Published last week with the results of the dairy auction organized by the New Zealand company Fonterra (specialized trading platform GlobalDairyTrade - GDT), showed a slight decline in world prices for dairy products (-0,6%). The main part of the New Zealand economy is the timber and agricultural complex, and a significant part of the New Zealand export is dairy products, primarily milk powder. Two weeks ago, the dairy price index, prepared by Global Dairy Trade, came out with a slight decrease (-0.5%) against the previous values of + 5.9%, + 4.9%, + 2.2% and +0.4 %. Nevertheless, the New Zealand dollar is the most successful of all other currency-competitors traded against the US dollar in recent days.

Investors continue to assess the impact of the decision of the White House on the introduction of import duties on steel and aluminum on international trade relations. Commodity currencies, including the New Zealand dollar, rose in response to this decision. Economists believe that the decision to impose import duties will positively affect the US economy. At least, the main US stock indexes are growing again, and the NASDAQ100 index updated its absolute maximum on Friday, and on Monday the NASDAQ100 futures are again trading higher, near the 7130.0 mark. Traditionally, it is believed that economic growth is accompanied by an increase in demand for primary commodities. The share of the United States in world GDP is estimated at 16-20%. Accordingly, the growth of the world's largest economy assumes a growing demand for commodities. The current weakening of the US dollar contributes to higher commodity prices, which also positively affects the quotations of commodity currencies, including the New Zealand dollar.

Wednesday (21:45 GMT) is expected to publish data on New Zealand's GDP for the 4th quarter (latest release). It is expected that GDP grew by 0.8% in Q4 (against + 0.6% in Q3), implying an annual GDP growth of about 2.5% -3.0%. This is strong enough data. If the data is confirmed, the New Zealand currency will strengthen, including in the NZD / USD.

On Tuesday at 21:45 (GMT) data on the balance of payments of New Zealand will be published.

Reducing the current account deficit in the balance of payments of New Zealand (expected to reach $ 2.40 billion from NZ $ 4.68 billion) will support the New Zealand currency. In the absence of important news in the economic calendar, flat and low trading volumes are expected in the foreign exchange market today. However, it is worth paying attention to the speech (at 23:45 GMT) of the deputy head of the RBNZ Grant Spencer. If he touches on the RBNZ monetary policy, then the volatility of the New Zealand dollar trades will go up. Rigid rhetoric of his speech on inflation and the likelihood of tightening monetary policy will cause the New Zealand dollar to grow.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

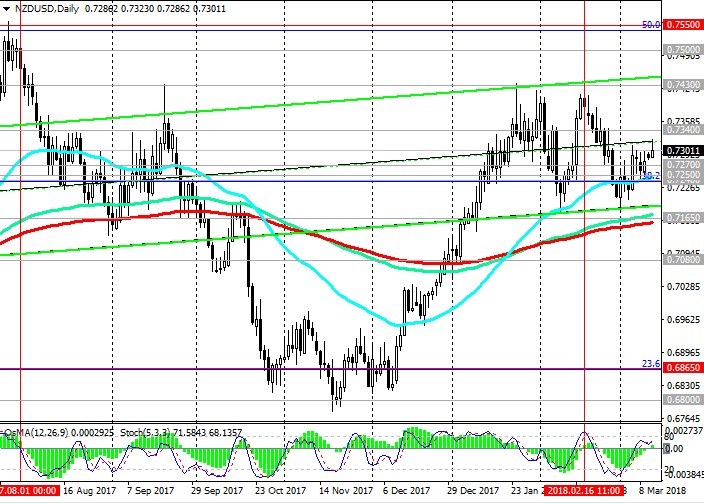

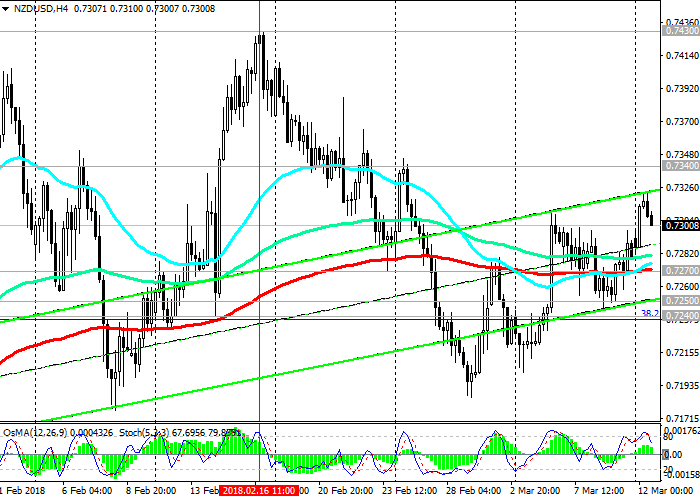

Support levels: 0.7300, 0.7270, 0.7250,

0.7240, 0.7200, 0.7165, 0.7080, 0.6865, 0.6800

Resistance levels: 0.7340, 0.7400, 0.7430, 0.7500, 0.7550

Trading Scenarios

Sell Stop 0.7290. Stop-Loss 0.7330. Take-Profit 0.7270, 0.7250, 0.7240, 0.7200, 0.7165

Buy Stop 0.7330. Stop-Loss 0.7290. Take-Profit 0.7400, 0.7430, 0.7500, 0.7550

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com