We’ve got a couple of central bank statements this week, one of which is the BOC monetary policy decision. If you’re thinking of grabbing pips during this event, make sure you take note of these factors first.

1. Economic data turning a corner?

If you’ve been keeping track of my monthly economic roundups, you’ve probably got a pretty good idea about how Canada is doing. In my latest Forex Snapshot, I’ve mentioned that the latest batch of GDP figures have reflected a slowdown but that consumer spending and business conditions are starting to pick up.

Also, last week’s jobs release printed a huge upside surprise as the Canadian economy added 40.6K jobs in March versus the projected 10.4K gain. This was actually enough to bring the unemployment rate down from 7.3% to 7.1% and confirm that Canada is starting to reduce its dependence on the energy industry.

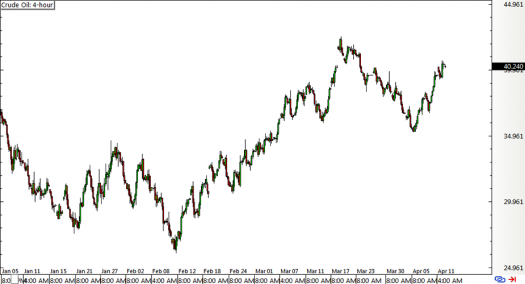

2. Crude oil prices have been climbing.

It’s no secret that a hefty chunk of Canada’s trade revenues comes from the oil industry so the recent rally in oil prices could usher in a more positive outlook for growth. Over the past few weeks, “black crack” prices were lifted by a reduction in stockpiles, decline in U.S. oil rig counts, and positive expectations for this month’s OPEC meeting.

Crude Oil 4-hour Chart

3. Previous BOC announcements were optimistic.

Several market watchers had been expecting the BOC to cut interest rates in their earlier statements, especially since the Canadian central bank hasn’t been one to shy away from pre-emptive stimulus efforts. Recall that BOC Governor Poloz and his buddies in the policymaking committee decided to announce a couple of surprise rate cuts last year to cushion the Canadian economy from potentially worse repercussions of the oil slump.

However, even with another oil price slide during the first few months of 2016, the BOC seemed to maintain a glass half-full outlook. In their January statement, BOC policymakers acknowledged the downturn in the energy industry but saw the silver lining in the Loonie’s depreciation and its positive impact on domestic inflation. During their March announcement, the BOC noted that the risks are roughly balanced and maintained an upbeat outlook for domestic growth and employment.

4. USD/CAD technical levels

At the moment, USD/CAD is treading around a long-term area of interest between the 1.2800 to 1.3000 levels. The pair has fallen by approximately 1,700 pips from its February highs so there’s a chance that the BOC might have a thing or two to say about Loonie appreciation and its impact on export activity and inflation.

USD/CAD 4-hour Forex Chart

All in all, the BOC isn’t exactly widely expected to make any interest rate changes for the time being since green shoots can be seen in the Canadian economy and crude oil has staged a pretty solid comeback. Of course risks to global growth remain and financial market volatility might still be an issue, but their overall tone could be a positive one.