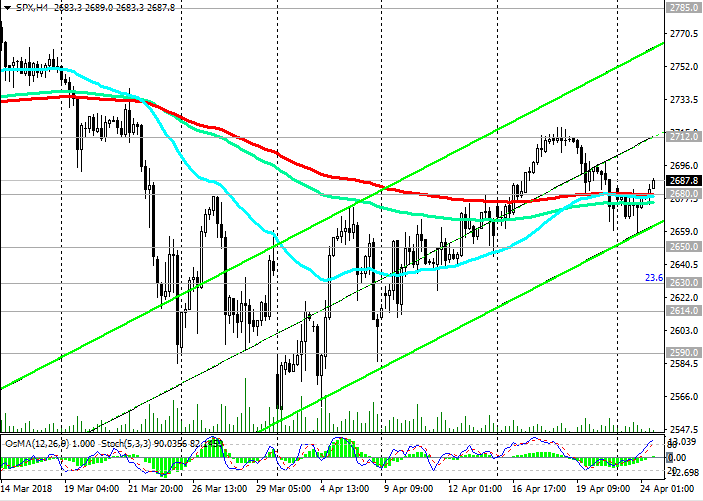

Trading Scenarios

Sell Stop 2670.0. Stop-Loss 2698.0. Objectives 2650.0, 2630.0, 2614.0, 2590.0

Buy Stop 2698.0. Stop-Loss 2670.0. Objectives 2712.0, 2785.0, 2800.0, 2829.0, 2877.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com