As the research company IHS Markit Ltd. reported today, the purchasing managers' index (PMI) for the UK manufacturing sector in January was 55.3 against 56.2 in December and the forecast of 56.5. Although the index values above 50 indicate activity in the manufacturing sector, the data suggest that growth in activity slowed to a 6-month low against the backdrop of rising price pressures on companies and consumers.

In January, the index became minimal since June, as the shortage of raw materials and rising prices on it against the background of the accelerated inflation in the UK after the referendum on Brexit negatively affected the release of finished products, and the costs again grew. Procurement prices grew at the fastest pace in 11 months. Brexit remains the main theme that affects the pound at the moment. At the same time, company IHS Markit Ltd., which calculates the index, reported that the index remains "well above the long-term average of 51.7" and still indicates the growth of new export orders.

The pound declined slightly after the publication of the PMI index. The positive dynamics of the pound was supported, in particular, by the head of the Bank of England Mark Carney, who in his speech in the upper house of the British parliament earlier this week said that he sees signs of accelerating the growth of wages in the UK due to higher demand for labor. "The demand for labor in the UK is growing, the pace of wage increases is accelerating", in his opinion, while "real income growth this year will resume." "Real incomes (households) this year may return to growth," added Carney. In his view, Brexit will have an impact on inflation rates for several more years, although the effect of the collapse of the British currency has already basically passed. Meanwhile, the pound remains stable against the dollar, which is growing today against the yen and commodity currencies, despite the fact that commodity and oil prices, again, have pushed up.

The dollar slightly reacted to the results of Wednesday's two-day Fed meeting, in which the Fed's interest rates were left unchanged in the range of 1.25% - 1.50%. The statement of the Fed was, on the whole, positive. The central bank signaled the strengthening of confidence in the optimistic outlook for the economy. Heads of the Fed expressed their hope that inflation will grow in 2018. "The level of employment, household expenses and companies' investments were marked by a significant growth, while the unemployment rate remained low", the Federal Reserve said in a statement.

Investors have already pawned in prices a 2-time rate increase this year. If the Fed will raise rates at a faster pace, then the dollar can break the already established multi-month negative trend. In a statement published on Wednesday the Fed has a hint that this year rates can be raised more than three times.

We are waiting for data from the USA today. In the period from 13:30 to 15:00 (GMT), data will be published on the number of initial jobless claims for the last week, labor productivity for the fourth quarter (preliminary release), PMI in the manufacturing sector of the US economy and gradual acceleration of inflation.

The dollar may continue its corrective growth if the data prove to be better than the forecast, while the GBP / USD will turn south, for now - in the short term while.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

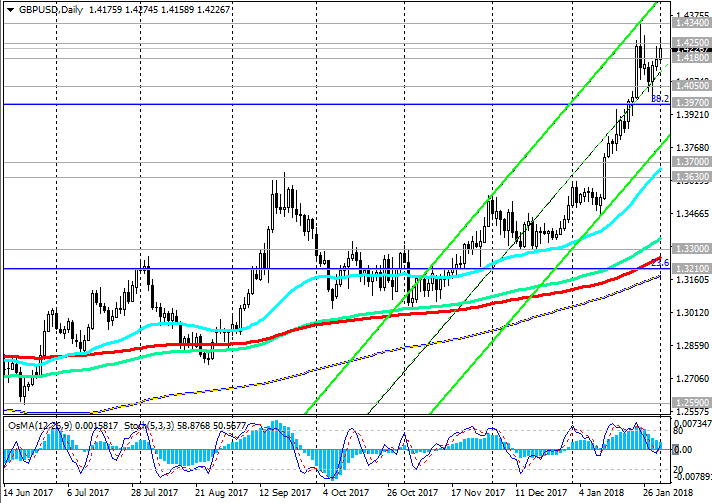

Support levels: 1.4200, 1.4180, 1.4050,

1.4000, 1.3970, 1.3800, 1.3700, 1.3630, 1.3550, 1.3420, 1.3300, 1.3210

Resistance levels: 1.4250, 1.4340, 1.4400, 1.4500, 1.4575

Trading Scenarios

Sell Stop 1.4160. Stop-Loss 1.4290. Take-Profit 1.4100, 1.4050, 1.4000, 1.3970, 1.3800, 1.3700, 1.3630, 1.3550, 1.3420, 1.3300, 1.3210

Buy Stop 1.4290. Stop-Loss 1.4160. Take-Profit 1.4340, 1.4400, 1.4500, 1.4575

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com