Carney tries to say that they are ready to do everything, but this comes on the background “risks materializing” in the few days after Brexit.

So, should we be find comfort in Carney message for the future or listen to his dark assessment of the present? Carney refrains from calling a recession, but does hint about it.

Carney Highlights

- Growing evidence that the referendum has delayed major investment decisions

- Banks are much better capitalized than before the Lehman crisis and respond well to volatility.

- Sterling adjustment has been significant, necessary

- Slower credit growth will come from demand, not supply.

- Sterling fall will help exporters

- BOE will ensure banks don’t use this flexibility to boost bonus payments, or dividends

- No immediate change to UK financial regulations until the actual Brexit happens

- Cannot fully offset the economic and market volatility

- We have a plan, and it is working

- Businesses who want to seize the opportunities in the post Brexit world will be supported by the financial sector.

Bank of England Governor Mark Carney makes his third public appearance after the historic Brexit vote. This time, it is a scheduled event – following the release of the Bank’s Financial Stability Report.

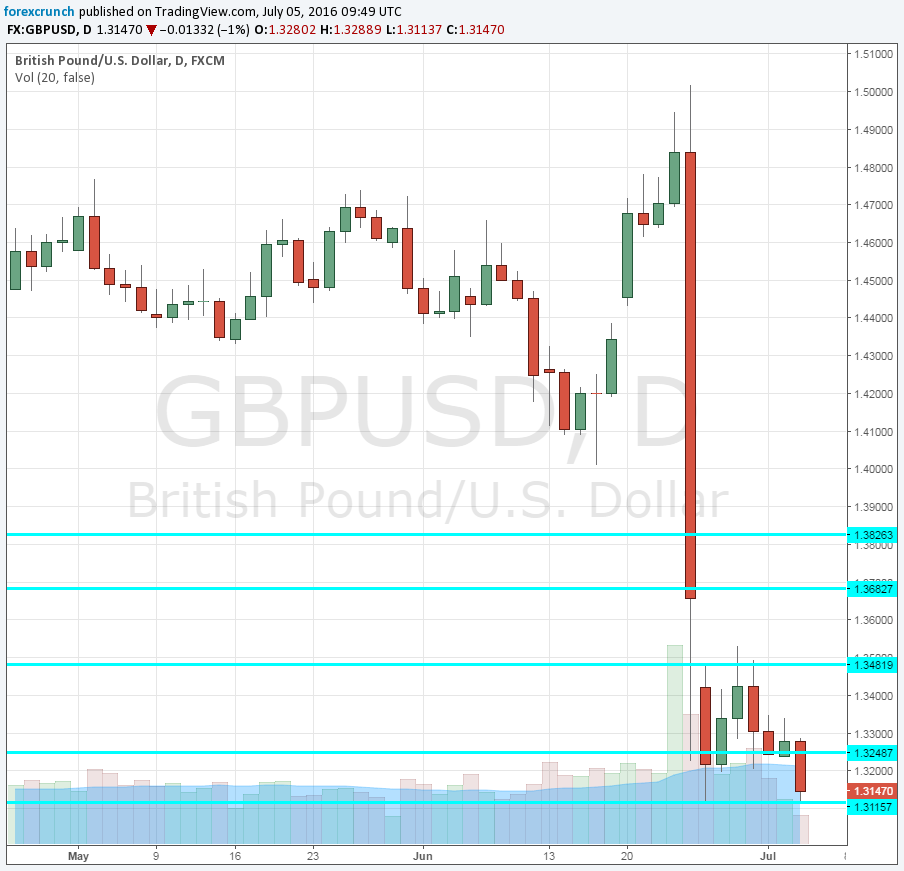

GBP/USD has already dipped to new 31 year lows at 1.3113 before Carney began talking.

In the report itself, the BOE reported that it is cutting regulatory buffers but will increase bank lending by up to 150 billion. They also reiterate their readiness to take further action tp cushion any fall in credit.

In addition, they already see the results of Brexit:

There is evidence that some risks have begun to crystallise. The current outlook for UK financial stability is challenging

There are many factor weighing on sterling: 3 big Brexit pressures on the pound – GBP/USD back to low range