World stock indexes on Wednesday continued to rise. On the eve, the major US stock indices Dow Jones Industrial Average, S & P 500 and Nasdaq Composite updated record highs. The Dow Jones Industrial Average rose 0.7% to 23590, S & P 500 added 0.7%, Nasdaq Composite rose 1.1%.

The leaders of growth were shares of technology companies. Apple's shares rose 1.9%, International Business Machines shares rose 1%, Microsoft shares rose 1.4%. The shares of these three technological giants made the largest contribution to the growth of DJIA. The shares of retailers also significantly strengthened. "Dollar Tree" went up by 2.4%, after the profit and proceeds of this discounter exceeded expectations. Shares of Hormel grew by 3.3%.

Yesterday's rally completely offset the losses suffered by the indices in the last two weeks. This points to the strength of growth, despite concerns about the high ratings and unclear prospects for the tax reform proposed by the Republicans.

Only a large increase in rates or a decline in the economy, according to economists, could lead to a more significant decline in the American stock market. In the next 6-12 months, this is not expected, therefore, most likely, the bullish trend will continue.

On Wednesday, trading on the stock markets is sluggish in anticipation of a weekend in the US on Thursday, and a shortened one on Friday.

Investors analyzed the statement of Fed Chairman Janet Yellen, who said that she would withdraw from the Board of Governors of the Central Bank, as soon as Jerome Powell will replace her at the post in February.

Today Janet Yellen delivered a speech at the business school at New York University, which investors regarded as soft. "We expect inflation to rise (to the target level) in the next one or two years, but I have to say that I'm not sure about it", Yellen said.

"We have almost reached full employment", Yellen said. The unemployment rate in October was 4.1%, becoming the lowest since December 2000. The Fed is facing a problem of low inflation for most of this year, despite the growth of the economy and a strong labor market.

Yellen did not comment on the immediate prospects for monetary policy. The probability of a rate hike in December is above 90%, according to the CME Group. The last time the Fed raised rates in June, to the range of 1% -1.25%. At its meeting on September 19-20, the Fed signaled another increase in rates this year. It is expected that in 2018, the Fed will raise 3 or 4 times.

As Janet Yellen previously stated, the rate hike speaks of the strength of the American economy. It is unlikely that a gradual increase in rates will cause a reversal of the bullish stock market. On the contrary, the banking sector of the economy will benefit from this.

Today, investors will focus on the publication (at 19:00 GMT) of the protocol from the November meeting of the Fed (minutes FOMC). Investors will carefully study the text to understand the outlook for the current Fed policy and the increasing of the interest rate in the US. Volatility during the publication of the protocol can significantly increase, especially against the backdrop of low trading volumes on the eve of the celebration of Thanksgiving Day in the US on Thursday.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

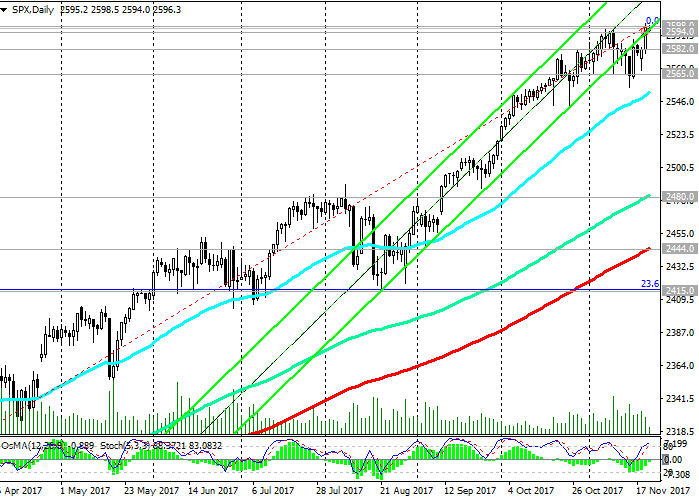

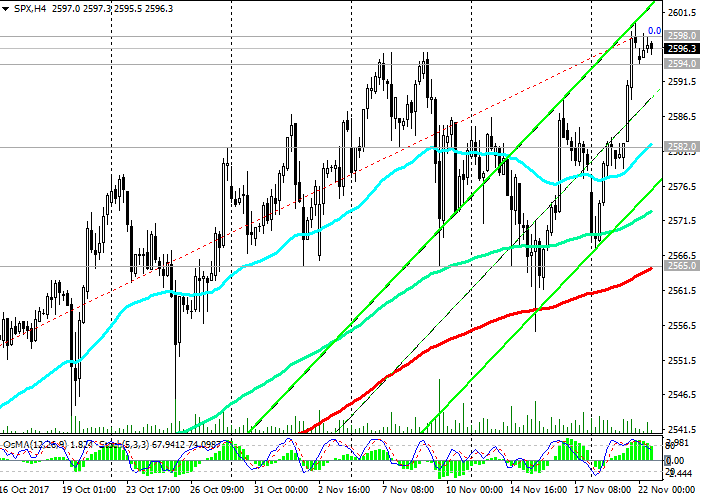

Support levels: 2594.0, 2582.0, 2565.0,

2500.0, 2480.0, 2444.0, 2415.0

Resistance levels: 2598.0, 2600.0, 2650.0, 2700.0

Trading Scenarios

Sell Stop 2592.0. Stop-Loss 2600.0. Objectives 2582.0, 2565.0, 2500.0, 2480.0, 2444.0, 2415.0

Buy Stop 2600.0 Stop-Loss 2592.0. Objectives 2650.0, 2700.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com