Instruction manual FoxTrotTWO EA

General information

FoxTrotTWO EA is a Scalper Expert Advisor intended for EURUSD. He is also available for other major pairs and cross currency pairs. Recommended timeframe is M15. FT2 trades a narrow range at night. At the top and bottom of the range, FT2 will try to generate trades in the opposite direction. To open suitable trades the Expert Advisor uses several indicators and analyzes several timeframes. But the trades are generated by price actions and are not opened by an indicator. FT2 requires a moderately volatile and a trend-free market environment.

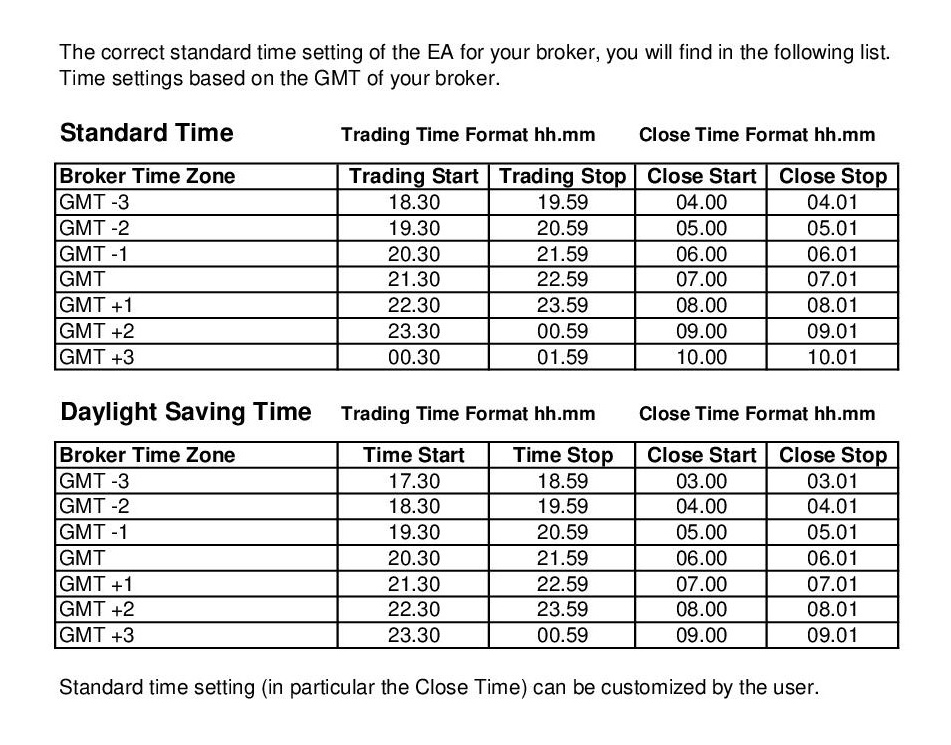

Ideal market conditions for FT2 with EURUSD are often in the time of 23.00 – 1.00 GMT + 2. This is the basis for the current default trading time from 23.30 - 0.59.

Recommendations

• Default Trading Time: Open Trades in first two hours after the end of NY Forex trading session.

• Trading Timeframe: M15.

• Trading Pairs: EURUSD, other pairs can be used after optimizing the parameters.

• Broker: It is recommended to use a low-spread broker and a VPS.

• Trading time: European Nights without (high-impact) news during the trading time. I recommend you do not trade on Friday PM and respective currency pairs relevant holidays.

• Minimum Deposit: 100 USD

• Minimum Leverage: 1:300

• Risk: 10-20 - low risk setting / 30-40 - middle risk setting/ 50-60 - high risk setting

Benefits

• Use of adaptive TP and SL values. That means, no rigid TP and SL values, but values adapted to the respective market situation.

• The EA is ideally suited to complement other Expert Advisors by using different Magic Numbers.

• No martingale, no grid, no hedging

• Equity protection by Stop Loss application

• Suitable for large and small deposits

Description FT2 input parameters:

== Trading Time Settings ==

• Trading Hour Start = 23 - hour (broker time), in which the EA starts the trading period

• Trading Minute Start = 30 - minute (broker time), in which the EA starts the trading period

• Trading Hour End = 0 - hour (broker time), in which the EA ends the trading period

• Trading Minute End = 59 - minute (broker time), in which the EA ends the trading period

• Close Hour Start = 9 - hour (broker time), in which the EA starts the closing period

• Close Minute Start = 0 - minute (broker time), in which the EA starts the closing period

• Close Hour End = 9 - hour (broker time), in which the EA ends the closing period

• Close Minute End = 1 - minute (broker time), in which the EA ends the closing period

== General Trading Settings ==

• Allowed Spread = 15.0 - maximum allowed spread (in points) to open a trade

• Slippage = 3.0 - maximum allowed slippage (in points) to open a trade

• Use Money Management = false - false means that EA trade with fixed Lot size; true means that EA trade with automatic Lot size via risk setting

• fixed Lot Size = 0.01 - if Use Money Management = false, then trade with fixed Lot size

• Risk = 30.0 - percentage of free equity to trade - Risk 30 means EA trade with 0.03 lot per 100 USD free equity, for example: free equity = 900 USD and Risk = 30, Lot size = 0.03 x 900 / 100 = 0.27

• max Lot size = 90.0 - maximum allowed Lot size to open trades

• Magic Number = 1 - magic number (each pair in the same account requires a different number)

• Order Comment = - here can you set your individual order comment

== Filter Settings ==

• Use Rollover Spread Filter - if true, then spread filter is active (new stop loss during rollover period)

• XMinutesBeforeRollover - change stop loss to a new value from x minutes before rollover period

• YMinutesAfterRollover - change stop loss to a new value until y minutes after rollover period

• relevant Spread Value in points during Rollover period - change stop loss value if market spread higher then this set spread value

• additional Stop Loss Value in points during Rollover period - new additional value of the stop loss in points during rollover period

It is possible to select a time period during the rollover time, in which the stop loss is briefly increased and if the market spread is exceeded by the desired amount. This can prevent unnecessary SL hits during rollover time and their sometimes volatile volatility and spread fluctuation.

• Use Pause Filter - if true, then the pause filter is active

• Pause between Trades in seconds - time interval between opening the 1st trade and 2nd trade

You can set a time span in seconds between opening the first and second trade. The higher this time, the less and less similar trades will be opened.

• Use Swap Filter = true - if true, then the swap will be taken into account in the trading

• Minimum Swap = -7.5 - choose minimum swap value

• YMinutesRange = 30 - amount of time in minutes to midnight, in which the swap should be taken into account

Example: In the Symbols tab of the MT4 terminal, right-click on the symbol EURUSD. Then press "Specification". Now you see the respective long and short swap values for EURUSD. The long swap is currently -6.94 for Tickmill and ViproMarkets. You must set the swap filter value lower in the EA setting. For this example, -7.5. All normal negative swap values are then taken into account during trading. On a triple swap day (usually Wednesday), the negative swap is automatically tripled. Then, 3 x -6.94 = -20.82. Thus, the permitted swap value is -7.5 > -20.82. There will be no buy trades opened 30 minutes before the Rollovertime (0.00). With YMinutesRange, you can set the time how many minutes before 0.00 no trades with too high a negative swap should be opened.

• Filter 1 = 16 - filter 1 period

• Filter 1 Value = 50 - filter 1 value

• Filter 2 = 12 - filter 2 period

• Filter 2 Value = 50 - filter 2 value

• Filter 3 = 10 - filter 3 period

• Filter 3 Value = 70 - filter 3 value

Filters 1-3 are different trend filters. The lower the trend values of the filters, the less trendy is the market. The higher the filter period, the more accurately the trends are determined.

• Filter 4 = 7 - filter 4 period

• Filter 4 Value min = 30 - filter 4 minimum value in Points (Filter 4 < value = there are no trades executed)

• Filter 4 Value max = 300 - filter 4 maximum value in Points (Filter 4 > value = there are no trades executed)

• Filter 5 Value min = 30 - filter 5 minimum value in Points (Filter 5 < value = there are no trades executed)

• Filter 5 Value max = 350 - filter 5 maximum value in Points (Filter 5 > value = there are no trades executed)

The filter 5 is another filter, which helps to find ideal market conditions for trading with FT2. He will mainly improve the trading on Monday AM, because if the setting is correct large weekend GAP can be filtered out.

== Trade Management ==

• Deltafactor = 0.3 - Determines the distance from the upper and lower end of the range for Strategy2. The factor depends on the filter 4.

• TP Factor = 0.6 - factor to determine the Take Profit. Factor depends on the filter 4

• SL Factor = 4.5 - factor to determine the Stop Loss. The factor depends on the filter 4

• TP Factor2 = 0.6 - factor to determine the Take Profit2. Factor depends on the filter 4

• SL Factor2 = 4.0 - factor to determine the Stop Loss2. The factor depends on the filter 4

The following example illustrates the relationship between given market volatility and the TP and SL values.

Volatility is limited in standard setting by Filter 4 Value min with 30 points and Filter 4 Value max with 300 points. Example: Current volatility is 40 points. TP Factor = 0.6 and SL Factor = 4.5 If a trade is now generated, the EA determines the following TP and SL values. SL = 40 x 4.5 = 180 points and TP = 40 x 0.6 = 24 points The TP value can further vary. If parameter value "TP min in Points" is 25, then 25 is greater than the above determined TP value. The EA therefore takes 25 points as a TP value. But here there is no further variation with SL min or max in Points!

• max allowed SL Value in Points = 160 - If the SL value, calculated on the basis of the given volatility, appears too high, the SL value can be limited with this parameter.

• max allowed TP Value in Points = 40 - If the TP value, calculated on the basis of the given volatility, appears too high, the TP value can be limited with this parameter.

• Use Safe Mode = true - false means trade without Safe Mode indicator; true means trade with Safe Mode indicator

Usually, opened Trades can be closed if trades hit TP, SL or Close time values. But is SafeMode active, the integrated SafeMode indicator terminates the trade prematurely if the trade is moving tendencially in the wrong direction. If the trade slowly tends in the wrong direction, the open trade is closed if the price touches the edges of the indicator used. Bollinger bands is the indicator in Timeframe M5. The default period is 20. If the period is increased, the trades with active SafeMode will tend to close later. When the period is reduced, the trades tend to close sooner.

Please note: The SafeMode tends to prevent some SL hit, but it also tends to prevent the possibility of hitting a TP later in a recovery.

• Safe Mode Indicator Period = 20 - SafeMode indicator period

• Update TP if lower then TP min - if true, then take profit min value will be readjusted, if the executed take profit value is below the calculated take profit min value

TP min update if, due to slippage and/or delayed order execution, the executed TP min is lower then the originally desired one. If so, the TP min is readjusted.

== Trading Day Settings ==

• MondayAM= true - if true, then trading on Monday AM is possible; if false, then will be no trades executed on Monday AM

Please note: Trading on Monday AM promises more profitable trades, but is also more risky. The volatility is increased due to a possible Weekend GAP. Increased volatility tends to mean higher TP and SL values of the open trades. Anyone who wants to reduce the risk can turn off trading on Monday AM.

• MondayAMStartTime = 00:00 - start time trading period Monday AM

• MondayAMEndTime =12:00 - end time trading period Monday AM

• MondayPM = true - if true, then trading on Monday PM is possible; if false, then will be no trades executed on Monday PM

• MondayPMStartTime = 12:00 - start time trading period Monday PM

• MondayPMEndTime = 23:59 - end time trading period Monday PM

The settings for Tuesday, Wednesday and Thursday are identical

• FridayAM = true - if true, then trading on Friday AM is possible; if false, then will be no trades executed on Friday AM

• FridayAMStartTime = 00:00 - start time trading period Friday AM

• FridayAMEndTime = 12:00 - end time trading period Friday AM

• FridayPM = false - if true, then trading on Friday PM is possible; if false, then will be no trades executed on Friday PM

• FridayPMStartTime = 12:00 - start time trading period Friday PM

• FridayPMEndTime = 23:59 - end time trading period Friday PM

== Newsfilter Settings ==

• UseNewsFilter = true - if true, then news filter is active

• CloseAfter_BeforeMins = false - if true, then already open trades are closed at time xBeforeMins and new trades will not be opened until y-AfterMins; if false, then already open trades remain open at the time x-BeforeMins and (only) new trades will not be opened until y-AfterMins

• SymbolsToCheck = EUR, USD - news relevant pairs can be set individually

• UseHighImpact = true - if true, then High Impact News will be considered

• HighBeforeMins = 120 - suspend the trading from x minutes before the High Impact News

• HighAfterMins = 120 - suspend the trading until y minutes after the High Impact News

• UseMediumImpact = true - if true, then Medium Impact News will be considered

• MediumBeforeMins = 60 - suspend the trading from x minutes before the Medium Impact News

• MediumAfterMins = 30- suspend the trading until y minutes after the Medium Impact News

• UseLowImpact = false - if true, then Low Impact News will be considered

• LowBeforeMins = 30 - suspend the trading from x minutes before the Low Impact News

• LowAfterMins = 30- suspend the trading until y minutes after the Low Impact News

The news filter has nothing to do with the basic strategy of FT2. Trading with FT2 as well as other night scalpers during relevant news can be unfavorable and negatively impact performance. The news filter helps to prevent trading with FT2 during relevant news automatically.

For the current default values in the news filter there are so far no experience values. A previous testing of the news filter with backtest is not yet possible. I am working on a solution to successfully test the news filter in the future.

For the news filter relevant for me are medium and high impact news. This news receives the news filter from FT2 from the news calendars linked to the EA. This is the economic news calendar of www.investing.com.

Why did I choose these default values? High Impact News with period of prevention of trading 120 minutes before the release of the news until 120 minutes after the release of the news. I think, that after 120 minutes enough time has passed that the news is priced in the chart and the market has normalized again. If there are still strong movements (volatility or trend), the other filters will continue to prevent the opening of trades after the end of the period. 120 minutes before the news should be published, no trades should be opened. There is also the possibility that the then open trades are still open at the time of the news.

The explanations are similar for the selection of the values for Medium Impact News. Low Impact News during the trading time of FT2, I think can be easily ignored.

Symbols to Check: Relevant are the news about the respective currency pair. This means EURUSD relevant news about EUR or USD. It is also possible to prevent trading during news to other currencies. For example, if during the trading period or afterwards very important news are to JPY and CNY. It is possible, that such news also affects USD Pairs.

The time span of the news filter and the currencies can be adjusted by each user.

The following graph illustrate how the economic news calendar of investing.com is inserted into the MT4 terminal.

F. A. Q.

1. Question: No results in the Backtest? Answer: Default value "Allowed Spread" in EA is 15 points. Spread value in MT4 Strategy tester must not be "current". The value must be less than 15 points.

2. Question: EA display „Open D1 Chart“. What should i do? Answer: Nothing. You do not have to open a D1 chart separately. The EA automatically determines the day of the week based on the D1 data in the background.

3. Question: How can news and special events affect the performance of FT2? What is to be considered? Answer: Important news during the trading period can adversely affect the performance of FT2. This also means that avoiding trading during important news can improve the performance of FT2! I use the economic calendar from investing.com. For me news are relevant just before, during and shortly after the trading time 23.30-0.59 GMT + 2. I mean in particular all 3 Bulls (high impact) news and all 2 Bulls News (medium impact), which are often speeches by FOMC Members. If are such important news within the described time span, then I turn off the EA during this time. I also avoid trading with FT2 during holidays. For example: GBPUSD, holidays are in Great Britain or in the USA I switch off the EA on that day.

4. Question: Why does FT2 generate trades with high SL and low TP values? Answer: As with many night scalper EA is the high ratio of TP to SL strategy-related. Small TP values because the range is tight at night. Larger SL values, because not every open trade moves immediately in the desired direction. The trade needs a "certain space" in order to have the opportunity to move in the right direction. Another reason is the higher spread values at night. There is a higher volatility in the spread, especially at midnight broker time (GMT + 2). If the SL values are too small, it will often happen that the open trades are stopped out. To avoid this unnecessary stop-out, the SL values are higher.

5. Question: Why do some of my trades differ from the trades of the comparison signals? Answer: With Forex Business, there is no uniform pricing for individual currency pairs. This means each broker generates (slightly) different OHLC charts. Smallest differences in the OHLC charts of the various brokers or various server from same broker can sometimes decide whether trades are triggered or not. One day once a broker has more trades, another day another broker generates more or less trades. This can vary slightly and is balanced in the long term between the different brokers.

6. Question: You mention to only trade on the evenings where there no high or medium impact news during the trading time. Is this for pair EURUSD only news for USD or EUR? Answer: Correct, in particular, I mean the important news to the respective pair. E.g. all USD and EUR News for EURUSD. But you are right, maybe it is important to consider news about other currencies. For example, important Japanese or China News at night can still affect open trades.

7. Question: Is VPS really necessary? I mean how important is latency to the performance of the EA? Answer: VPS is not necessarily important, but advantageous. I also use a normal german VPS provider. My latencies of the different brokers are between 25ms and 100ms. You see, normally latency is completely sufficient.

8. Question: If I want to optimize FT2 further. How do I proceed? Answer: A further parameter optimization of the EA is possible. Default setting is good, but there are certainly better and for each user individually more suitable settings. With the further optimization, I would start with the trade management, which means with the change of TP, SL and delta factor and their effects on the results

such as number of trades, drawdown, profit factor, profit or winning trades in%. Furthermore, one can improve the appropriate market conditions by changing the values for the filter 1 - 5. And in the end you could still vary the trading time and close time to get better results.

9. Question: How can I learn more about trading with FT2? Answer: Current informations and an exchange of trading experience with FT2 or Nightscalping in general can be obtained quickly and in time in my WhatsApp group. You can send me your mobile number and I will add you to the group. If further questions are open, you can also write me via MQL5.

The operating instructions will be extended and supplemented in undefined intervals.

Date: 29.05.2018