Trading recommendations

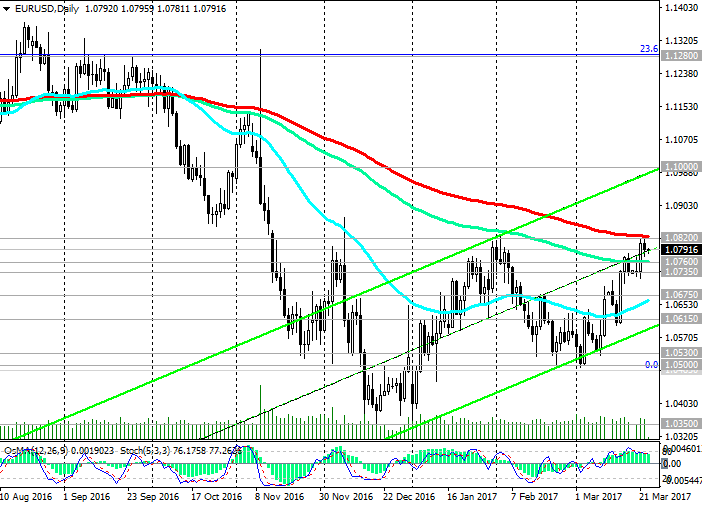

Sell Stop 1.0770. Stop-Loss 1.0830. Targets 1.0760, 1.0735, 1.0675, 1.0615

Buy Stop 1.0830. Stop-Loss 1.0770. Targets 1.0850, 1.0890, 1.0940

Overview and Dynamics

Last week, as you know, at the end of two day meeting of the Fed raised short-term interest rates 25 basis points to 0.75% -1.00% range. In this case, the Fed pointed to the likelihood of the two rate hikes this year. Fed comments did not meet expectations of investors, who were counting on 3-4 fold increase in the rate.

In response to the Fed's comments that the Fed showed inclination for a more loose monetary policy, and contrary to the decision to raise rates, the greenback fell sharply on the foreign exchange market. The WSJ dollar index, which tracks the US dollar's value against a basket of 16 major currencies, fell on Wednesday by 1.2%, to 90.82, which was its strongest one-day fall since January 17.

Investors who have been actively investing in the safe-haven yen, gold, took up negative attitude towards the dollar. The EUR / USD which received additional support after the results became known primaries in France, where the leader, former Minister of Economy, Industry and Digital Affairs of France, Emmanuel Macron, a supporter of euro integration. The leader of the political party "National Front" Marine Le Pen, which is against the euro integration and for exit of France's from NATO, again moved to 3rd place.

Among the investors became more euro buyers than before, and there are proponents of the view that the ECB will soon turn off the program of quantitative easing, QE in the Eurozone.

So, on Monday, Bundesbank President Jens Weidmann said the ECB should gradually start to move away from loose monetary policy, which leads to inflation.

Last week was presented the February data on inflation, which for the first time in four years showed accelerating price growth towards the ECB target (below 2.0%). At a recent press conference ECB President Mario Draghi said "there is no more sense of further action urgent need" to deal with the extremely slow pace of inflation. However, the consensus among the leaders of the ECB on this matter has not. Thus, the head of the Bank of France said Wednesday that "the time is not to fold stimulate the economy."

On Friday at 09:00 (GMT) will be presented the most important data for the level of business activity in key sectors of the economy of the Eurozone in March. There is expected growth of business activity in the services sector and the manufacturing sector of the economy. Earlier on Friday, also should pay attention to the publication at 06:30 and 08:30 (GMT) on the French GDP data for the first quarter and the index of business activity in Germany in March. Thus, on Friday published a number of important macro data for the Eurozone, which will cause a surge in volatility and trading in euro, including a pair of EUR / USD.

In the center of the attention of investors today will be the speech at 12:45 (GMT) of Fed chief Janet Yellen. In addition, if she will give a signal to accelerate the pace of increase in US interest rates, the dollar may be supported in the currency market.

Technical analysis

The EUR / USD rose sharply this month. Despite the interest rate rise in the US dollar weakened significantly in the currency market. The growth of EUR / USD pair reached March nearly 230 points. Indicators OsMA and Stochastic on the daily, weekly, monthly charts were developed on long positions.

The pair came close to the strong resistance level 1.0820 (EMA200 on the daily chart). However, to break through the 1.0820 level EUR / USD pair will not be easy. Any change in the Fed’s sentiment quickly returns the positive momentum that will lead to its growth over the currency market.

In this case, reduction in the EUR / USD below support levels 1.0760 (EMA144 on the daily chart), 1.0735 (EMA200 the 1-hour chart) return it to the downtrend. Nearest goal - to support levels 1.0675 (EMA200 and the lower line of the rising channel on 4-hour chart), 1.0615 (the lower line of the rising channel on the daily chart).

Only in the case of consolidation above the level of 1.0820 is possible to speak about the future growth of the EUR / USD in the rising channel on the daily chart, the upper limit of it is held near the level of 1.1000.

Uncertainty about the upcoming elections in France will hold back until the euro and the pair EUR / USD.

Support levels: 1.0760, 1.0735, 1.0675, 1.0615, 1.0530, 1.0485

Resistance levels: 1.0820