AUD/USD: if the price goes above the level of 0.7445? Overview and Dynamics on 07/06/2016

Trading recommendations

Sell Stop 0.7360. Stop-Loss 0.7410. Take-Profit 0.7300, 0.7260, 0.7200, 0.7140, 0.7100, 0.7000

Buy “in the market”. Stop-Loss 0.7390. Take-Profit 0.7500, 0.7545, 0.7600, 0.7720, 0.7820

Technical analysis

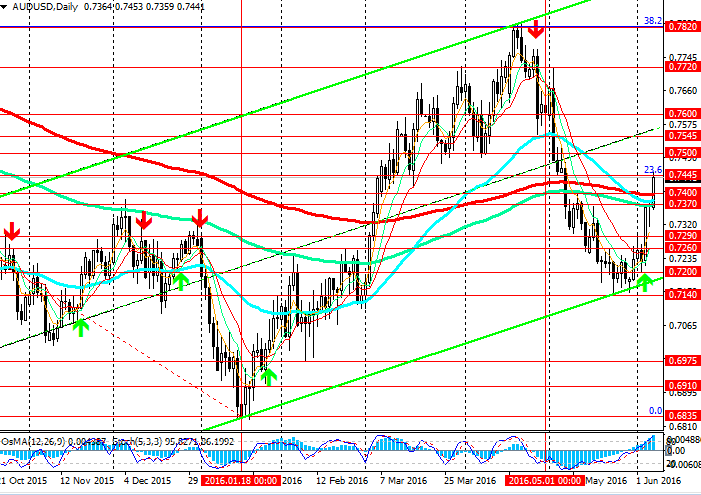

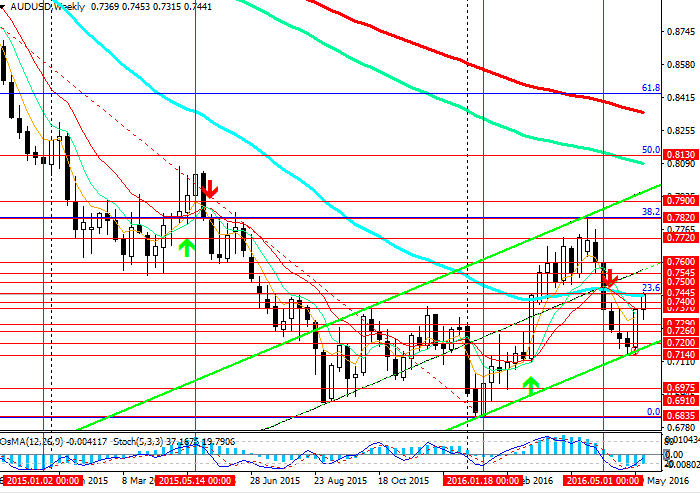

Against the background of disappointing data on non-farm employment USA, published on Friday, as well as the RBA's decision to keep interest rates in Australia, unchanged at 1.75%, the pair AUD / USD is very close to the resistance level 0.7445 (23.6% Fibonacci level correction to the wave of decrease in pair from July 2014).

Earlier, the AUD / USD has found support near the level 0.7200 (the lower line of the rising channel on the weekly chart) on the strong Australian GDP data for the first quarter.

Today, the pair broke important resistance levels 0.7370 (EMA144), 0.7400 (EMA200 on the daily chart) and the positive dynamics of growth is maintained.

Australian currency and the oil and gas sector of the Australian economy is also supporting the growing price of oil.

Since early June the pair AUD / USD managed to recover already half the losses of the previous month, when in early May, the RBA cut interest rates for the first time since June 2015.

OsMA and Stochastic indicators on the daily and 4-hour charts recommend the purchase, on a monthly - and deployed on long positions.

In case of breaking the resistance 0.7445 (23.6% Fibonacci level, EMA50 on the weekly chart) level and consolidation above the 0.7500 price will go to the resistance levels of 0.7545, 0.7600 and then at the rising channel on the daily chart with the upper boundary, passing near the level of 0.8000.

Nevertheless, despite the dynamic upward correction, the Australian currency continues to be under the pressure of a few fundamental factors (different directions of monetary policy the Fed and the RBA, low inflation and the ambiguous situation in the labor market in Australia, the decline in world prices for iron ore, the main export product of Australia) . And as long as the pair is below the level of 0.7445, the downward dynamics is preserved. In the case of breakdown of support levels 0.7200, 0.7140 (May lows), the pair will go to the levels of 0.7100, 0.6975, 0.6910

Support levels: 0.7400, 0.7370, 0.7290, 0.7260, 0.7200, 0.7140, 0.7100, 0.7000

Resistance levels: 0.7445, 0.7500, 0.7545, 0.7600

Overview and Dynamics

After the disappointing employment data out of the US agriculture, published on Friday, significantly lowered expectations of interest rate rises in the US in June, the US dollar has fallen across the financial markets, including in the pair AUD / USD. Speech on Monday the head of the Fed D.Yellen contained mixed signals and confirmed the Fed's intention to use caution when raising interest rates. Of course, lower interest rates put pressure on the US dollar, making it less attractive to investors.

However, it should be noted that in his speech D.Yellen also contained instructions on folding the program of gradual tightening in US monetary policy.

Another important event for the pair AUD / USD was today, when the RBA left interest rates in Australia, unchanged at 1.75%. In the accompanying statement the RBA noted that the current level of rates over time, will stimulate economic growth and contribute to the return of inflation to the target level.

In May, the RBA lowered the rate after data signaled that in the first quarter of this year in Australia for the first time since the financial crisis of 2008 came deflation.

The RBA lowered the forecast of inflation in the country, waiting for him in 2016 of less than 2%. Inflation will also remain below or near the lower limit of the target range of 2% -3% in the coming years.

Low inflation may force the RBA to reduce interest rate in August to 1.5%. But before that the RBA will analyze the latest data on inflation, as well as the outcome of a referendum on Britain's membership of the EU and the decision on the interest rate the Fed adopted in June and July.

A combination of several fundamental factors allowed the pair AUD / USD to grow for three days at 200 points, recouping nearly half of all losses of the previous month after the RBA cut interest rates in early May to a level of 1.75%, for the first time since June 2015.

However, risks still balance is shifted toward lower rates. This will keep the pressure on the pair AUD / USD in the medium term, despite the dynamic short-term upward correction the pair that has arisen in the beginning of June. It all depends on the evaluation of the RBA current situation in the economy and inflation.