The Energy Information Administration of the US Energy Ministry recently made another forecast, according to which, the production of shale oil in the country in April will increase by 131,000 barrels a day to a record level of 6.95 million barrels per day.

The rapid growth in the production of shale oil in the US reduces OPEC's efforts to stabilize the level of demand and supply of oil and maintain world oil prices. As you know, the OPEC agreement on the reduction of oil production by about 1.8 million barrels per day was signed in 2016 and will continue until the end of 2018.

In the opinion of the UAE Energy Minister Suhail Al-Mazrui, who is the president of OPEC at the present time, "reducing the cartel's production has prevented chaos in the oil market". And this, to a large extent, is true. But the increase in oil prices began, mainly, from June 2017, when OPEC confirmed the extension of the contract to reduce oil production before the end of 2018. Moreover, Saudi Energy Minister Khaled Al-Falih said at a press conference in Riyadh in February that Saudi Arabia is ready to take additional measures in this direction. "We believe that it is better for us to take redundant steps (to reduce supply) and ensure the restoration of the balance of the market", said Khaled Al-Falih.

Meanwhile, in the Organization of the Petroleum Exporting Countries (OPEC), disagreements arose over the necessary level of oil prices.

Saudi Arabia is aiming for prices around $ 70 per barrel or higher, while Iran would like prices to be around $ 60 per barrel. According to Iran, prices in the levels of $70 per barrel will provoke oil companies in the US to increase production even more rapidly, which will cause a collapse in prices.

There is a certain share of truth in this. For example, US Deputy Energy Minister Dan Brulett said recently that US oil production this year may show "phenomenal" growth, making oil rally almost impossible.

Participants in the oil market are waiting for OPEC's monthly reports, which will be released this week.

According to the American Petroleum Institute (API), which was published on Tuesday evening, US oil inventories rose by 1.2 million barrels last week. However, gasoline inventories decreased by 1.3 million barrels, and distillate stocks decreased by 4.3 million barrels, which could push up oil prices.

And today the attention of traders will be riveted to the report of the Energy Information Administration (EIA) of the US Department of Energy on data on oil reserves in the US, which will be published at 14:30 (GMT). It is expected that oil and oil products stocks in the US increased by 2,023 million barrels last week. If the data is confirmed, oil quotes may decrease.

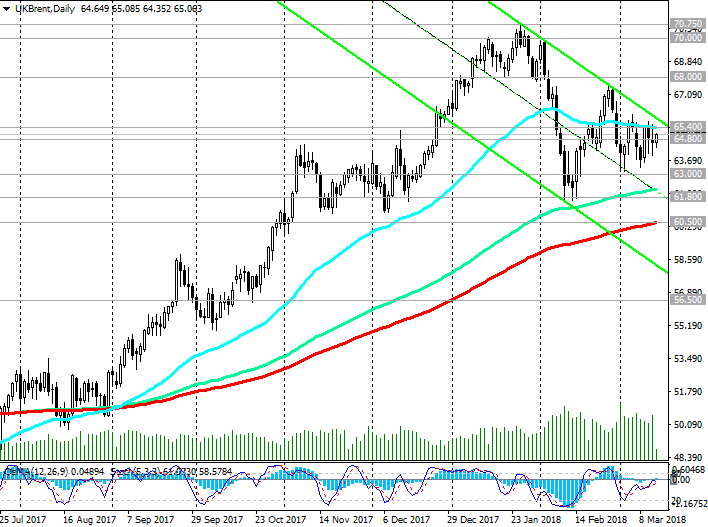

Meanwhile, the second week Brent crude oil is trading near the level of 65.00 dollars per barrel. It seems that the oil market lacks drivers for either resuming growth, or for further, deeper, lowering. Thus, the current situation can be described as flat.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 64.80, 64.00, 63.00,

61.80, 60.50, 56.50

Resistance levels: 65.40, 66.50, 68.00, 69.00, 70.00, 70.75

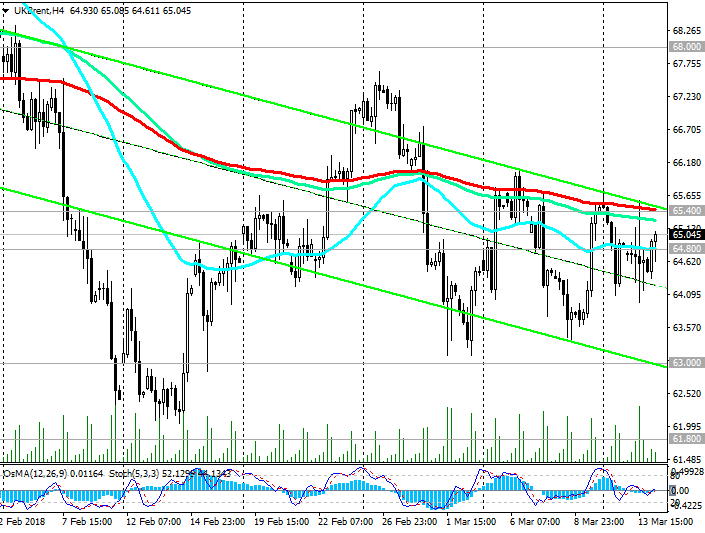

Trading Scenarios

Sell Stop 63.80. Stop-Loss 65.70. Take-Profit 63.00, 61.80, 60.50, 56.50

Buy Stop 65.70. Stop-Loss 63.80. Take-Profit 66.50, 68.00, 69.00, 70.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com