Trading recommendations

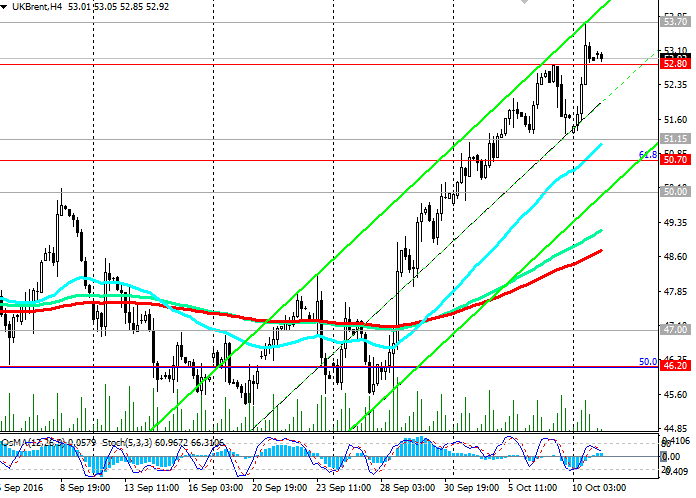

Sell in the market. Stop-Loss 53.80. Take-Profit 52.80, 51.15, 50.70, 50.00, 47.00, 46.20

Buy Stop 53.80. Stop-Loss 52.60. Take-Profit 55.00, 56.00

Technical analysis

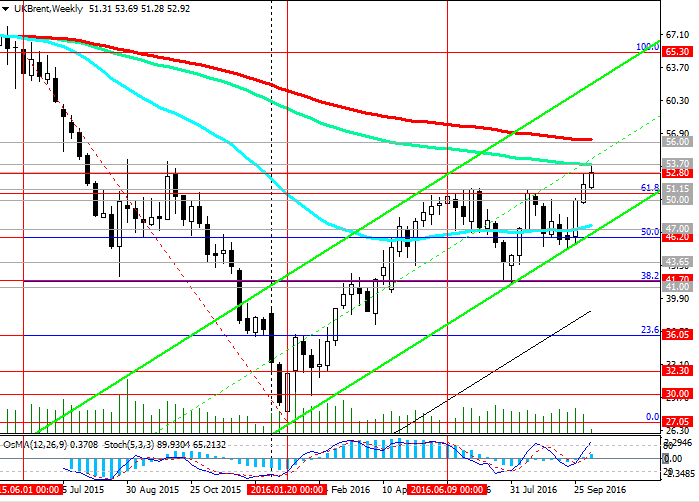

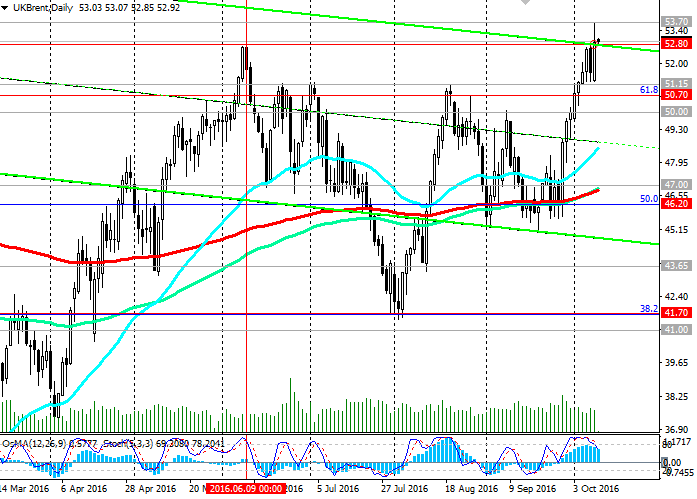

The price of Brent crude oil reached new yearly highs yesterday near the mark of 53.70. The last time prices were at these levels in October 2015 and in June 2016. A mark of 53.70 and the resistance level passes (EMA144 on the weekly chart). In the case of the continued growth of oil prices on the price of Brent crude will rise to the level of 56.00 (EMA200 on the weekly chart).

Indicators OsMA and Stochastic on the weekly chart point to continued growth. But on the 4-hour and daily chart indicators are starting to turn around on short positions, which may indicate a probable correction after such a rapid growth. The nearest support levels in the case of corrective decline will be the levels 51.15 (July highs of August), 50.70 (Fibonacci level 61.8% decrease from the level of 65.30 to lows near the 2016 mark of 27.00). In case of breaking the support level 50.00 price risk decreased to the level of 47.00 (EMA200, 144 on the daily chart). Break of the support level 46.20 (50.0% Fibonacci level) can determine the beginning of a new round of easing oil prices. The nearest targets will be the levels of 43.65, 41.70 (38.2% Fibonacci level and the lows of July / August).

Alternative Scenario – is an increase to the level of 56.00 (EMA200 on the weekly chart).

Support levels: 52.80, 51.15, 50.70, 50.00, 47.00, 46.20, 45.00, 43.65, 41.70, 41.00

Resistance levels: 53.70, 55.00, 56.00

Overview and Dynamics

Once the OPEC countries failed to reach a preliminary agreement at the meeting in Algiers last Wednesday, oil prices began to rise, and came close to the level of 52.00 dollars per barrel of Brent crude oil yesterday. OPEC agreed to cut production to 32.5 - 33 million barrels per day, reducing it to 1% - 2% from current record levels. Meanwhile, after yesterday's speech Russian President Vladimir Putin at the World Energy Congress in Istanbul, the price of Brent crude soared to a mark of 53.70. Putin said at an energy conference, said that Russia "is ready to join the joint efforts to curb oil production," adding that the freeze or reduction in oil production is "the only way to save the stability of the oil and gas sector."

Futures for Brent crude on the ICE Futures Europe rose 2.3%, to 53.14 dollars per barrel. Against the background of the energy sector stock price US stocks rose on Monday. Dow Jones Industrial Average index rose 0.5% to 18329 points, S & P500 - on 0,5%, Nasdaq Composite rose 0.7%. Subindex oil and gas sector as part of S & P500 gained 1.6%.

Energy Minister of Saudi Arabia Khaled Al-Falih said on Monday, he is optimistic about the future and believes that the major oil producers will be able to reach an agreement on limiting production in November. According to him, "we can not exclude" the likelihood that oil prices could rise to $ 60 per barrel.

On Wednesday, 20:30 (GMT) American Petroleum Institute (API) will publish its report on the change in US oil inventories last week. It is likely that the US oil reserves decline. Because of the "Matthew" hurricane in the United States could be a disruption of oil supply and discharge. If US oil inventories indicate their reduction, the price of oil on a wave of optimism of investors could soar above $ 53.70 (yesterday's high) and go to the markings near the level of 56.00 dollars per barrel of Brent crude oil. On Thursday, the data will be published by the International Energy Agency and the US Department of Energy (14:30 GMT). It is expected the high volatility in the oil until the end of the week prices when at 16:00 in favor Fed chief Janet Yellen, and at 17:00 will be a report oilfield services company Baker Hughes on the number of active drilling rigs in the United States. The report is an important indicator of the activity of the oil sector of the US economy and significantly affects the quotations of oil prices. The current value of the index – is 428 active rigs.

In the meantime, more active growth of prices for oil prevents the strengthening of the dollar in the foreign exchange market and there is still a significant excess of oil supply over demand in the world.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.