The focus of the traders this week will be the meetings of the central banks of the United States and Japan. Wednesday (18:00 GMT) will publish the Fed's decision on the interest rate. Also, economic forecasts of the Federal Reserve will be presented, including for 2020. At 18:30 (GMT), the FRS press conference will begin, and investors will closely follow the speech of the Fed Chairman Janet Yellen to catch signals about further plans by the Fed to tighten monetary policy. According to CME Group forecasts, the probability that interest rates will remain unchanged is 98.6%.

Meanwhile, the US dollar / Japanese yen pair is trading today with an increase of 0.5%, at 111.30 after reaching the highest level in almost eight weeks at 111.41. Concerns about political risks have weakened.

On Friday, North Korea launched another missile, but on Monday the market ignores this fact. In addition, in Japan today is a state holiday, and the market is experiencing a reduction in liquidity and trading volumes on the yen.

On Thursday (02:00 GMT) will be published the decision of the Bank of Japan on the interest rate. It is widely expected that the main interest rate in Japan will remain at the same level (-0.1%).

The Bank of Japan adheres to an extra soft monetary policy. As repeatedly stated by the representatives of the bank, in order to accelerate inflation, which is near zero values, the Bank of Japan can expand the measures of quantitative and qualitative easing.

Nevertheless, since the end of 2016, the yen has appreciated significantly against the dollar, including against the backdrop of investors buying yen as a safe haven.

This worries the monetary authorities of Japan, whose economy is focused, mainly, on the export of high-tech products.

At 06:30 (GMT) on Thursday, the Bank of Japan will hold a press conference. The head of the Bank of Japan Kuroda will present to investors the CBR's position on the issue of monetary policy and will assess the prospects for economic activity in the country and the course of monetary policy.

In this regard, the pair USD / JPY is expected to increase volatility on Wednesday from 18:00 (GMT) and on Thursday from 02:00 to 07:00 (GMT).

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

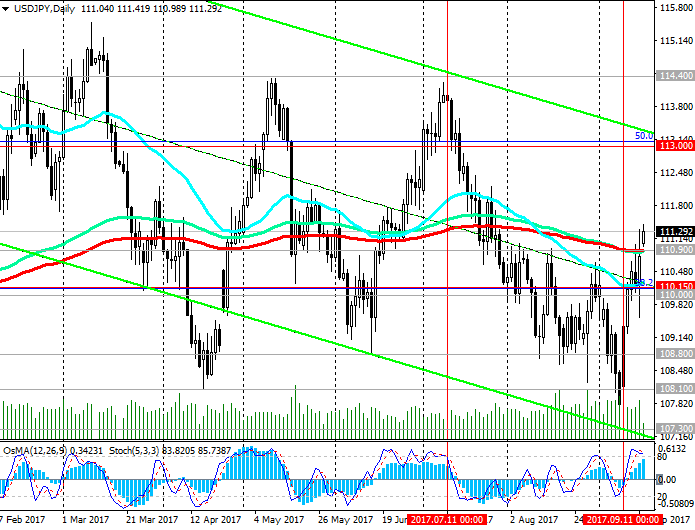

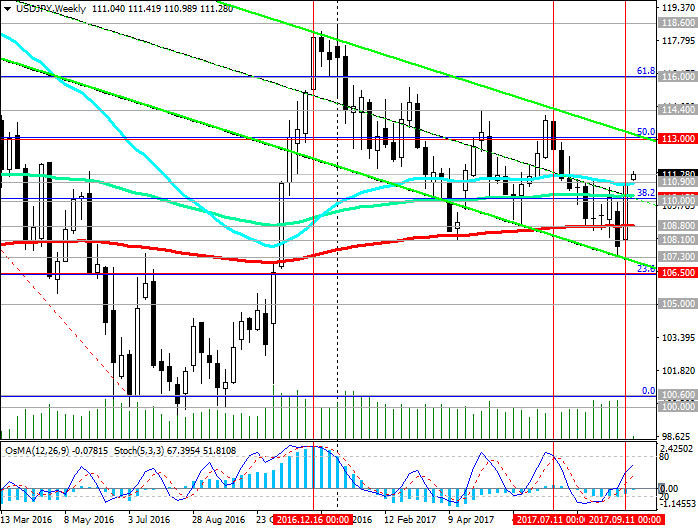

A week earlier, amid growing tension between the United States and North Korea, the pair USD / JPY fell to the support level of 107.30 (the lows of September and the year, as well as the bottom line of the descending channel on the daily chart).

Nevertheless, the market ignored the next launch of the North Korean missile last Friday. As a result, USD / JPY broke through resistance level 110.15 (EMA50 on the daily chart, Fibonacci level 38.2% correction to the pair growth since August of last year and 99.90 level), and today it makes an attempt to gain a foothold above the important level of 110.90 (EMA200, EMA144 on the daily chart ).

Today, the dollar demonstrates multidirectional dynamics in the foreign exchange market.

Nevertheless, the indicators OsMA and Stochastics on the 4-hour, daily, weekly charts went to the side of buyers.

If the pair USD / JPY continues to grow, the immediate target will be level 113.00 (50% Fibonacci level and the top line of the descending channel on the daily chart).

The reduction scenario implies the return of USD / JPY to the level of 110.15 and the resumption of the decline in the downlink on the weekly chart, the lower limit of which runs near the level of 106.50 (Fibonacci level of 23.6%).

Support levels: 110.90, 110.15, 110.00, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

Resistance levels: 112.00, 113.00, 114.40, 115.00, 116.00

Trading Scenarios

Buy Stop 111.50. Stop Loss 110.80. Take-Profit 112.00, 113.00, 114.40, 115.00, 116.00

Sell Stop 110.80. Stop Loss 111.50. Take-Profit 110.15, 110.00, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com