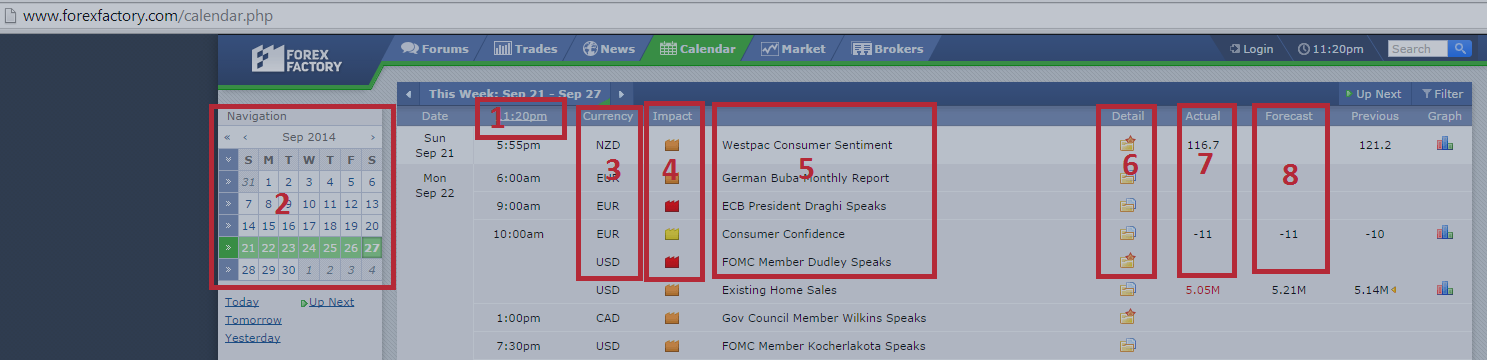

Forex Factory is probably one of the best known calendars available to retail traders, and this post will help you to understand how to use this tool in your trading.

The calendar itself identifies all of the economic announcements that are due to be released throughout the month and also helps to determine which announcements will have the most impact on the markets, and what traders are expecting from those announcements.

So how can you use this to actually make some profit?

The first thing to do is focus on those announcements that can be expected to cause a high impact on the markets, because this is what will cause moves worth trading.

Once you have identified all of the high impact announcements for the day, the next step is to simply monitor the expected number and how that relates to the number that is actually released; it is this possible deviation from the expected number that holds all of the potential.

The calendar itself gives a handy description of each announcement and how the possible deviations will impact the currency of the country in which the announcement is being made.

Next, you need to determine what the expected effect on the price will be should the number come out better or worse than expected. If for example, the number is better than the expected number, then traders will want to buy more of that currency and if the news is worse, than expected traders will be looking to sell it.

Once the news is released and you have your deviations you can then have a very good idea about the short term sentiment for that currency, and look for trading set ups that correspond with that sentiment.

If the news brings a bullish sentiment, make sure that the next signal you take is a long trade and vice versa for bearish sentiment.

If you adhere to these simple steps when trading the markets it will also protect you against false moves and those seemingly random times when the price just blows your trade out for a loss with a sharp move. Most of these ‘random’ moves are often caused by deviating news events so keeping a close eye on them can pay off.

With time you will become proficient at following these economic announcements and predicting their impact on the markets, which will only improve your trading results in the long run.